ipopba

Investment Thesis

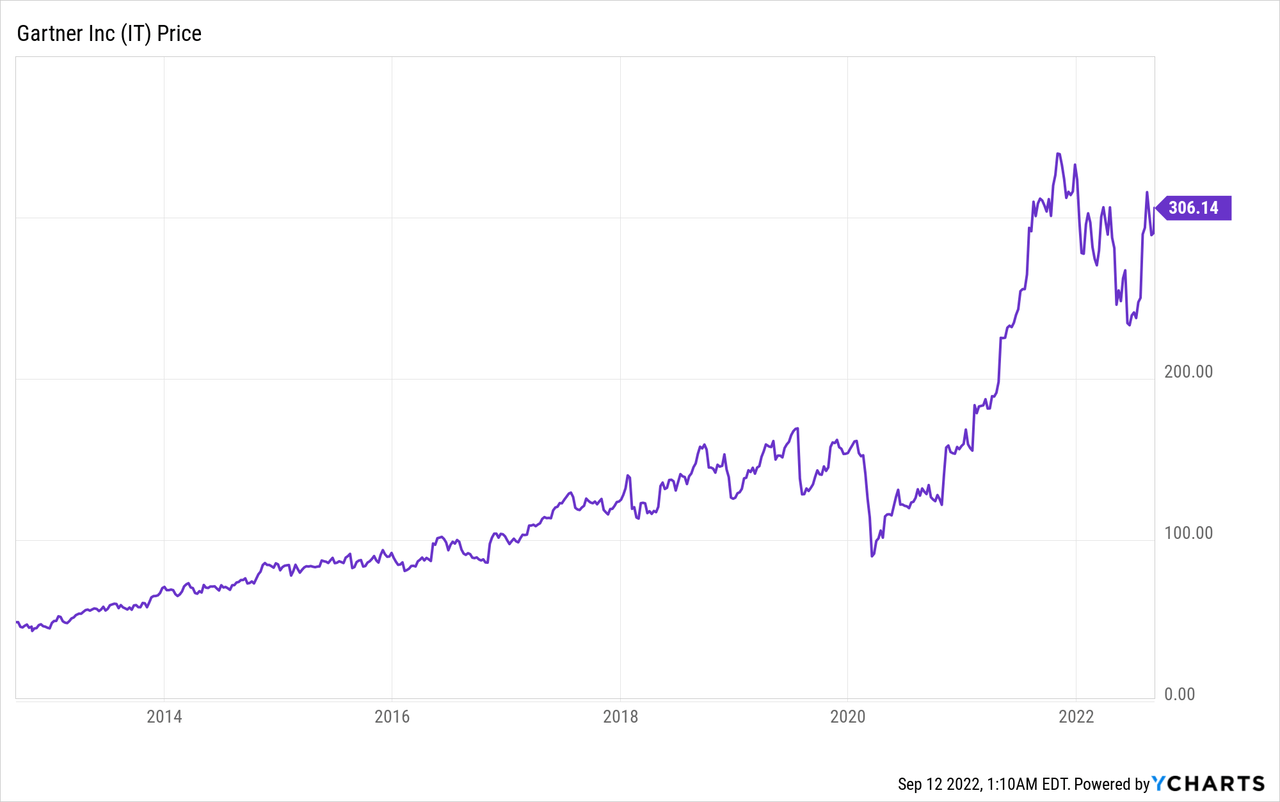

While Gartner (NYSE:NYSE:IT) is not one of the most widely recognized stocks, the company has been one of the best compounders in the past decade. Since 2010, the company recorded a 510% increase in share price, significantly outpacing the S&P index, which rose 176% during the period. For investors not familiar with Gartner, it is a US-based research and advisory company founded back in 1979. The widely popular magic quadrant is conducted by the company. It provides insights and guidance for clients through its proprietary research, and also hosts events and functions for organizations to connect and learn.

The world has been changing more quickly than ever. New trends and technologies keep emerging and it can be hard for organizations to keep up. Therefore, they are turning to Gartner for guidance and tools that enable them to make faster and smarter decisions. Gartner currently has approximately 16,000 associates working in over 90 offices globally. As the world continues to evolve drastically, the demand for Gartner will only continue to increase. The company continues to report strong financial results despite facing a tough macro environment. It also has a lower valuation compared to peers while posting a higher growth rate. Therefore I rate Gartner as a buy at the current price.

Strong Tailwinds

Digital transformation has been one of the biggest trends in the past decade and is continuing to generate strong tailwinds for Gartner. As the world continues to evolve quickly, the adoption of new technologies is becoming increasingly important. For example, during the pandemic, the adoption rate of video conferencing software skyrocketed.

Gene Hall, CEO, on market opportunities

Our expert guidance and tools enable faster, smarter decisions and stronger performance on our client’s mission-critical priorities. We continue to have a vast market opportunity across all sectors, sizes, and geographies and we’re delivering more value than ever. The rate of change in the world is the fastest I’ve ever seen. Against this backdrop, Gartner continues to get even more agile. We’re generating new insights to address timely impressing issues, such as leveraging and emerging technologies, optimizing costs, attracting and retaining talent in a hybrid world, managing cybersecurity risk, and more.

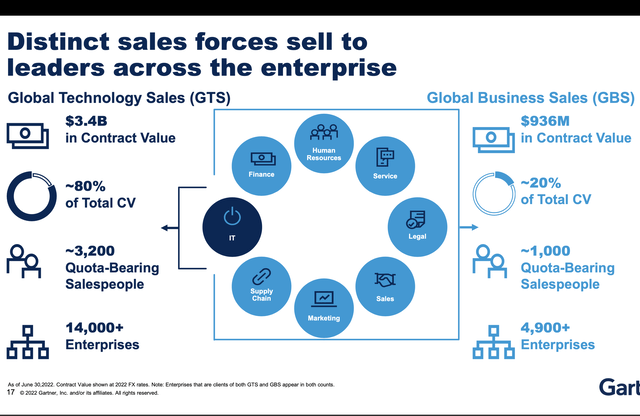

More and more companies are now turning to Gartner as it is able to provide the insight and solutions required for change. The company’s research & advisory experts currently engage in over 495,000 client interactions each year. Gartner covers a wide range of topics including cloud technologies, cybersecurity, e-commerce, cost optimization, supply chain, and more. Currently, technology sales account for 80% of total contract value while business sales account for the remaining 20%. I believe as digital transformation continues to accelerate, Gartner will continue to benefit from significant tailwinds.

Financials

Gartner reported its second-quarter earnings last month and the results are impressive, as it continues to see strong demand across the board.

Gene Hall, CEO, on second-quarter earnings

“Gartner had another strong quarter with double-digit growth in contract value, revenue, and Adjusted EPS. We are again raising our guidance and remain well-positioned to deliver long-term, sustained, double-digit growth. And we continue to buy back stock, which will increase our per share results this year and beyond.”

The company reported revenue of $1.4 billion, up 17.9% YoY (year over year) from $1.2 billion. On an FX-neutral basis, revenue increased by 21.8%. The increase is driven by contract value (CV) growth in both the technology segment and the business segment. Global technology sales CV for the quarter was $3.4 billion, up 13.5% YoY, while the global business sales CV was $0.9 billion, up 23.3% YoY. The company saw especially strong demand from the retail, media, and manufacturing sector.

The adjusted EBITDA for the quarter was $389 million compared to $355 million, up 9.5% (or 14.2% on an FX-neutral basis). The adjusted EBITDA margin dipped slightly from 29.6% to 27.8% due to higher SG&A expenses, which increased 24% YoY as the company continues to increase headcount to meet higher demand. Adjusted EPS increased 27.2% from $2.24 to $2.85, as aggressive buyback significantly reduced the number of shares outstanding.

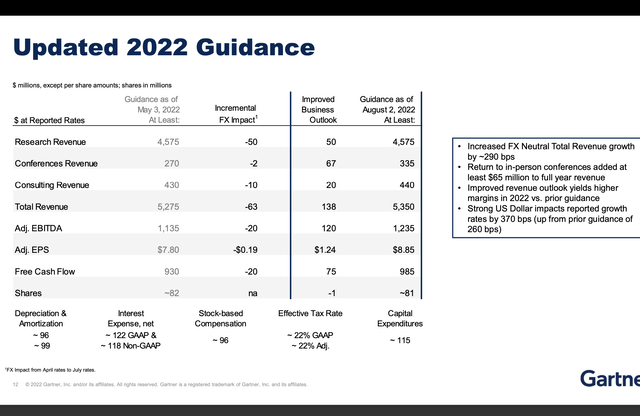

The company’s balance sheet remains healthy. The gross debt/adjusted EBITDA ratio was 1.9x for the quarter, below the target of 2x–2.5x leverage. The company continues to return cash to shareholders through buybacks. During the quarter, it bought back $479 million worth of shares, or 5.5% of the outstanding share count. I believe the ongoing buyback will continue to provide additional support for the EPS figure. Given the strong overall backdrop, Gartner raised its FY22 guidance on all metrics.

Valuation

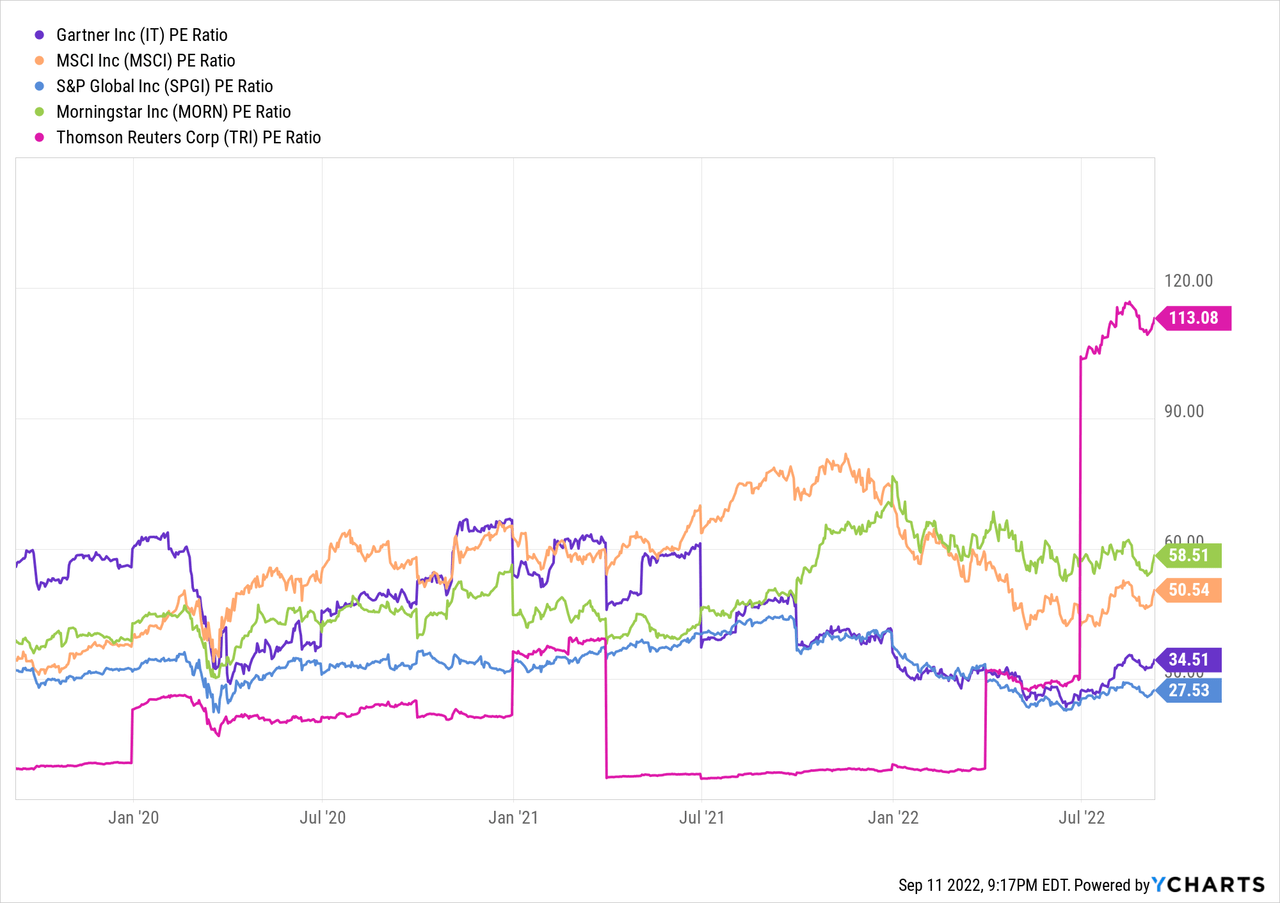

Despite the drop in share price amid the broad market sell-off, Gartner is still trading at a P/E ratio of 34.5. This looks expensive on a standalone basis, but when compared to peers, it is currently trading at a discount.

Firstly, I want to talk about the research and insight space. Currently, the space has one of the highest valuation out there, trading at a significant premium when compared to other sectors. However, the premium is justified in my opinion. Currently, almost all companies in the sector operate with a SaaS (subscription as a service) model. This allows them to generate consistent recurring revenue which has strong stability and superb margins. For instance, Gartner’s TTM EBITDA and FCF margin are both above 20%. The space can also almost be classified as non-discretionary, as insights are needed during both good and bad times, especially during bad times. I believe the space will continue and always trade at a premium valuation.

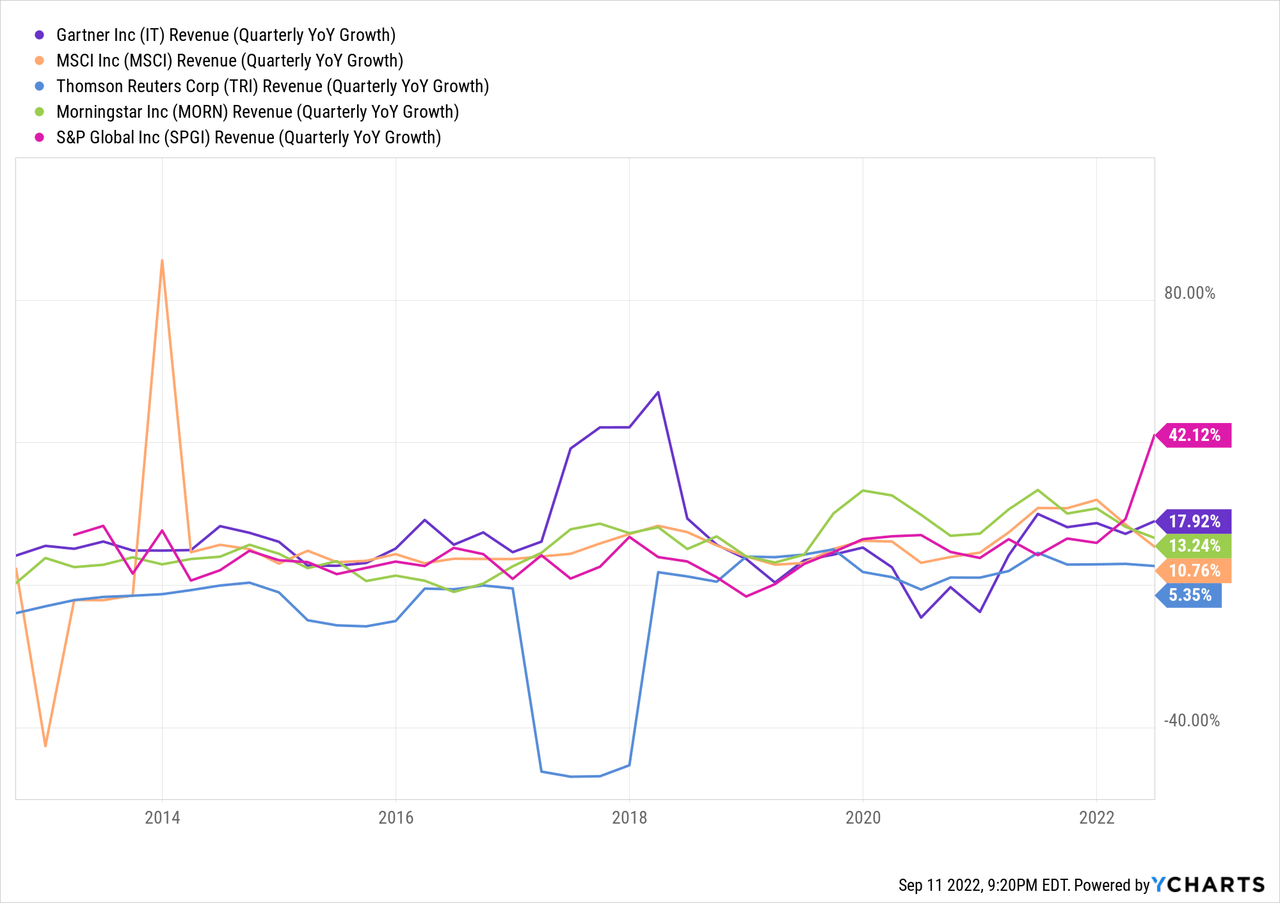

From the first chart below, you can see that Gartner’s valuation is much lower compared to other companies besides S&P Global (SPGI). It is currently trading at a 40%+ discount compared to MSCI (MSCI), Thomas Reuters (TRI), and Morningstar (MORN). It is worth noting that S&P Global isn’t a pure research and insight company as it also consists of the more cyclical credit rating business, therefore its multiple has been trailing behind the sector’s average. However, I believe Gartner deserves a multiple similar to its peers. From the second chart below, you can see that its growth rate outpaced others. The growth rate of S&P Global shown here is due to the acquisition of IHS Markit. On a Pro-Forma basis, revenue declined 5%. Therefore, I think multiple revisions back to peers’ level are highly possible.

Risks

One of the most significant risks in regards to Gartner is strong currency headwinds. Due to its strong global presence, 40%+ of its total revenue is generated outside of the US region. However, as the dollar continues to spike sharply, while the Euro and Yen continue to slump due to weak economic conditions, Gartner is now facing significant currency headwinds. The CFO mentioned during the recent earnings call that the company now expects a 370 basis point hit on full-year revenue growth rates due to FX impact, up from the prior 260 basis points guided in May. If the current trend continues, I suspect the impact may even be larger, putting further pressure on the company.

Conclusion

I really like Gartner’s prospect. The company is benefiting from substantial tailwinds driven by the acceleration of digital transformation. An increasing number of legacy companies are now adopting new technologies in order to catch up with the latest trends. The business nature Gartner combined with its SaaS business model gives it a very resilient recurring revenue stream. It continues to report outstanding results and guidance as demand across the board remains very strong. Its aggressive share repurchases are also helping the bottom line significantly. Gartner is currently trading at a discounted valuation compared to its peers yet it has a higher growth rate. I believe an upward revision in multiples toward peers level should be warranted. Therefore, I rate Gartner as a buy.

Be the first to comment