Joe Raedle/Getty Images News

After taking a couple weeks off, I wrote up my two favorite tobacco stocks on Sunday and Monday. I’m talking about British American Tobacco (BTI) and Altria (MO). I’m still very bullish on both and I recently topped off my Altria position after a 10% selloff due to a bearish analyst note from Morgan Stanley. After writing up the two companies that I own, I figured it would be worth covering the other major tobacco company, Philip Morris (NYSE:PM).

Investment Thesis

Philip Morris is one of the largest tobacco companies in the world, with a market cap of $160B. They sell their products in international markets and have worked to diversify their product line into reduced risk products other than cigarettes. The company has had to deal with complications in Ukraine and Russia due to the invasion, but the business should be fine over the long term. Unlike the other tobacco giants, shares currently trade near fair value. At 17.4x earnings, there isn’t the same margin of safety that there is with other companies in the industry. Some investors might be interested in the 4.9% dividend yield, but I would urge them to consider some of the cheaper competitors if they are interested in the tobacco industry.

The Business

Philip Morris operates in markets outside of the US, with Europe, Australia, and Asia making up the majority of their revenues. The company sells the well-known Marlboro brand outside the US, along with several other recognizable brands. Their business has taken a hit with the conflict in Ukraine, but the company should be able to weather any complication fairly well over the long term.

Like the other tobacco giants, the company has a solid balance sheet and an impressive margin profile. The company has $4.6B in cash on hand and carries a reasonable debt load with interest rates that are well below the rate of inflation. Philip Morris has net margins above 25% and will likely be able to maintain these margins for the foreseeable future. They were also in the news in May for striking a deal to acquire Swedish Match (OTCPK:SWMAY), which is well known for their tobacco free nicotine pouch, ZYN. The total price of the deal is $16.1B and should help the company continue to grow their reduced risk product line.

Philip Morris has more exposure to Ukraine and Russia than British American Tobacco, which led to a guidance cut. If Philip Morris were trading at similar multiples to BTI or Altria, I wouldn’t be too worried about the guidance cut. However, at 17.4x earnings, there isn’t the same margin of safety there as there is with BTI or Altria.

Valuation

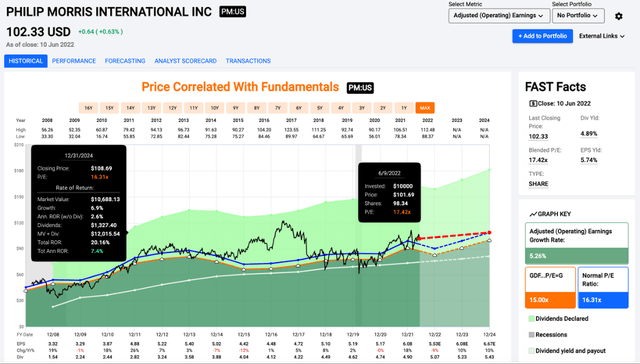

Philip Morris is currently trading right around fair value. Shares are slightly above the average multiple of 16.3x earnings right now. At 17.4x earnings, there isn’t a margin of safety for new investors. The company will certainly stay on my watchlist because of the impressive margin profile, but I’m not interested in shares at the current price.

Price/Earnings (fastgraphs.com)

I don’t think we will see multiple expansion for shares Philip Morris. That means most of the total return will be driven by earnings growth and the dividend. While EPS is expected to decline for 2022, FAST Graphs is projecting double digit EPS growth in 2023 and 2024. While the valuation isn’t much to salivate over, the capital return program might be enough to entice investors.

Dividends & Buybacks

Like the other tobacco giants, Philip Morris pays a generous dividend and is buying back shares at a decent clip. The dividend yield is currently 4.9%, which isn’t as juicy as some of the competitors in the tobacco industry but is well above the S&P 500 dividend yield. They have grown the dividend at a decent clip, and that should continue as the company continues to grow earnings and repurchase shares. In the first quarter of 2022, Philip Morris repurchase 2M shares for $199M. They had approximately $6B left on the repurchase program at the end of Q1, and I’m assuming that they will continue to repurchase shares at a similar pace.

Conclusion

If you have owned Philip Morris for a long time, this isn’t a call to sell your shares to buy BTI or Altria, especially if there are tax implications to consider. However, for new investors, I would strongly recommend looking at alternatives to Philip Morris given the cheaper valuations and higher dividends. The company has the impressive margin profile of the tobacco industry, along with a decent dividend and share buybacks.

With BTI and Altria trading near 10x earnings, I think the forward returns will be better for investors in those two companies. With Philip Morris at 17.4x earnings, I doubt there will be multiple expansion to compliment EPS growth and dividend income. The dividend yield is 4.9%, which is markedly lower than BTI’s 6.7% and Altria’s 7.3%. If you are looking to put cash to work, you could do a lot worse than Philip Morris. However, the returns are unlikely to match the returns for some of the competition in the tobacco industry, which is why Philip Morris is still a hold for me right now.

Be the first to comment