peshkov/iStock via Getty Images

Introduction

ARC Resources (OTCPK:AETUF) is a diversified oil and gas producer with its key operations located in the Montney region in Alberta and northeast British Columbia. Approximately two-thirds of its production is natural gas with the balance being made up of oil & liquids. ARC is guiding towards roughly 350,000 boe/day of production in 2022 thanks to its acquisition of Seven Generations Energy in 2021. With its founding in 1996, ARC has demonstrated an ability to navigate through many commodity cycles, its resiliency and conservatism is a practical approach to surviving and ultimately thriving in the long term. ARC is a Canadian focused company that trades on the TSX and therefore all figures discussed will be in CAD.

Conservatism

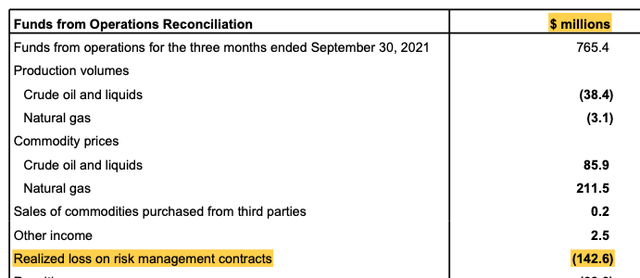

In Q4 2021, ARC Resources generated $459 million in free funds flow, certainly an impressive figure, however it also recognized a realized loss on risk management contracts of $143 million.

ARC Resources Q4 2021 news release

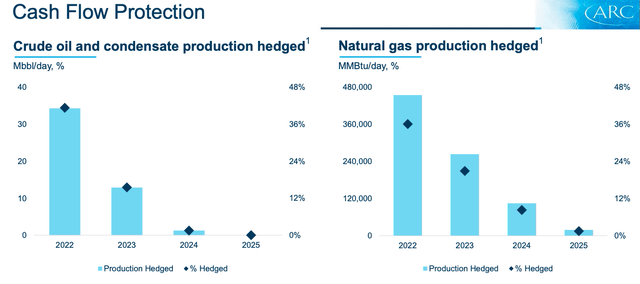

Unfortunately 2022 doesn’t look like it will be any better in terms of realized hedging losses. Approximately 42% of oil is hedged in 2022 via different risk management contracts at prices in the $50s. Nat Gas has nearly 48% of its 2022 production hedged at prices hovering around $3, depending on the location.

March 2022 Corporate Presentation

While these hedging losses will continue to be ugly given where prices are today, it’s important to think about the future as the market is a forward looking mechanism. While management’s hedging aggressively in 2022 hurts today, it demonstrates a prudence with which they operate, something important to surviving in a cyclical business.

Don’t Fuss About Hedging Losses

It’s easy to bemoan management for capping upside during these good times but what needs to be looked at is how the market is viewing things. Currently ARC is trading at $17 per share, with 694 million shares outstanding at year end 2021, which implies a market cap of $11.8 Billion. As mentioned, ARC’s management is a conservative bunch and their debt outstanding demonstrates that. At the end of Q4 2021 they had net debt of 1.8 Billion or 0.8 times funds from operations. Let’s remember in Q4 2021 with realized pricing of 92.11 CAD in crude oil and $6.45 mcf, free funds flow totaled $459 million or $0.65 per share. If one simply annualized that figure, it’d provide $2.60 per share in free funds flow. With a $17 share price that’d be over a 15% yield on equity, a very healthy return. Considering where oil and gas prices are today, free funds flow is on track to be significantly higher going forward, regardless of their poor hedges. By buying shares today one can feel secure in downside protection via the company’s hedging profile yet look forward to 2023 and 2024 as hedges roll off and the gusher of free cash flow trickles down to shareholders.

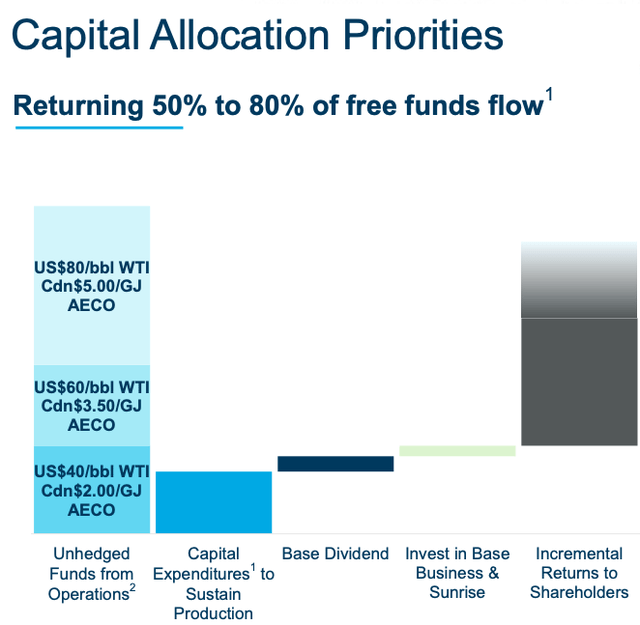

Running a conservative operation allowed ARC more flexibility over the past few quarters with their capital compared to heavily indebted companies that had to exclusively focus on repairing the balance sheet. ARC was in the enviable position of being able to pull multiple levers. They’ve been able to repay debt, pay a dividend and buyback shares over the past few quarters, getting a head start on their competition. They’ve provided a capital return framework where 50-80% of free funds flow is returned to shareholders through a combination of dividend growth and share repurchases.

Capital Allocation (March 2022 Corporate Presentation)

In an environment where potentially $2.5 billion of free funds flow is being generated, it’s not difficult to envision a scenario where $2 billion is being returned directly to shareholders annually. In that scenario were the entire amount allocated to a dividend, it would equate to an annual dividend of $2.88 per share, giving an investor today a 17% yield. While it’s unlikely the entire free funds flow will be allocated to a dividend it does demonstrate the future return potential. It’s a key reason a lagging share price isn’t the end of the world, either the share price goes up or the dividend yield becomes eye watering. As long as commodity prices remain near today’s level, returns will be strong.

Benefits of diversification

What’s perplexing is that ARC is trading at multiples similar to undiversified and smaller competitors. Based on TD’s 2022 expected cash flow of $5.09/share, ARC is trading at a 3.3x cash flow multiple while Advantage Energy (OTCPK:AAVVF) with a 2022 expected cash flow per share of $2.27 and a stock price of $8.60 is trading at a 3.80x cash flow multiple. While this isn’t a knock on Advantage it is an observation that a 55,000 boe per day, mostly undiversified producer with a $1.6 billion market cap is trading at premium multiples to ARC. Where is the premium multiple for a diversified producer of both oil and gas with owned infrastructure, long reserves life, significant scale, rock solid balance sheet and a proven track record? As multiples have compressed over the years in the energy space, producers were all painted with a similar brush. As the world begins to appreciate the importance of energy, expect to see investors looking more closely at this space and to be more discerning in terms of which companies they invest in. A re-rating to a premium multiple to peers is warranted. In the past, ARC and Tourmaline (OTCPK:TRMLF) would often be compared to one another. Today Tourmaline trades at roughly a 4.5x multiple of projected 2022 cash flow per share, applying the same multiple for Arc indicates a reasonable $23 per share valuation and a potential 35% return on a rerating alone.

Growth

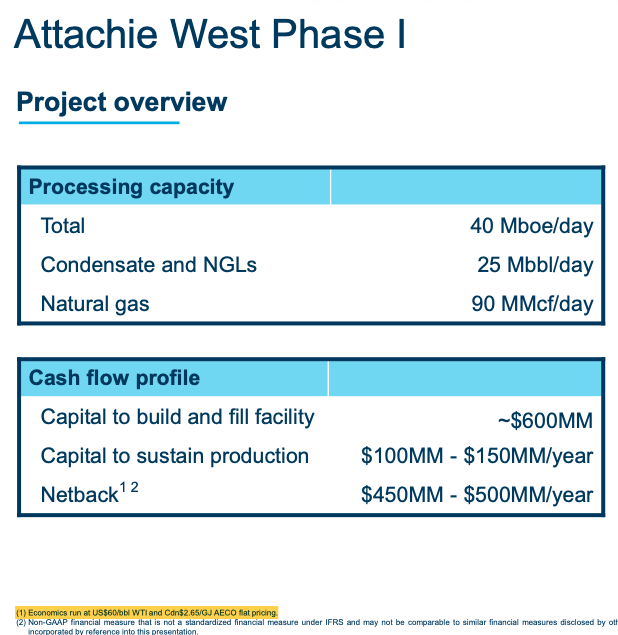

Based solely on Q4 figures, ARC Resources would seem to make a viable case for an investment. What hasn’t been mentioned is their opportunity for growth. While hedges rolling off over the coming years will provide a tailwind and act as a growth lever, the buildout of Sunrise and Attachie have the potential to truly be a game changer. Attachie is a condensate and liquids rich natural gas rich play located in Northern British Columbia, it’s anticipated to provide a netback of $450-500 million per year, and this is based on $60 WTI & $2.65 AECO pricing!

March 2022 Corporate Presentation

Capex spending for Attachie is set to rise once the BC regulatory environment clears up, which analysts are hopeful can be achieved in the next quarter or two. Sunrise is a dry natural gas play also located in Northern BC with plans to expand capacity by 80 mmcf per day in 2022. LNG Canada is inching closer to completion, which will finally provide Canadian gas exposure to the growing Asian markets. This will help support gas pricing in Canada and provide an opportunity for gas producers like ARC to tap into a new market to obtain global pricing.

Conclusion

ARC Resources is a well managed, conservatively run organization that is primed to exceed the low expectations set by the market. If an individual with high risk appetite is concerned about management’s prudent approach, then the investor can take the risk simply leverage up to purchase shares. The company rightfully understands they have more than just shareholders looking to make a quick buck to look out for. Building a resilient company with all stakeholders in mind is a proven winning formula.

ARC Resources ticks all the boxes for a high quality investment in the oil and gas space:

-

Large diversified producer with conservative balance sheet

-

Demonstrated commitment to shareholder returns via in place quarterly dividend and share repurchase plan

-

Internal growth opportunities via Sunrise and Attachie development

-

Cheap valuation due in part to hedges dragging down near-term performance, and the market’s inability to look far enough into the future

-

Strong macro backdrop in place that indicates elevated pricing for both oil and gas over both the near and medium term.

With these five critical pillars all in place, ARC Resources justifies consideration in any investment portfolio.

Be the first to comment