swissmediavision/E+ via Getty Images

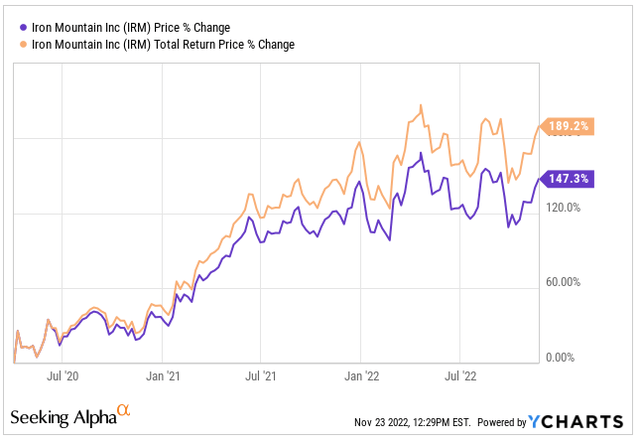

Since bottoming out in April 2020, shares of Iron Mountain (NYSE:IRM) have been one of the best-performing names around. Let’s just say the company has climbed higher from those low valleys.

Since the April 2020 lows, shares of IRM have increased nearly 150% and when you consider total return, shares are up nearly 190%.

For comparable purposes, the S&P 500 (SPY) is up “only” 60% during that same period.

Iron Mountain was founded in 1951 by Herman Knaust after he paid $9,000 for a depleted iron ore mine in Hudson Valley, New York, naming it Iron Mountain.

The company grew over the years so much so that they opened their first sales office in the Empire State Building.

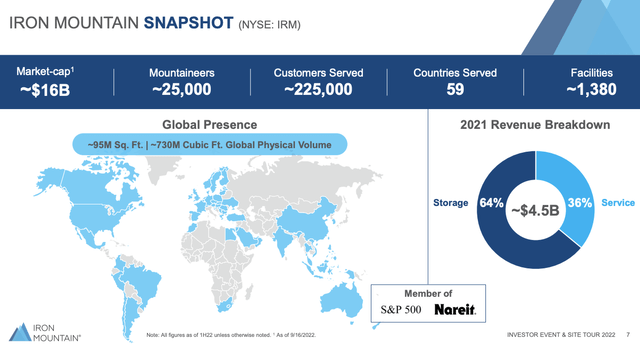

Here’s a snapshot of IRM today:

Iron Mountain has come a long way from being just a storage and records-keeping company to now expanding into a large player in the data center real estate sector.

The storage segment of the business still accounts for ~60% of total revenues in 2022, which is down from the 64% weighting we saw in 2021.

The company has built a strong reputation with its roughly 225,000 customers, which is evidenced by their 98% retention rate.

Iron Mountain Q3 Results & Guidance

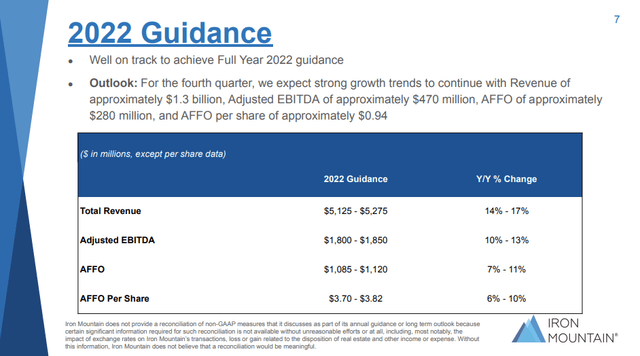

In Q3-22, Iron Mountain reported a record quarter with total revenue of $1.29 billion, up 14% year over year, or 18% yoy excluding the impact of Fx. IRM generated adjusted EBITDA of $469 million, which was an increase of 12% yoy, or 16% excluding Fx.

AFFO during the quarter was $288 million, or $0.98 per share, good for 9% growth over the prior year.

Organic storage rental revenue grew 9.7%, which was driven by higher prices and positive volume trends and data center growth.

There were 7 megawatts of new data center leases signed in Q3-22. The company had originally expected to have 130 megawatts of data center space leased out, but they are now expected to exceed those projections by the end of 2022.

For the fourth quarter, the company expects strong growth trends to continue with revenue of approximately $1.3 billion, Adjusted EBITDA of approximately $470 million, AFFO of approximately $280 million, and AFFO per share of approximately $0.94.

Project Matterhorn Introduced

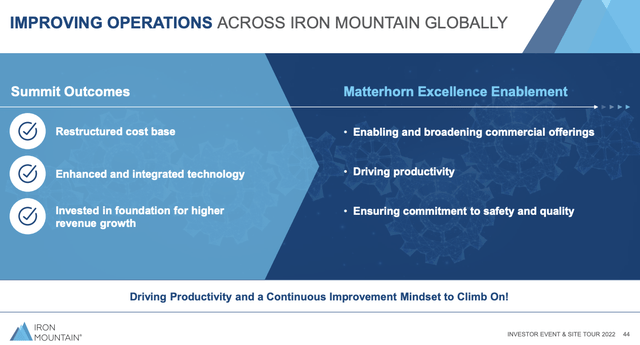

In 2019, the company introduced a Project Summit, which was a transformation program that would leave the company with a simpler and more dynamic management structure, better supporting the company’s future.

Project Summit successfully restructured the company’s cost base, enhanced and integrated their technology, and invested in the foundation for further revenue growth.

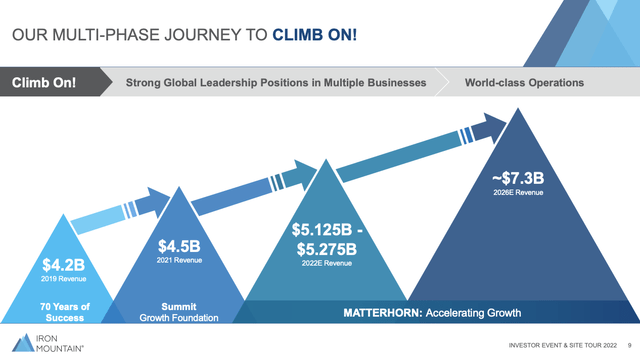

In the most recent Investor Day, IRM management introduced Project Matterhorn.

Project Matterhorn has a new vision for the next few years at Iron Mountain, focusing on:

- Enabling and broadening commercial offerings

- Driving productivity

- Focusing on safety and quality

Project Matterhorn is expected to drive the company’s revenue up to ~$7.3 billion by 2026, expanding on the success and the foundation laid by Project Summit.

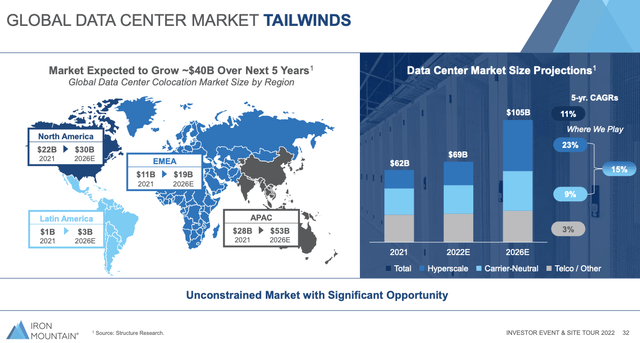

Data Centers continue to be a huge growth driver for the company today, and that is expected to be the case moving into the future. Moving into the data center space has increased the company’s total addressable market by over 10-fold.

Over the next five years, the data center market is expected to expand by $40 billion, from $62 billion in 2021 to over $100 billion in 2026.

Investor Takeaway

Iron Mountain already had a reliable business model, but by making the decision a few years back to expand into data centers, it has taken a mature company and turned them back into a growing business.

The core business model, with a 98% retention rate, is about as good as it gets, but the company is adapting to the way of the business world and technology today with Data Centers.

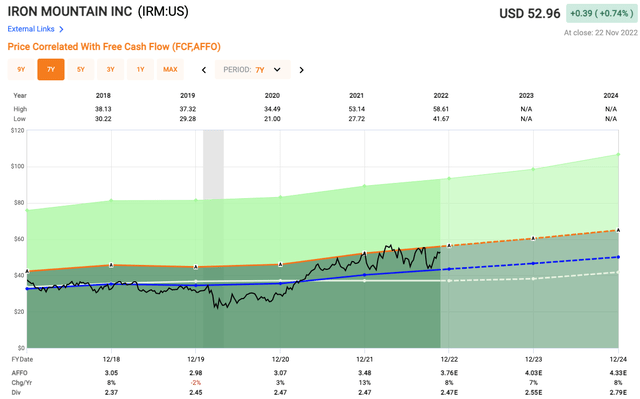

AFFO growth since 2015 has had a CAGR of ~6%, but over the next five years, IRM management is looking for AFFO growth of roughly 8% per year through 2026.

Shares or IRM currently trade at a forward AFFO multiple of 13x. Over the past five years, IRM shares have traded closer to 12x.

As such, IRM shares are trading near fair value over the past five years, but we must remember, growth was slower for the past five years compared to what is expected for the next five years, suggesting IRM shares should command a higher AFFO multiple moving forward, which is why I rate shares of IRM as a Buy.

Be the first to comment