Stefonlinton/iStock Editorial via Getty Images

There’s no denying the fact that the world is, whether fast or slow, transitioning from fossil fuel-powered vehicles to electric vehicles. How long this transition will take is up for debate. But it is occurring and will one day result in all or substantially all of the vehicles on the road being powered by some form of alternative energy. In this vein, a number of companies have stepped up with the objective of meeting this demand. Many of these are large players. But there are some smaller enterprises that have established niche operations over the years. One such company that is dedicated to providing the technologies necessary to complete this transition is Xos (NASDAQ:XOS). For investors who believe that this transition will happen sooner rather than later, Xos might make for an interesting prospect. But given the company’s performance on both its top and bottom lines, most investors would be wise to stay clear of the firm for now.

A niche player in electric vehicles

Xos describes itself as a mobility solutions company that is dedicated to the manufacture of battery-electric commercial vehicles ranging from Class 5 to Class 8 in type. Operationally, the company has developed multiple technologies aimed at meeting this end goal of transitioning from fossil fuel to electric power. For instance, one of its technologies is called the X-Pack. This is a proprietary battery system that is used specifically for medium and heavy-duty commercial vehicles, with a particular interest on servicing last mile commercial fleets. Its offerings also include the X-Platform, which is the company’s own purpose-built vehicle chassis platform dedicated to the same market. When designing its technologies, the company has focused on a rather modular design that they believe will make it easier to service a wide range of last-mile applications. This technology design also makes it easier for operators to customize vehicles in order to fit their own personalized commercial applications.

A big part of the company’s business model involves the sale of its equipment to OEMs (original equipment manufacturers). The company also has other areas of interest. For instance, the business is also working on what it calls its Fleet-as-a-Service strategy. According to management, this service essentially works by bundling technologies into a single package in an attempt to make it easier and more cost-effective for customers to electrify their commercial fleets. Examples of offerings here include its own in-house services like the X-Platform, as well as digital fleet management products, software updates, and more. The company also hopes to include offerings from other providers in this kind of package.

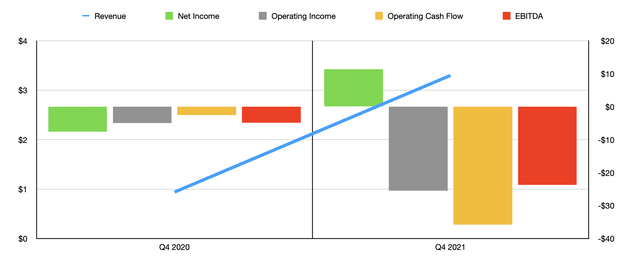

Although this may all sound exciting at first glance, investors need to keep in mind the difference between a business striving to achieve success and actually achieving that success. Fundamentally, Xos is lacking in a lot of ways. Consider, for instance, recent financial performance revealed by the firm. During the final quarter of its 2021 fiscal year, the company generated revenue of $3.30 million. Not only was this up from the $0.94 million the company generated one year earlier, it was also higher than what analysts anticipated by about $0.44 million. Earnings per share, meanwhile, came in at $0.07. This was up from me $0.12 loss analysts were expecting.

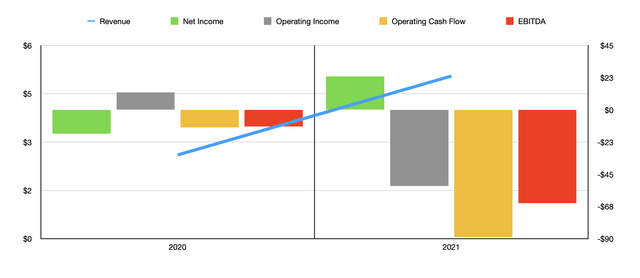

At first glance, this outperformance may seem great. And, truth be told, when you consider the company’s year over year results for all of 2021, the picture did show improvement. For instance, revenue in all of 2021 came in at $5.05 million. That’s roughly double the $2.64 million generated one year earlier. The company’s net loss of $16.67 million turned into a profit of $23.40 million. But as is common in the world of small businesses, the picture is more complicated. For the full 2021 fiscal year, the company generated a profit of $18.50 million associated with the change in fair value of derivatives contracts that it owns. It also experienced a $24.30 million profit associated with a change in the fair value of earn-out interest liabilities. Excluding these figures, the business would have generated a significant loss for the year.

To really get to the bottom of the fundamental condition of Xos, you need to look at cash flow. Operating cash flow for the year was negative to the tune of $88.90 million. This compares to the negative $12.34 million the company reported for the same time one year earlier. Another important metric to consider is EBITDA. Based on the data provided, this was negative by $65.25 million. One year earlier, for the 2020 fiscal year, it was negative by a more modest $11.56 million. For a company with a market capitalization of $491.05 million, these figures are tough to swallow.

This is not to say, of course, that everything regarding Xos is bad. The company’s balance sheet is actually quite solid at this time. Including finance leases, the company has gross debt of just $2.08 million. By comparison, it boasts $168.69 million in cash, cash equivalents, and marketable securities. Collectively, this brings the company’s EV (enterprise value) down to $324.44 million. Even with this, however, the company must fare well moving forward if it has any hopes of achieving financial success. One positive thing for investors is that management did offer strong guidance for the first quarter of its 2022 fiscal year. Revenue should range from between $4.5 million and $6.3 million, driven by between 40 and 50 units being delivered. This compares to the 44 units the company sold in all of 2021 and is up from the 17 sold in 2020. As a note, for the 2021 fiscal year, the 44 units sold consisted of 22 stepvans and 22 powertrains. Even with this improvement, however, the company is forecasting an operating loss of between $20 million and $25 million for the quarter. In order to help cover this, the company has decided to enter into an interesting agreement with a firm called Yorkshire. Basically, over the next 36 months, Xos will have the opportunity to sell stock in the enterprise to Yorkville in an amount of up to $125 million. That could help to keep the company going as it steps up output. But the downside is that it leads to further dilution for existing investors.

Takeaway

In order to actually be worth what the company is trading for, it must eventually generate positive cash flows. This is likely years away. But it does not mean that it won’t happen. Other companies in this space managed to pull off tremendous growth over an extended timeframe and ultimately turn cash flow positive. What this does mean, however, is that investors should be very cautious with an enterprise like this. Because we don’t have guidance beyond the first quarter of this year, we do not know what kind of future the business has. We do know that the company’s two Flex facilities are each currently tooled in order to produce up to around 2,000 vehicles per year. Ultimate capacity, once fully equipped, would be 5,000 vehicles annually per facility. But just because the firm has the capacity does not mean that it will ultimately capture the orders to meet that. In short, this is a highly speculative prospect that is forecasting rapid growth in the very near term but that will likely end up as a binary play where either the business grows into its valuation or generates a significant loss in principal for its investors. Prudent, value-oriented investors should steer clear, while risk-loving investors might find this worthwhile at this time.

Be the first to comment