ti-ja

Co-Produced with Treading Softly.

When I drive into town, I love to look around at all the stores and shops. Sure, it’s not a long drive and we have the usual hodgepodge of shops and offerings.

I love owning income sources from “boring” or “mundane” sources. My power bill, gas bill, or even the local gas station. These recurring income streams flow into my account and I enjoy the stability and recession resilience they provide.

The average consumer is blissfully unaware that most corporate debt isn’t sitting as everyday loans on banks’ balance sheets. Banks love to originate loans and service them, but overall they seek to offload them to third parties. After all, they need to free up capital so they can provide more loans.

To do this, they will collateralize them or bundle loans together and sell off parts of that portfolio to investors. We’ve seen this done with mortgages for years, and everyday investors who have ample cash, can go to their online brokerage and buy mortgage-backed securities or MBS. Another form of bundled loans is collateralized loan obligations or CLOs, these are bundles of senior secured loans. These loans are not auto loans or loans to small mom-and-pop businesses but to large companies like Petco, Dell, or even Hilton hotels.

CLOs are usually outside of the ability of average investors to reach. Thus the need to invest in a fund that buys them becomes the main avenue to achieve exposure to these sources of income.

Let’s look at two excellent routes to do just that.

Pick #1: XFLT – Yield 13.2%

The carnage in the bond markets even spread into floating-rate debt. While floating-rate debt investors see their income rise as rates go higher, the prices of floating-rate loans have also fallen. This makes buying funds with exposure to floating-rate debt particularly attractive as protection against the Fed hiking even more.

XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) is a CEF (closed-end fund) that invests in a variety of floating rate debt. Including leveraged loans, CLO debt, and CLO equity positions. Ironically, when interest rates were low, XFLT routinely traded at a premium to NAV. Today, with higher interest rates driving higher interest payments, XFLT is trading at a slight discount to NAV!

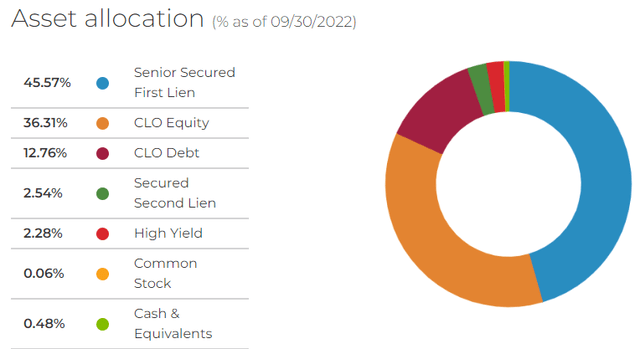

XFLT’s largest allocation is to “Senior Secured First Lien” loans, aka “leveraged loans.” Source

These are loans made by banks to corporations with B/B+ credit ratings. They are first-lien loans that are at the top of the capital stack for the borrower. If you are reading the financial statement of a borrower, they will usually be labeled as “term loans.”

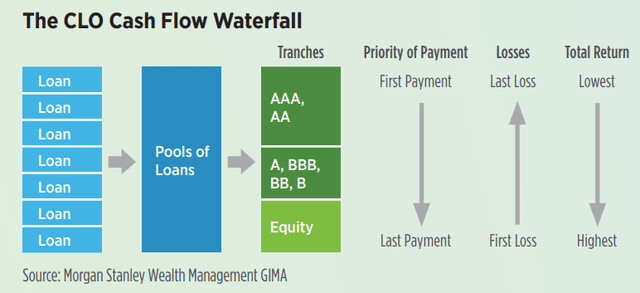

CLOs provide indirect exposure to leveraged loans. A CLO buys up a bundle of loans, and then resells “tranches” to investors. Investors with a low-risk tolerance can pay a hefty premium for the “AAA/AA” tranches which are paid first. Each tranche is only paid after all the more senior tranches are paid. As a result, investors can choose their own risk level. Paying a premium to ensure a safe but lower return or accepting risk in exchange for a much higher return. Source

The lower tranches benefit from the premiums that institutions like banks or insurance companies are willing to pay for the security of senior tranches. Let’s look at the life of a CLO.

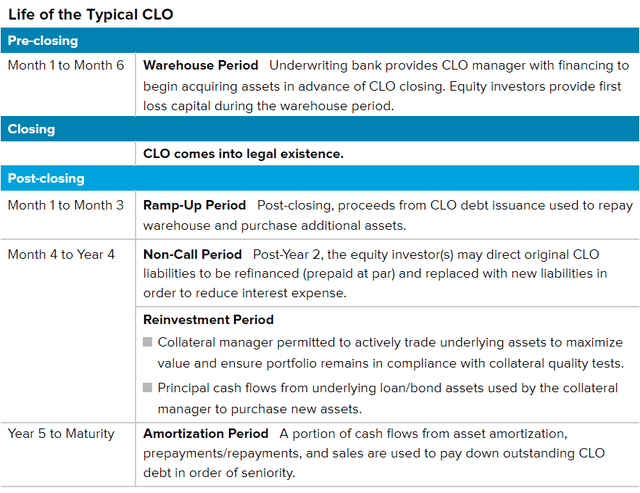

CLO equity positions have particularly benefitted the past couple of years because the CLO manager has the right to repay the senior tranches and refinance with new tranches. With interest rates near 0% in 2021, many CLOs were able to exercise this option and get new debt tranches at lower rates. The interest expense for the CLO declined, but the interest owed by the loans owned by the CLO did not.

As borrowers repay, CLOs reinvest the principal payments for the first 4 years. With interest rates and interest spreads much higher than they have been in recent years, this reinvestment period is being done with higher returns, while the interest expense for the CLO remains at rates set in 2020/2021.

In short, income for most CLOs is going up faster than expenses, this makes it an extremely attractive time to own CLO equity.

The risk for CLO equity investors lies in defaults. It doesn’t matter how much a borrower owes if they can’t pay you!

Fitch is currently predicting that loans will see default rates of 2-3% in 2023 and up to 4% in 2024, with the assumption that there will be a recession in 2023. If those levels are hit, there is a word for that: Average.

Right now, default rates are well below historical averages. They are expected to remain low, even in the event of a recession, because borrowers are healthy.

- Companies spent much of 2020 and 2021 improving their balance sheets and refinancing debt at historically low rates.

- Defaults from an inability to pay interest expenses are very rare. A default usually occurs when a borrower cannot refinance a balloon payment. With high refinancing activity, there is an unusually low number of debt maturities in 2023/2024.

- Inflation makes it easier for borrowers to repay old debt. Inflation has an impact on both revenues and expenses. This will make it easier for many companies to repay their obligations.

For these reasons, the dip in the price of leveraged loans and CLOs is a very attractive buying opportunity. XFLT is one of our favorite ways to gain exposure to this sector.

Pick #2 EIC – Yield 12.6%*

When one thinks of CLO exposure, we are often drawn to the highest-yielding, riskiest investments which are largely held by well-known names. Oxford Lane Credit (OXLC) and Eagle Point Credit (ECC) have both been laser-focused on the equity tranche. XFLT plays a more conservative role, as we noted above holding CLO equity, debt, and individual loans.

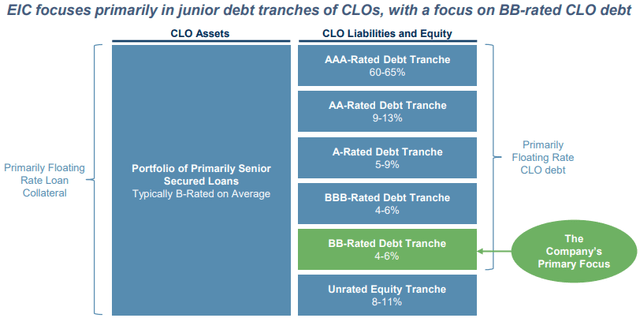

There is yet another CLO-focused option in the market, Eagle Point Income Company Inc. (EIC) invests in junior-level debt tranches of CLOs. This fund should be viewed less as a highly volatile CLO fund and more as a specialized bond fund.

They take on less risk for less reward aiming to provide a smoother ride for investors. EIC has provided a steady stream of dividends to its holders. EIC did reduce its regular dividend in 2020 but also paid out a special dividend in 2020 and 2021. For 2022, we’ve seen two dividend increases in the regular monthly dividends, and a 14% hike in 2023 has already been announced for Jan., Feb., and March.

EIC’s monthly dividend starting Jan 2023* will be higher than its original dividend when the fund was initiated, something of a rarity for CLO-focused funds. How is this possible? EIC was proactively reinvesting its excess income into below PAR debt tranches to boost its income generation, allowing them to be able to grow the dividend again.

EIC is an extremely small fund, ECC is 4x larger for example, and the volume is lower. So investors should use limit orders and buy into EIC with patience. However, if you’re worried about a pending recession, EIC offers a lower-risk avenue to have widespread CLO exposure.

* 12.6% yield is calculated based on an increase of the monthly dividend from $0.14 to $0.16 effective in January.

Conclusion

XFLT and EIC are strong income generators on the lower-risk side of options for CLO exposure. Both offer strong monthly income, with EIC hiking its dividend in 2022 and again looking toward 2023.

For a retiree, using funds to gain exposure to and access to investments that otherwise are unavailable to them is an easy route to recurring income. CLOs are designed to produce stable and steady income from a pool of loans to large companies, and we can enjoy a piece of the pie via EIC and XFLT.

This way, when your friends buy dog food or stay at a hotel among many other day-to-day expenses, they are paying the companies who will be paying you.

So thank them for spending their money, you’re the beneficiary of it. They could just hand you the money directly, but that might make for an awkward situation.

I love finding diverse sources for my income, the more income flowing into my coffers the better. This ensures if any one stream stops, my income is unabated and my portfolio carries on.

That creates a low-stress retirement, and that’s the beauty of our Income Method and income investing.

Be the first to comment