Michael Vi

Palantir Technologies Inc. (NYSE:PLTR) once again failed to meet third-quarter earnings expectations. Growth rates, particularly in the commercial business, are approaching critical levels, undermining the entire investment thesis for Palantir’s stock.

The risk/reward ratio and Palantir’s valuation multiple are both out of whack, and the company continues to demonstrate its inability to generate any kind of profitability.

Since Palantir lost more than $100 million in the third quarter and the outlook is bleak, I believe PLTR will become a penny stock in the near future.

A Double-Miss For The Third Quarter

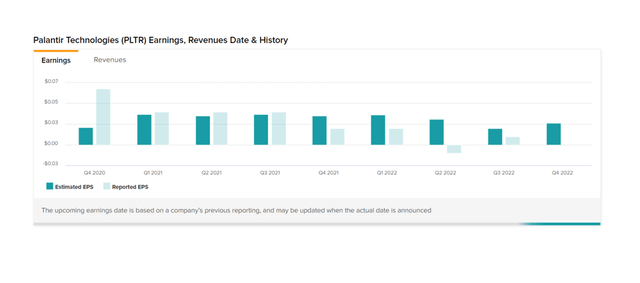

If you are a Palantir investor, the previous lesson was to not expect any profits from the software company and to be disappointed in terms of earnings surprises. And Palantir did it again in the third quarter.

The software company reported Q3’22 earnings of $0.01 per share. Earnings of $0.02 per share were expected, representing a -50% earnings surprise. Palantir delivered a negative earnings surprise for the fourth consecutive quarter.

Earnings And Revenues (Palantir Technologies Inc)

The Streak Of Mind-Blowing Losses Continues

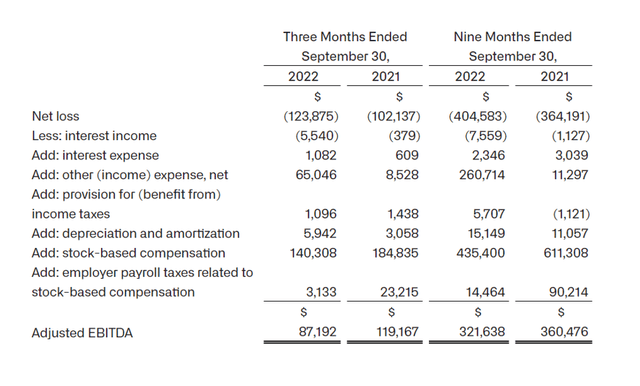

Unfortunately, Palantir generates profits by deducting a slew of expenses, most notably non-cash stock-based compensation (“SBC”) expenses. These costs totaled $140.31 million in Q3’22 and $435.40 million in the nine months ending September 30, 2022.

Palantir continued to incur net losses of $123.88 million in the third quarter and $404.58 million in the nine months ending September 30, 2022, owing to high SBC expenses.

As shown in the chart below, Palantir’s year-to-date net losses were entirely driven by Palantir’s highly preferential treatment of executives.

YTD Net Losses (Palantir Technologies Inc)

Palantir’s YTD losses increased the company’s accumulated deficit to $5.89 billion as of September 30, 2022, indicating that an investment in the software company has proven to be extremely harmful to the company and its shareholders.

Despite operating as a going concern for nearly two decades, the software company has yet to establish even a basic level of profitability.

Palantir Commercial: Slowdown

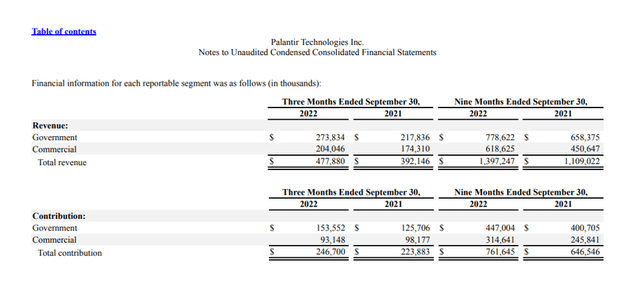

Much of the optimism for a higher valuation was based on Palantir’s commercial success.

Palantir served government and corporate clients with its software platforms and is paid a recurring stream of income as a result. Palantir generated commercial sales of $204.05 million in Q3’22, up from $174.31 million the previous year.

Palantir’s commercial sales increased by only 17% YoY, a significant slowdown from the 46% growth rate in Q2’22. Palantir’s government sales increased by 26% YoY to $273.83 million from $217.84 million.

Government And Commercial Revenue (Palantir Technologies Inc)

Many analysts used Palantir’s commercial strength as an excuse to recommend the company and argue for a higher valuation, but the third quarter demonstrated that the software company can’t rely on commercial sales growth.

Palantir’s commercial business may become a drag on overall company performance as companies spend less money on software.

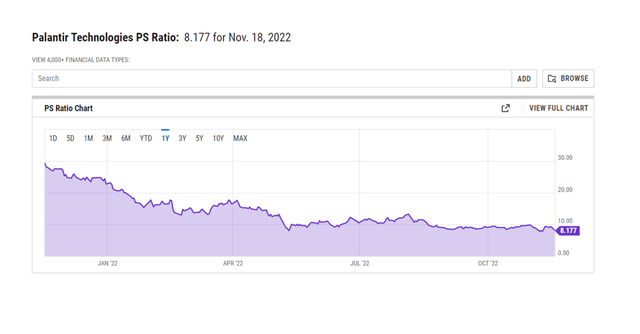

Inflated Sales Multiple

It’s a mystery to me how a company like Palantir, which has demonstrated its inability to generate even the smallest of net profits over the last two decades, has persuaded investors to pay 8.2x sales. However, it appears that there are a large number of investors willing to pay such a high multiple.

Why Palantir Could See A Lower/Higher Valuation

Palantir, in my opinion, is unlikely to grow into a significantly larger valuation simply because the company is struggling on so many fronts.

The company is unable to generate positive net income, the commercial business is struggling, and Palantir likely will not achieve its much-touted sales growth of 30% this year.

Palantir would have to engineer a turnaround in profitability and reignite growth in its commercial business to reach a higher valuation.

My Conclusion

Don’t be duped twice. Palantir already discredited its investment case in Q2’22 when it stated that it would be unable to increase sales by 30% this year, and now the commercial portion of Palantir’s business, whose traction was hyped as an excuse for an inflation valuation, is also causing concern.

Palantir’s commercial sales growth slowed dramatically in the last quarter, and the company’s net losses exceeded $100 million once again. Palantir only achieves positive adjusted EBITDA profitability by deducting SBC expenses, which is a damning indictment after two decades in business.

Palantir’s sales multiple, in my opinion, is not sustainable given the company’s current deceleration. The stock could very well be on its way to becoming a penny stock (trade at $5 or less) in the very near future if Palantir does not start showing profits soon.

Be the first to comment