ewg3D/E+ via Getty Images

Due to the recent drop in natural gas prices in the last few weeks, Energy Transfer LP (NYSE:ET) stock price dropped from $12 to $10 per share. However, natural gas price is still about 50% more than their levels a year ago (in July 2021, ET stock price was at the same level it is now). The company’s recent developments in the Permian Basin, combined with increased natural gas production in the Basin, support the company’s 2022 guidance. Furthermore, Energy Transfer’s healthy liquidity position is observable from its liquidity ratios. Based on my valuation, the stock is undervalued and has an upside potential of more than 50% to reach around $16. ET stock is a buy.

Operations and developments

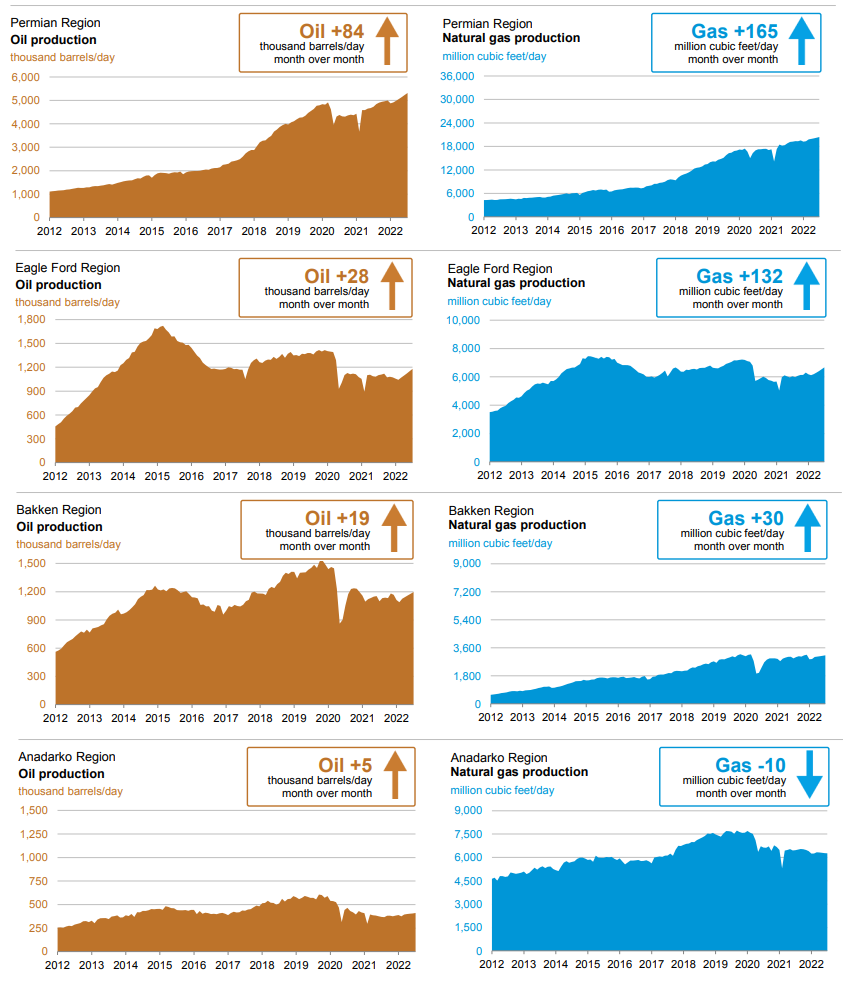

In the first quarter of 2021, Energy Transfer completed the construction of the final phase of the Mariner East Pipeline. Also, the company completed Phase II of the Cushing South Pipeline, which brings the capacity to 120000 Bbls/d. In the second quarter of 2022, ET announced a second new processing plant in the Permian Basin and started construction of a new 200 MMcf/d Grey Wolf processing plant in the Permian Basin (expected to be completed in the second half of 2022). Customer demand for growing natural gas volumes in the Permian Basin increased significantly in recent years. According to U.S. Energy Information Administration (EIA), the Permian Basin is the second-largest shale gas-producing region in the United States, which produced, on average, 34.8 Bcf/d of marketed natural gas in 2021.

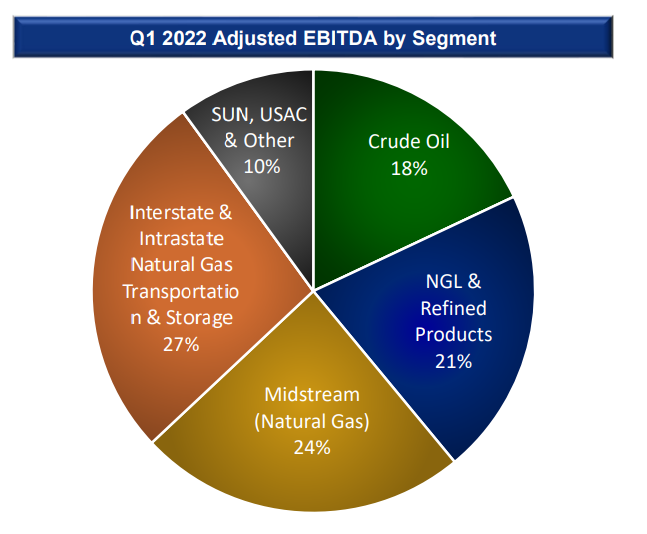

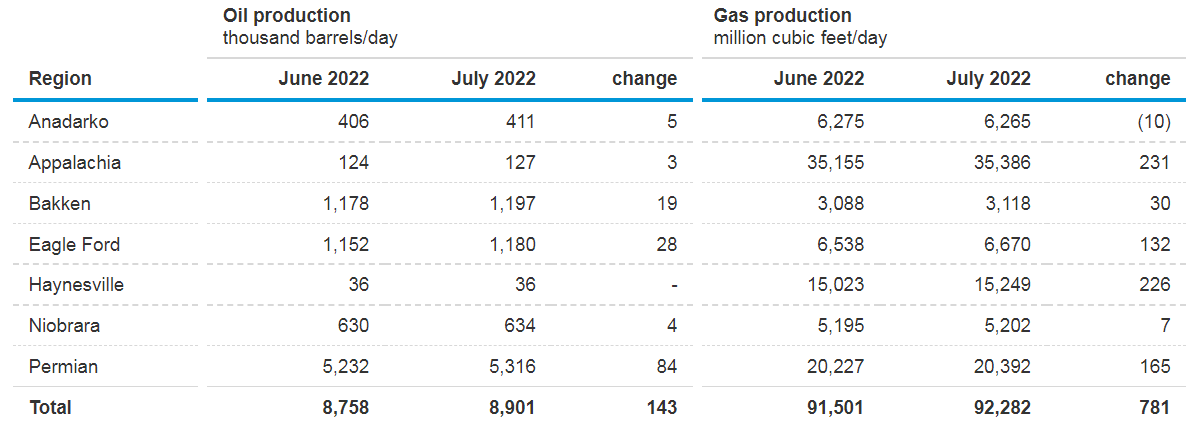

Figure 1 shows that 18% of ET’s adjusted EBITDA belongs to the crude oil segment. The company’s revenues from the crude oil segment come from transportation, terminalling, and storage of crude oil. ET’s revenues from the crude oil segments have significant connectivity to Permian, Bakken, and Midcon Basins. According to EIA’s recent report, oil production in the Permian Basin is expected to increase from 5232 thousand barrels per day in June 2022 to 5316 thousand barrels per day in July 2022. Also, oil production in the Bakken Basin is expected to increase by 19 thousand barrels per day to 1197 barrels per day in July 2022 (see Figure 2).

Figure 1 – ET’s adjusted EBITDA by segment in 1Q 2022

ET’s June 2022 presentation

Figure 2 – Oil and gas production by region in June and July 2022

www.eia.gov

Moreover, Figure 1 shows that 24% of ET’s adjusted EBITDA in 1Q 2022 belongs to the midstream (natural gas) segment. The company’s natural gas revenues depend on the company’s operations in Permian, Eagle Ford, Anadarko, and Marcellus/Utica Basins. According to Figure 2, gas production in the Anadarko region is expected to decrease by 10 million cubic feet per day in July 2022. However, in July 2022, gas production in Eagle Ford and Permian is expected to increase by 132 and 165 million cubic feet per day, respectively. Energy transfer expects its capital to grow to $1.8 – 2.1 billion in 2022. The company estimates that 35% and 6% of its 2022 capital growth is related to midstream and crude oil segments, respectively.

Figure 3 shows that in the first half of 2022, oil and gas production in the Permian and Eagle Ford regions has increased significantly. Also, oil and gas production in the Bakken and Anadarko regions has been almost stable. Moreover, Figure 3 shows that oil and gas production is expected to increase in July in the Permian, Eagle Ford, and Bakken regions. Thus, the oil and gas production data support the company’s estimation of 2022 capital and adjusted EBITDA growth rates (ET expects 2022 adjusted EBITDA of $12.2 – 12.6 billion). Furthermore, according to Figure 4, total natural gas storage is now more than 12.5% below the 5-year average levels and 11.6% below the natural gas storage a year ago. Because of recent developments, the company can benefit from the market condition. Besides, due to the summer cooling demand, I expect ET’s natural gas operations to increase in the following months.

Figure 3 – Oil and gas production in different regions

www.eia.gov

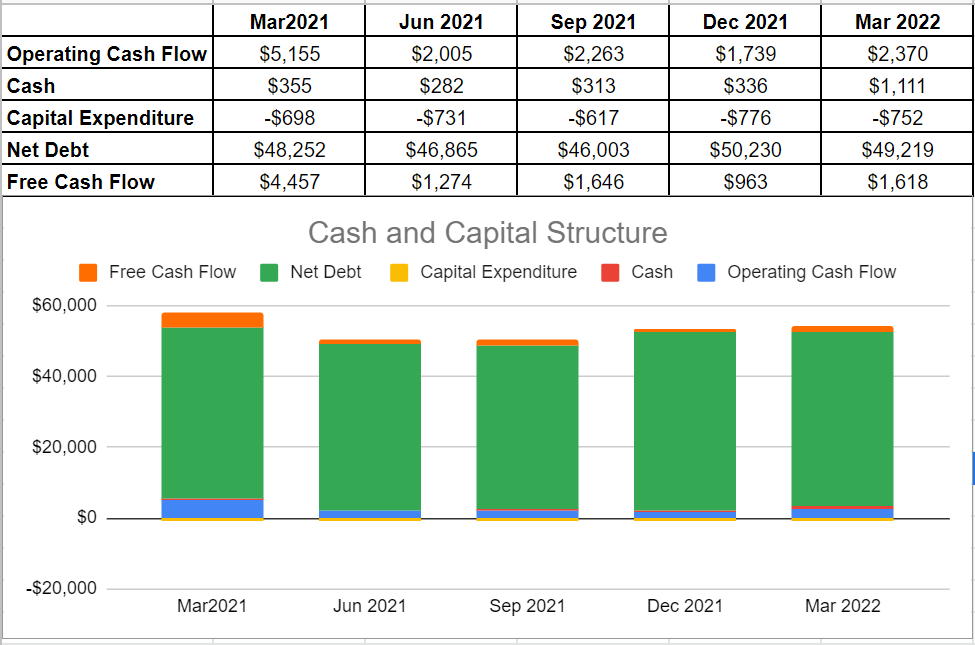

ET performance outlook

ET’s cash flow performance represents that the company’s operating cash flow of $2370 million during the first quarter of 2022 is more than half year-on-year compared with its level of $5155 million during the first quarter of 2021. However, the ample amount of operating cash flow in the 1Q2021 was due to the winter storm which happened in Texas in the first months of 2021. In short, in light of their up-to-now performance and the guidance for 2022, we can expect strong cash and capital structure outlook for the rest of 2022. The company’s growth of 36% in operating cash flow versus its previous level of $1739 million at the end of 2021, combined with a 3% decline in capital expenditure to $752 million, resulted in $1618 million free cash flow in 1Q2022, compared with its previous level of $963 million at the end of 2021, up 68%.

Energy Transfer’s net debt level of $49.2 billion in the first quarter of 2022 shows a slight decrease year-on-year versus its previous result of $50.2 billion during the same quarter of 2021. Moreover, the cash balance increased impressively to $1.111 billion versus only $336 million at the end of 2021 (see Figure 4).

Figure 4 – ET’s cash and capital conditions

Author (based on SA data)

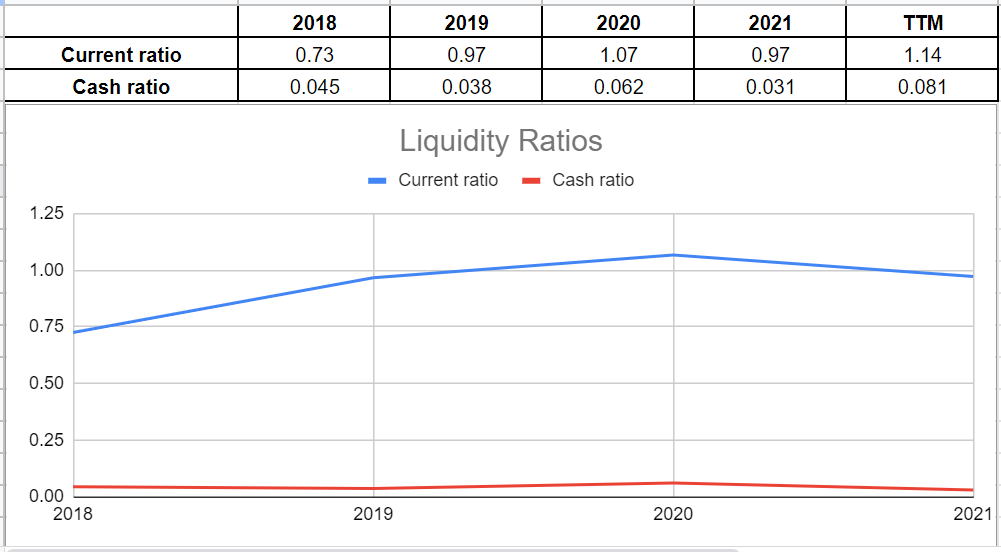

Following its strong cash and capital performance, it is not surprising to observe increases in its liquidity ratios. The company’s current ratio of 1.14x is 17% higher than its result of 0.97x at the end of 2021. Albeit the cash ratio is still low, it has improved to 0.081x versus its previous level of 0.031x during 2021. In short, Energy Transfer’s healthy liquidity position is observable from its liquidity ratios (see Figure 5).

Figure 5 – ET’s liquidity ratios

Author (based on SA data)

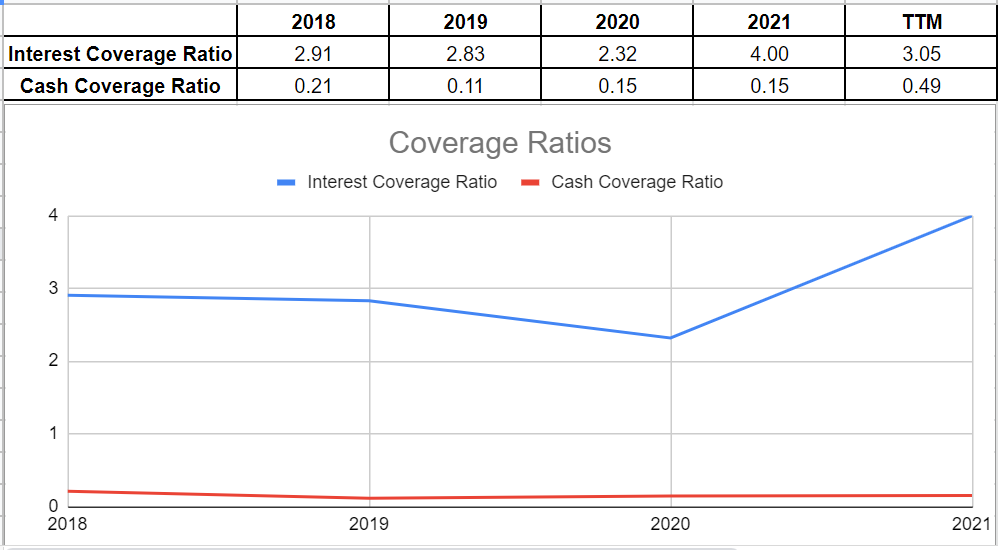

Moreover, we can analyze ET’s coverage ability across the board of its Interest Coverage Ratio (ICR) and cash-coverage ratio. Currently, its ICR indicates that 3 times the company is able to pay its interest expenses on its debt with its operating income. Also, as a conservative metric to compare the company’s cash balance to its annual interest expense, ET’s cash-coverage ratio has increased to 0.49x versus its previous level of only 0.15x at the end of 2021 (see Figure 6).

Figure 6 – ET’s coverage ratios

Author (based on SA data)

Stock valuation

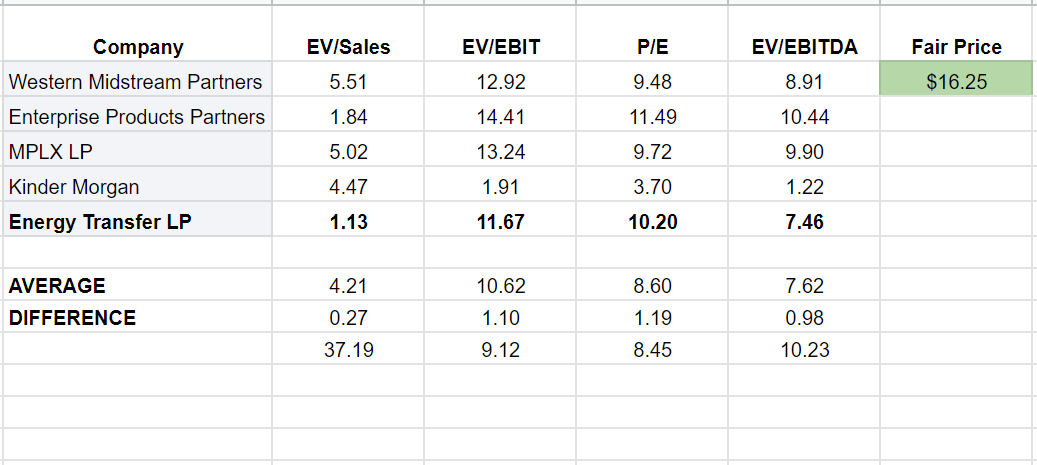

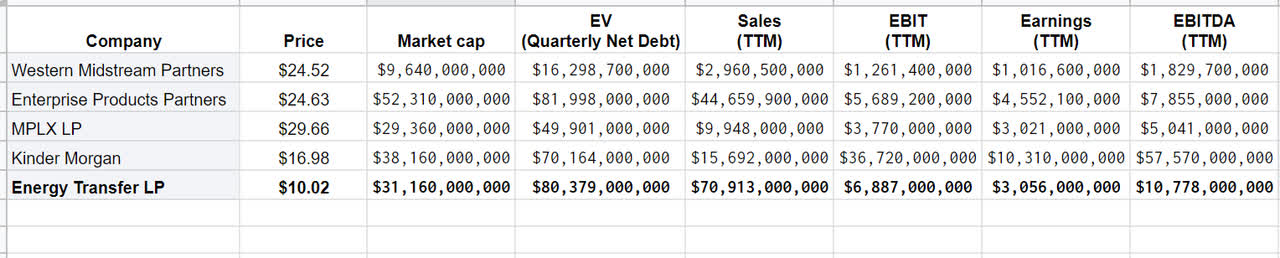

I used Competitive Companies Analysis (CCA) to evaluate Energy Transfer stock. Comparing ET with other peer competitors and using the CCA method, I estimate that the stock is undervalued and has an upside potential to reach around $16. I selected the midstream peers and used common key ratios in a CCA method to illustrate the value of similar companies. Data was gathered from the most recent quarterly and TTM data (see Table 1).

Table 1 – ET financial data vs. its peers

Comparing ET’s ratios with other peer companies, I observe that the stock is undervalued – ET’s EV/sales ratio is 1.13x, which is far lower than the peers’ average of 4.21x. Moreover, Energy Transfer’s EV/EBITDA ratio equals 7.46x, which is in the same line with the average of 7.62x. On the other hand, ET’s P/E ratio is 18% higher than the average of 8.6x. Shortly, ET’s financial ratios versus its competitors indicate that the company is attractive as a potential investment (see Table 2).

Table 2 – ET stock valuation

Author

Summary

Because of its recent developments, the company can benefit from the market condition. Besides, due to the summer cooling demand, I expect ET’s natural gas operations to increase in the following months. Moreover, in light of their up-to-now performance and the guidance for 2022, we can expect strong cash and capital structure outlook for the rest of 2022. ET’s financial ratios versus its competitors indicate that the company is attractive as a potential investment. The stock is worth $16 per share. It is the right time to buy ET.

Be the first to comment