fatido/iStock via Getty Images

Investing In The Information Age

BitFreedom Research first mentioned the term ‘Information Age’ in an Ethereum (ETH-USD) article from September 2021. To understand the newfound growth potential behind Meta Platforms (NASDAQ:META), it is necessary to explain what we mean by this term:

The Information Age refers to a non-physical, location-agnostic economy driven by intelligence, innovation, expansion, sustainability, and fun.

In our view, the Industrial Age ended during the turn of the millennium, and society is now within the very early stages of the Information Age. Consequently, microprocessors have spurred numerous new opportunities over the past two decades. As digital technology advances, we expect more innovations from AI, bioengineering, quantum physics, digital networks, and robotics.

Industrial Age – Information Age Megatrend (Author)

The societal shift into the Information Age represents a massive investment opportunity for those who are sufficiently aware of the transition.

- To understand the innovations of tomorrow, investors need to look at the fringes of society.

This article covers a few promising investment opportunities related to ‘digital networks‘ (a small subset of Information Age technologies), as we feel that META’s price is at an attractive level. Future articles will examine profitable developments in AI, bioengineering, quantum physics, and robotics.

Meta Platforms: Positioned For Innovation

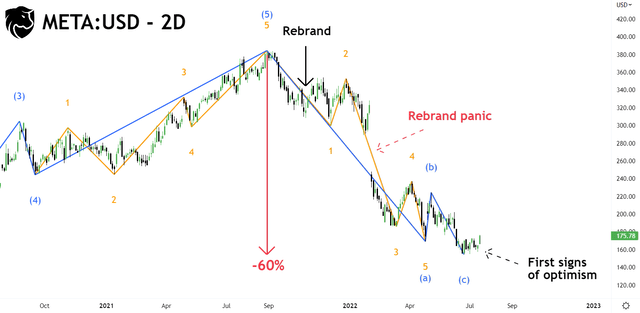

Our article from November 2021 explained the motivation behind Facebook’s rebrand to ‘Meta Platforms.’ In our opinion, Facebook rebranded to Meta to align itself with the Web 3 economy and draw attention away from the negative aspects of its business practices (such as lack of privacy).

In hindsight, the rebrand was highly volatile and emotional. However, it appears to have worked, and the worst of the downtrend looks over.

META:USD – 2D (TradingView 7-19-2022)

Although we were initially critical of Meta’s rebrand (with the justification that Meta does not value the ideological tenets of Web 3), we no longer believe this perspective holds any weight. We now expect Meta’s ventures into Web 3 will do well regardless of privacy concerns.

As a result, we believe Meta is well positioned to profit alongside the progression of Information Age technologies. Specifically, Meta will benefit by:

- Integrating itself within Web 3 networks. For example, Meta is currently working with Polygon (MATIC-USD) to introduce NFT profile pictures on Instagram and Facebook.

- Utilizing cutting-edge AI to produce cheap and profitable virtual content. For example, Instagram Reels represent cheap and profitable virtual content.

As society progresses into the Information Age (and everything becomes increasingly virtualized), Meta should benefit tremendously from future technological innovations.

Huge Metaverse Profits – No Risk Or Cost

Although Meta’s current metaverse products aren’t yet breaking any boundaries, this doesn’t necessarily matter. Meta does not need to invent an original metaverse. Instead, Meta only needs to align itself with the most successful metaverse. Mark Zuckerberg clearly stated this motivation in a recent interview:

It’s not like we just put something out there, and we’re done. You know, we’ll see what you all build. And then we’ll see what resonates with the people using the worlds, and then we’ll build the next round of tools based on that and keep improving it.

This ‘see what works’ methodology is nothing new to Meta. In fact, Meta already followed this process when it released Instagram Stories in 2016 (following Snapchat’s (SNAP) success with the feature) and Instagram Reels in 2021 (following TikTok’s success).

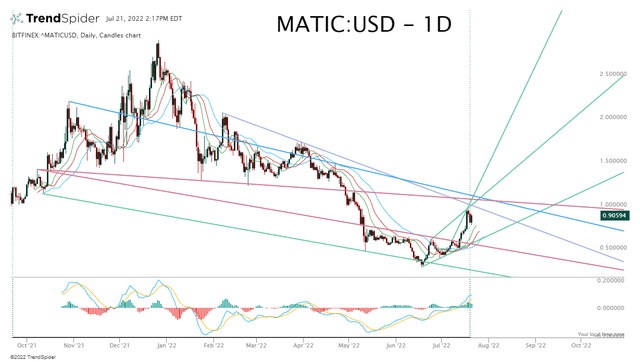

Currently, Meta is continuing its process of ‘following what works’ by aligning itself with the metaverse/Web 3. As previously stated, Meta’s first strategic partnership in this sector is with Polygon Network. Polygon is an efficient Ethereum scaling platform with an extensive product stack and numerous high-level corporate alliances. In our opinion, Polygon is the future Google (GOOG) (GOOGL) of Web 3.

MATIC:USD – 1D (TrendSpider 7-21-2022)

As shown above, MATIC has performed exceptionally well recently. To our understanding, this indicates that metaverse/Web 3 sentiment is shifting back to positive. Accordingly, we expect this positive sentiment will spill over to Meta and help to boost the company’s stock price.

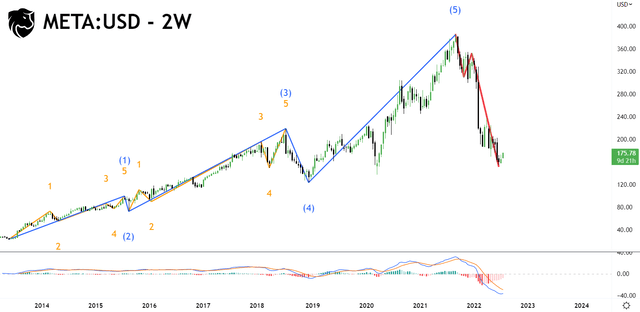

META: Technical Analysis

META’s Weekly Elliott wave structure shows the stock may have completed its long-term A-B-C Wave correction. Since its IPO on May 18, 2012, META traded in a secular bull trend to eventually reach a 5-wave peak at $384. META currently trades over 50% lower at about $177 per share, and the MACD shows downward momentum is slowing.

META:USD – 2W (TradingView 7-20-2022)

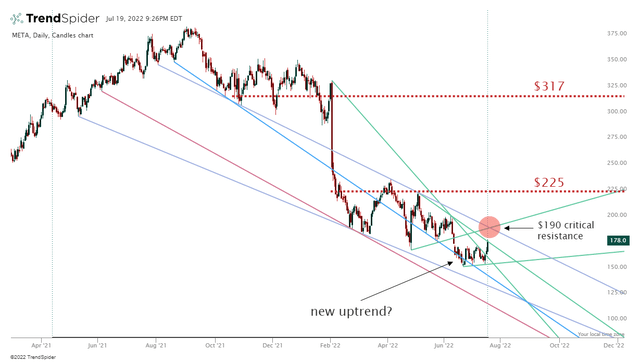

META’s daily chart shows consolidation (trading in a range). The worst of the downtrend appears to have occurred in February 2022, with sell pressure decreasing gradually as the following months progressed. With its recent July uptrend (higher highs and higher lows), META is giving the first indications of beginning a new bull trend.

META:USD – 1D (TrendSpider 7-20-2022)

META must break through its $190 critical resistance level to verify a new uptrend. Therefore, investors wary of the recession risk on Meta’s stock price should watch this level closely. After $190, the next resistance level is $225; then clear skies until $317.

Key Takeaways

- This article examines the macroeconomic arguments for investing in META over the next two to five years.

- Human society is in the early stages of the Information Age, and innovations in artificial intelligence, bioengineering, quantum physics, digital networks, and robotics will soon significantly impact the world.

- Following this thesis, we believe Meta Platforms is well positioned to benefit from future technological innovation.

*Due to limited space, we did not cover Meta’s fundamentals in this piece. Prospective investors should note that Meta’s Q2 2022 earnings call is scheduled for July 27th.*

Be the first to comment