wacomka

Investment Thesis

AbbVie (NYSE:ABBV) is a global, diversified biopharmaceutical company that has a portfolio of drugs in leadership positions across immunology, oncology, neuroscience, and aesthetics. Patent protection and technological superiority have created an economic moat that allows them to grow while generating a large amount of operating cash flow. Based on the strong performance from newly launched products and the solid pipeline, I expect AbbVie to thrive in the coming years. I believe AbbVie is a strong investment choice because:

- Skyrizi and Rinvoq continue to grow at a rapid pace and generate billions of dollars for AbbVie.

- The overall portfolio (neuroscience, aesthetics, oncology) is performing very well, and several drugs in the pipeline have the potential to provide large growth in the future.

- AbbVie generates substantial operating cash flow, and this is effectively strengthening their balance sheet.

Strong Portfolio Performance

As mentioned in my previous article, AbbVie still struggles to get out from under the label of being a “one trick pony” with an overreliance on blockbuster drug Humira. Starting several years ago, AbbVie’s management has been strategically working to diversify beyond Humira, by expanding the portfolio and acquiring key businesses. This quarter has once again illustrated that AbbVie’s portfolio is becoming more diversified and will continue to do so in the future.

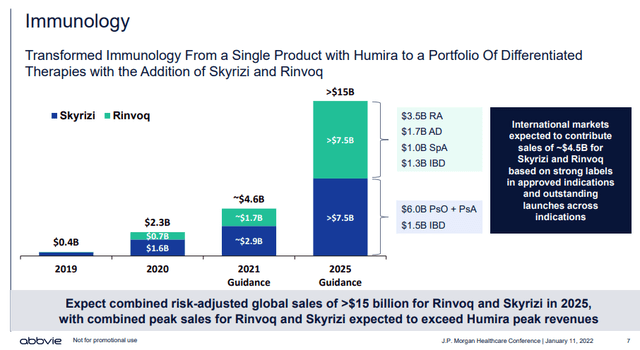

Skyrizi and Rinvoq continue to grow impressively, and their combined revenue is projected to be $7.5 B this year. Neuroscience, led by migraine and Vraylar, showed double-digit growth, while Botox aesthetics grew nicely as well. Venclexta (treatment for Chronic Lymphocytic Leukemia, Small Lymphocytic Lymphoma, and Acute Myeloid Leukemia) also grew significantly. Combining all these products, Humira now accounts for 36% of sales ($5,363 M out of total revenue of $14,583 M in 2Q 2022), significantly lower than several years ago, while overall revenue grew by 6.1%.

Multiple Growth Catalysts

The aforementioned drugs Skyrizi and Rinvoq will be the heart of AbbVie’s growth engine. Skyrizi and Rinvoq are already exceeding management’s growth expectations, while the recent expansion of Skyrizi’s label to include Crohn’s disease and newly launched indications (PSA, AS, atopic dermatitis, etc.) for Rinvoq will add more sources of long-term growth.

Skyrizi and Rinvoq Trajectory (AbbVie Investor Relations)

Neuroscience also has several growth catalysts. Vraylar is expected to continue its growth and to reach $4 B with currently approved indications. Pending regulatory approvals of Vraylar for major depressive disorder, Qulipta for chronic migraines, and ABBV-951 for advanced Parkinson’s disease could add strong growth to the Neuroscience portfolio. Oncology also has a strong pipeline of drugs. Navitoclax (myelofibrosis), Epcoritamab (non-Hodgkin’s lymphoma), and Teliso-V (non-small cell lung cancer) are progressing well, and they all have the potential to turn into blockbusters.

Strengthening Balance Sheet

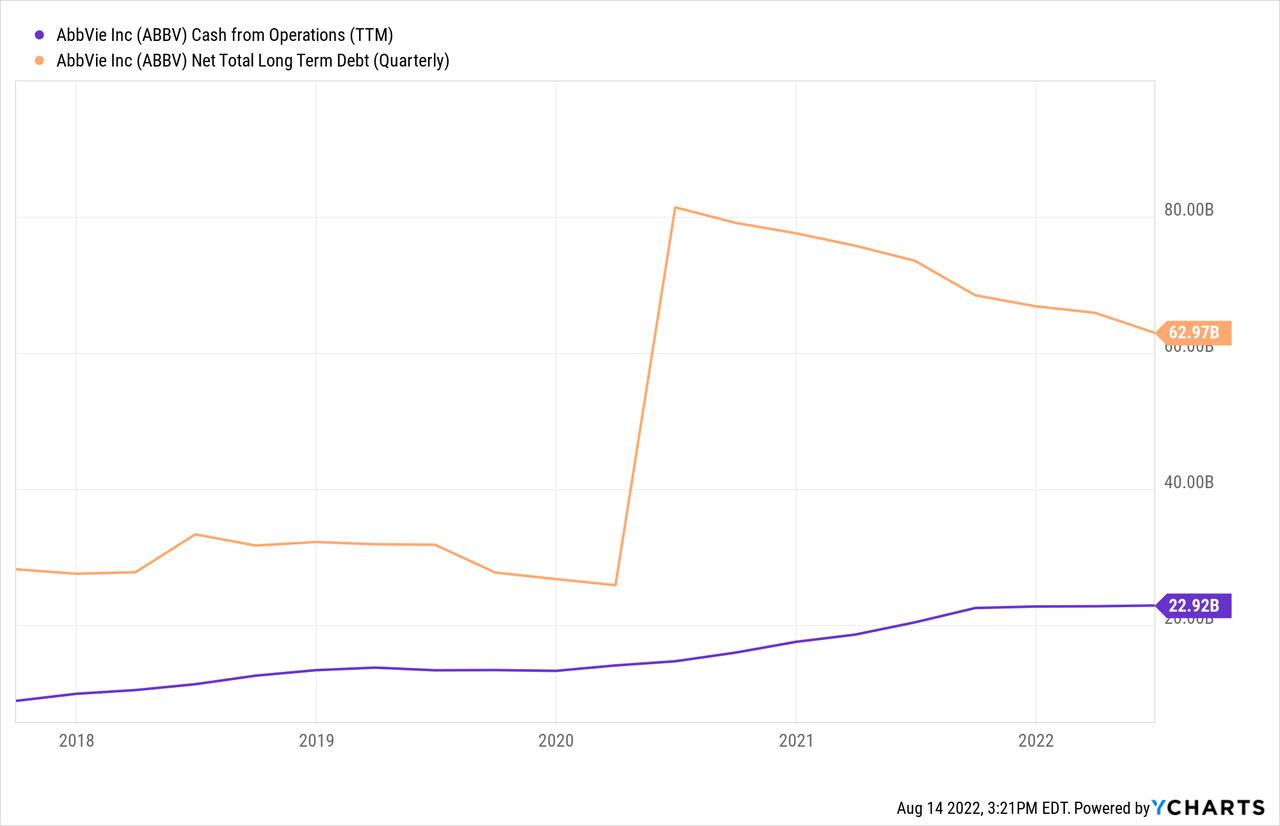

After acquiring Allergan, AbbVie’s debt level grew substantially. Their long-term debt increased from $35 B in 2018 to $77 B in 2020, and their interest payment increased from $1.3 B in 2018 to $2.4 B in 2020. Given how much operating cash the company generates ($22 B in the past twelve months), I don’t see this as too concerning. However, it is something to be aware of as an investor.

Looking at their balance sheet and cash flow statement, management is certainly committed to improving their balance sheet and bringing down the debt level. They repaid $5.6 B and $9.4 B of long-term debt in 2020 and 2021, bringing long-term debt back down to $62 B. There is still a way to go, but the trend is pointing in the right direction for sure.

Intrinsic Value Estimation

I used DCF model to estimate the intrinsic value of AbbVie. For the estimation, I utilized operating cash flow ($22.9) and current WACC of 8.0% as the discount rate. For the base case, I assumed operating cash flow growth of 8% for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed operating cash flow growth of 10% and 12%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price presents 35-45% upside. With a diversified portfolio, strong growth of Skyrizi and Rinvoq, and an improving balance sheet, I expect AbbVie to achieve this upside in the long run.

|

Price Target |

Upside |

|

|

Base Case |

$191.69 |

34% |

|

Bullish Case |

$207.08 |

45% |

|

Very Bullish Case |

$232.23 |

57% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Operating Cash Flow Growth Rate: 8% (Base Case), 10% (Bullish Case), 12% (Very Bullish Case)

- Current Operating Cash Flow: $22.9 B

- Current Stock Price: $142.6 (08/14/2022)

- Tax rate: 20%

Cappuccino Stock Rating

| Weighting | ABBV | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 3 |

| Growth Rate vs. Sector | 15% | 4 |

| Margin of Safety | 15% | 5 |

| Sector Outlook | 10% | 4 |

| Overall | 4.2 |

Economic Moat

AbbVie has a very strong economic moat with patent protection, brand recognition, and technological superiority. With continued R&D effort to maintain the strong pipeline and key acquisitions, I expect AbbVie to maintain their strong moat well into the future

Financial Strength

AbbVie has very strong operating cash flow generation, and their revenue and profits will continue to rise. They are far from financial distress. However, the large debt incurred during the Allergan acquisition needs to be reduced before I can give them a higher financial strength rating.

Growth Rate

AbbVie has multiple long-term growth sources, spanning oncology, immunology, and neuroscience. Revenue growth from Skyrizi and Rinvoq is exceeding management’s expectations already, and they will be the heart of their growth engine.

Margin of Safety

Due to the high debt level and concerns about Humira’s upcoming patent expiration next year, AbbVie is being traded substantially below its intrinsic value. However, they have several cash cows in their business that provide enough cash for growth and R&D. Also, their portfolio’s diversification will only improve in the future.

Sector Outlook

Health care sector in general will always grow alongside the population. Also, the need for neuroscience, oncology, and immunology will only increase. AbbVie will see stable growth for a long time.

Risk

Patent protection for Humira, AbbVie’s blockbuster drug, is set to expire in 2023. Humira has earned more than $200 B for AbbVie, and replacing that level of revenue will be a big task. Also, there are lots of unknowns (the rate that revenue will decline from Humira, rate that other portfolio products (e.g., Skyrizi) will increase, etc.), and we all know how much Wall Street hates uncertainties. Therefore, investors should monitor these developments closely.

Part of their portfolio (e.g., Imbruvica and Juvederm) experienced a setback recently, with growth lagging the expectations. The negative impact from Covid, economic pressure, and increasing competition were among the main reasons. Overall, it should not have a lasting impact on AbbVie, but investors should consider the entire portfolio before making a decision.

Conclusion

AbbVie has been a stellar investment choice with a strong dividend yield for a while. With an increasingly diversified portfolio and strong pipeline, I expect AbbVie to remain a great investment in the future as well. Uncertainty around Humira’s patent expiration and negative impact from Covid, economic pressure, and increasing competition pose some challenges. Overall, however, I believe AbbVie is undervalued at this point and the stock price will rise over the long run.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment