Meletios Verras/iStock via Getty Images

Houston-based Alaunos (NASDAQ:TCRT), which changed its name from Ziopharm Oncology on January 26, is a small (~$200 million market cap) clinical-stage company focused on developing T-cell receptor (TCR) therapies based on its non-viral Sleeping Beauty gene transfer technology and its TCR library targeting tumor-specific oncogenic gene mutations called neoantigens. The TCR-T Library Phase 1/2 trial (TCR001-201) is an open label, dose escalation study being conducted by the renowned University of Texas MD Anderson Cancer Center. The next patient is anticipated to be treated sometime this quarter. Investors should probably wait for stronger clinical results, the earliest announcement of which would probably be in the first quarter of 2023.

TCR-T Library Trial

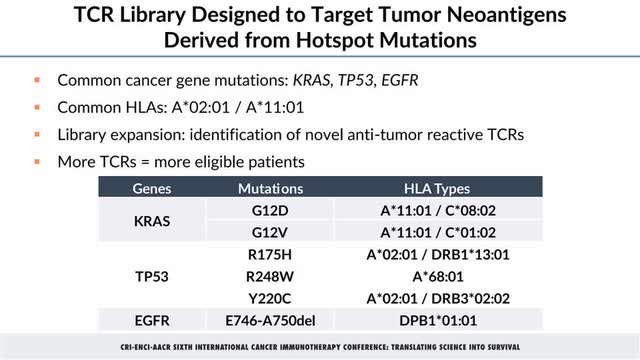

TCR001-201 is enrolling patients with non-small cell lung (NSCLC), colorectal, endometrial, pancreatic, ovarian, and bile duct cancers that have a matching human leukocyte antigen (HLA) and hotspot mutation pairing in Alaunos’ TCR-T library (Figure 1). The company expects to file an Investigational New Drug (or IND) amendment by next month to add two additional TCRs to the current ten.

Alaunos

On May 2, the first patient dosed had been diagnosed with NSCLC with a KRAS G12D mutation and initiated treatment at dose level 1 (5×109 TCR-T cells). The patient was confirmed to have achieved a partial response with a max regression of 51.2% in target lesions at week 12, TCR-T cell persistence at 24 weeks comprising approximately 30% of all T-cells in the blood, and a six-month progression-free survival (or PFS). Alaunos’ Chief Executive Officer emphasized the last observation as being competitive to the 6.5 month PFS of an approved product in the KRAS space, Lumakras Amgen (AMGN).

The second patient dosed was diagnosed with colorectal cancer with a TP53 R175H mutation and was treated in August at dose level 2 (4×1010 TCR-T cells). This patient achieved the best overall response of stable disease at six weeks and a 12-week progression-free survival, at which point TCR-T cell persistence was at 20% of all T-cells.

Financials

Operating cash burn for the first 3 quarters of 2022 was $7.8 million, $9.9 million, and $8.9 million, respectively, leaving Alaunos with $37.8 million in cash and cash equivalents. They also have restricted cash of $13.9 million collateralized to an August 6, 2021 loan with Silicon Valley Bank (SIVB), of which $2.5 million and $4 million will be released following the 8th and 10th monthly payment, respectively. Management claims that the cash runway will be sufficient to fund operations into Q2 2023 are reasonable, but worrisome. It is shorter than the typical 12-month cushion given by many biotechs.

Alaunos has a Cooperative Research and Development Agreement (CRADA) with the National Cancer Institute (or NCI) through January 2025. Under the CRADA terms, the NCI will generate proof of concept in solid cancer tumors by identifying TCRs that react to neoantigens in the patient’s tumor. Then, Sleeping Beauty will be utilized to transpose one or more of these TCRs into T cells for re-infusion, thus generating a personalized TCR-T cell therapy.

Alaunos is to provide test materials necessary for the NCI to conduct their studies and clinical trials. The company leases a cGMP-compliant facility near the Texas Medical Center in Houston. They recently expanded manufacturing capacity to produce two products in-house simultaneously. The conversion from a fresh to cryopreserved manufacturing process also slashed the time to produce TCR-T cells from 30 days to 26 days. The government being what it is, more than five years into the CRADA, the NCI has not yet enrolled its clinical trial despite clearing the requisite IND. Still, beginning in Q1 2023, Alaunos would have to begin contributing $0.25 million quarterly towards the CRADA.

This could be offset by future earnings from their Solasia Pharma partnership. In June 2022, darinaparsin had been approved for relapsed or refractory peripheral T-cell lymphoma in Japan. In Q3, Alaunos recorded $2.9 million of collaboration (not royalty) revenue primarily from Solasia’s achievement of certain sales-based milestones, representing a 631% increase over the $0.4 million in Q3 2021.

Risks and Takeaways

The most obvious risks are that Alaunos is currently a penny stock after falling from its 52-week high of $4.01 last month; large institutions are precluded from buying TCRT until it goes over $5. The collaborations were the only source of the company’s revenues in the past two years. It’s not safe to be long this stock until there’s actually signs of hope. A single complete response would do it. Until then, it’s is a speculative biotech in a bear market with no approved products and nowhere close to getting there, and may be better suited for options and day traders playing the volatility.

The planned 180-patient TCR001-201 has yet to recruit its third. Researchers are actively enrolling only for the second dose cohort. Perhaps better outcomes could be had at the third and highest dosing level of 1×1011 TCR-T cells, but that will take time and money. Milestones payments are variable, and Alaunos hasn’t received any royalty revenues on darinaparsin net sales and will probably recognize these in the succeeding quarter. Therefore, a lot will be riding on the results from the third patient. As a comparison, the latest CAR-T cell therapy, Carvykti from Johnson and Johnson (JNJ), was approved based on a 78% complete response rate.

So if results are good (complete response), in my view TCRT shares should again break $4. A rally might be tempered by the realization that the trial would still be batting .333. On the other hand, Lumakras, which targets KRAS G12C-mutated NSCLC, was approved on 2% complete and 35% partial response rates. In Q3, Lumakras netted $61 million in U.S. sales after being approved in May 2021. According to Amgen, only 13% of NSCLC patients have G12C, while 15% have G12D, so Alaunos potentially has a slightly larger niche market where it won’t have to compete off the bat with Big Pharma and in fact, has no approved competition. Furthermore, Lumakras’ showing suggests there is potential for annual sales in the first full year after approval that exceeds Alaunos’ current cap. That said, any less stellar result could mean an extended stay below $1; disappointment is probably already baked into current prices. Whatever the outcome, investors should be prepared for the dilutive issuance of more shares in the few days following the announcement, as the company really needs more financing.

Be the first to comment