bymuratdeniz

Quick, if a company trades at 4x P/E with no debt and has bought back 30% of its shares in the past 5 years, would you be interested?

I think the risk/reward in Parex Resources Inc. (PARXF, TSX:PXT:CA) shares is very attractive at the moment. While there is political overhang on valuations due to the newly elected Colombian government, I think pragmatism will prevail in the end and actual enacted tax and oil and gas reforms will not be as harsh as the market is expecting. Parex is currently trading at PDP reserves value.

Company Background

Parex Resources was started in 2009 (although the predecessor company Petro Andina was founded in 2003) to acquire assets and explore for petroleum in Colombia and Trinidad & Tobago, particularly in the prospective Llanos Basin in Colombia. The first financing for the company was a private placement at C$3.00 for C$30 million, with C$10 million of the total coming from the management team at the time.

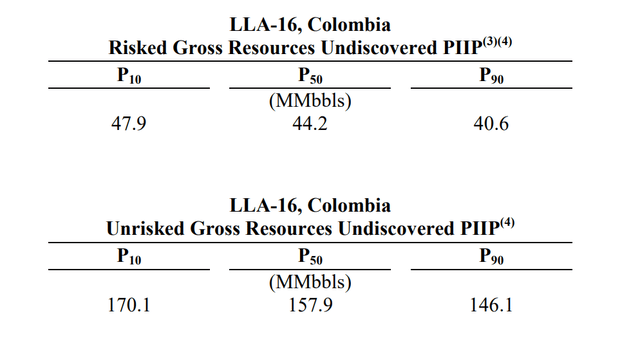

Colombia in the early 2000s was not an easy place to do business, as large parts of the country was overrun by militant guerrila groups like the FARC. However, the Llanos Basin was very prospective for petroleum. Figure 1 shows a consultant’s estimate on one of Parex’s early Llanos exploration blocks.

Figure 1 – Early GLJ resource estimate of LLA-16 (Parex 2009 AIF)

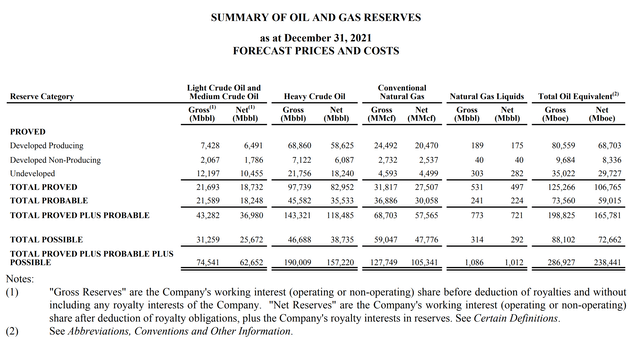

From those humble beginnings, Parex’s management team led by Wayne Foo (formerly CEO, now Chairman) has been able to build a C$2.3 billion market cap company that produced 47,000 boe/d of mostly heavy crude in 2021 with net 3P reserves of 238 million boe (Figure 2), becoming the largest independent oil and gas company in Colombia in the process.

Figure 2 – Parex reserves (Parex 2021 AIF)

Parex Targeting Next Phase Of Growth

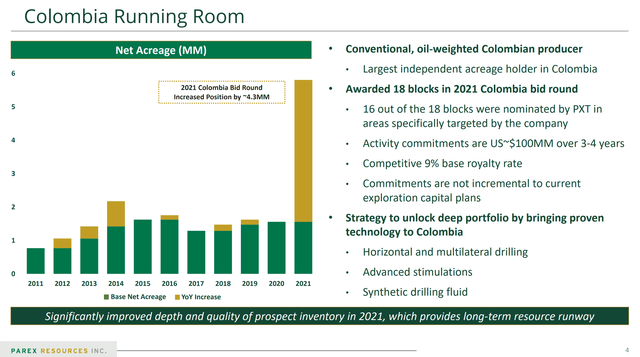

After bidding for and winning significant acreage in the 2021 Colombia bid rounds, Parex is now about to embark on its next leg of growth. Parex was awarded 18 blocks in the latest bid round, adding 4.3 million acres of prospective blocks (Figure 3). Parex intends to bring best-in-class technologies (horizontal drilling, advanced stimulations, and synthetic drilling fluids) to unlock Colombia’s petroleum potential.

Figure 3 – Parex won significant acreage in 2021 (Parex investor presentation)

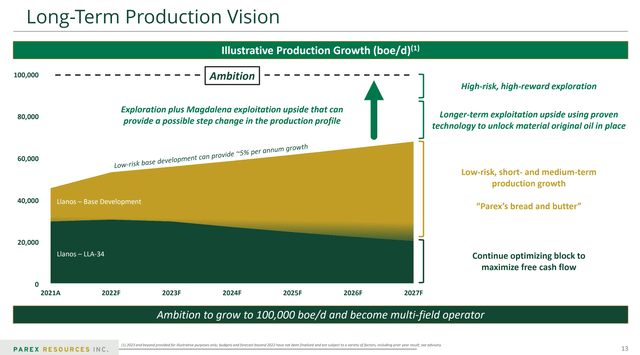

By exploring and developing the recently acquired blocks, Parex intends to grow production to 65-100k boe/d within the next few years (Figure 4). Note, a low-risk path to 65k boe/d is shown in the figure below, with upside to 100k if the newly awarded blocks turn out to be amenable to newer exploration and production techniques.

Figure 4 – Parex growth plans (Parex investor presentation)

Production Growth Funded Through Cash Flows

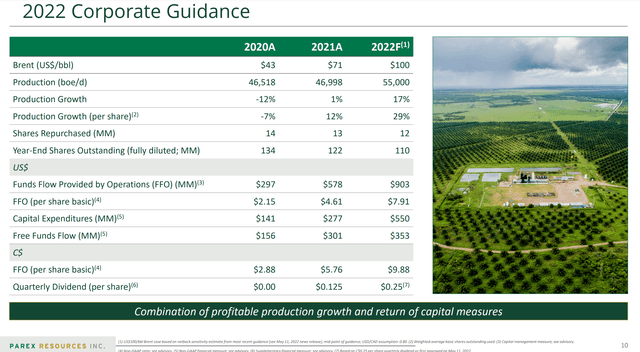

This base production growth is well funded by cashflows. In 2022, Parex is expecting to spend US$550 million in capex to bring production to 55,000 boe/d. Using US$100 /bbl Brent as the base case, Parex expects to generate US$900 million in cashflows in 2022, which should be more than sufficient to fund the capex and quarterly C$0.25 dividend.

Figure 5 – Parex 2022 guidance (Parex investor presentation)

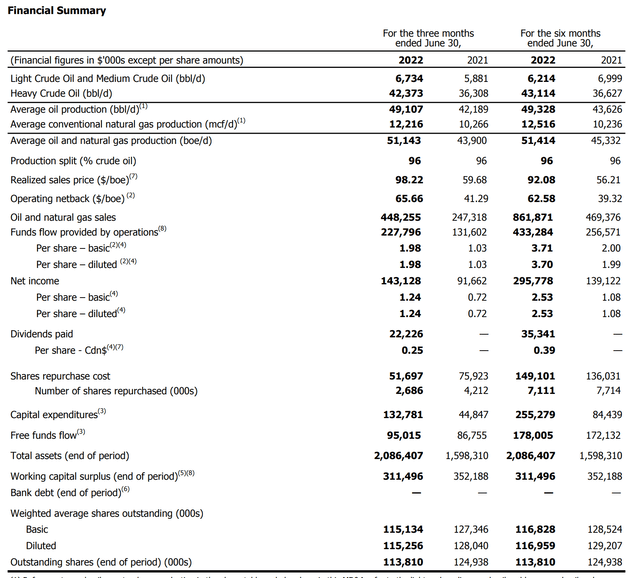

Since production in the the first half of 2022 averaged 51k boe/d, we should expect the second half to be significantly above that, with the Company exiting 2022 at ~60k boe/d (Note, in its 2nd quarter report, Parex guided to Q3 production of 53 – 55k boe/d).

Figure 6 – Parex Q2/2022 financial summary (Parex Q2/2022 report)

Parex Has Been Shareholder Friendly

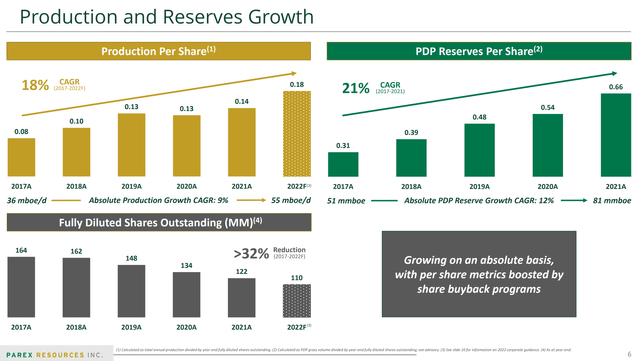

The most impressive thing about the Parex story is how incredibly shareholder friendly the company is (no surprise, as Mr. Foo is the largest individual shareholder and owns 1.3% of Parex). Since 2017, Parex has increased production per share and PDP reserves per share by 18% and 21% respectively (Figure 7). The company has bought back an incredible 32% of shares outstanding, despite volatile commodity prices. At the same time, the company has zero debt.

Figure 7 – Production growth (Parex investor presentation)

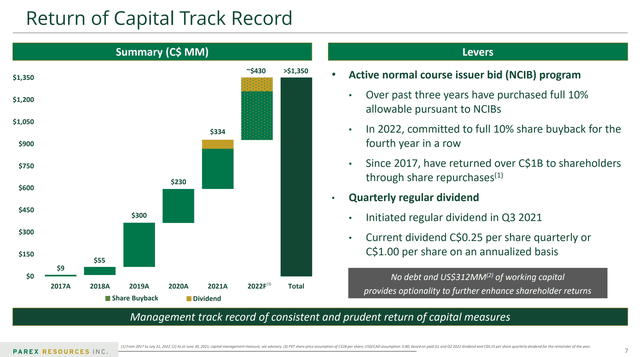

Figure 8 shows the amount of capital that Parex has returned to shareholders. With share buybacks and a recently instituted quarterly dividend, Parex has returned over C$1 billion to shareholders. Pretty incredible for a C$2.3 billion market cap company.

Figure 8 – Return of capital history (Parex investor presentation)

Why Does Parex Trade At Such Cheap Valuations?

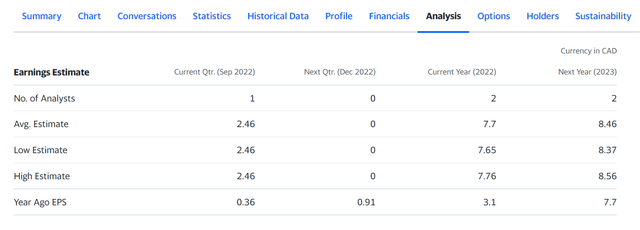

If the company is so shareholder friendly, why does Parex trade at such incredibly cheap valuation? Based on LTM earnings of US$3.86, Parex is currently trading at only 4.2x P/E. Analysts currently expect Parex to earn C$7.70 per share in 2022, which means the company is trading at only 2.5x Fwd P/E (Figure 9).

Figure 9 – Parex earnings estimate (Yahoo Finance)

Geopolitics Is The Valuation Overhang

The main reason Parex is trading at such low valuations is because of the political uncertainty in Colombia. Colombia’s newly elected President, Gustavo Petro (ironic surname!), is notoriously anti-oil, and has proposed new export taxes on extractive industries and bans on hydraulic fracturing for oil and gas. If these measures come into law, they will severely harm Parex’s economics and growth plans.

Will Pragmatism Prevail?

While the headlines are terrible for foreign companies such as Parex, in the end, pragmatism may prevail. First, President Petro named Jose Ocampo as his finance minister. Mr. Ocampo has a PhD from Yale University and has been a professor at Columbia University. This appointment appears to be an olive branch to big businesses, as Mr. Ocampo is widely seen to be market savvy and business friendly.

Next, extractive industries such as oil and coal are Colombia’s biggest exporters, bringing in $13 billion and $5 billion respectively in 2019. If Colombia really does enact draconian taxes and reforms, it may “kill the golden goose” and the government can expect many foreign companies like Parex to stop investing in Colombia, which would harm the government’s social policies in the end.

Finally, we are already seeing signs that President Petro’s harsh stance is softening, with articles hinting he is open to negotiations on the tax reforms.

While geopolitics is always hard to analyze, I believe there is a good chance the ultimate reforms will be not as bad as currently priced into Parex’ shares.

Worst Case Scenario

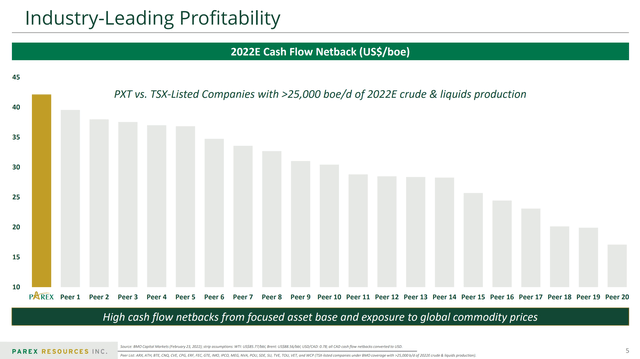

Parex currently has industry leading netback (revenues less all production costs) of over US$40 / bbl (Figure 10). In the worst case scenario, Parex can stop all development activities and wind down the portfolio for cash flow. Even if the government’s 10% additional royalty tax above US$48 / bbl were included, netbacks should still be ~US$35 / bbl at current oil prices. This would translate into US$2.4 billion in cash flows for Parex’s Proved-Developed-Producing (“PDP”) reserves of 68 million boe (from Figure 2 above).

Figure 10 – Parex netbacks (Parex investor presentation)

Historically, being able to buy oil and gas companies at PDP reserves value is highly lucrative, as you basically get all the non-producing and undeveloped reserves for “free.”

Conclusion

In conclusion, I think the risk reward in Parex’s shares are very attractive at the moment. True, political uncertainty in Colombia is a risk. However, I think pragmatism will prevail in the end and actual enacted measures will not be as harsh as the market is expecting. Parex is currently trading at PDP reserves value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment