Delmaine Donson

Roughly three months ago, I discussed why investors should wait before buying shares of Polestar (NASDAQ:PSNY). The electric vehicle maker had just completed its SPAC deal, bringing in some new capital to help fund its ongoing growth plan. Since then, shares have fallen quite a bit, and the end of year setup doesn’t provide a lot of hope at the moment.

Earlier this month, the company announced its results for the first half of 2022. As expected, revenues nearly doubled to more than $1 billion, as the company reported a 123% increase in deliveries to over 21,000 vehicles. Unfortunately, as we’ve seen with most early stage EV names, net losses also rose as the company builds out its network and starts the first major stage of growth. The company reiterated its 50,000 vehicle delivery forecast for this year, which originally was projected to be 65,000 units but was impacted by the Covid situation and supply chain issues in China.

In the short term, there are a few major headwinds that Polestar has to deal with. First of all, the US Inflation Reduction Act that was passed to help electric vehicle sales does not help the company for its main vehicle, the Polestar 2, as it is being manufactured in China. The base version of next year’s Polestar 3 may be eligible for credits, although its currently close to the price cap for SUVs and we don’t know the full details of the bill just yet. Either way, not having full access to the credits hurts as the name tries to make inroads against more established competitors like Tesla (TSLA) and Ford (F) in the United States. Competition is already fierce in China and Europe and is seemingly growing by the week.

The second item is one that the entire US EV industry has to deal with, and that’s falling gasoline prices. While oil prices and thus gasoline surged when Russia invaded Ukraine, almost all of those gains have been lost as the chart below shows. Current gasoline futures imply the US gasoline average could be back down to $3.25 or so in the next few months, which might hamper the consumer’s appetite to shift to electric vehicles. Surging electricity prices and a potential power crisis in Europe may also concern people who are looking at their next vehicle.

US Gasoline Prices (gasbuddy.com)

I mentioned in my previous article that Polestar could easily require a capital raise later this year or next to continue its growth. That process has gotten a bit more complicated in the past couple of months. On one hand, you have bond yields like the 2-year US Treasury surging nearly a full percentage point since then. A bond raise would become a bit more expensive, which isn’t good for a company that’s losing a bit of money and burning through cash. At the same time, Polestar shares have gone from $11 to just $7, meaning an equity raise could require meaningfully more dilution than previously thought.

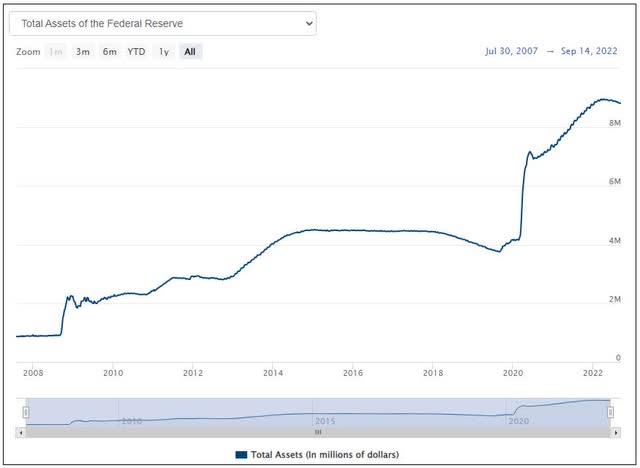

The market situation could get a bit more tough for Polestar this week and beyond as well. Expectations are that the Fed will raise rates by at least 75 basis points, which will raise interest costs for companies that borrow with variable rates using LIBOR or SOFR. Also, as the chart below shows, the Fed’s balance sheet runoff plan has barely impacted things so far, with over $8.8 trillion in assets still held as of last week’s update. If the plan continues for the Fed to reduce this figure by a few trillion in the next couple of years, we could see the market continue to drop in the near term, with investors further shying away from names that are losing money and burning through cash.

Fed Balance Sheet Growth (Federal Reserve)

Polestar’s current plan is to deliver 290,000 vehicles in 2025, which isn’t going to be a lot of market share. You have Tesla and Chinese company BYD (OTCPK:BYDDY) that will be well above that on a quarterly rate next year, with many more global automakers racing to ramp up their EV offerings. Even a smaller Chinese name like NIO (NIO) is aiming to sell 40,000 units a month at some point in 2023, so think of where they could be in 2025. Polestar is also battling in the premium / luxury part of the market, the smallest portion of the EV space, so it faces an uphill battle.

As the chart below shows, Polestar is very close to its 52-week low, when including time spent as the “GGPI” SPAC ticker. Since the combination was completed in late June, the stock was as high as $13.36, but as low as $6.17. The issue here in the short term is a declining 50-day moving average (purple line), which could add pressure as the key technical trend line continues lower. The average street price target of $11.50 currently implies significant upside, but this isn’t yet a name followed by a ton of analysts. That number could easily come down with another quarter of losses and cash burn to be in the books soon, with a potential capital raise on the horizon as well.

Polestar Last 12 Months (Yahoo! Finance)

In the end, Polestar faces an uphill battle as 2022 comes to a close. The low volume EV maker is looking to grow rapidly, but it’s also fighting in a highly competitive luxury market. As interest rates rise and the stock falls, a potential capital raise becomes even more painful for investors. With the market not favoring high net loss and cash burn names currently as the Fed continues to tighten, it wouldn’t surprise me to see new lows as this company looks to burst on the scene.

Be the first to comment