JHVEPhoto

On January 26th of 2021, I wrote up Pitney Bowes (NYSE:PBI) on Seeking Alpha and once the article was published the stock promptly jumped off its low of $7.26 on the day and ended the day over $12 per share before topping out at $15.50 on the 27th. At that time, it is likely that Maplelane Capital got squeezed out of their short position which, like Melvin Capital (who was also probably shorting PBI), they disclosed via a 13F as they had acquired put options in addition to shorting the shares. The short interest today is only about 6% of the total float.

Enter Hestia Capital

If you don’t remember Hestia Capital – they are the activist hedge fund that essentially began the GameStop saga in late 2019, when they filed their first GME 13D (ironically, approximately 6 months after DOMO Capital’s first article on GameStop), and literally paved the way for Ryan Cohen to eventually take over the company. You may not find any mention of them in any GameStop documentary, but in my mind it is clear that Ryan Cohen’s acquisition of GameStop would never have happened without Hestia Capital.

And so – after a two year hiatus in complete silence – here we are again. Hestia Capital has found their next activism target – Pitney Bowes. A company that once again was highlighted by DOMO Capital prior to the 13D filing. In fact, I had even started an article in early February (see image below) where we were essentially explaining that the poor management from Lautenbach was going to encourage activists to target the company (note the article title)…

Draft Articles (Seeking Alpha)

Interestingly, PBI is a target that also once again already includes Bill Miller and Permit Capital, as well as DOMO Capital and other institutions that were also involved in the early days of the GameStop saga. In fact, Bill Miller reported a 6.3% (passive) stake in PBI back in February of this year. Hestia Capital, however, isn’t known for taking a passive role which is why they came out swinging with a 13D (not G) showing they have quickly acquired just under 7% of the outstanding shares. With a 13D, a filing must be made within 10 calendar days after having breached 5%.

Perhaps Senvest Capital will once again join as a latecomer to the party?

In any event, if Hestia’s previous history with GameStop is any indication, they are likely to push for board seats (as noted in this exclusive) and may once again pave the way for another company/individual to acquire some or all of PBI – and it may once again be Ryan Cohen!

Ryan Cohen May Take Notice

Interestingly, Ryan Cohen – who developed a strong relationship with Kurt Wolf, Managing Member / Chief Investment Officer of Hestia Capital, during the unprecedented GameStop coup will almost certainly perk-up on the news.

On September 11th, of 2020 I wrote about how Ryan Cohen had found “What’s Next” with GameStop and was likely to take over the company.

That is precisely what happened!

However, as we highlighted in detail in that article, Ryan Cohen has always had Amazon as a target in his mind. Therefore, Ryan’s interest in Bed Bath & Beyond (BBBY) didn’t surprise us at all, and at the time we saw it as an advancement of this goal and suspected that he may be looking for a way to compete with Amazon on a much larger scale than just video games. While it appears that Ryan Cohen changed his mind and sold his investment in BBBY, his ultimate goal of competing with Amazon head-to-head is likely still in the back of his head. The involvement of Hestia Capital in PBI may peak his interest for a number of reasons.

How so?

First of all, PBI as a whole, is the exact type of contrarian play that Ryan Cohen typically looks for. Additionally, unlike BBBY, PBI is not in distress or in risk of bankruptcy. PBI has legacy business that the market incorrectly believes is obsolete, and PBI also has a growing global ecommerce business that the market doesn’t believe will ever be profitable. But, it can be with the proper management team in place.

Secondly, Ryan has always talked about taking a hyper-localized approach towards fighting and winning against Amazon (which we highlighted back in 2020); however, while hyper-localized – it is still ecommerce based. That equates to a lot of shipping, which is precisely why Amazon used FedEx (FDX) and United Parcel Service (UPS) for only as long as required until developing their own logistics segment. How better to accomplish this goal then, of competing with Amazon, then for him (or GME) to acquire the strongest global ecommerce network outside of FDX and UPS? At that point, Ryan could then work backwards by taking an existing global ecommerce network and then integrate an ecommerce platform on top of it.

Whether as a personal investment or as an acquisition with an eye towards competing with Amazon, Pitney Bowes is precisely the type of business / stock that is likely to catch Ryan’s eye. Hestia Capital’s involvement makes that even more likely.

Pitney Bowes Global Ecommerce

Pitney Bowes Global Ecommerce business was first acquired through the acquisition of Newgistics for $475M back in 2017. Since then, PBI management, specifically Marc Lautenbach, have done a spectacular job of ruining a prime asset.

In my January, 2021 article we highlighted how it appeared that the Global Ecommerce business was finally poised to inflect, become profitable, and shock the market. Nearly two years later… and that still hasn’t occurred due to gross mis-steps in the management of the business. PBI had the opportunity to once again shock the market with their Q4 earnings report in the beginning of 2022, but once again fell short due to why I deem a managerial failure.

In Q4 of 2021, PBI management made the inexplicable decision to stop on-boarding new customers as noted in the Q4 earnings call:

we deferred a fair amount of business that we won in the fourth quarter into the first quarter because we were trying to be disciplined in terms of not adding to the network at a time where we assume the network was going to be under stress.

Then, as the data started to come in showing that the current customers wouldn’t ship as much as they had forecast, management appears to have ignored their own data and continued to remain fully staffed and pay nosebleed rates for labor that wasn’t even being utilized. The result wasn’t pretty as the global e-commerce segment reported a $41M EBIT loss ($20M EBITDA loss) versus a $15M EBIT loss and $3M EBITDA gain from Q4 of 2020.

The quarter couldn’t have been more of an embarrassment. In retrospect, Marc Lautenbach continually talking about “ingesting” packages into the postal network back on the Q2 and Q3 earnings calls of 2022 should have been a red flag. The correct terminology is to “inject” packages. We don’t think it’s too much for investors to expect the CEO to be using the correct business terminology 5 years into an acquisition…

DOMO Capital Management, LLC manages close to 2 million shares of PBI through separately managed accounts, adding to the position as it has fallen, and in our Q3 letter to clients we highlighted how this may finally be the quarter that PBI shocks the market with their Global Ecommerce results (in a good way for once). We highlighted how the recent warnings from FedEx don’t apply to PBI due to the miniscule market share that PBI has and the ability for new customers to overwhelm any decline in shipment volume from older customers.

On the last earnings call, we were pleasantly surprised, and pleased, to hear the CFO, Anna Maria Chadwick, not only reinforce, but also quantify, our belief that the FDX warning does not apply to PBI:

Our Domestic Parcel network is well positioned to handle peak volumes this year as well as an expected increase in the run rate parcel volumes driven by recent new client wins. Since the beginning of the third quarter, 32 new Domestic Parcel clients have gone live ahead of peak. New clients are expected to account for roughly 20% of fourth quarter parcel volumes. New notable clients include SHEIN, Hudson’s Bay, and Japan Crate.

We also highlighted to clients that PBI’s horrible (financial) performance in peak of 2021 may have actually been a blessing in disguise for 2022’s peak as service levels, due to massively over-staffed distribution centers, helped create fantastic service levels last year. Shockingly, it was almost as if the CFO had a copy of my letter:

As a direct result of better service levels, we are seeing material pickup in volumes from existing clients such as BarkBox, Supergroup, and Victoria’s Secret. We are already seeing the volume uplift in October. On a month-over-month basis weekly volumes have grown over 25% to $3.6 million. We are encouraged by the healthy increase in volumes which are critical in driving margin improvement. As we stated in our materials from mid-September, we expect annual run rate volume levels in the Domestic Parcel Network to exit the year at approximately 195 to 200 million.

Therefore, Pitney Bowes reaffirmed Q4 guidance of a positive EBITDA for the Global Ecommerce segment. While a positive EBITDA would likely exceed market expectations at this point and lead to a significant increase in the share price, let’s be real, if PBI doesn’t generate positive results at a EBIT level in Q4, something is wrong. Afterall, the Global Ecommerce unit was already EBITDA positive when it was acquired back in 2017. Costs should have declined substantially over the last year as more trucking lanes have been in-sourced and automation has been added to the distribution centers. There is no reason not to be EBIT positive at this stage after having invested hundreds of millions in capital expenditures.

To be clear – we want nothing more than for PBI to retain the Global Ecommerce business and grow it into an entity that is generating hundreds of millions in EBIT a year. DOMO Capital is not looking for the unit to be sold off, especially after years of mismanagement.

However, If PBI can’t generate positive EBIT in Q4, long-term investors need answers. Thankfully, with Hestia Capital involved, we have much greater confidence that the incompetent management of the global ecommerce unit will be resolved. If it cannot be resolved, then we would agree that the sale of the unit would unlock significant shareholder value.

If PBI does generate positive EBIT, then the market will have to re-rate the shares as the Global Ecommerce unit, by itself, should be worth well over $10 per share as should the legacy businesses!

PBI Bank

We addressed PBI’s legacy businesses (Presort and SendTech) back in 2021 – SendTech continues to stabilize, and the moment that it inflects and starts to grow again will be yet another revaluation moment for a market that has long thought PBI’s legacy businesses were completely obsolete. Furthermore, the risk to the digital offerings within the SendTech business associated with the USPS have been completely resolved. For all of his failings on the Global Ecommerce side, Marc’s management of and ability to innovate SendTech has been top notch and that should be recognized.

However, one thing we didn’t address back in 2021 was PBI’s bank which we believe is yet another valuable asset. Yes – they have an actual chartered bank which we believe the market is not only not rewarding them for, but is actually penalizing PBI for due to an inability to understand the total corporate debt composition. Many market participants believe that PBI is heavily levered and simply stop their research there.

In fact, even one of the last bullish articles written on Seeking Alpha notes the following as a key risk:

Due to the company’s large debt load, there isn’t much room for continued underperformance.

The article goes on to say that if PBI were to sell-off the Global Ecommerce segment for $1 billion that they could do the following:

If this $1 billion was used to pay down debt there would be about $500 million in net debt remaining or $1.2 billion in total debt. This would be a 45% reduction in debt so if we were to reduce the 2021 interest expense by 45%, it would be reduced by $65 million.

However, this analysis completely ignores the fact that over $1 billion of the debt on the books is due to PBI’s chartered bank. If PBI were to sell-off the Global Ecommerce unit for $1 billion in cash, they would not be $500 million in net debt remaining – there would be just over $400 million in net cash!

Furthermore, we’d note that a potential sale price of $1 billion seems extraordinarily low. Bill Miller values PBI’s Global ECommerce unit at over $2 billion ($12 / share) which is much more in-line with our internal analysis.

While PBI has recently done a better job of attempting to explain their debt profile to the market, as the above example illustrates, market participants just don’t understand it. Therefore, we would like to see even more aggressive action to separate the bank from the operating company. Additionally, we would much rather see the company sell-off the bank than the Global Ecommerce segment.

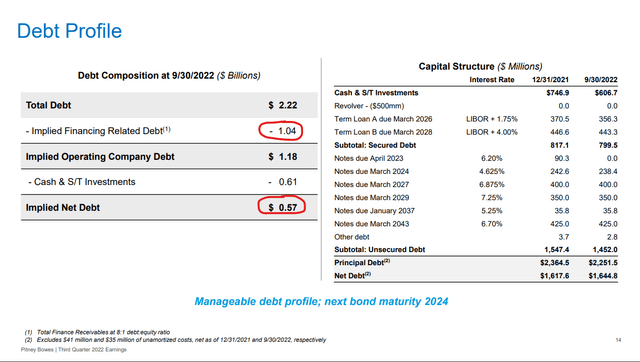

Pitney Bowes Debt Profile (PBI Q3, 2022 Earnings Presentation)

As the table above from the Q3 presentation shows, while PBI has total debt of $2.22B, $1.04B of this debt is actually associated with the chartered bank. After backing out cash and short-term investments (40% of which is also associated with the bank), PBI’s net debt stands at around $570M – a far cry from the $2.22B shown on the balance sheet.

Cue the collective eye-rolls, but one (or at least we) can’t help but to see the parallel to a very similar, but different, misunderstanding that the market had about GameStop. Back in the day, the short sellers were obsessed with debt on the balance sheet that GameStop was forced to add due to new accounting rules requiring store leases to be shown. The short sellers completely ignored the fact that most of GameStop’s leases were very short-term leases and the fact that GameStop already had hundreds if not thousands of unnecessary and overlapping stores. In fact, that was the very bull case, that GameStop’s footprint needed to be significantly reduced. Yet, it was foolishly touted as one of the short-sellers main arguments to short the stock.

How did that end?

It is no different with PBI. In our opinion, market participants focused on PBI’s debt are missing the forest for the trees. What the debt level actually shows is just how valuable PBI’s chartered bank is – other banks that are being forced to entice customers with temporary high-interest yields and/or one-time cash payments would kill for PBI’s customer-base of deposits.

Risks

The most imminent risk facing Pitney Bowes is a rail strike. The increased odds of this possibility is likely why the stock did not rally off of the news of Hestia Capital’s involvement since one of the largest rail unions in the U.S. rejected a labor contract on the same day as Hestia Capital’s announcement. Barron’s recently noted that the odds of a strike, while low, have increased to 30% due to this vote. On the flip side, a quick resolution of the issue in the coming weeks would lead to shares no longer having to discount the potential risk.

A deep recession would also pressure PBI shares if consumers pull back much further than expected to the point where new customer wins would no longer be able to make-up for the decline in business of current customers.

Previously, PBI faced large, unknown risks with changes that were happening within the USPS. While the company may still face risks with their USPS relationship in the future, these near-time risks have been completely alleviated as noted in the company’s last earnings call.

Perhaps the greatest risk that shareholders currently face is an acquisition of the company at a price far below PBI’s intrinsic value. This is why it is imperative that PBI quickly resolves the market’s misperceptions surrounding their debt as well and, more importantly, has very strong execution within the Global Ecommerce segment this peak season.

Conclusion

In conclusion, little has changed from the original thesis we published in early 2021. The legacy businesses continue to stabilize and SendTech will soon show annualized growth. The Global Ecommerce segment is still primed to shock the market as going from a $100M financial drag on annual income towards a $100M to $200M addition will force the market to completely revalue PBI. If, for some inexplicable reason, the market doesn’t revalue PBI once the Global Ecommerce segment becomes profitable, then, at that point, PBI could simply spin-off the segment to unlock the value.

However, if the Global Ecommerce segment once again fails to be operated with any sort of competency this peak season, then shareholders should be very thankful for Hestia Capital’s involvement.

We are sure that speculation of Ryan Cohen’s involvement will be written-off as far-fetched, but then again, it was written-off as far-fetched back in 2020 as well. Maybe, just maybe, we know a thing or two after-all. And make no mistake, Ryan Cohen aside, there would be a multitude of suitors for not only Pitney Bowe’s Global ECommerce segment, but also the Pitney Bowes bank.

One thing is clear, the current valuation of the enterprise makes little sense – Pitney Bowes should be trading well over $20 per share and whoever is short 6% of the total float… will likely regret it. Hestia Capital has a strong track record of unlocking shareholder value, and we expect them to have similar success with PBI as they did with GME.

Be the first to comment