imaginima/E+ via Getty Images

Plains All American Pipeline, L.P. (NASDAQ:PAA) is one of the largest midstream partnerships in the United States. This has certainly been an interesting sector to be in over the past few years as it was booming prior to the COVID-19 pandemic and the resulting oil crash caused many energy companies to scale back on their growth plans. This of course meant that some of the growth projects that midstream companies were developing were no longer needed, forcing them to shelve their own growth plans. A few midstream firms, including Plains All American Pipeline, even cut their distributions to weather the crisis, which was naturally irritating for investors. Fortunately, the energy industry has since recovered due to the surge that we have been seeing in energy prices, and Plains All American Pipeline is no exception as the partnership units are up a respectable 9.68% year-to-date. The company has even begun to increase its distribution, although it remains lower than what the partnership had prior to the crisis. The firm still yields 7.61% at today’s price though and there may certainly be some reasons to add Plains All American Pipeline to your portfolio today.

About Plains All American Pipeline

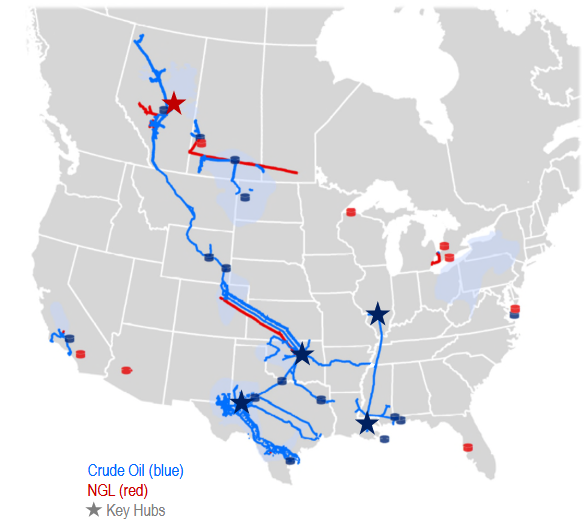

As stated in the introduction, Plains All American Pipeline is one of the largest midstream partnerships in the United States, boasting an infrastructure network stretching across much of the central part of the country and even up into Canada:

Plains All American Pipeline

The scale of the company’s network is immense. Plains All American Pipeline’s infrastructure is capable of transporting more than seven million barrels of liquids per day. The company also boasts approximately 140 million barrels of storage capacity and about 200,000 barrels per day of natural gas liquids fractionation capacity. This easily puts it into the size range of the largest midstream companies around. One of the things that we notice from looking at the map above is that the partnership’s infrastructure extends to most of the basins in which liquid hydrocarbons are produced, most notably the Permian Basin, the Bakken shale, and the Western Canadian Sedimentary Basin. This is nice because all of these basins have somewhat different fundamentals. For example, it is generally more expensive to produce in the Bakken shale than in either of the other two, which caused the total basin output of the Bakken to decline much more than the other two when crude prices collapsed. Curiously, the Bakken has also seen somewhat more production growth than the other two regions now that energy prices have recovered. The fact that Plains All American Pipeline has operations in all three areas thus provides it with diversification benefits over the long haul.

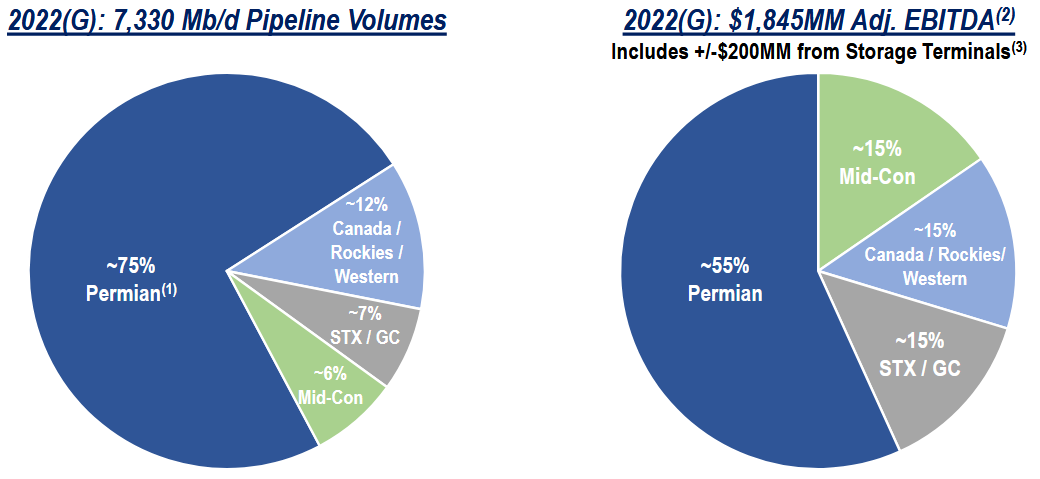

With that said though, the overwhelming majority of Plains All American Pipeline’s operations are in the Permian Basin. As we can see, approximately 75% of the company’s 2022 volume throughput and 55% of its adjusted EBITDA is expected to come from its Permian Basin operations:

Plains All American Pipeline

This could prove to be a drag on the company’s forward growth potential. As I have pointed out in a few previous articles (such as this one), several of the major producers in the Permian Basin such as Diamondback Energy (FANG) have stated their intentions to hold production steady going forward in order to focus their attention and efforts on maximizing free cash flow. However, Plains All American Pipeline and Enverus project that the total production in the Permian Basin could grow by as much as two million barrels per day over the next three years:

Plains All American Pipeline

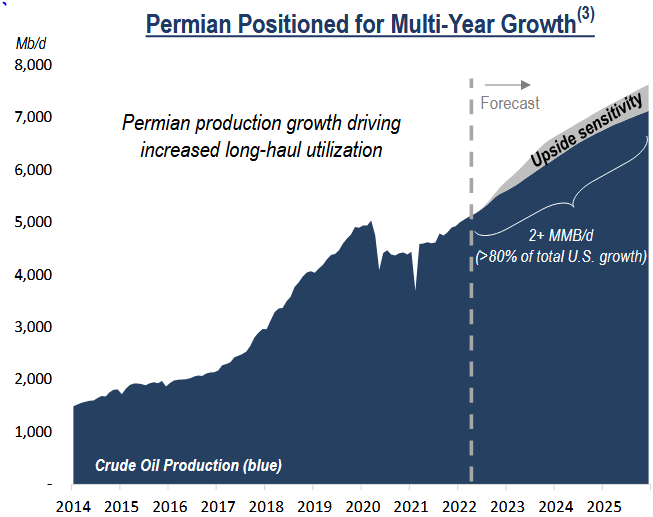

For its part, the United States Energy Information Administration also notes that the production of crude oil has risen sharply in the Permian Basin so far in 2022 and has exceeded the previous peak set in early 2020:

U.S. Energy Information Administration

It thus appears that not all of the upstream operators in the Permian Basin are following the lead of the larger operators. As it still remains to be seen if the production in the basin will actually grow to the degree that Plains All American Pipeline projects, it is certainly possible that management is being too optimistic here. The reason that this is important is because of the business model that Plains All American Pipeline uses. In short, the company enters into long-term contracts with its customers under which the customer compensates Plains All American Pipeline based on the volume of resources that the company handles. Thus, should production in the Permian Basin increase, Plains All American Pipeline could be in a position to benefit since that means that more resources will need to be transported to the market where they can be sold. The nice thing about this business model is that it provides Plains All American Pipeline with a relatively steady source of cash flow over the long term. Plains All American Pipeline currently has approximately 70% of its total pipeline capacity booked under contracts with an average remaining term of five years. This should help protect the company from wild fluctuations in cash flows no matter what energy prices do, although as we will see later in this article, energy prices are generally poised for growth.

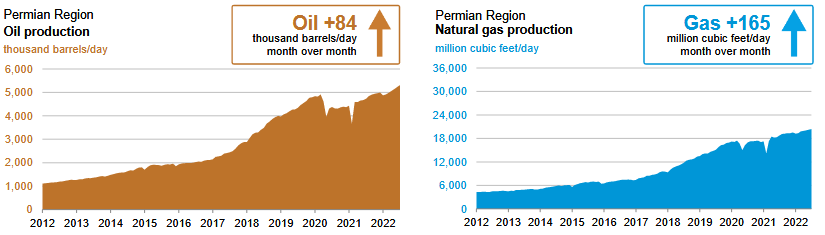

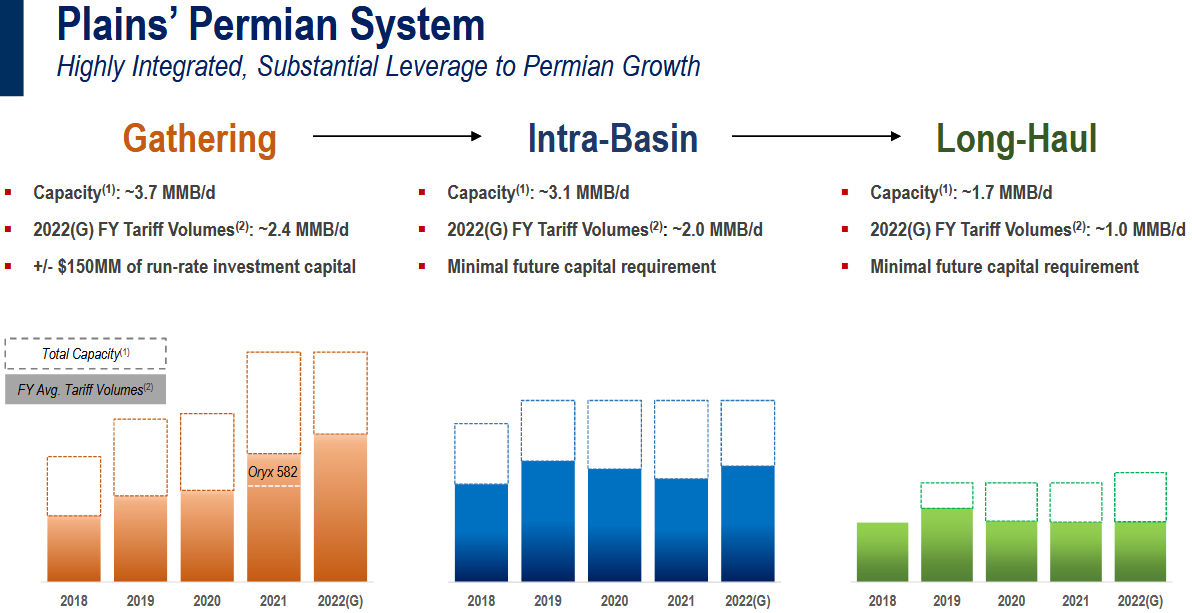

Earlier in this article, I mentioned that many midstream companies were forced to cut back on their growth projects since they were no longer needed following the collapse of oil prices. Unfortunately, Plains All American Pipeline was one of these companies, and as such it has fairly limited growth potential from new projects coming online. However, it is not totally out of growth prospects. In fact, the company is quite well positioned to see cash flow growth should production in the Permian actually increase to the degree that the company has projected. The growth will come from the fact that Plains All American Pipeline currently has a significant amount of unused capacity in its infrastructure in the Permian Basin. In other words, the company’s network is capable of handling much more than what the company’s customers are currently sending through it. We can clearly see that here:

Plains All American Pipeline

Thus, the company’s path to growth is now easy to see. If the upstream resource producers in the Permian Basin increase their output, then they can simply purchase transit through Plains All American Pipeline’s excess capacity. This is actually a reasonably good position for Plains All American Pipeline to be in. This is because it does not require significant capital expenditures for the company to generate growth. The normal way that a midstream company would grow its cash flows is to seek out a contract with a customer and then construct a pipeline or other infrastructure to meet the needs of that contract. As we can see, Plains All American Pipeline does not need to do that because it already has the infrastructure in place, which helps it keep growth capital spending down and thus maintain its balance sheet strength. This situation could also provide Plains All American Pipeline with a competitive advantage. This is because it will not have to spend the time constructing the infrastructure that the customer needs whereas a potential competitor might, which could lead that customer to prefer to contract with Plains All American Pipeline for its midstream needs. Overall, this is quite a good position for Plains All American Pipeline to be in.

Fundamentals Of Crude Oil

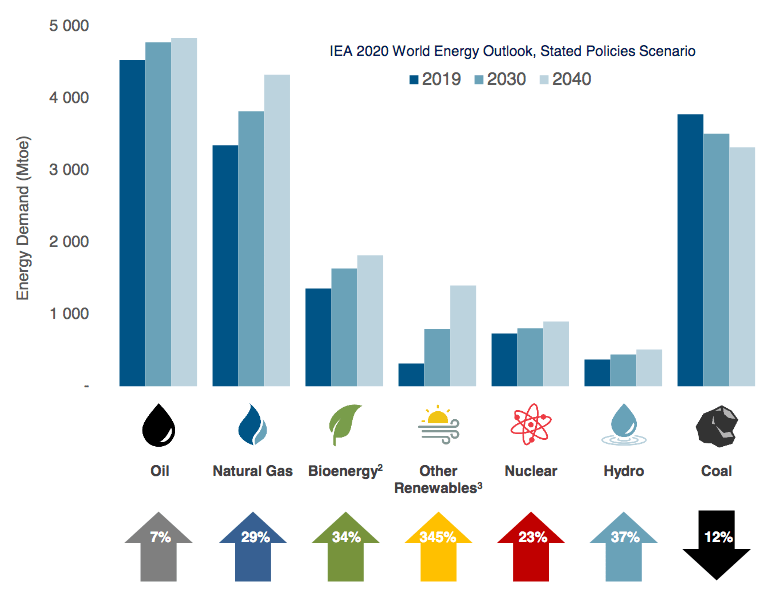

Overall, approximately 80% of Plains All American Pipeline’s adjusted EBITDA is derived from providing midstream infrastructure to customers that need to transport and store crude oil. As such, we should take a look at the fundamentals of crude oil as part of our analysis. Admittedly, crude oil, in general, has been getting something of a bad rap lately from the media, politicians, and climate activists so one could easily be forgiven for thinking that the fundamentals are not particularly good. However, nothing could be further from the truth. In fact, the global demand for crude oil is expected to increase over the coming years. According to the International Energy Agency, the global demand for crude oil will increase by 7% over the next two decades:

Pembina Pipeline/Data from IEA World Energy Outlook

This may be surprising, particularly when considering that many developed nations are actively attempting to reduce their consumption of crude oil. However, it becomes somewhat more understandable when we look at the numerous emerging nations around the world. These countries are expected to see tremendous economic growth over the projection period. This will naturally have the impact of lifting the citizens of these nations out of poverty and putting them firmly in the middle class. These newly middle-class people can be expected to want to enjoy a lifestyle that is much closer to what their peers in the developed nations enjoy than what they have now. This will naturally require growing energy consumption, including energy derived from crude oil. As the populations of these nations are much larger than the populations of the developed nations, the growing demand for crude oil can be expected to more than offset the stagnant to declining demand in the developed world.

The United States is one of the few nations around the world that can significantly increase its production of crude oil in order to satisfy this demand growth due to the wealth of regions like the Permian Basin. We have already seen that Plains All American Pipeline will benefit should the energy industry increase its output to meet the growing demand. However, most indications are that any increase will not be sufficient to fully satisfy demand, which points to the likelihood of high oil prices going forward. This is because the energy industry has underinvested in production and infrastructure ever since the 2015 bear market. This underinvestment is one reason that the offshore drilling firms never recovered from that event, despite the strong recovery elsewhere over the 2016 to 2020 period. According to Moody’s, the energy industry needs to immediately invest $542 billion into upstream production alone if the market is to avert a supply shock. When we consider the incredible pressure that the industry is under from politicians and environmental activists to improve the sustainability of its operations as well as from investors to improve returns, it seems highly unlikely that the industry will actually do this. Thus, we have a situation in which demand growth is likely to outstrip supply growth. According to economic law, this leads to rising prices.

Distribution Analysis

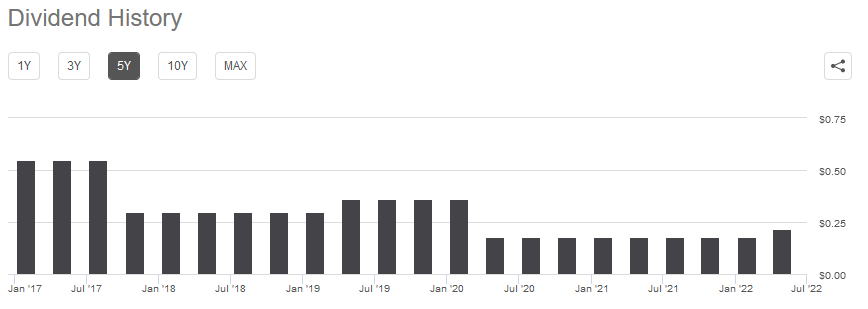

One of the biggest reasons that investors purchase midstream partnerships is because they historically have higher yields than most other things in the market. Plains All American Pipeline is certainly no exception to this as the company yields 7.61% at today’s price. Unfortunately, the company was one of the midstream partnerships that was forced to slash its distribution dramatically back in 2020 in response to the COVID-19 lockdowns and the ensuing collapse in oil prices. Although the company did begin to reverse that with a distribution hike in the most recent quarter, the distribution still remains well below the level that it had heading into 2020:

Seeking Alpha

This history may prove to be a turn-off for investors that are looking for a stable and secure source of income to fund their lifestyle, as is the case with many retirees. However, anyone purchasing the partnership units today will receive the current distribution and the current yield and does not actually have to be concerned about the company’s somewhat troubling past. The most important thing for us today, therefore, is whether or not the company can maintain its distribution at the current level.

The usual way that we analyze a midstream company’s ability to pay its distribution is by looking at a metric known as the distributable cash flow. This is a non-GAAP financial figure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the limited partners. During the first quarter of 2022, Plains All American Pipeline reported a distributable cash flow of $401 million, which works out to $0.57 per common unit. However, the company only pays out $0.22 per common unit quarterly. This gives Plains All American Pipeline a distribution coverage ratio of 2.59x, which is quite attractive. Analysts generally consider anything over 1.20x to be a reasonable and sustainable level and as we can see, Plains All American Pipeline is substantially above that. Overall then, the company’s distribution should be reasonably safe at the current level and investors should not have to worry about another cut going forward.

Conclusion

In conclusion, Plains All American Pipeline was one of the more heavily impacted midstream companies by the events of 2020 but it appears to have weathered through reasonably well. The company may still have some significant growth potential ahead of it but I do worry that management may be too optimistic about the potential for production growth in the Permian Basin. With that said though, the company currently has excess capacity throughout its Permian Basin systems so it should not have to worry too much about capital expenditures even if growth is not as strong as the company predicts. The company still boasts a sustainable distribution that should continue to reward investors even should this growth not happen so it may still make sense to purchase for a portfolio.

Be the first to comment