Sezeryadigar/E+ via Getty Images

I generally stay away from ETFs for various reasons. I don’t really believe in diversification past a certain point, and I despise the idea of paying fees to the vultures on Wall Street. However, there are a couple exceptions for ETFs that are on my watchlist. I will be writing about one of them today, and that is the ProShares UltraPro QQQ ETF (NASDAQ:TQQQ).

Investment Thesis

TQQQ is a 3x levered ETF based on the underlying (QQQ) index. While that creates more risk, the upside is greater as well. The problem is that the biggest components of the index are megacap tech companies, most of which range from expensive to wildly overvalued. There are a couple in there that are cheap enough to buy right now, but I will not be buying TQQQ without a significant selloff in the broader markets. It might or might not come in 2022, but I’m not buying yet. The ETF will stay on my watchlist, but now is not the time to start a position in TQQQ.

A Brief Recap of Recent History

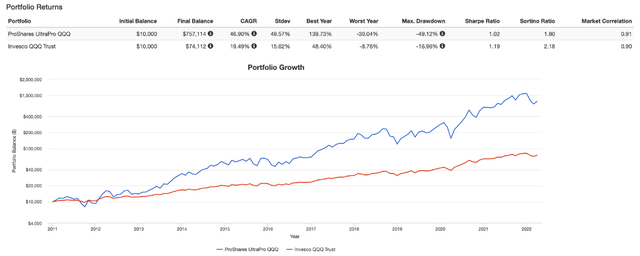

I’m sure most of you are aware of this, but we have been in a bull market for well over a decade. I’m not counting the COVID panic selling as a bear market since the Fed and the clown car that is the US Congress came in with the helicopter money. While QQQ has had impressive returns over the last decade, average nearly 20% CAGR, TQQQ has left it in the dust. It has been a bumpier ride, but TQQQ averaged nearly 47% since inception in 2010.

QQQ vs. TQQQ (portfoliovisualizer.com)

The problem is that we sit a record high valuations, and we are likely looking at rising interest rates. Everyone seems to have an opinion on interest rates, but negative real interest rates have been rocket fuel for tech companies and other long duration assets. I will do a quick breakdown of several of the largest companies in the QQQ ETF and explain why I’m not in a rush to start a position in QQQ or TQQQ.

Apple

I wrote a more detailed article on Apple (AAPL) and Berkshire Hathaway (BRK.A) (BRK.B), describing why I sold my shares of Apple to buy Berkshire instead. Apple is richly valued today, with an earnings multiple just over 28x and a market cap of $2.7T. Apple is probably going to announce a dividend hike and an increase in their buyback program soon, but I still am not interested in starting a position in Apple here.

I also think we could see some supply chain issues for Apple related to the return of lockdowns in China. I’m not sure exactly what kind of impact it could have, but my guess is that it will take some time to play out over the coming months. I would love to own the stock because it’s a great business, but I’m neutral on shares at the current valuation.

Microsoft

Microsoft (MSFT) is another tech giant trading at a rich valuation. I’m assuming most readers are familiar with the company and many of you probably use Office on a frequent basis. I will be writing up a more detailed article on the company soon, but it’s hard to justify starting a position in Microsoft at a $2.1T valuation. It’s a fantastic business that I would buy if the valuation was more attractive because they are certainly a wide moat tech business.

Google (GOOG) (GOOGL) is the search engine monopoly and has built a dominant position with an impressive advertising business. I have no interest in owning a part of the business, but the shares are trading at a reasonable valuation today and I could understand why investors would want to own the company. They also have been buying back stock and announced a 20:1 split recently. Shares trade at 22x forward earnings, and investors might want to buy a piece of a large high margin cash cow.

Amazon

Amazon (AMZN) is the only big tech company that I’m bullish on today. I still own what I bought a couple years ago and I have no intention of selling. I like the different segments of the company and the valuation is attractive in my opinion as the shares have traded sideways for a couple of years. They recently announced a 20:1 split.

The company is valued at just under 28x cashflows, which might seem steep, but cashflows are projected to explode over the next couple years. They recently upped the buyback program, and they have been investing heavily in the business over the last couple years. If you are looking to add an individual tech stock to your portfolio, Amazon would be the megacap I would choose.

Tesla

I wrote an article comparing Tesla (TSLA) to Paccar (PCAR) with a focus on the trucking industry. I have been bearish on Tesla for a while, but the stock seems to levitate on the options market trading and the cult of personality surrounding Elon Musk. He has been in the news for his run at Twitter (TWTR) more recently, but I still think Tesla is materially overvalued and investors would be wise to sell their shares or avoid it altogether.

Nvidia

Nvidia (NVDA) was a stock I owned for a long time until the recent run up above $300. The valuation just got too rich to justify holding onto shares, but I love the business. The management team is fantastic, and the long-term growth runway is long, but shares had gone parabolic, and I knew it was time to take my gains and invest somewhere else. At 45x earnings and a $533B market cap, the growth is more than baked into the current share price. It was even more expensive in November, but Nvidia will remain on my watchlist because I like the business a lot more than I like the stock right now.

Facebook (FB) has had a rough start to 2022, with shares selling off nearly 40% to start the year. This leaves the stock at 15.8x earnings, which has caused many investors to turn bullish. I still think the stock is cheap for a reason. Wall Street is bullish on the company’s transition to focusing on the Metaverse, but I am skeptical and think that the company’s advertising revenues from its social media platforms could be in jeopardy. Some investors might be bullish, but I’m not interested in owning Facebook for many of the same reasons that I stay away from Google.

Conclusion

TQQQ is a 3x leveraged ETF that can give investors a lot of bang for their buck. The problem is finding a good entry point, as a relatively minor selloff in the scheme of things for QQQ could lead to significant losses for holders of TQQQ. Some investors use TQQQ as a short-term trading vehicle, but once I buy shares, I plan to hold onto them for a long time. It won’t be a large position, but the returns could be impressive for investors buying after a significant market selloff.

Be the first to comment