Torsten Asmus

This morning, Federal Reserve Chair Jerome Powell participated in a moderated discussion at a virtual event on monetary policy hosted by the Cato Institute. Jay once again underscored the importance of getting inflation under control. Stocks and bonds sold off as the FOMC Chair wrapped up his discussion with the moderator: The S&P 500 initially dropped 0.8 percentage point to under 3950 while Treasury rates inched higher – the 10-year rose to 3.27% while the two-year approached 3.50%. The U.S. Dollar Index was higher by 0.2% to above 110. Strong claims data and an ECB decision were significant factors impacting markets this morning along with the Fed Chair’s speaking engagement.

Powell said he “hopes to achieve a period of growth below trend” in an effort to bring the rate of increase of consumer prices down. Jay also gave color to his Jackson Hole address: He opted for a “concise and focused message” to get his hawkish point across to market participants two weeks ago. On crypto, Powell not surprisingly said it remains a speculative asset. Regarding government spending issues, the chair mentioned that the current federal fiscal path is not sustainable – key as the mid-term elections are just two months away.

They’re calling it “the summer of 75.” Powell’s words come after the European Central Bank hiked its policy rate by 0.75 percentage point this morning, as expected, and drastically increased its inflation outlook and slashed the Euro Area’s GDP forecast. More major rate hikes are anticipated across the pond. The ECB is clearly tightening into a likely recession – the Eurozone August composite PMI index notched a fresh 18-month low as reported earlier this week.

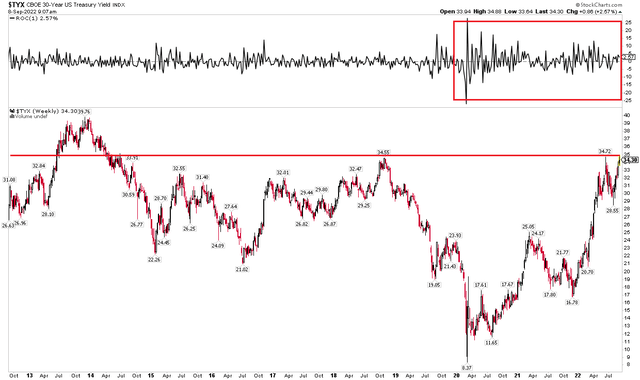

Treasury yields continue to be volatile and are revisiting their highs from June 14 – right before the S&P 500 notched its 3636 low. While the focus has been on much higher short-term rates as the Fed has turned more hawkish in its tone, particularly at Jackson Hole by Chair Powell, the long bond’s rate has quietly rallied to levels not seen since 2014. A move above 3.5% could spark a fresh selling wave that could send the 30-year toward 4% – the high from more than eight years ago.

Generally, the 30-year Treasury yield climbs when there’s more optimism about economic growth prospects, somewhat in contrast to short-term rates which move more on Fed policy and inflation expectations. There’s a low-cost way to play moves in the long bond that is overlooked by many traders.

30yr Treasury Rate: High Volatility and Near the Highest Since 2014. Four Percent In Play?

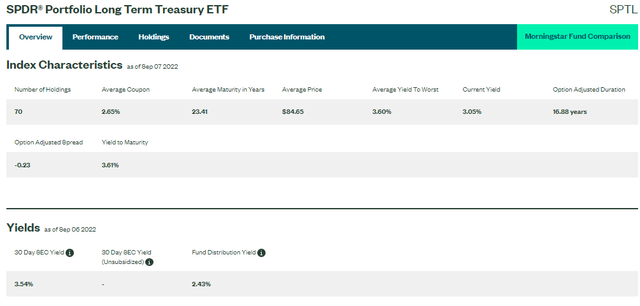

The SPDR Portfolio Long Term Treasury ETF (NYSEARCA:SPTL) offers investors a low-cost fund that seeks to offer precise, comprehensive exposure to US Treasuries with remaining maturities of 10 or more years, according to SSGA funds. Many investors know about the iShares 20+ year Treasury Bond ETF (TLT) which has about five times the assets under management of SPTL, but the SSGA version comes with a 0.06% annual expense ratio vs 0.15% on TLT, according to ETF.com. So SPTL is a cheaper option with still high liquidity.

SPTL: An Inexpensive Way to Play the 30yr Treasury

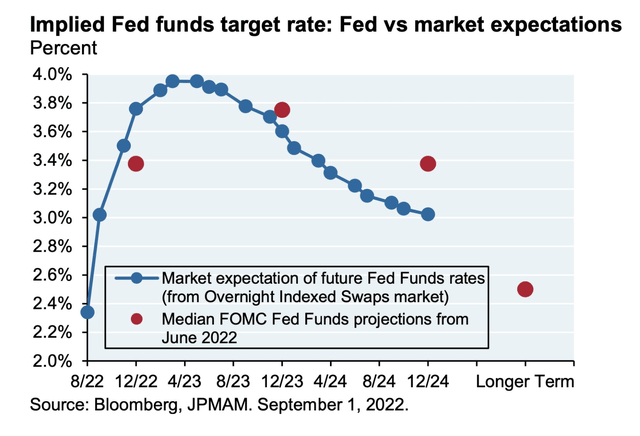

Rate traders have gotten the hawkish message. The peak Fed Funds rate is now priced near 4%, up from about 3.6% earlier this summer. The real question is where will the policy rate be looking out a year or two? Are we in a “higher for longer” regime or will a faster-than-expected GDP slowdown force the Fed to cut rates quickly during the second half of 2023? There’s much uncertainty on the trajectory of inflation and growth from here. That uncertainty has certainly contributed to Treasury rate volatility.

Fed Funds Rate Expectations

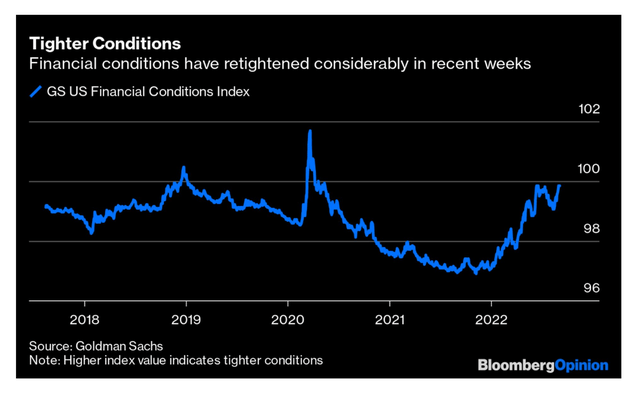

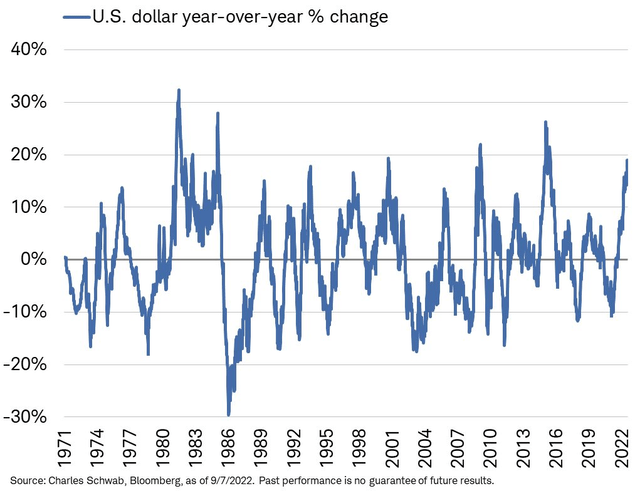

Looking back, the Fed must be encouraged by tighter financial conditions over the last few weeks. In mid-August, at the peak of the summer stock market rally, there were signs of loosening. Higher equity prices, moderate corporate bond spreads, and low Treasury yields no doubt caused the Fed to take a tougher stance. A high U.S. dollar worked to the Fed’s goal of tightening policy, though.

Financial Conditions Tighten After Summer Loosening

USD Continues to Rip: +20% YoY

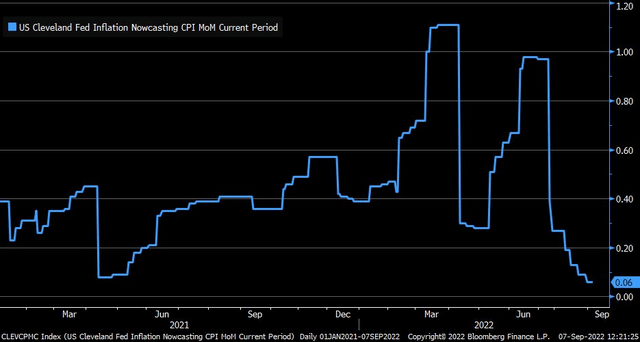

It’s important to see forward-looking trends in inflation. The public’s expectation of future consumer price rises has moderated lately, and real-time inflation readings certainly suggest tamer CPI levels in the coming months. Just last week, the August jobs report revealed positive signals like a higher labor force participation rate and lower than forecast wage growth. Moreover, supply chain pressures are easing and the price at the pump cannot go unnoticed – the average price of a gallon of regular looks to fall below $3.50 in the coming weeks based on where RBOB gasoline futures are right now. Finally, it was reported this morning that used car prices plummeted 4% in August from July – that promotes the odds of a negative August headline CPI figure.

US Cleveland Fed Inflation Nowcast: Near Zero CPI

The Bottom Line

Investors now turn their eyes to next week’s pivotal August CPI report which the Fed undoubtedly hopes will show another cooler-than-forecast figure. If we continue to see financial conditions tighten and inflation ease, there will be room for the FOMC to step off the rate-hike gas pedal next year. Investors should watch the 3.5% level on the 30-year in the weeks ahead.

Be the first to comment