bhofack2/iStock via Getty Images

Portillo’s Inc. (NASDAQ:PTLO) is not a year-old public company. They are a nascent public company renowned for Chicago-style hot dogs and sandwiches. They will celebrate their 60th anniversary in business next year. We are bullish for the long-term, as we watch same-store sales grow and locations blossom to 600 from 71 today.

Portillo’s Inc enjoys top customer loyalty among America’s fast-casual dining destinations. A few potential risks might because for investor caution: this is a new IPO and management has to adjust from operating as a private company to the glare of a public one; there is no dividend to cushion a retail value investor; and, the wait for better returns might take three or four more quarters. We are bullish on this consumer-popular and growing company and expect it to prosper.

Growing Waistlines And Business

The crush of customers we see waiting for their renowned Chicago hot dogs on poppy seed buns, Italian beef sandwiches, cheese fries, chocolate cake, and shakes is unrivaled. To soothe investor angst, visit any of their 70 locations. There are plans to open five more restaurants in the coming months, and eventually 7 to 10 every year. Portillo’s also caters for events and delivers.

Portillo’s revenue is one measure of growth. Revenue grew 7.0% during the quarter that ended June 26, 2022. Revenue increased by 10.5% for the two quarters that ended June 26, 2022. Same-restaurant sales grew a remarkable 25.0% amidst the pandemic in the same quarter in 2021. Same-restaurant sales grew 4.8% and 12.7% for the two quarters ended June 26, 2022, and June 27, 2021, respectively.

We are bullish on the food industry and restaurant stocks at the present time. People have to eat, and, in our experience, fast-casual eateries experience less hassle raising prices than companies in other industries. Portillo’s management confirmed this, ascribing its nearly 7% increase in same-store sales in Q3 ’21.

Challenges

Portillo’s enjoys a healthy reputation for food quality, tastiness, customer convenience, and excellent service. That is a winning combination, but a challenge to any expanding operation. Management pays particular attention to training, leadership retention, and hourly pay scales knowing they are keys to success.

The CEO talks about this in his comments to investors and the media. At Portillo’s, employees stay an average of 2.8 years before leaving, whereas the industry has between 100% and 150% turnover. An article about Portillo’s links the company’s training, pay scales, and opportunities for promotions to better than average retention. Portillo’s hourly turnover rate bests the industry average at 20% to 30% below the industry average. Retention is the root of restaurant growth in 2022.

The company’s CEO discusses these issues in an interview with QSRmagazine.com, for instance. He talks admiringly about the company’s new and unique drive-thru in Joliet, Illinois as a model for future construction that enhances customer satisfaction and builds sales.

The CEO claims data before going public was insufficient for a lot of planning but the quantity and quality of data improved since going public, leaving him to tell QSRmagazine that “In March, the company achieved its highest order accuracy and customer satisfaction scores in the past 24 months” attributable to employee coverage and extensive 14 months of training.

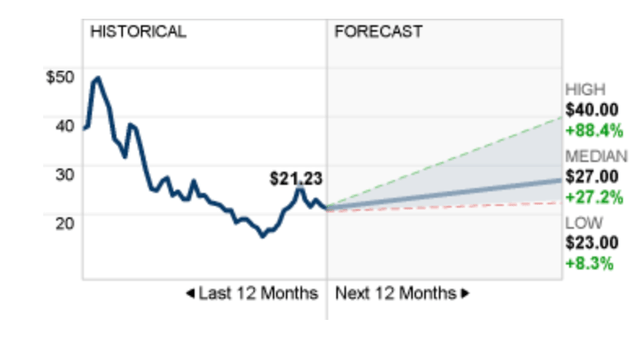

Berkshire Partners LLC bought Portillo’s in 2014; the IPO hit 11 months ago amidst the economic remnants of the pandemic. Shares topped $57 after opening, tumbled to ~$15 as lockdowns spread especially in the Midwest, climbed to about $28 in August ’22, and slipped to $23.62 at the time of this article. The 50-day moving average is around $22.87.

On September 8th, news came from Baird Real-Time Restaurants Survey that same-store restaurant sales rose 6% vs. +5% in August ’22, +4% in July, and +6% in the second quarter overall. Following the lead, Portillo’s stock rose 3.14% the same day. We believe the stock has potential, if the next two financial quarters are good, for the shares’ average price target to hit $30. Shares will move up to $26 or $28 per share over the next 6 to 12 months on more good news. NASDAQ forecasts a higher average price target by July 2023 at least $45.88 or higher to $68 per share:

Share Price Graph (money.cnn.com)

Potential Growth

The hot dog and apple pie are America’s signature comfort foods. The two knit tastes and patriotism. July 4th is the hot dog’s outstanding day for consumption. More than half the nation’s population eats hot dogs year-round. The numbers are trending upwards, as the population grows and under the stress of harder economic times.

The Nielsen Company estimates that in 2020, near to a billion pounds of hot dogs were sold at retail stores totaling $2.8B. Ballparks sold 19.4M. We estimate from the literature that 50 billion hot dogs and sausages are consumed every year at breakfast, dinner, snacks, and recreational times. Nielsen describes the typical consumer as younger families (seniors not so much) and probably living in the New York, Los Angeles, and Chicago areas.

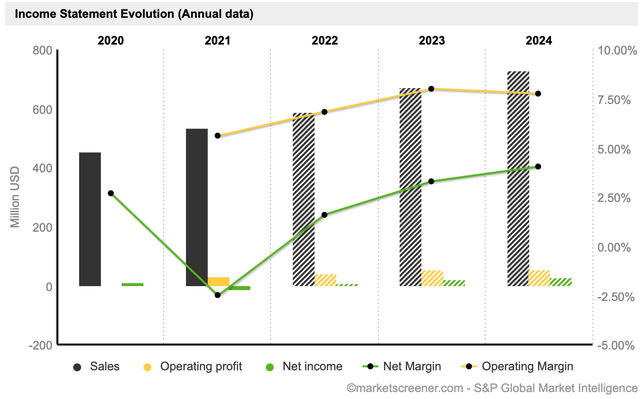

Portillo’s Inc opened for business 59 years ago. As trends for fast-casual eateries, hot dogs, and Italian beef sandwiches trended, Portillo’s grew from a neighborhood family stop to the furious destinations their locations are today. Revenue is expected to keep expanding, and the company expects to grow to 600 restaurants. This chart demonstrates the potential opportunity for Portillo’s and its investors as the demand grows for Portillo’s food:

Financial Growth (marketscreener.com)

One Sandwich At A Time

Going public and expanding come with problems. For instance, The Takeout rates Portillo’s new plant-based meat-free hot dog only as a “good try,” but abounding with traditional hot dog toppings for just $3.89, the Chicago-style Portillo’s sandwich is “a veritable steal.”

On August 12, ’22, the company announced an 8M shares public offering at $23.75 of Class A common stock, closing less than a week later. Perhaps an insider was converting warrants or another instrument? In any case, the share price slipped 2.28%. The stock has not recovered from this or from downward pressures affecting the stock market. Overall, the shares are not volatile but sensitive to larger market conditions.

A high rate of short interest persists. It is now a whopping 17.6%. The PE is 107. The market cap is $1.57B. The enterprise value is $1.21B.

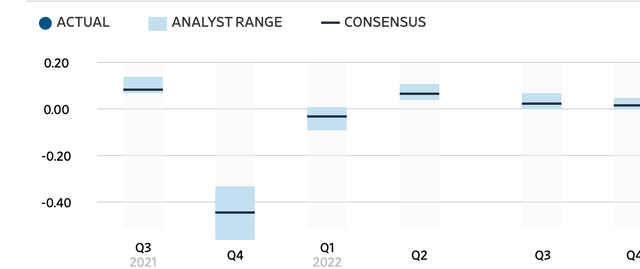

Portillo’s revenues over the past year hit $534.95M. The company suffered $34.59M in losses. Earnings per share were -$1.52 on a gross profit of $135.6M. Net income was -$18.11M. The company holds about $50M in cash and equivalents and over $318M in debt. The free cash flow is $3.79M after capital expenditures. We expect revenue to grow over 10% Y/Y. Earnings might move closer to break-even. EPS will be 2 or 3 cents compared to last year’s Q3 of 9 cents.

Share Price Forecasts (wsj.com)

The Q2 ’22 financials suggest a good year is in the offing. Revenue was up 7% for the quarter Y/Y to $150.6M. Portillo’s raised menu prices by almost 7% in Q2 to keep up with higher labor costs and costs for beef, chicken, and pork. Margins took a hit.

At the close of 2021, 15 hedge funds held PTLO shares. Only five still hold shares by the end of Q2 ’22. Insiders were also selling in 2022, as the price fell below $24. But, on the brighter side, corporate insiders own almost 7% of the shares, and the public owns +35%. Institutions and financial firms divide the remaining outstanding shares. The next financial report, Q3, is expected on November 17th.

Takeout

We are bullish about Portillo’s. The chain is among the best for quality and value in surveys of fast-casual diners. The market is growing and Portillo’s is along with it. We give the financials mixed reviews but value the excuse the company is young. Management is positively dealing with headwinds from going public and expanding in a tough economy. Investors were excited and drove up the share price. We especially harken to the significant ownership percentage shared by insiders and the public. There are a lot of fast-casual dining eateries but none match Portillo’s for its uniqueness and reputation. It is a folkway, a fairy tale story of rags to riches, and investors who tag along will probably feel the extra weight in their wallets.

Be the first to comment