Sonja Filitz

Tyson Foods, Inc., (NYSE:TSN) together with its subsidiaries, operates as a food company worldwide. It operates through four segments: Beef, Pork, Chicken, and Prepared Foods.

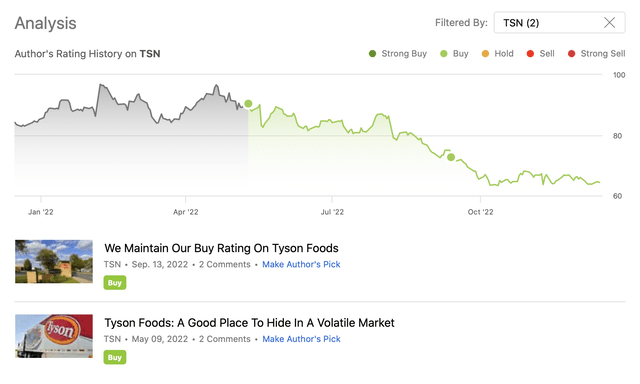

This year, we have published two articles on TSN so far, rating the stock as “buy” both times.

The primary reasons for our positive ratings were:

- Firms like Tyson Foods operating in the consumer staples sector are less likely to be impacted severely by low consumer confidence

- The company is actively working on cost reduction and efficiency improvement initiatives.

- A relatively small international segment, meaning a relatively small impact from the relative strength of the USD compared to other currencies.

- Safe and sustainable dividend, combined with a strong track record of share repurchases.

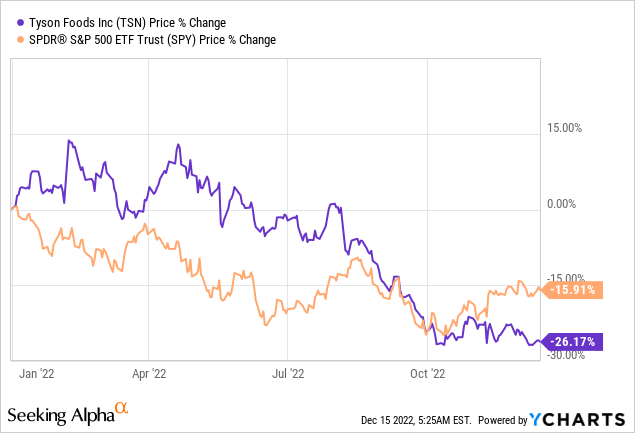

Despite these facts, the stock price has declined significantly in the second half of the year, leading eventually to an underperformance compared to the broader market.

In today’s article, we are going to take a look at two drivers, which have been causing this decline, and elaborate on whether our previous “buy” rating is still valid or not.

Avian flu

In the current avian flu outbreak, which has started back in February 2022, more than 50.5 million birds have died already, making it the worst outbreak in U.S. history. The disease is especially dangerous as it is highly contagious.

The birds infected with the virus often die, resulting in entire flocks, which can sometimes exceed a million egg-laying birds at chicken farms, being killed to avoid further transmission.

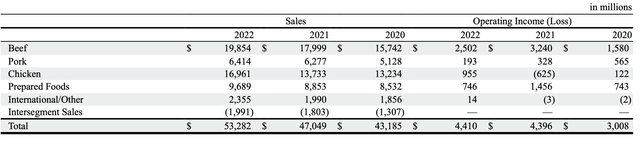

According to the firm’s latest 10-K, in terms of sales, the chicken segment is the second largest segment of the firm. It has made up about one third of the total sales in 2022.

While sales have increased year-over-year, mainly because of the improved domestic production, which has been partially offset by inventory growth and strategic initiative mix impacts, we believe that the avian flu can have substantial impact on the financial performance of the firm in the coming quarters. As “chicken” is the second largest segment, these impacts likely cannot be ignored.

In our opinion, the avian flu and its negative impacts are likely to be temporary, but investors need to be aware that any negative development around the disease can have a further negative impact on the stock price.

Questionable margin guidance

After releasing the latest earnings results, analysts questioned 2023 guidance, which eventually led to a sharp share price decline. JP Morgan analyst Ken Goldman made the following comment about the guidance:

We are a bit challenged at this time to understand how, in a year when chicken prices likely will be down by a great degree and consumers will continue to trade down, 3-7% sales growth is reasonable, […] All in, clearly Q4 and 2023 are worse than anticipated; however, the buy side was already more pessimistic than the sell side on this story, so downside in the share price may be limited.

We partially agree with the analyst’s comments.

Due to the continuing avian flu, we see high uncertainty with regards to chicken prices. If the supply will be restricted, prices are not likely to decline dramatically. But it will likely have a negative impact on the sales, due to lower volume. On the other hand, if supply will be sufficiently high, prices may decline as forecasted by the analyst, potentially leading to a margin contraction. In both cases, the result is negative for TSN.

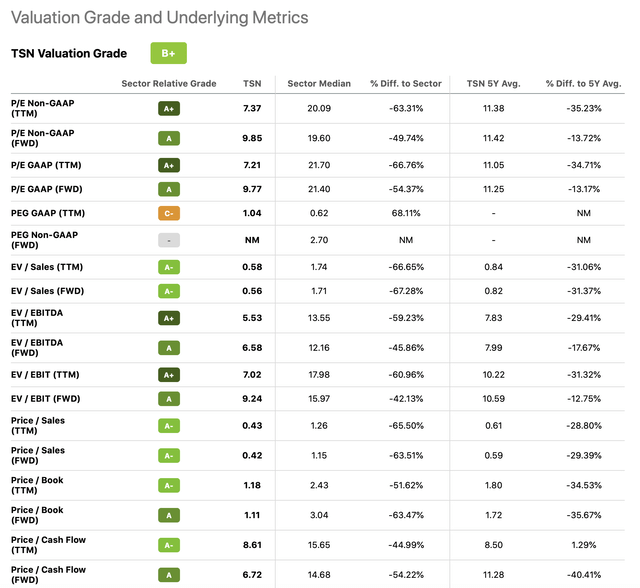

Looking at the second part of the comment, we agree that the downside in the share price is limited. Already in one of our previous writing we have commented that the stock appears attractive from a valuation point of view. If we take a look at the traditional price multiples again, we can see that TSN’s stock is selling at a significant discount compared to both the consumer staples sector median and the firm’s own 5Y avg.

While the above-mentioned factors may indeed have negative impacts on the company’s financial performance, we believe that such a discount is not justified. For this reason, in our opinion, the previous established “buy” rating is still intact.

Our take

The continuing avian flu may have negative impacts on the firm’s financial performance in the coming quarters.

The guided sales and margins for 2023 are somewhat questionable, as pointed out by one of JPM’s analysts. If the firm will not meet the guidance or adjust it downwards later, it may have short-term negative impacts on the stock price.

In our opinion, for long-term investors, TSN is an attractive option at the current valuation.

We maintain our “buy” rating.

Be the first to comment