Joe Raedle/Getty Images News

With the travel rebound in full swing, the cruise lines have become a disappointing segment in the general travel segment. Norwegian Cruise Line Holdings (NYSE:NCLH) posted a Q2’22 miss last week and isn’t making the expected progress towards a profitable return to full operations due to lingering Covid restrictions. My investment thesis remains Bullish on the cruise line stock, but investors will have to be patient.

Lingering Covid Impacts

The cruise lines generally reported disappointing Q2 earnings reports and provided weak Q3 profit pictures primarily due to lingering Covid impacts. While the rest of the leisure market is full speed ahead with limited Covid restrictions, the cruise lines managed to remain in a situation where passengers needed vaccines and negative Covid tests to book trips.

For Q2’22, Norwegian reported revenues missed analyst estimates by $60 million and most importantly the company missed EPS targets by a wide $0.31. The premium cruise line was busy ramping up operations during the June quarter, so investors didn’t exactly expect a perfect quarter.

The problem is that the market thought startup costs would end in Q2 setting up a profitable picture for Q3. Unfortunately, Norwegian just hasn’t gotten occupancy high enough with the restrictions on passengers.

The Q3 guidance is for occupancy levels is to reach the low 80% range after reaching 85% in July. The problem is that Norwegian hasn’t reached the 2019 occupancy levels primarily due to Covid restrictions.

The cruise line recently removed restrictions on vaccinated passengers and on kids 11 years old and younger while still requiring unvaccinated passengers to obtain a negative Covid-19 test within 72 hours of departure. In response, the company saw a big jump in bookings per CEO Frank Del Rio on the Q2’22 earnings call:

These modifications or protocols are meaningful and give us additional flexibility to reach a wider cruising population, reduce friction and travel-related hassles for our guests and bring greater variety to our itineraries. In fact, yesterday’s announcement was an instant catalyst, resulting in one of our top three best booking days of the year.

The problem here is that Norwegian was still willing to accept Covid restrictions more restrictive than the general leisure industry standards. In fact, the CDC came out two days later and basically eliminated all restrictions on Covid, including removing any requirements for screening of asymptomatic people (read unvaccinated people don’t need to be tested). The CDC basically appeared to shift Covid to the flu while Norwegian was willing to accept unnecessary restrictions while complaining about being held to higher standards.

Source: NPR

Naturally, the biggest risk to the sector is the reapplication of Covid restrictions next year impacting passengers enough to push the cruise line back into the red. After all, the CDC only has to flip flop on restrictions to cause enough passengers to pause trips again to disrupt the industry. Passengers will find alternative travel plans when restrictions are confusing and constantly changing.

Headed For Records In 2023

Due to the expected end of the remaining Covid restrictions by 2023 and all ships actively cruising along with new ships entering service, Norwegian forecasts record EBITDA next year. The stock recently skimmed close to the Covid low levels despite the far different operating environment now and the strong prospects for above normal numbers next year.

Norwegian continues to see incredible bookings for 2023 when passengers see a clear path to restriction free travel similar to domestic air travel now. The cruise line sees booking prices up 20% over 2019 levels with total bookings up 40% when accounting for new ships entering the mix in comparison to 2019.

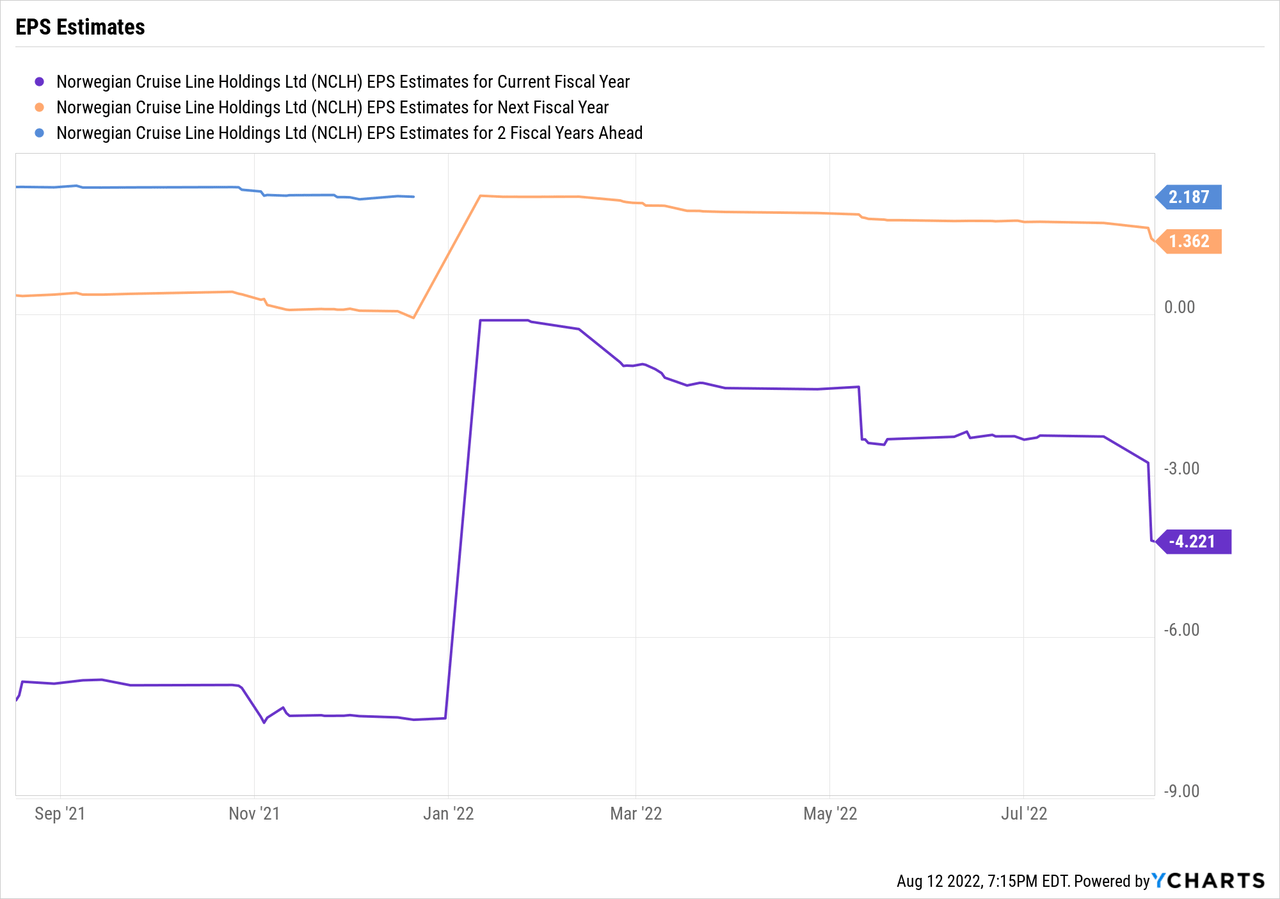

Analysts continue to predict a strong profit picture in the next couple of years leading to a 2024 EPS estimate of $2.19. The stock is very attractive here at only $14.

Norwegian continues to add new ships to fill growing demand. With limited voyages in the last three years, pent up demand should be enormous in the sector and the cruise line should overcome the issues facing the airlines this year where soaring demand met capacity constraints. The cruise line should be well prepared for normal operations next year.

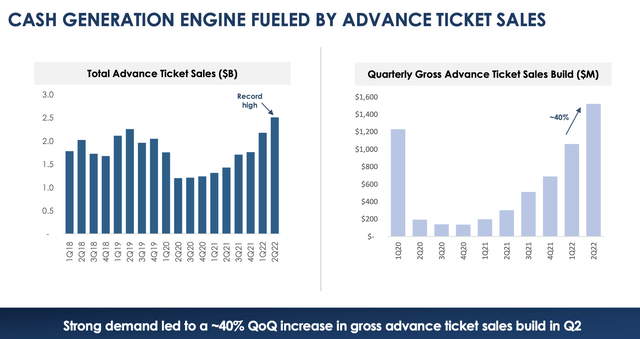

The cruise line was cash flow positive in Q2’22 due to strong advance ticket sales. Norwegian has net debt of $11.3 billion, but these advance sales will help the company maintain current debt levels before the profits start rolling in next year.

Source: Norwegian Q2’22 presentation

Takeaway

The key investor takeaway is Norwegian investors have to be patient. The cruise line is headed back towards a profits machine, but Covid restrictions have delayed the return until normal. The major risk is that new Covid restrictions are reimplemented next year, but the stock appears cheap for the risk considering even the CDC has thrown in the towel now.

Be the first to comment