Abu Hanifah/iStock via Getty Images

Despite the fact that an unprecedented global pandemic had an impact on the U.S. real estate market in 2020, Spirit Realty Capital (NYSE:SRC) expects to increase adjusted funds from operations (per-share) by up to 10% this year.

The trust is on track to reach $600 million in annualized base rent this year and will almost certainly increase dividend payments to shareholders in 2022. Because Spirit Realty Capital’s stock has a low AFFO multiple, I believe it has the potential for attractive total returns in the future.

Recovering All Pandemic Losses

In 2020, Spirit Realty Capital’s real estate business faced significant uncertainty. However, as it became clear that the trust’s real estate portfolio was performing well and rent collection remained high, the stock experienced a significant recovery. The stock has recovered the majority of its pandemic losses, and I see it as promising in light of rising rental income and strong portfolio performance.

A Heavyweight REIT With A Focus On Safety

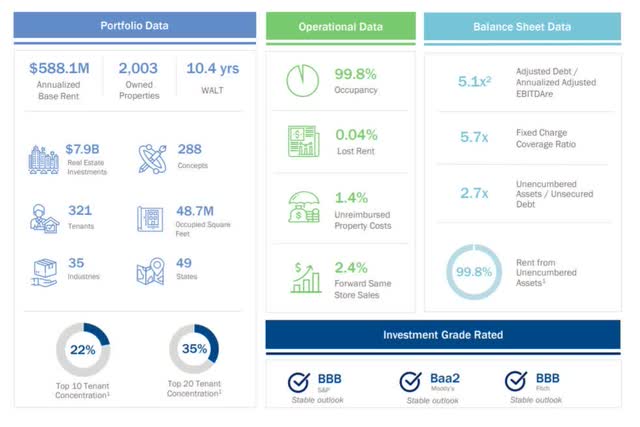

Spirit Realty Capital primarily invests in industrial, retail, and office properties, but it also purchases real estate in other categories when management sees an opportunity to deploy capital efficiently. Based on 2021 data, the trust’s total real estate consisted of approximately 2K properties valued at approximately $7.9 billion.

The occupancy rate, which I will discuss further below, was 99.8%, giving the trust a nearly perfect lease score. What is worth noting here is that the trust experienced only a small number of tenant defaults during the pandemic, losing less than 1% of its annualized base rent.

Portfolio Summary (Spirit Realty Capital)

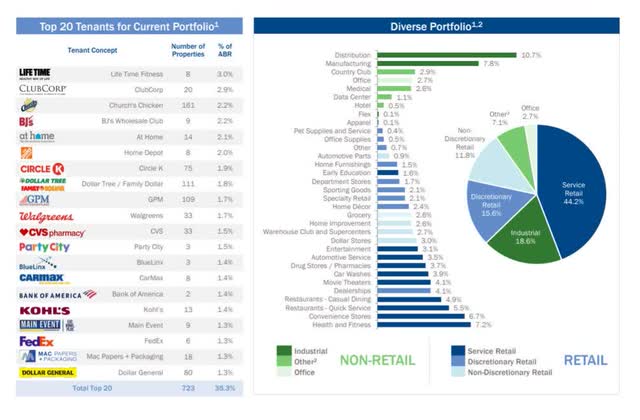

Spirit Realty Capital’s real estate portfolio is primarily made up of service retail properties, which account for 44.2% of the trust’s total assets. Industrial properties, which include distribution, manufacturing, and even country club properties, are the second largest asset class.

The real estate portfolio is spread across 35 different industries, significantly increasing the trust’s diversification. More statistics on diversification can be found in the trust’s supplement presentation that accompanied the most recent earnings release.

Portfolio Diversification (Spirit Realty Capital)

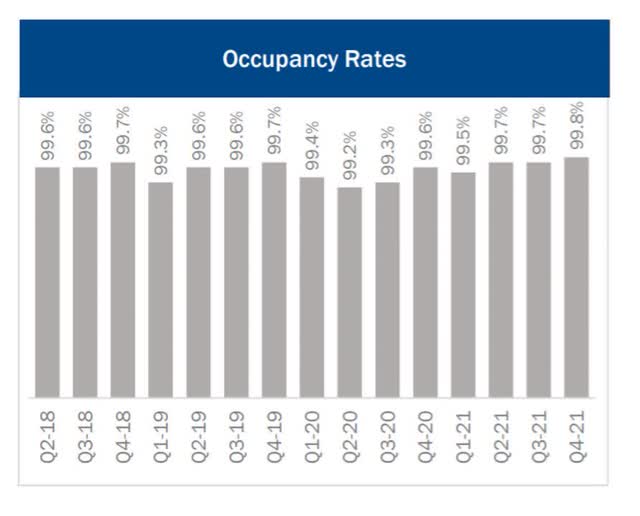

The trust’s exceptional historical occupancy rates are the best reason to own Spirit Realty Capital. The occupancy rate dropped to 99.2% during the Covid-19 pandemic, demonstrating that the trust is working with a very stable and solvent tenant base. Approximately 85% of the trust’s tenants have annual revenues of $100 million or more, and approximately 22% are investment-grade.

Occupancy Rates (Spirit Realty Capital)

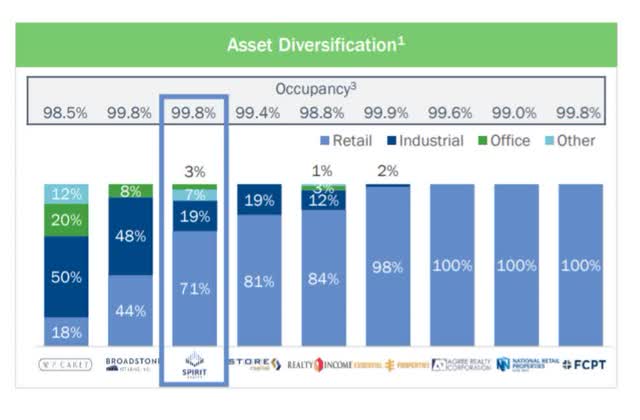

Spirit Realty Trust’s occupancy rate is right up there with the best in the REIT class, despite the fact that the trust’s portfolio is potentially riskier due to the presence of more cyclical industrial real estate.

Asset Diversification (Spirit Realty Capital)

Pandemic Has Been A Catalyst For Growth

Spirit Realty Capital has amassed approximately 27% of its current portfolio since 2020 as a result of aggressive capital deployment. In fact, the pandemic proved to be a significant catalyst for trust growth. Since 2020, the trust has spent $2.1 billion, or $266.9 million per quarter, on real estate purchases, primarily industrial and retail properties, positioning the trust for long-term funds from operations growth.

Moving forward, acquisitions will be critical to the trust’s growth projections, as Spirit Realty Capital intends to acquire a large number of properties in 2022. Spirit Realty Capital expects to invest between $1.3 billion and $1.5 billion in 2022.

Asset Growth (Spirit Realty Capital)

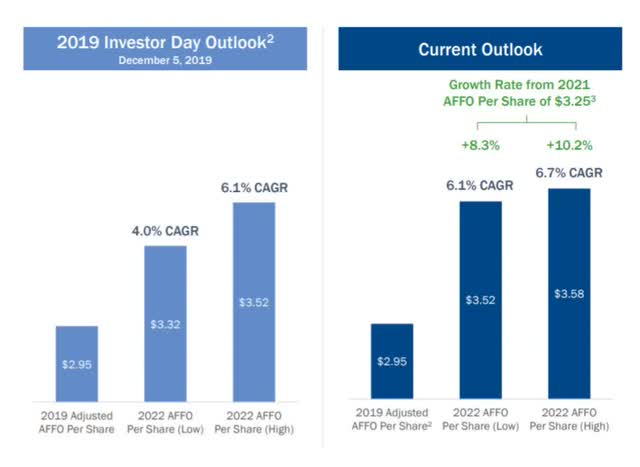

AFFO Forecast, Multiple, Pay-Out Ratio

Spirit Realty Capital expects adjusted funds from operations to increase by up to 10% YoY in 2022. The current forecast calls for a share price of $3.52-$3.58 and a capital expenditure of at least $1.3 billion. The current outlook is even better than the trust’s 2019 forecast, which called for $3.52 per share in AFFO.

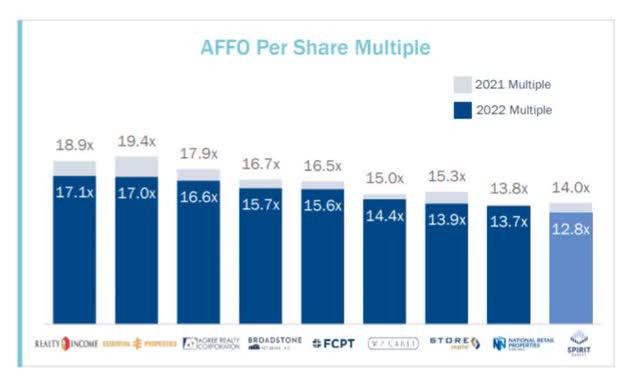

Spirit Realty Capital has a multiple of 12.8x based on the trust’s expected top end of AFFO guidance for 2022, making it one of the cheapest REITs in the sector.

AFFO Per Share Multiple (Spirit Realty Capital)

Spirit Realty Capital has a low pay-out ratio of 71.9%, implying that the dividend could increase. In terms of pay-out ratio, the trust ranks firmly in the middle of its trust peers and has an even lower pay-out percentage than Realty Income, which is the gold standard in the retail REIT sector and which I covered here.

Why Spirit Realty Capital Could See A Lower Valuation

The portfolio of Spirit Realty Capital is performing well: the trust has optimal occupancy rates, funds from operations are increasing (even during the pandemic), and the dividend is set to increase. However, there are risks, though they are mostly found on the macro level rather than the company level.

Interest rates and inflation are not significant risks for real estate investment trusts because real estate values tend to rise in tandem with inflation. The state of the economy is a macro risk factor for Spirit Realty Capital. A recession would almost certainly increase occupancy rates, lowering the trust’s AFFO prospects in the short term.

My Conclusion

Spirit Realty Capital should be purchased because of its recession-resistant real estate portfolio, 99% or higher occupancy rates, and low pay-out ratio. Other factors to consider include strong adjusted funds from operations growth, good diversification metrics, and the potential for dividend growth due to a low pay-out ratio.

Spirit Realty Capital is a REIT with which you can sleep well at night, and the stock is also inexpensive.

Be the first to comment