Dilok Klaisataporn

Evergy (NYSE:EVRG) has rallied 13% since I recommended purchasing the stock, about three months ago. This is an unusually steep move for a utility stock. Consequently, some investors may think that it is time to take their profits. However, this high-quality utility stock remains attractive, especially given the volatility and uncertainty surrounding the broad stock market during the ongoing bear market.

Evergy Business Overview

Evergy is a regulated electric utility company, which serves more than 1.5 million customers in Kansas and Missouri. A key characteristic of the company is the generation of approximately half of its energy from clean energy sources.

Evergy is also doing its best to continue to grow the share of renewable energy sources at the expense of fossil fuels. It has been expanding its wind portfolio for more than a decade and thus it has reached about 4,400 megawatts of wind energy. If the production of its nuclear plant is also taken into account, the share of the emission-free generation of Evergy currently stands at 56%.

Even better, Evergy does not rest on its laurels. It aims to include another 3,500 megawatts of renewable energy sources and retire nearly 2,000 megawatts of coal by 2032. Overall, thanks to its focus on emission-free energy sources, Evergy is essentially immune to the secular shift of the entire world from fossil fuels to renewable energy sources.

Evergy currently enjoys positive business momentum. In the second quarter, it benefited from favorable weather, an increase in weather-adjusted demand and higher transmission margins. These tailwinds more than offset the increased operating and maintenance costs and hence the company grew its earnings per share from $0.85 in the prior year’s quarter to $0.86, thus exceeding the analysts’ consensus by $0.02.

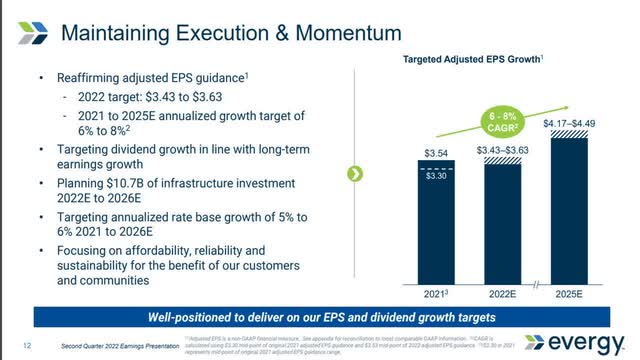

Evergy has exceeded the analysts’ estimates for six consecutive quarters. This is a testament to the sustained business momentum of the company and its proper execution. Moreover, in the latest conference call, management reiterated its guidance for adjusted earnings per share of $3.43-$3.63 in the full year. This guidance implies essentially flat earnings per share vs. the record earnings per share of $3.54 in 2021 but management continues to expect 6%-8% growth of earnings per share between 2022 and 2025.

Growth prospects

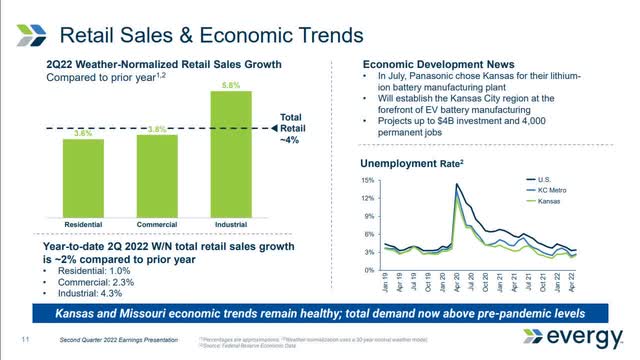

During the last decade, Evergy has grown its customer count in almost every single quarter. It also benefits from some key characteristics of Kansas, which has experienced superior economic growth and a lower unemployment rate than the rest of the country for years. Meta Platforms (META) recently chose Kansas for its new $800 million data center while Bombardier selected Wichita, Kansas, for its U.S. headquarters.

Evergy Business Overview (Investor Presentation)

Moreover, in July, Panasonic chose Kansas for its lithium-ion battery manufacturing plant and thus Kansas will become a major manufacturing region for batteries for electric vehicles. Given the immense growth potential of these batteries, Evergy will undoubtedly benefit from this development.

As a regulated utility, Evergy enjoys a wide business moat and is essentially immune to recessions. This has proved to be the case throughout the coronavirus crisis, as the company posted all-time high earnings per share in 2020 and 2021 and is on track for another almost record year in 2022. Evergy has grown its earnings per share in 8 of the last 10 years, at a 5.7% average annual rate. This growth rate is in line with the mid-single-digit growth rate of most utilities.

However, the company has more promising growth prospects ahead. To be sure, it has an immense 5-year capital plan of $10.7 billion, which aims to expand and improve the infrastructure of the company.

Evergy Growth Of Earnings & Dividend (Investor Presentation)

As the amount of the investment plan is 69% of the current market capitalization of the stock, it is obvious that the utility is laser focused on enhancing its growth pace. Indeed, thanks to its huge investment plan, Evergy expects to grow its rate base at a 5%-6% average annual rate and its earnings per share at a 6%-8% average annual rate until 2026. Analysts agree with the guidance of management, as they expect the company to grow its bottom line by 6% in 2023 and by another 7% in 2024.

Valuation

The S&P 500 has entered bear market territory this year due to the surge of inflation to a 40-year high and fears of an upcoming recession. High inflation exerts pressure on the operating margins of most companies, as it significantly increases their cost base. It also exerts pressure on the valuation of most stocks, as it reduces the present value of their future cash flows.

Fortunately for the shareholders of Evergy, the company is essentially immune to the above headwinds, which have caused the ongoing bear market. As a utility, Evergy is immune to recessions. It is also resilient to the highly inflationary environment prevailing right now, as it can transfer its increased fuel costs to its customers. The only essential headwind for Evergy is the effect of inflation on its valuation.

Evergy is currently trading at a price-to-earnings ratio of 18.9, which is only slightly higher than its 10-year average price-to-earnings ratio of 18.2. It is also important to note that the stock is trading at only 15.9 times its expected earnings in 2026. As soon as inflation begins to subside, the stock is likely to be rewarded with a higher earnings multiple by the market. Moreover, if a recession shows up, Evergy is likely to outperform the broad market thanks to its safe-haven nature. To cut a long story short, despite its 13% rally in the last three months, Evergy remains attractively valued, especially given its reliable growth trajectory and its resilience to recessions and inflation.

EVRG Stock Dividend

Evergy has grown its dividend for 17 consecutive years and is currently offering a dividend yield of 3.4%, which is higher than the 3.1% median dividend yield of the utility sector. Moreover, the company has grown its dividend at a 6.4% average annual rate over the last three years. This growth rate is higher than the median dividend growth rate of 5.0% of the utility sector.

Furthermore, Evergy has a healthy payout ratio of 64% and a solid balance sheet, with interest expense consuming only 25% of its operating income. Given also its promising growth prospects and its resilience to downturns, Evergy is likely to continue raising its dividend for many more years. In fact, management has repeatedly provided guidance for 6%-8% annual growth of the dividend until at least 2026. The company is expected to announce its next dividend hike in the first week of November. If Evergy raises its dividend by 6%, it will be offering a 3.6% dividend yield, which will be a nearly 10-year high level for the stock.

Risks

As a utility, Evergy is less risky than the vast majority of stocks. Nevertheless, investors should be aware of some risk factors. First of all, the company may not be able to meet the aforementioned analysts’ estimates in the upcoming years. In such a case, the valuation of the stock may come under pressure. However, thanks to its regulated business, Evergy enjoys reliable rate hikes year after year and thus it has (marginally) missed the analysts’ estimates only twice in the last 10 quarters. Overall, the risk of poor business performance is low, especially given the expertise of the company in the transition from fossil fuels to clean energy sources.

A more important risk factor is the adverse scenario of persistently high inflation for years. In such a case, the valuation of Evergy is likely to remain under pressure for years. However, in such an adverse scenario, the broad stock market will remain under pressure, with Evergy likely to outperform the broad market. Moreover, the Fed has prioritized reducing inflation at any cost and hence inflation is likely to begin to subside next year. Nevertheless, as inflation has already persisted longer than initially expected, investors should be aware of this risk factor.

Finally, the stock of Evergy has another risk factor, namely a potential strong recovery of the economy from its recent slowdown in 2023 or 2024. In such a case, the company will perform well but the stock will probably underperform the broad market. This is a general rule for utilities; they tend to underperform the broad market by a wide margin during boom times. However, the Fed is likely to keep interest rates high for a considerable period in order to fight inflation and hence a strong recovery of the economy is not likely to show up anytime soon.

Final thoughts

Evergy is a safe haven in the ongoing bear market and hence it can save investors from the pain caused by the prevailing volatility and uncertainty. As Evergy is about to announce its next dividend raise in early November, it will soon be offering a nearly 10-year high dividend yield of approximately 3.6%. Given also its reliable growth trajectory, its immunity to a potential recession and its reasonable valuation, Evergy remains attractive in the current investing environment.

Be the first to comment