jetcityimage

Since 2020, our internal team had monitored Evonik’s (OTCPK:EVKIF) performance. In our initiation of coverage, we explicitly said that the company’s valuation was a little rich; however, thanks to demonstrated resiliency and ongoing portfolio optimization, and good time management, we increased our rating from neutral to buy. So far, it was a good call given the stock price appreciation (compared to the S&P 500 return). Indeed, in our analysis called Evonik – Earnings Defensiveness, our buy case recap was supported by: the company’s pension deficit development, depressed multiple valuations, lower intermediate automotive exposure, and a solid end-demand, in particular across the Specialty Additives/Smart Materials segment.

Evonik – Earnings Defensiveness

Source: Mare Evidence Lab’s previous publications

Q3 results

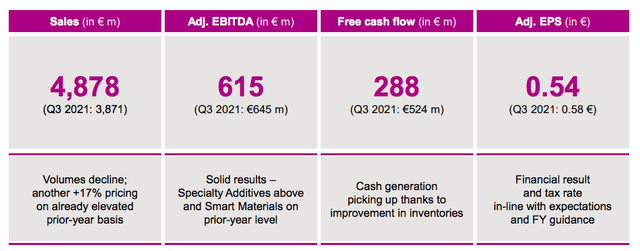

The results released were pretty in line with our estimates. In Q3, sales reached €4.88 billion with an increase of 26% compared to the top-line sales achieved in the same quarter of the previous year. Evonik also exceeded its internal forecast of €4.39 billion. However, the higher costs for energy and gas reduced the company’s net profit. In detail, the adjusted EBITDA stood at €615 million versus last year’s results of €645 million (and again beating VARA consensus estimates that were forecasting an average EBITDA of €608 million). It wasn’t just higher costs that weighed on the P&L, but also a decline in demand in the animal feed industry as well as in the performance materials division. Aside from the financial consideration it is important to highlight the company’s positive development.

Source: Evonik Q3 results presentation

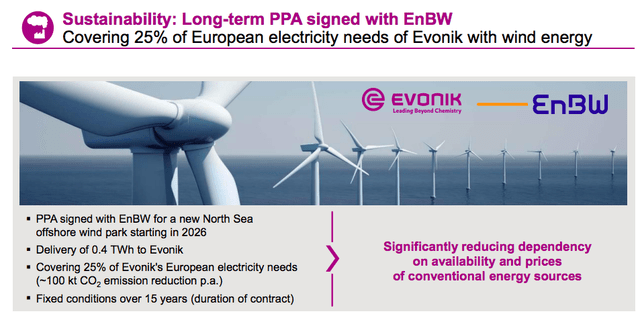

First of all, Evonik is reducing its dependency on gas, the German chemical player announced an agreement with the renewable energy operator EnBW to receive 100MW of green power (generated by a wind farm) for the next 15 years. In numbers, almost 25% of the company’s electricity needs in Continental Europe will be derived from green energy. As a reminder, Evonik’s geographical sales are divided into three main areas with the EU which accounts for 40% of its volumes.

Source: Evonik Q3 results presentation

As already mentioned in our buy case recap, the company is revamping its portfolio. Following the recent sales of its betaine business in the United States, the company also recently divested from its TAA derivatives business. In the meantime, it is working on organic growth and more resilient businesses. In Alabama, there was a new announcement for a new plant to produce methyl mercaptan. Again in the US, a new CAPEX investment was communicated to produce lipids for mRNA medical applications.

Conclusion and Valuation

Last time, we concluded that FCFs were negatively impacted by higher working capital requirements, and we are assuming a reverse trend starting next year. During the Q3 Q&A, Evonik’s CEO suggest that “further significant NWC improvements are expected already in Q4 to achieve a 30% cash conversion for the full-year results”. The company increased its sales forecast to €18.5 billion from a previous estimate of €17/18 billion and also confirmed the current year’s EBITDA; however, the upper end of the range will not be reached. Accordingly to the press release, EBITDA should be between €2.5 and €2.6 billion. The company announced a new cost-saving plan measure for 2023 and we are not pricing in this new development. Here at the Lab, we decide to maintain our 6x EV/EBITDA on 2023 numbers, deriving a target price of €23 per share, and the company is already up by 8% since our new buy rating target. Portfolio optimization with more anti-cyclical sectors and guidance left unchanged are positive margins of safety to maintain our overweight rating.

Be the first to comment