tifonimages/iStock via Getty Images

Planet Labs PBC (NYSE:NYSE:PL) is one of the leading providers of satellite imagery and geospatial analytics on a worldwide scale. The company has a strong position in the market and is well positioned to cater to the growing trends in digitization and sustainable transformation of the global economy. Planet Labs has been able to capture a large share of this market by developing more satellites and actually making them one of the largest earth observation satellite fleets in the world.

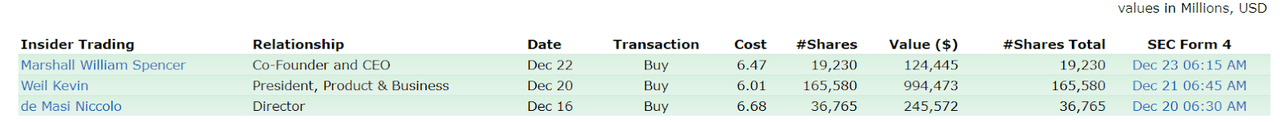

Although the company doesn’t have a positive bottom line yet, it has a growing number of customers and its business model remains a key part of planet monitoring. This unlocks massive upside potential with positive insider trading from the management. This stock is priced attractively near its book value per share of $2.37, making it an attractive buy at its further drop.

Company Background

PL offers a variety of data products to customers in agricultural, energy, government, and other industries that require high-resolution images from space to gain a new perspective on the world. PL’s ambitious objective is to make earth observation data accessible and inexpensive not just to the government but also to businesses, and to give them a depth of information that assists them in gaining a deeper understanding of our planet’s resources.

As of the date of this writing, the company has been able to expand its customer base and now serves over 800 customers, up from 700 in January 2022. Among these customers include big commercial and government agencies worldwide. PL closed its Q1 2023 with an exceptional net dollar retention rate of 104.6%, up from 93.2% from the same quarter last year, which translated to a growing top line of $139.4 million. This has been accomplished by launching more satellites into space. PL presently has over 200 earth observation satellites, making it one of the world’s largest earth observation satellite fleets. This is way better than its peer, Maxar Technologies Inc. (MAXR), which only has 81 low earth orbit satellites.

PL also released an outstanding product update in April of this year with its next generation high resolution satellite called Pelican, which is expected to be launched in early 2023.

Pelican satellites are designed to deliver up to 30 centimeter resolution imagery, reduced latency and rapid revisit, 12 times per day globally and up to 30 opportunities in mid latitudes, an unprecedented revisit rate. As with all satellites designed at Planet, we are targeting a payback period of one year or less for the Pelican, a reflection of our cost efficient agile aerospace capabilities. Source:Q1 2023 Earnings Call Transcript

The Pelican has a greater precision of up to 30 cm and is expected to surpass its Skysat satellites with 50 cm of resolution. It is also built with reduced latency for faster transmission of earth data and a higher daily revisit rate of up to 30 captures per day.

New Partnerships and Contracts

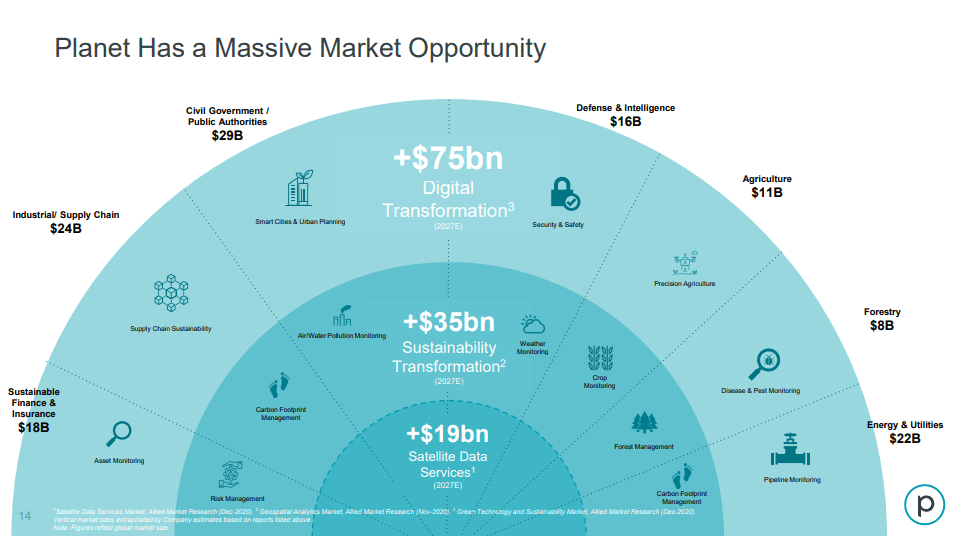

PL: Massive TAM (Source: Planet.com)

I believe PL is set to capitalize on its $129 billion TAM with its growing satellite fleet in orbit, improving customer base, and meaningful partnerships in agriculture and energy industry such as with Bayer and SynMax.

Although competition between MAXR and BlackSky Technology Inc. (BKSY) remains a question for the company, they are all awarded contracts for Electro-Optical Commercial Layer (EOCL), contracts by the National Reconnaissance Office (NRO). This resulted in a secured profit for PL, as quoted below.

The EOCL award is Planet’s largest contract to date, and we’re thrilled to have been awarded a firm fixed price contract of $145.9 million in the initial period of up to five years, of which $89 million is for the first two years. This initial award significantly increases our revenue visibility by almost doubling the backlog of contracted revenue as we had on April 30. Through EOCL, Planet will supply planet scope monitoring, sky set tasking, and archive access to the US government. Source: Q1 2023 Earnings Call Transcript

As of Q1 2023, PL has an outstanding $152.4 million in remaining performance obligations (71% to be recognized within 12 months) on their balance sheet and, with its $145.9 million EOCL contract, I believe it remains liquid and stable in today’s high inflation environment.

Management Released More Conservative Figures

Despite this positive catalyst, the management cut its higher range outlook for its top line in FY2023 from $170-$190 million to $177-187 million. There is also an update about its Non-GAAP gross margin from 43%-50% to 47%-49% and adjusted EBITDA loss from ($75)-($50) million to ($70)-($60) million for FY2023. I believe the management is trying to be more conservative and looking at their lower range target, it actually improved, especially looking at its estimated top line and non-GAAP gross margin. This leaves PL with an outstanding 34% YoY potential top line growth and potentially outperforming MAXR’s current Non-GAAP gross margin of 45.99%.

Caveat: Still Unprofitable

PL still faces a negative bottom line this Q1 2023. In fact, it generated ($44.4) million, down from ($29.3) million in the same quarter last year. However, with its disappointing adjusted EBITDA outlook for FY2023 of being around ($70)-($60) million compared to ($41.05) million recorded in FY2022, this makes PL unattractive and is one of the reasons why it dropped more than 30% from this year’s high.

On the brighter side, on top of its product upgrades and meaningful partnerships mentioned earlier, PL is also exploring new solutions to ESG risk with Moody’s. Its improving brand awareness due to the Ukraine conflict, as quoted below by the management, will help PL sustain double digit growth over the next five years and hopefully see a shift in its operating margin trend.

We are working with and supplying data to nearly 30 NGOs and intergovernmental bodies who are supporting a number of humanitarian operations in Ukraine. These include civilian evacuation and planned demining operations, conducting building damage assessments, tracking alleged human rights abuses, and trying to mitigate and measure impact to food supplies. Source: Q1 2023 Earnings Call Transcript

PL Is Relatively Cheap vs Peers

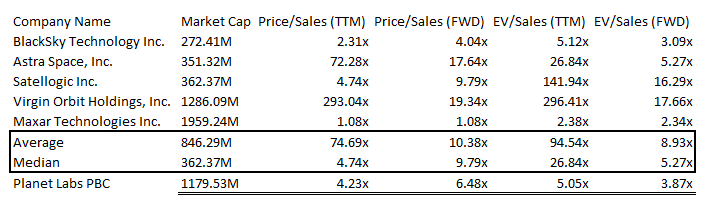

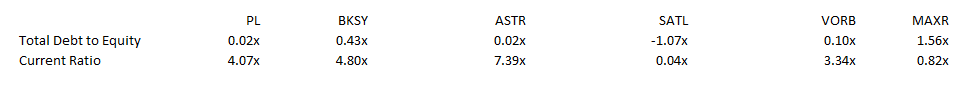

PL: Relative Valuation (Source: Data from SeekingAlpha. Prepared by InvestOhTrader )

BlackSky Technology Inc., Astra Space, Inc. (ASTR), Satellogic Inc. (SATL), Virgin Orbit Holdings, Inc. (VORB), Maxar Technologies Inc.

By simply looking at the image above, we can assume that PL provides more upside potential than its peers. Investigating its forward EV/Sales ratio of 3.87x and its peers’ median of 5.27x, shows that it is one of the cheaper companies as of this writing. Additionally, PL trades at a trailing 4.23x P/S ratio and analysts estimate a 2.80x P/S for FY2025. Comparing these figures to its peers’ median of 9.79x and its P/S of 40x in FY2022, I believe PL is undervalued and is ripe for at least a 1x price return. Using the street’s price target of $8 as our initial target seems reasonable, especially considering today’s global economic slowdown due to rising inflation.

Although MAXR seems the cheapest among its peers in terms of its P/S and EV/Sales multiples, putting the balance sheet into consideration makes PL a safer company, as shown in the image below.

PL: Relative Valuation (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

MAXR has 1.56x debt to equity, while PL only has 0.02x. This is thanks to PL’s low total debt of $9.5 million. Looking at current ratio, ASTR seems to be the winner with its 7.39x, followed by BKSY and PL. To sum it up, I believe PL is undervalued compared to its peers and has better liquidity suited to today’s macro uncertainties.

Consolidation Above $3

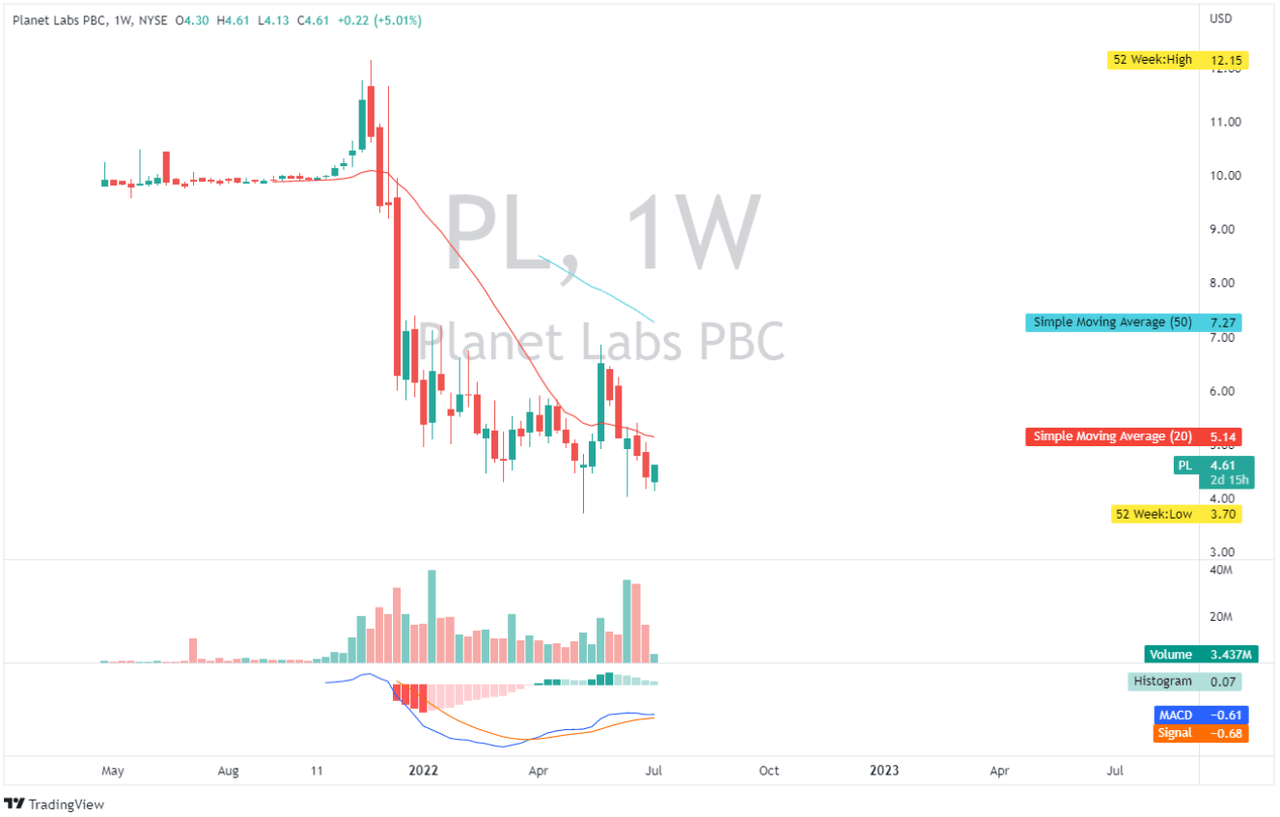

PL: Weekly Chart (Source:TradingView.com)

The chart above clearly shows how much PL’s value dropped from the highs of its 2021. It is currently consolidating at around $3, which in my opinion is a strong support zone to monitor. A break of its 20 day simple moving average may imply short term bullish price action and potentially form a double bottom reversal pattern. PL’s MACD indicator stays below the zero line but above the signal line, indicating that bulls are gaining ground.

Final Key Takeaways

As we face negative sentiment from the slowing global economy, investing in an unprofitable company like Planet Labs comes with high risk. Nonetheless, the company’s top line is robust and its moat in planet monitoring is expanding as its industry services improve. With $484.5 million in cash and cash equivalents and $9.5 million in total debt on the balance sheet, I believe that PL is highly liquid and is ripe for a meaningful acquisition.

PL: Positive Insider Trading (Source: Finviz.com)

PL’s improving gross margin outlook is something to commend, especially in today’s macro environment. It also benefits from positive insider trading, as shown in the image above, which serves as a positive catalyst for the company. PL’s sustainable growing top line and good liquidity makes this stock worth buying at today’s level.

Thank you for reading and good luck!

Be the first to comment