TD shareholders should continue to see green, even if the First Horizon deal does not close. Elijah-Lovkoff/iStock Editorial via Getty Images

Author’s Note: Other than the ‘Background’ section in this article, we are picking up where we left off from Part 1. That article provides background on the deal, our strategy and how to trade First Horizon Corporation (FHN) shares. In this article, we will focus on implications for Toronto-Dominion Bank (NYSE:TD) and how to trade its shares.

Background

As we discussed in Part 1, we believe that this week will give investors following the TD-First Horizon deal further insight into what to expect as far as local opposition because on July 14th BMO Financial (BMO) will have its meeting for community input regarding its proposed merger with BNP Paribas’ (OTCQX:BNPQY) US subsidiary Bank of the West. Should that meeting go similarly to U.S. Bancorp’s (USB) earlier meeting for their acquisition of MUFG Union Bank, then we think in the interim that it would be good news, and increase the probability of the TD-First Horizon merger closing.

It is also important for us to mention that over the last week or so there have been a few stories, all of which seem to be based upon the same reports, about troubling sales practices at Toronto-Dominion’s U.S. subsidiary, TD Bank. While some of the articles we have seen discuss past events which appear to have been covered in a previous settlement with regulators, there do appear to be some reports alleging new problems. We have not performed any channel checks, but in our personal dealings with TD, we have not experienced anything we found to rise to the level of some of these allegations.

Impact Upon The Deal

This merger agreement was written pretty favorably from the perspective of Toronto-Dominion shareholders, as the bank offered to pay a handsome premium to First Horizon shareholders, threw in an automatic extension with an annualized $0.65/share ticking fee (which in reality is worth a maximum of an additional $0.1625/share using the February 27, 2023 final close date) and appear able to walk away from the deal on February 27, 2023 if it has not closed without major penalty.

If you read the Form 8-K, as well as a deeper read within the merger agreement, it appears that the break-up fees are minimal for both entities as long as regulators prevent the deal from happening. In short, reading from Section 7.1 to Section 8.2 of the merger agreement, it would appear that $25 million for reimbursement of professional fees, etc. is what would be owed from TD to First Horizon.

How Investors Should Play Toronto-Dominion

As we stated in our previous article about First Horizon, if a long-only investor already owns shares of Toronto-Dominion then we believe that it is in their best interest to hold shares through the meeting on July 14th. Where we differ with Toronto-Dominion, is that we believe Toronto-Dominion shares are a ‘Buy’ regardless of what is said at the July 14th meeting, so long as this is being viewed as a long-term investment.

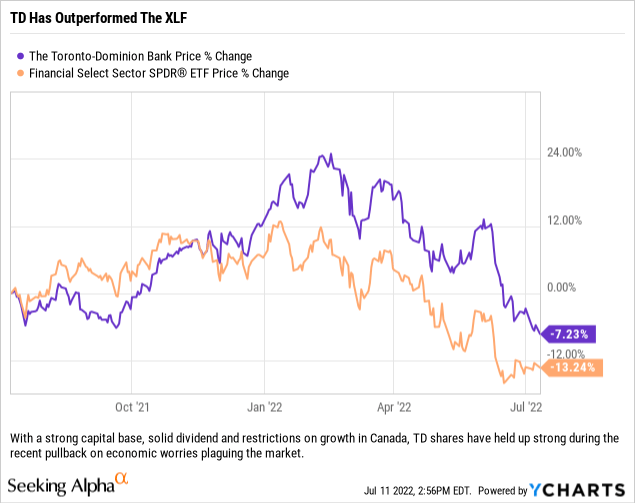

While Toronto-Dominion shares have performed better than the market over the last year, as well as year-to-date, we think that there is the potential for long-term outperformance regardless of whether the merger with First Horizon occurs or not. TD will get a really nice franchise that complements its current footprint nicely if the deal does go through, and because the transaction is being paid for in cash, the deal should be accretive to EPS right off the bat. Should the merger fall apart, TD will maintain its strong capital levels heading into a potential recession that hits both of its main territories; Canada and the United States. The strong capital base could enable the company to focus on returning capital to shareholders while also looking at smaller, bolt-on M&A that would not raise any antitrust or regulatory issues in an environment where deals might be easier to get approval for. In either case, we think TD shareholders are winners.

Long Only Investors

With the probability that this merger happens to be low by merger standards, some analysts have it slightly over 50% (Bank of America’s Ebrahim Poonawala recently had it handicapped between 60-65%), we think that investors looking to add long-only exposure in the names associated with this deal would be best served by going long Toronto-Dominion shares and avoiding First Horizon shares due to the potential downside (as it relates to the period before the meeting). Sure, First Horizon was able to sell some Preferred Stock for $494 million to TD to help fund future growth, but with some of our estimates pointing to roughly 30% downside, we believe long-only investors are better served by buying shares of Toronto-Dominion Bank, avoiding a potential big one-day move lower, collecting a roughly 4.32% annual dividend while also potentially being able to benefit from a less volatile TD share price if the deal looks in trouble or does not go through.

We would point out that anyone buying this week missed out on the last dividend, so that is something to consider when planning on when to purchase shares.

Investors Looking To Utilize Options

The options market for Toronto-Dominion consists of monthly contracts, not weekly, so for anyone trying to utilize the options market to generate an option premium to offset the last dividend payment (the stock went ex-dividend last week) we think the only contract that makes any sense for those wanting to put capital to work today is the July 15, 2022 $62.50 Puts which currently trade at a $0.40/$0.50 bid/ask. The mid-point here would be just over half of the missed dividend.

Note: At current prices, this does not guarantee that you own the shares though, so for those wanting or needing the financial exposure it might be best just to purchase the shares outright.

Closing Summary

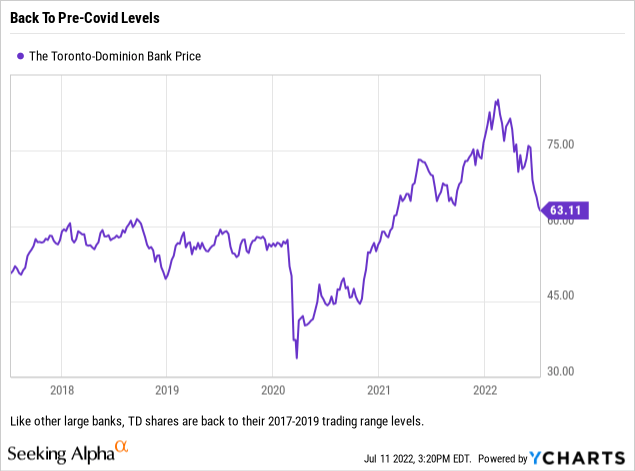

When it comes to banks, we have long been a fan of Toronto-Dominion because of its ability to use its mature home market to fund growth and expansion in a far more lucrative market; the United States. For years, that has worked well for the company, but now with regulatory issues creeping up and an aggressive Administration in the United States focused on M&A transactions and their effects on the economy, we think that the company will face headwinds and not have the easy path to growth that it once did. With that said, we still think that this is one of the better names to own among the large banks, and while the dividend may create some headaches when filing your annual tax return, it is arguably the most attractive payout among TD’s large, U.S.-listed peers. TD is a buy under $64/share.

Be the first to comment