trumzz/iStock via Getty Images

Investment Thesis

PLDT Inc. (NYSE:PHI) has been setting record financials in its H1’22, increasing subscribers in its broadband and fixed line subscriber base, and is paying out special dividends from its tower sale. However, I believe the company will have difficulties in the second half of 2022 due to a weaker peso FX rate and inflation impacting its customers. Still, I also think management is shifting its focus in the right direction (generating FCF, deleveraging back to 2.0x, and paying out special dividends), which leads me to a Hold rating.

Record High Revenue & A Declining Subscriber Base

Source – PLDT Q2’22 Earnings Call Presentation

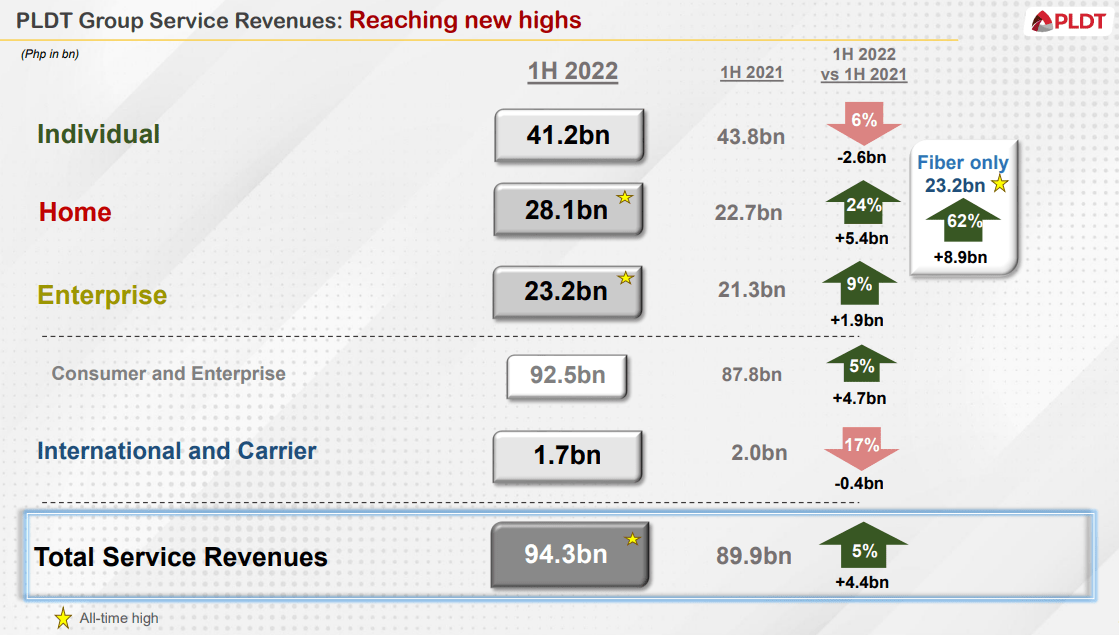

On the company’s second-quarter results of FY2022, the company set an all-time high with a 24% revenue growth in its Home business, while a 9% revenue growth in its Enterprise business, and a significant revenue increase of 62% in its Fiber only business YOY, resulting in a 5% increase in total service revenue.

In the Home business, PLDT gained PHP2.7 billion in revenue in its Q1’22 results, which is a 25% increase YOY, and achieved PHP2.7 billion in Q2’22, which is a 23% increase YOY, setting an all-time high revenue for the Home business. Moving on to the Enterprise business, PLDT saw a 7% revenue YOY increase or PHP800 million in its Q1’22 results and an 11% revenue YOY increase in PLDT’S Q2’22 results or PHP1.2 billion, which also set an all-time high for the company’s quarterly revenue results. However, PLDT did lose some of its revenue in its Individual business, losing PHP1.7 billion or an 8% decline in its Q1’22 performance, and with a 4% decline or PHP900 million decrease in its Q2’22 performance, which means the Individual business is at a decline of 6% compared to H1’21.

The decline in its Individual business was offset by its Home and Enterprise businesses resulting in a 5% revenue YOY revenue increase in the company’s H1’22 results or an increase of PHP4.4 billion compared to the company’s H1’21 performance. This shows that PLDT’s revenue is increasing due to consumer and business industry demands. Around two years ago, the Philippines had to adapt to the new normal, which forced people into a community quarantine and forced households without an internet connection to avail the Philippines’s fastest internet provider. Although two years have gone by, the demand in these markets, specifically in Fiber connectivity, continues to increase, as proven by its revenue growth. However, I’m not saying that demands have increased throughout all of PLDT’s markets:

Source – PLDT Q2’22 Earnings Call Presentation

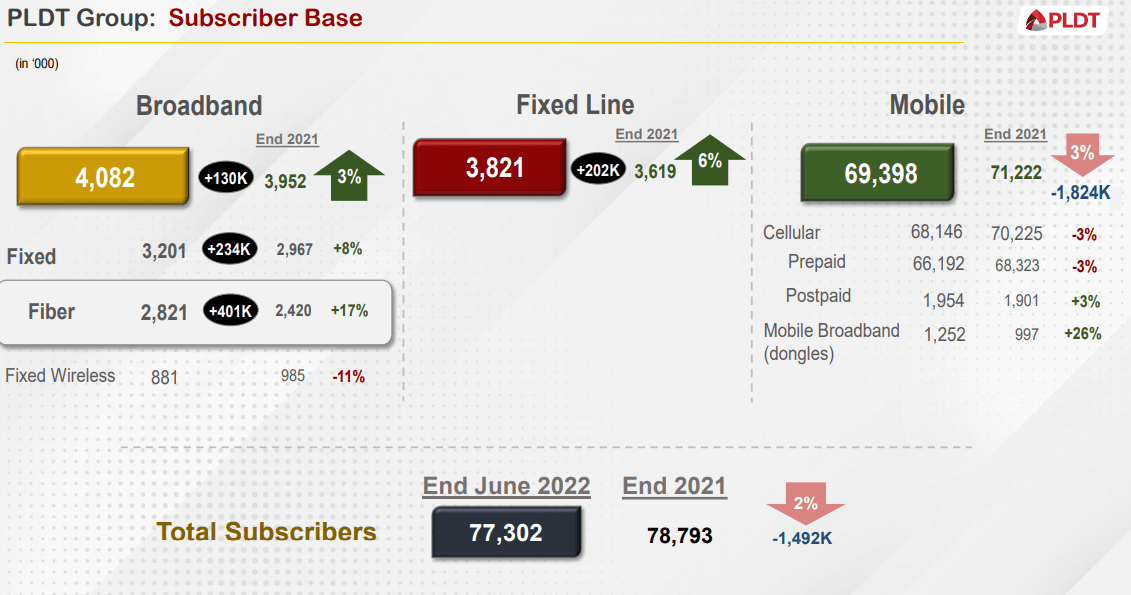

PLDT also has had its fair share of subscribers decrease primarily in its Mobile market and under its Broadband market in the Fixed Wireless area. Overall, the Broadband market had a subscriber increase of 3%, a Fixed Line increase of 6%, and a 3% decline in its Mobile market caused by softness in Cellular demands, which is not looking optimistic as Globe Telecom, Inc. (OTCPK:GTMEY) reported a 7% increase in mobile subscribers YOY. The Broadband market also faced a subscriber decrease in its fixed wireless, losing around 100,000 or an 11% decrease compared to the end of 2021. Overall, PLDT had a total subscriber decline of 2%.

Tower Sale & Dividends

Source – PLDT Q2’22 Earnings Call Presentation

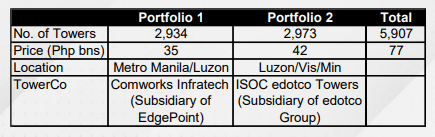

In April 2022, PLDT signed tower sales and leasebacks for PHP77 billion. On its first closing on June 01, 2022, the company received PHP39.2 billion for 3,012 towers out of 5,907 and received PHP13.2 billion on its second closing on August 01, 2022.

Source – PLDT Q2’22 Earnings Call Presentation

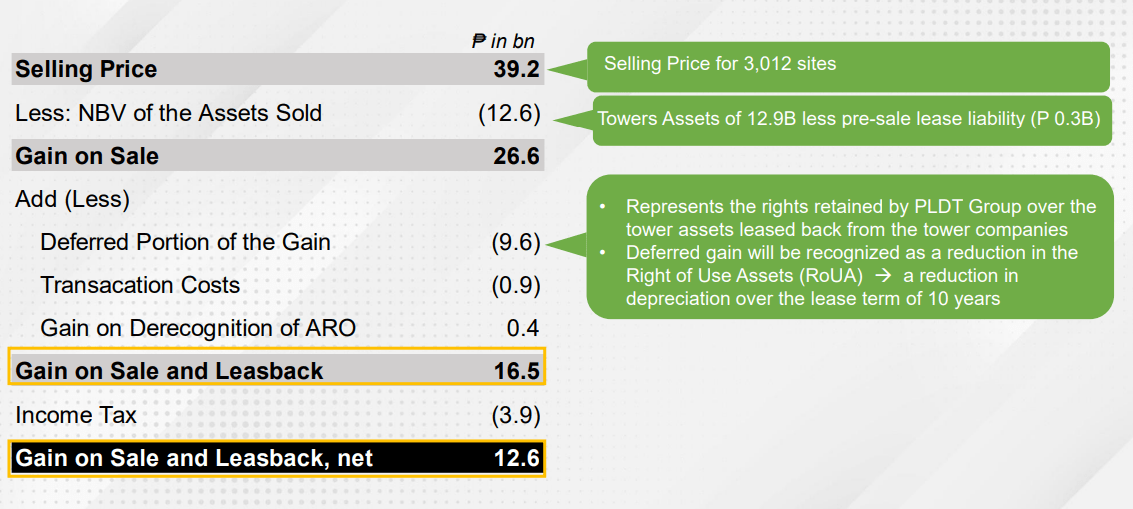

PLDT received a gain of PHP16.5 billion from the tower sales, which is expected to provide a valuation uplift and enable capital reallocation for the company.

“This partnership with experienced international tower companies represents another milestone in PLDT’s strategic transformation. We expect to reap benefits in terms of a valuation uplift and capital reallocation, with PLDT applying the proceeds to deleverage, further invest in the network, and return cash to shareholders via a special dividend.”

I am on management’s side on this one. The tower sales and leasebacks can provide value for the investors and be a way to insulate in a problematic macro situation. With their dividend policy, the sales can potentially improve the company’s value while giving back cash to its shareholders.

Source – PLDT Q2’22 Earnings Call Presentation

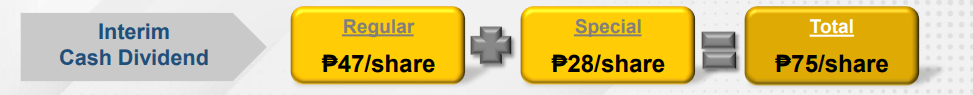

With PLDT’S dividend policy: 60% payout of H1’22 telco earnings of PHP17 billion, the company will pay PHP47/share for its regular dividends. Out of the PHP9 billion earmarked from tower sale proceeds, PHP6 billion is to be paid as special dividends – proportionate to the amount received from the two first closings, paying out a total of PHP75/share in dividends.

Outlook & Guidance For 2022

Source – PLDT Q2’22 Earnings Call Presentation

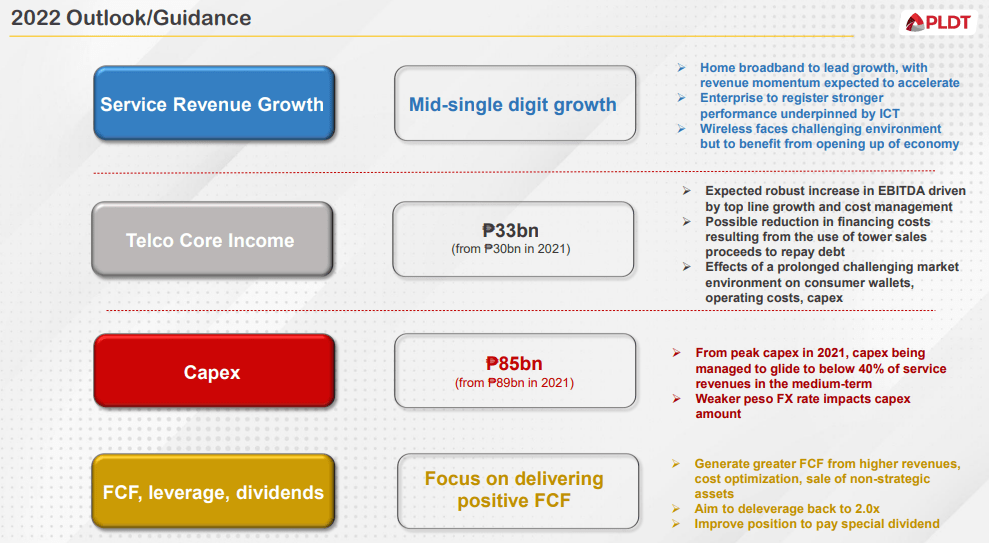

The picture above shows PLDT’s guidance for the rest of 2022, and I must commend management for their ability to recognize strengths and weaknesses. I agree with their outlook on the service revenue growth but wouldn’t be too optimistic about a mid-single digit growth. Sure, there are demands in the home broadband market, and revenue momentum is present, but I still think the future is uncertain. Inflation can affect PLDT’s core operations, mainly in the Broadband and Mobile markets. The company also reduced its CapEx due to a weak peso FX rate, which I think would continue to become weaker depending on the current macro situation. It’s also good that they’re slowly leveraging and focusing on generating FCF and creating a valuation uplift through their special dividends.

Price Return & Valuation

Source – Seeking Alpha Price Return

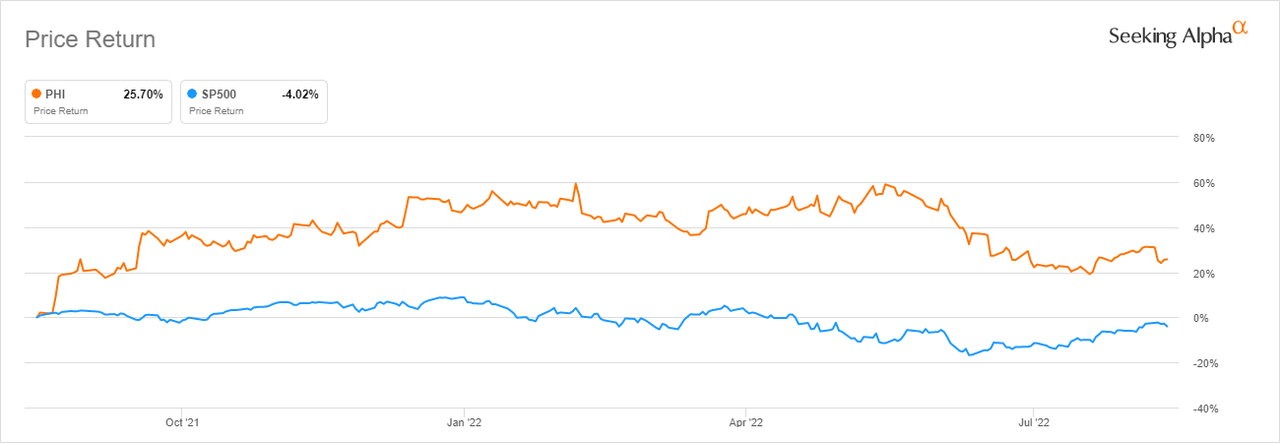

PLDT’s price has been up by 25% for the past year, while the S&P 500 has been a bit flat over the past year. I think the stock will hover around PHP1,600-PHP1,700 in FY2022 because of inflation and how it can change consumer spending patterns.

Source – Seeking Alpha TTM EV/EBITDA

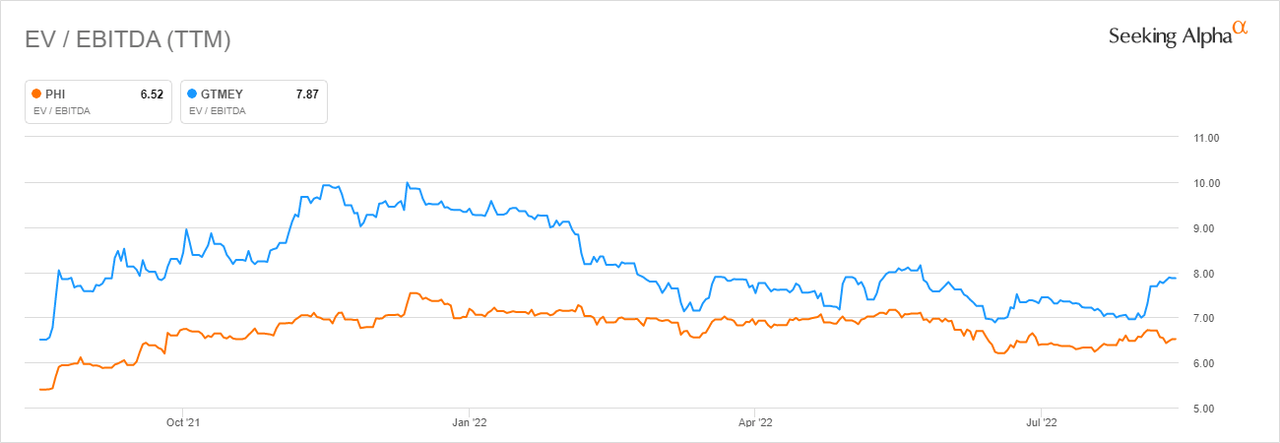

PLDT is trading right below Globe, which can signify that PLDT is currently undervalued compared to its telecom rival. The company hasn’t been generating cash in the past quarters too, and without further announcements, I rate the stock as a Hold for now.

Risks

The main risk I am seeing right now is inflationary pressures that can cause a decline in consumer demand. PLDT should expect a second half with stronger headwinds as inflation worsens.

“We expect stronger headwinds in the second half, with higher inflation impacting our customers’ pockets as well as our own operating costs. With so much pressure on growth, it is imperative that we stay focused on our strategic initiatives and managing costs.”

– PLDT Chairman Manuel V. Pangilinan

Even PLDT’s chairman expects to see stronger macro headwinds in the next quarters. This is also why I rate the stock as a Hold. Without further announcements on how they would insulate in potential stronger headwinds, I don’t find the confidence to rate the stock as a Buy for now.

Investor Takeaway

I think it’s excellent that PLDT has achieved all-time high revenues this first half of 2022. However, I’m still doubtful if they can maintain that growth over time, primarily when operating in an unfavorable economic environment. I also see their tower sales and leasebacks as a way to give more cash back to its investors, which, in my opinion, is suitable for both parties. Their special dividends will also keep them happy for the FY2022 and give a sense of assurance to the company’s investors. I’d be willing to follow the stock even further and wait for relevant announcements, but I rate the stock as a Hold for now because of inflationary pressures and macro headwinds.

Be the first to comment