inhauscreative

Investing in high yields can be a great way to stay ahead of inflation. While I see bargains in the REIT segment for long-term investors, they are admittedly not the most responsive to inflationary effects due to tenants being locked into leases. This is especially true for net lease REITs, which tend to have lease terms up 10 years, with annual rent escalators in the 2 to 3% range.

This brings me to TriplePoint Venture Growth (NYSE:TPVG), which is a BDC that’s better positioned for rising rates. As shown below, TPVG stock is still beaten down, trading well below its 52-week high of $18 from April. This article highlights why TPVG is a good high yield option for income investors at present.

Why TPVG?

TriplePoint Venture Growth is an externally-managed BDC that mainly provides debt financing along with equity investments into high growth, venture capital backed companies. Like its peers Hercules Capital (HTGC) and Horizon Technology Finance (HRZN), TPVG focuses on technology and life science companies, and targets high returns of 10-18% on debt investments from interest and fees.

What sets TPVG apart from private equity firms is its primary focus on venture debt, which sits higher on the capital stack. This gives investors exposure to high growth firms in a relatively low-risk manner. At present, TPVG holds debt investments in a record level 59 portfolio companies, warrants in 102 companies, and equity investments in 50 companies.

TPVG continues to demonstrate strong underlying returns, achieving a high 13.8% weighted average annualized portfolio yield on total debt investments and a 15.4% return on equity during the third quarter. Despite a tough market for emerging growth companies, 12 of TPVG’s portfolio companies were able to raise an aggregate $270 million of capital in private financings in the last reported quarter.

Moreover, with the share price trading above NAV a few months ago, TPVG was able to raise $55 million of net proceeds from equity issuances, enabling it to fund $102 million in debt investments to 14 portfolio companies at a 14.5% weighted average yield, which sits 70 basis points above the portfolio average. Importantly, with all of the portfolio activity, TPVG maintains a healthy amount of leverage, with a debt to equity ratio of 1.15x, sitting well below the 2.0x regulatory limit.

Notably, investments on non-accrual remain low, representing 1.0% of portfolio fair value, equating to a 50 basis point reduction from the second quarter, and a 120 basis point reduction from the prior year period.

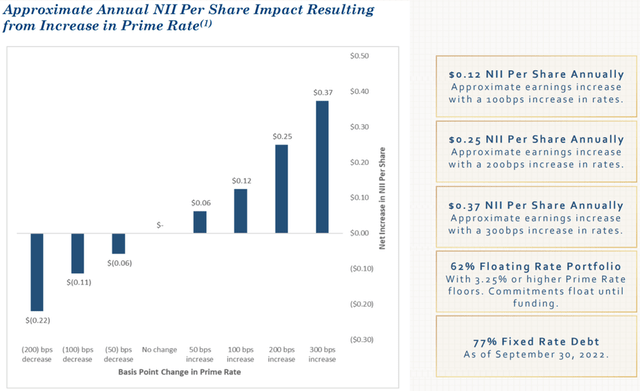

Looking forward, TPVG is in position to benefit from higher interest rates, considering that the market largely believes that the Federal Reserve will do another interest rate hike when it meets again when it meets on Wednesday, December 14th. As shown below, TPVG is expected to see around a $0.06 annual NII per share improvement with every 50 basis points rise in interest rates.

TPVG and Rising Rates (Investor Presentation)

Risks to TPVG include the unpredictability of where rates will land in the future, and that’s why management is locking in low cost fixed rate debt on its own borrowings, while setting floors on new debt investments at the current prime rate, which currently sits at 6.25% and set to increase with the expectation of another rate hike on Wednesday. This enables TPVG to take benefit from a growing investment spread.

Meanwhile, TPVG currently sports an attractive 11.6% dividend yield that’s very well covered by a 72.5% payout ratio (based on Q3 NII per share of $0.51). TPVG also has plenty of spillover income, enabling it to declare a special dividend of $0.10. Investors who buy shares before the ex-dividend date of December 14th will be able to lock in the regular $0.37 per share dividend, and those who buy before December 21 will be able to lock in the special dividend.

I see value in TPVG at the current price of $12.72, which sits just $0.03 above its NAV per share of $12.69. As shown below, this sits towards the low end of TPVG’s valuation range over the past 3 years. Analysts have a consensus Buy rating with an average price target of $13.66, translating to a potential total return of 20%+ including the regular and special dividend.

TPVG Price to Book (Seeking Alpha)

Investor Takeaway

TPVG is an attractive investment for income-seeking investors looking for yield without taking on the risk of traditional private equity. It’s seeing strong portfolio fundamentals and is benefitting from higher interest rates and larger investment spreads.

Meanwhile, it maintains a strong balance sheet and pays a very well covered regular distribution supplemented by a supplemental payout. Lastly, investors who buy before the key aforementioned ex-dividend dates can lock in 2 dividends to be paid out by the end of this month.

Be the first to comment