shank_ali

Shares of Teck Resources (NYSE:TECK) have performed well over the past year as the company has been a major beneficiary of higher commodity prices. Still, shares are off about a third from their June highs as recession fears have outweighed strong results. However, this is a company with cost advantaged assets that has timed its diversification efforts well. With $5+ in trough 2023 earnings power, TECK is a cheap stock worth owning despite cyclical headwinds.

At the moment, Teck is performing fantastically. In the company’s second quarter, profits quintupled from last year to a record $1.7 billion CAD or $3.12 per share. EBITDA tripled to $3.3 billion CAD. With this influx of cash, the company bought back $572 million CAD in stock and repaid $650 million in debt. Teck has built a fortress balance sheet with net debt to EBITDA of just 0.4x and no significant maturities before 2030. This means Teck is in a much stronger place than during the commodity price collapse of 2014-2016 when high debt forced it to fight for survival and cut its dividend. Alongside Q2 results, it authorized another $500 million buyback.

Across segments, results were solid even as operating costs rose 14%, about half of which was due to higher diesel prices. Copper profits rose 5% to $450 million CAD, and zinc more than doubled to $156 million CAD. Steelmaking (or metallurgical) coal profits rose 10x to $2.5 billion CAD—this is Teck’s largest unit by a significant margin. Its energy unit swung from a $22 million loss to a $174 million profit on higher prices. As energy costs are an input everywhere else in the business, this unit serves a nice diversifier to limit the company’s exposure. Teck also drove cash costs down from $50 CAD to $37 CAD as it has scaled up production. Given its role in the overall company, this unit helps to stabilize Teck’s cash flows.

Copper profits only rose due to timing of shipments as production was flat but shipments rose 15%. Due to higher energy prices, cash cost guidance was increased from $1.4-$1.5/lb to $1.48-$1.58. While copper is just 15% of the business today, it will grow significantly over the next two years as the QB2 project in Chile comes online (more below).

Realized zinc prices rose from $1.32 last year to $1.79 this year. The fundamentals for zinc are strong as sanctions on Russian supply continue to bite with the London Metals Exchange no longer permitting deliveries of zinc and aluminum from Russia. High natural gas prices in Europe have also meant that zinc production is not as profitable in Europe, which may temporarily shut in more supply.

In coal, the primary business driver, prices tripled from $144 to $453 far outweighing the $35 increase in costs. Production was just 5.3 million tons from 6.4 last year as it deals with labor shortages forcing a guidance reduction to about 23.75 tons this year from 24.375 previously. Higher labor costs have increased cash costs, but transportation costs began to fall in Q3. The coal unit’s operations are entirely located in Canada.

The steel market began to soften in June due to weakness in the global auto sector, which in turned let to reduced prices for met coal. Chinese coal inventories are very low, and while they have increased imports from Russia, this should support demand, particularly if China resorts to more infrastructure spending to combat slow economic growth. Teck is seeing its labor shortage problem improve, which should help stabilize production and costs.

Teck announced Q3 steel-making coal production of 5.6 million tons, inside the 5.5-5.9 million guidance at an average price of $304. This will result in taking a negative provisional pricing adjustment of $191 million when it reports results on October 27. This price is down about a third from Q2 as economic activity cools.

The Q2 earnings rate was not sustainable, and this will lead to a sequential decline in earnings with coal driving about $1.05 less in EPS. That still would leave the company with $8 in earnings power all else equal. What the market is grappling with is how much further do prices fall and where does that leave cash flow and earnings. Here, there are several things to consider.

First, Teck gets the vast majority of its revenue in USD as oil, zinc, copper, and met coal are all priced in USD. However, its coal operations are all in Canada, and so most of its costs (taxes, labor, PP&E) are in Canadian dollars. The CAD has fallen steadily and is sitting near a 5-year low today. This means that the price of commodities can fall somewhat in USD terms without reducing its margins because the dollar value of its costs falls when the CAD weakens. This gives Teck a bit of a hedge against lower commodity prices vs companies with operations in the US.

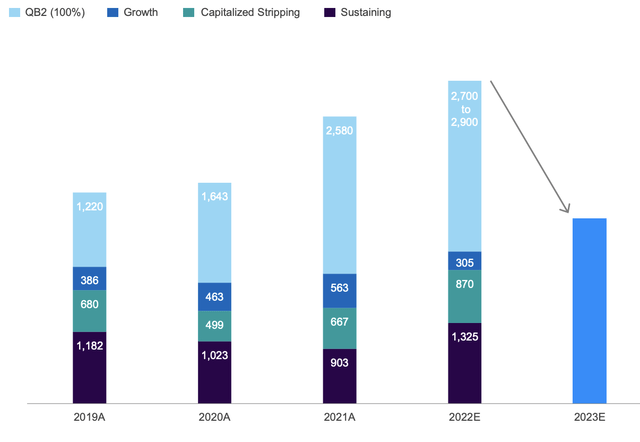

Additionally, the company’s spending needs are set to fall. Cap-ex should decline from $5.3 billion CAD to about $3.3 billion CAD next year as the company completes spending on its massive QB2 copper project in Chile, which will more than double the company’s copper production. Due to higher input costs, this project will cost about $1.5 billion more than expected, but with copper prices still higher than pre-COVID, this cost will be negated by better revenues.

Cap-ex falling this much means commodity prices can fall without reducing free cash flow as much, which was $1.8 billion CAD last quarter and $2.7 billion CAD YTD. Additionally, the doubling of copper production will boost profits, helping to offset lower profits from legacy operations if profits continue to decline. At current prices, QB2 could add up to $1.7 billion CAD in EBITDA—enough to offset about $75 of coal price declines.

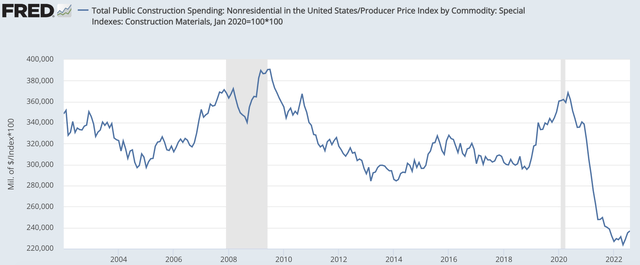

I also am of the view steel (and as a result met coal) demand will prove a bit more resilient than some fear. In addition to the prospect of Chinese infrastructure spending, US infrastructure spending has yet to pick up from the 2021 bipartisan bill because it takes time for permitting, etc. As this spending starts to ramp up next year, US demand for steel should rise, helping to offset weakness we may see in Europe or other economies.

St. Louis Federal Reserve

I am not arguing Teck will be immune from an economic downturn, but it is actually positioned relatively well within a cyclical industry for this coming downturn. Cap-ex is set to fall right as the cycle turns. Its currency exposure and energy unit provide natural hedges, and increased copper production will serve to offset declining prices. Government stimulus efforts may also help to limit the downside in the steel ecosystem.

These factors leave me expecting Teck’s profits to fall but only to about $5 next year, leaving the stock at just 6.6x earnings with free cash flow that should stay above $3 billion USD due to lower cap-ex, thereby enabling ongoing buybacks. As markets appreciate the resiliency in Teck’s business, I think shares can get back to $50 or about 10x earnings, and I would be a buyer here.

Be the first to comment