JHVEPhoto

As a homebuilder, Lennar (NYSE:LEN) is a cyclical stock, which makes valuation harder to determine. Using 2022 earnings, LEN appears too cheap at a multiple of 5.5X, but with anything cyclical one has to make assumptions about cyclically adjusted runrate of earnings. Macro data makes it clear that 2022 earnings are the peak and the worry keeping the market out of LEN is how low the trough is going to be.

LEN is facing multiple headwinds right now:

- Higher mortgage rates

- High labor costs

- Potential impending recession

There is also likely to be margin contraction, as LEN has been operating at margins well above its norm.

With all this in mind, is 5.5X 2022 earnings still cheap?

The Buy Thesis

4Q22 provided some key data as to what the trough will look like. The sales figures for this quarter were fully impacted by the aforementioned headwinds so this fresh data allows us to more precisely calculate what the earnings trough looks like and I think LEN looks significantly undervalued on its cyclically adjusted runrate earnings.

Let me begin by discussing the data from LEN’s 4Q22 earnings and use that to estimate trough earnings.

4Q22 – full on headwinds but still underlying strength

Adjusted GAAP EPS came in at $5.02 which was a significant beat and revenues of $10.17B also beat consensus estimates.

These numbers, however, are not the ones that really matter. The strong 4Q22 earnings are just a reflection of the ample backlog that was already in place. Homes that were contracted to be sold during the more favorable environment are being delivered now. From the earnings release:

- Backlog decreased 21% to 18,869 homes; backlog dollar value decreased 23% to $8.7 billion

Deliveries, which is the driver of current quarter revenue significantly exceeded new orders which is the driver of future quarter revenues.

- New orders decreased 15% to 13,200 homes; new orders dollar value decreased 24% to $5.5 billion

That is the figure from the earnings report that gives the best indication of trough earnings. It is roughly inline with 1Q23 guidance provided by LEN.

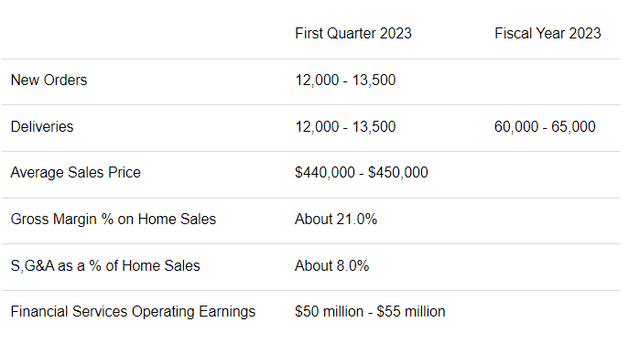

LEN

Full year delivery guidance of 60K-65K homes indicates Lennar is anticipating an increased pace of sales in the back half of 2023 bringing the average to just over 15K per quarter.

That is quite good for a year that is so full of headwinds. 2022 deliveries were about 66.4K so it is only a slight downtick.

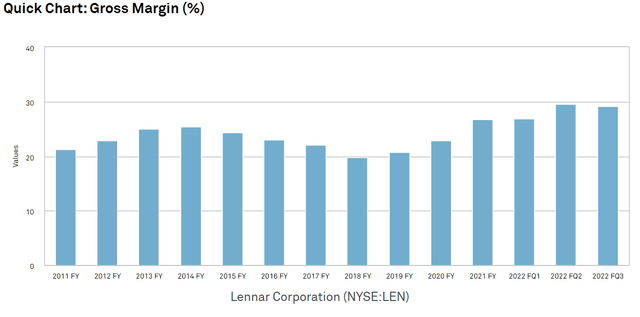

Perhaps the bigger hit comes from margins. Lennar has been running at impressively high gross margin.

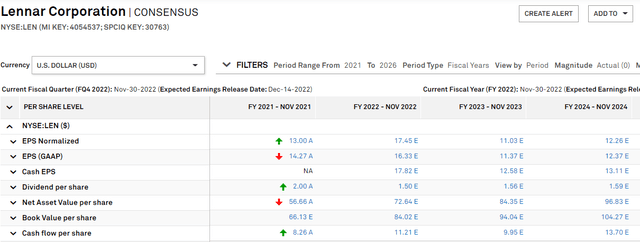

S&P Global Market Intelligence

Guidance calls for gross margins to contract to 21% with SG&A of about 8%.

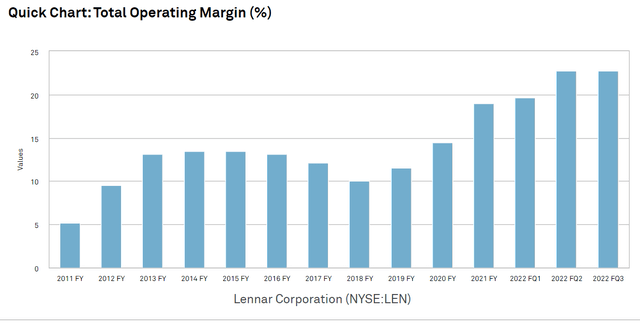

That brings anticipated net margin down to roughly 13% which is not out of line with history, but a significant drop from the recent 20s.

S&P Global Market Intelligence

Given the uncertainty present in the forward environment it would be a sham to present my forward estimates as precise. Instead, the goal is to ballpark the approximate trough.

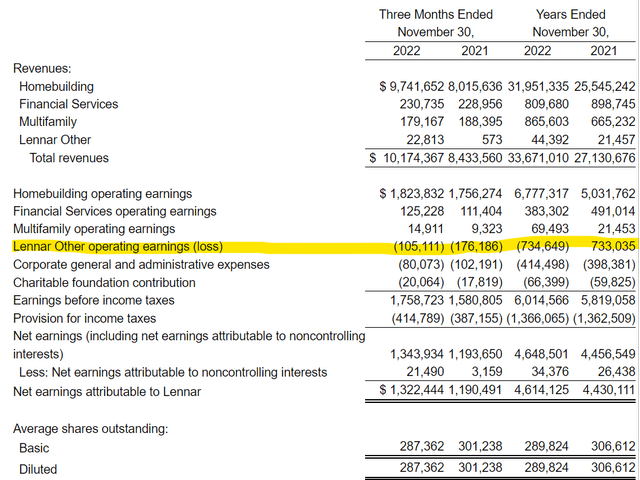

Using guidance of 62,500 deliveries at an average price of $445,000 that is gross homebuilding revenue of $27.8B. Applying the guided 13% net margin (after SG&A) that is contribution margin of $3.615B. Lennar’s financial services operating income and multifamily operating income largely cancel out their corporate expenses as seen below.

LEN

The only reason they didn’t fully cover the overhead in 2022 was the “other” line which consists primarily of mark to market losses in Opendoor (OPEN) and other housing related stocks. Such losses are one time in nature and should not be included in a runrate calculation.

Thus, overall earnings before taxes are likely to come in quite close to the homebuilding contribution margin.

Lennar has been running at about a 23% tax rate so the $3.615B operating earnings would be after tax net income of about $2.785B or about $9.70 per share.

I see that as the ballpark figure for annual runrate trough earnings.

In the 95 minute 4Q22 conference call Lennar executives expressed confidence that 1Q23 was likely to be the worst quarter with significant margin improvement in the second half.

The margin improvement comes from a combination of:

- Cheaper lumber

- Cheaper other input costs as demand for homebuilding supplies wanes from the 2022 peak

- Reduced incentives as mortgage rates come back down

Indeed, lumber has already come back down to a more normal price.

Trading Economics

As such, I would expect full year 2023 earnings to come in significantly north of the $9.70 which I would consider the 1Q23 runrate.

This puts my estimate for full year 2023 earnings fairly close to inline with consensus.

S&P Global Market Intelligence

Long run normalized earnings

With trough year earnings around $11 and peak earnings in the $17s cyclically adjusted runrate earnings are somewhere around $14. I think it will grow overtime from there as homes are still woefully undersupplied in the U.S.

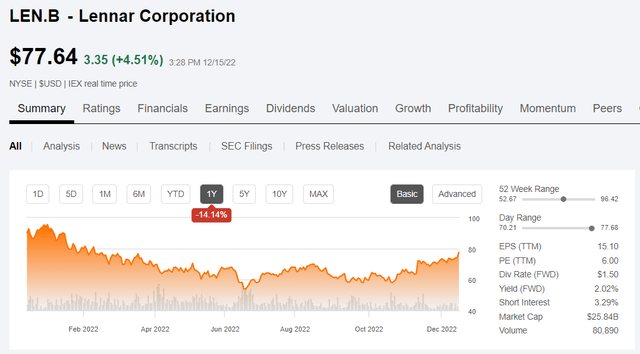

That puts Lennar at a 6.7X multiple of stabilized earnings and importantly it puts Lennar B (NYSE:LEN.B), the pari-passu but cheaper and higher voting version of the shares at a 5.5X multiple.

I think that is significantly undervalued. Lennar is a high quality business with impressive cash generation.

In recent years, LEN has improved its process optimization allowing it to build at a lower cost such that it can do the market share grab that they are executing presently. LEN’s cost structure enables it to cut prices at times like this to maintain sales volume even as the housing market is facing headwinds.

A higher cost structure company would not be able to do that.

There are a few other aspects of Lennar that suggest it should trade at a higher multiple.

- Minimal debt

- Long history of successful operations

- One of the market leaders in its space

Pessimism drove stock price to irrationally low levels

While LEN has performed well recently, its stock price remains quite discounted to where it was.

SA

I think the market broadly is overestimating the impact of mortgage rates on demand. In the short term it has quite clearly stifled demand, but in the long run people still need homes. Thus, long term sales volume is largely unaffected.

As such, I think mortgage rates are a short-term headwind that the market has incorrectly priced in as a secular headwind.

Catalyst to recovery

Lennar is working down its inventory levels of both land and in-process builds. This makes its cashflows significantly larger than its GAAP earnings and has resulted in a cash hoard of $4.6B. Further billions of free cash flow continue to come in and they are putting some of this to work through share buybacks. Per the earnings release:

“In October 2021, the Board of Directors authorized an increase to our stock repurchase program to enable us to repurchase up to the lesser of an additional $1 billion in value, or 25 million in shares, of our outstanding Class A or Class B common stock. As a result of prior authorizations being almost exhausted, in March 2022, our Board of Directors approved an additional authorization for us to repurchase up to the lesser of $2 billion in value, or 30 million in shares, of our outstanding Class A or Class B common stock.”

Such activity, along with the paydown of much of their debt, should increase earnings per share and I think will help the stock price rise.

Be the first to comment