seewhatmitchsee/iStock Editorial via Getty Images

The Snap (SNAP) collapse on weak Q4 guidance based on assumptions pulled down Pinterest (NYSE:PINS) last week. Investors have to be careful reading too much into the numbers provided from Snap due to a volatile advertising business not always providing a direct read to other social media companies. My investment thesis remains Bullish on Pinterest with a dip back towards $20, as the business normalizes following the covid pull forwards.

Interpreting Snap’s Guidance

Every investor needs to understand that the social media companies are all slightly different. Snap focuses more on social messaging with a general younger crowd. Pinterest is focused on social imaging with an older user base tilted towards females while Meta Platforms (META) has a massive global user base.

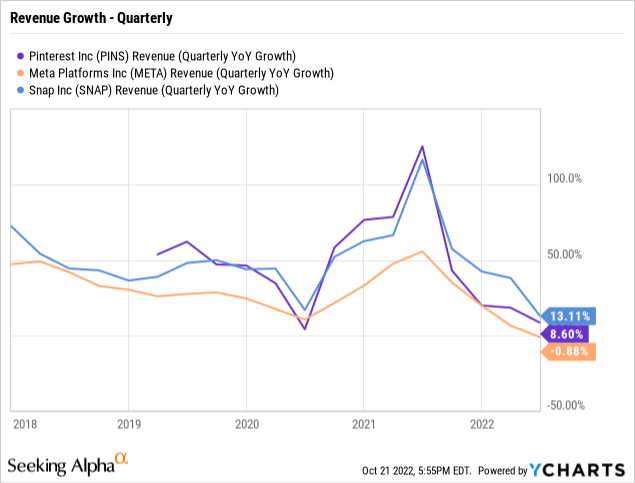

All of these companies have slightly different business plans along with various stages of development and growth rates. As the below chart highlights, these social media companies have revenue growth generally trending in the same direction, but the numbers do deviate on a quarterly basis.

Snap just reported that Q3 revenues grew at a nearly 6% clip. The big issue was the guidance for Q4 revenues where the company made some “assumptions” for an initial 9% growth rate to end up at only flat revenues for the quarter.

Management is basically assuming November and December revenues fall from 2021 levels despite revenues trending up from Q3 levels for the first 20 days of the quarter. Specifically, Snap sees brand advertisers reigning in advertising spending during the holidays.

Remember, Snap provided initial Q3 commentary suggesting revenues were challenging in the early part of the quarter. In fact, the early Q4 numbers are far stronger than the Q3 numbers where the social messaging player ended up generating nearly 6% growth. Management made the following statement on the Q2’22 investor letter:

Thus far in Q3, revenue is approximately flat on a year-over-year basis. Forward-looking visibility remains incredibly challenging, and it is unclear how the headwinds we observed in Q2 will evolve as we move through Q3. Given this, we do not intend to provide financial guidance for Q3. That said, it is clear that our rate of revenue growth has slowed considerably and we must adapt our investment strategy. We intend to substantially slow our rate of hiring, as well as the rate of operating expense growth. W

When reporting Q2 results on August 1, Pinterest guided to mid-single digit sales growth during Q3. The company hardly misses analyst estimates, so the current consensus growth target at 5.3% still appears solid.

Of course, the question is whether Pinterest lowers expectations for Q4 sales. Analysts have growth dipping to 4.5% in the December quarter. Investors shouldn’t expect Pinterest management to provide any better commentary on the advertising market considering the fears of a global recession, but the companies view is far less volatile and probably more predictable.

Focus On Commerce

As the above revenue growth chart highlighted, all of these companies saw massive revenue growth in 2021 placing the 2022 results with perilous comps. Said another way, investors can’t read too much into the reported growth rates in 2022 with Q3 trying to top a 43% growth rate from last year and Q4 needing to top 20% growth last year on top of 76% growth back in 2019. Pinterest only generated $400 million in Q4 revenues back in 2019 and the company is trying to top $847 million from the period last year.

Outside of the market extrapolating too much on current growth rates after the tough comps from the last couple of years, Pinterest is pushing for a focus on commerce. The new CEO from PayPal (PYPL) is working on integrating the social imaging platform into offering the ability to purchase goods posted on the site with payments directly via Pinterest.

The commerce opportunity has the potential to move the company away from market reliance on digital advertising. The space is becoming increasingly competitive with secondary social sites like Pinterest, Snap and Twitter (TWTR) constantly facing pressure from the market leaders in Meta and Google (GOOG, GOOGL), along with Apple (AAPL) changing privacy settings. The secret to success for this group is a push into subscriptions or commerce to reduce the reliance on a volatile ad market and internally control the monetization of large user bases.

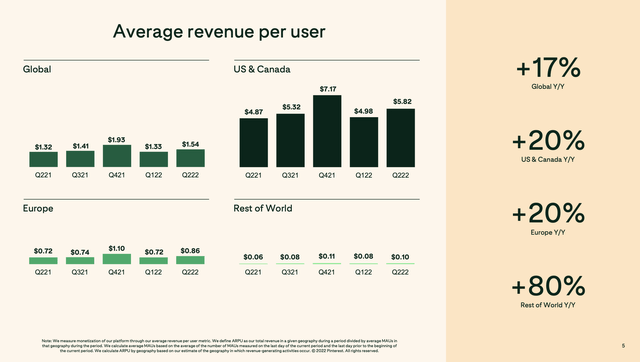

CEO Ben Ready only started back in late June. Investors shouldn’t expect much from the commerce push with a focus on 2023. The company only obtains quarterly ARPUs in the $1.50 range providing a great opportunity to use commerce to vastly boost revenues.

Source: Pinterest Q2’22 persentation

In the last quarter, the Pinterest API for Shopping drove higher ad revenues compared to the overall ad revenue growth. The company definitely made progress in the platform being utilized for shopping functions, but the holy grail is Pinterest becoming more of a commerce platform where transactions take place on the site preventing users from having to leave the imaging platform in order to conduct business.

Meta Platforms obtains nearly $10 per Facebook user. Even more important, Facebook has a far larger focus on ROW users with much lower monetization. If Pinterest users were monetized at the same rate of Facebook by region, the company would produce the following quarterly revenues:

- US & Canada: 92M x $50.25 = $4,623M

- Europe: 117M x $15.64 = $1,830M

- ROW: 223M x $4.00* = $892M

- Total: $7,345M

* Facebook has a separate rate for Asia-Pacific and ROW that averages to about $4 per user while Pinterest only reports a combined user total as all ROW.

A social site like Pinterest with a revenue split of advertising and commerce could monetize users over time at a higher rate. Regardless, the company would reach $7.3 billion in quarterly revenues from just matching the ARPUs produced by Facebook. Note from above, the analyst quarterly revenue goal for even the big Q4 is only $0.9 billion.

Either way, Pinterest has a long way to go in order to build a model less reliant on brand advertising and more reliant on direct response and services. What matters with Q3 results next week after the market close on October 27 and Q4 guidance is the progress towards commerce on the platform and ability to return to solid user growth similar to Snap. What doesn’t matter is the difficulty of topping tough comps from the last couple of years due to macro economic issues.

Takeaway

The key investor takeaway is that Pinterest shouldn’t be sold due to Snap making assumptions on Q4 ad revenues. Investors should focus on the opportunity to monetize uses at higher rates via a focus on commerce very suitable for social imaging site.

The stock is too cheap with a market cap down to $15 billion, but the next few quarters will be volatile.

Be the first to comment