Wirestock/iStock Editorial via Getty Images

Don’t “Let it go.”

Disney’s (NYSE:DIS) plight over the last few years is no fairytale, as evidenced by its stock price performance. Selling off 36.70% this year, buying the Disney dip could backfire. But we believe the stock has tremendous metrics and opportunity. As SA Marketplace author Grant Gigliotti writes,

“Disney’s disappointing quarterly revenue and profit misses sent the stock to a new 52-week low and is leading to hiring freezes and cost-cutting measures. The company is restricting corporate travel, creating a task force to find ways to slash spending, and says it will limit hiring to only positions that drive business acceleration.

And while Disney expects a possible slowdown in theme park attendance in future quarters, the company hopes to battle its impact on revenue with several new innovations it has put in place to drive per-person spending.”

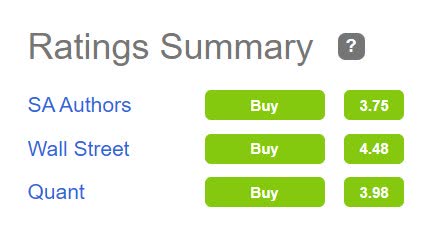

After all, Wall Street analysts, SA Authors, and Quant ratings indicate the stock is a buy. So, why would one forego this stock? Disney is a proven leader in theme parks, entertainment, and fun, and with the introduction of Disney+, in less than three years, have overtaken Netflix (NFLX). Disney’s diversified revenue model is tremendous, and there’s never a lack of content creation.

Disney Ratings Summary (Seeking Alpha Premium)

With the return of Bob Iger, will he be able to right the ship and bring some stabilization to the organization amid the search for a permanent CEO replacement? Or is Iger merely a band-aid? Given Iger’s continued involvement with the Disney Board and company leading up to his re-hire, the transition at the helm should be relatively smooth. One of the unknowns with Iger coming back is the direction of Hulu, which has not been a great fit compared to Disney+. With a 2024 deadline approaching that would pay Comcast (CMCSA) billions for Disney’s 33% stake in Hulu, no details have been outlined as to whether Disney has a plan for the platform.

Is Disney a Buy?

Where investor fear has turned to greed, now may be a buying opportunity. Competition is stiff in the streaming space, and Disney has not only become a big contender for subscribers, but it’s also targeting demographics, bundling, and flexibility is why the company has remained so profitable despite its selloff.

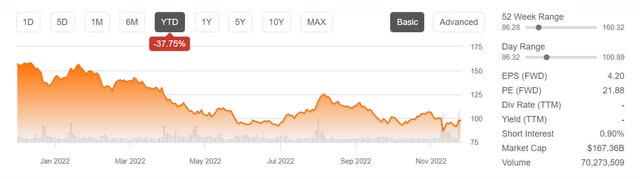

Disney YTD Price Decline

Disney YTD Price Decline (Seeking Alpha Premium)

Disney+ is just one of the many revenue sources offered by the company. Some of the additional money-makers are theme parks, cruise travel, entertainment, and experiences. Quant-rated a buy, before you decide to dismiss this stock or “let it go” given any headwinds, take a look at Disney’s tremendous metrics. This stock has a potential upside.

The Walt Disney Company (DIS)

-

Quant Rating: Buy

-

Market Capitalization: $167.36B

-

Quant Sector Ranking (as of 11/21): 21 out of 254

-

Quant Industry Ranking (as of 4/30): 3 out of 35

One of the top stories this week is the ousting of The Walt Disney Company’s CEO, Bob Chapek, only to be replaced by former longtime Disney CEO Bob Iger. The shocking news resulted in shares of the stock +10% premarket, ending the day +6.3%. Disney’s 10-day average trading volume increased, and more than 70 million shares were traded following the announcement, showcasing improving momentum.

As a household name since 1923, together with its subsidiaries, Disney operates through two divisions, Disney Media and Entertainment Distribution. A diversified stock that entered the world of streaming with its Disney+ offering, the company took on streaming services like Netflix and ROKU. Disney+ launched in November 2019, just before the pandemic peak, and ramped up during two years of lockdown when people were desperate for entertainment, and streaming services were their lifeline. As competition has increased in the Communications Services sector, Disney already has a diversified mix of products and service offerings from theme parks to cruise ships and streaming services, Disney is eating away at the competition, forcing them to differentiate itself.

This year’s market volatility has resulted in streaming services taking a nosedive, beginning in April, with Netflix’s Q1 decline that sent a ripple effect on rival streaming services like Disney. Overvalued yet highly profitable, Disney, known for its theme parks and entertainment, is a truly diversified company that is bringing its direct-to-consumer business to you. I believe there may be upside potential, and this stock maintains a quant-buy rating.

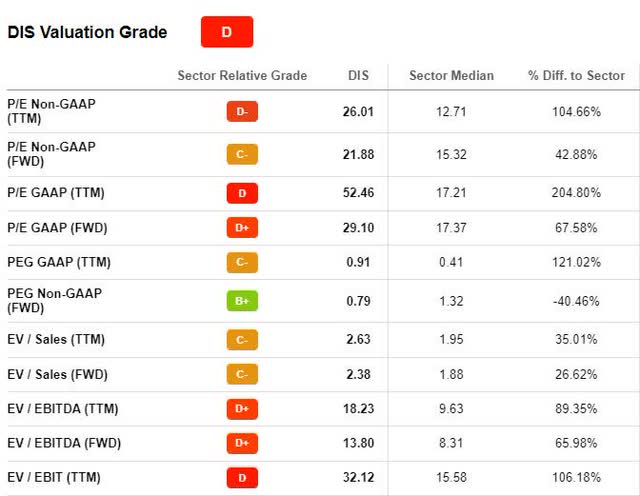

Disney Stock Valuation

Disney’s ‘D’ valuation grade is nothing to marvel about. Its shares are currently trading at $97.58 and have fallen 37.75% YTD. Despite a forward P/E ratio of 29.10x versus the sector median of 17.37x and forward EV/Sales of 2.36x compared to the sector median of 1.95x, indicating Disney trades at a premium, the all-important forward PEG ratio of 0.79x is a B+ grade and stands at a 40% discount to the sector.

Disney Stock Valuation (Seeking Alpha Premium)

Disney’s other factor grades, specifically growth and profitability metrics, are very attractive, primarily due to direct-to-consumer services, which include streaming Disney+, Hulu, and ESPN.

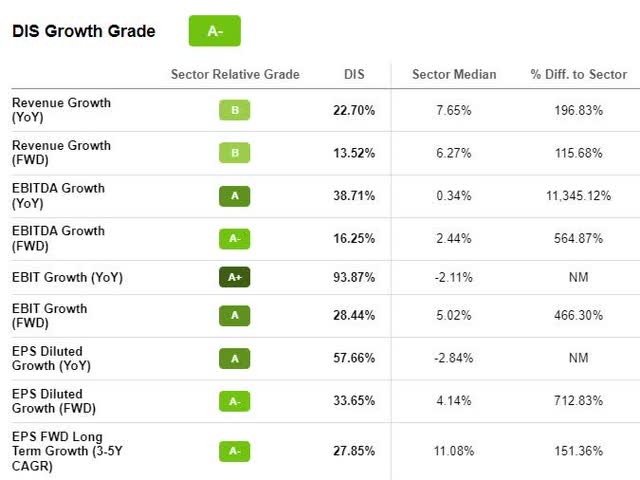

Disney Growth & Profitability

Despite the volatile market swings this year, Disney’s growth and profitability have been relatively stable over the last ten years, which includes the pandemic. In addition to strong demand for its theme parks and movies, its direct-to-consumer business and streaming services have been on fire.

Owning an interest in multiple broadcast stations like ESPN, FX, and National Geographic, Disney owns a controlling stake in the popular subscription streaming service Hulu. Disney+ was launched on the eve of the pandemic, perfect timing that has resulted in significant subscriber growth, giving streaming provider Netflix a run for its money while offering strong revenue, year-over-year EBITDA growth, and forward EPS Long Term growth, as evidenced below.

Disney Growth Grade (Seeking Alpha Premium)

Despite a Q4 2022 EPS of $0.30 miss by $0.26 and revenue of $20.15B missing by nearly 9%, the two-year deal signed by the return of CEO Bob Iger is a strategic move for the company. Given his close ties to Hollywood, his reinstatement should help build relationships, increasing business and community ties in hopes of a turnaround. As part of the evolving media industry, Disney+ should have a strong and long runway for growth in global markets, given its vast and well-known library of movies and shows. With Q4 growth that included the addition of almost 57 million Parks, Experiences, and Products subscriptions for more than 235M and the addition of 12M Disney+ subscriptions, Disney+ has become an industry leader. With a library that continues to grow, its streaming platform should offer a cushion to offset some other segments, like theme parks still suffering from lockdowns, including Shanghai’s Disney Resort. Demand is high for resorts that remain open, prompting Disney to flex its pricing power by raising ticket prices, effective December 8th.

With millions of ad dollars being slashed amid prolonged slowdown fears, companies feel the effects on their revenues. Because Disney is at the forefront of content creation, capitalizing on sports and bundling to offer viewers a mix of options to suit their needs.

Disney’s “advertiser interest has been strong. We have been a leader in streaming advertising for some time and are bringing our years of experience, leading ad tech and relationships to this important opportunity. Disney+ has secured more than 100 advertisers for our domestic launch window, spanning a wide range of categories, and our company has over 8,000 existing relationships with advertisers who will have the opportunity to advertise on Disney+.

Strong base pricing reflects the value advertisers put on our audience, our brand safe environment for their messages, and our sales experience. We also have proven technology to deliver a great advertising experience on day 1. And importantly, we have the ability to scale and innovate for audiences and advertisers alike. We are incredibly excited about the launch of our new ad-supported subscription offering for Disney+, which rolls out on December 8”- Bob Chapek, Former Disney CEO.

Despite the headwinds the many global companies face, including the risk of lockdowns and macro and geopolitical concerns that could eat into Disney’s profits or halt operations, its diversified mix of Disney-branded products and services offers strong pricing power and a wide economic moat. Although Disney raised substantial debt during COVID, they are making strides to pay down debt, recently announced layoffs and a hiring freeze. Like most companies, Disney has some headwinds to overcome, especially with recession fears mounting, as most of its revenue models are based on discretionary income. When recessions hit, people stop spending on Disney World, luxury items, cruises, and theme parks. But, according to a Bank of America Institute publication, discretionary consumer spending increased 2.9% year-over-year in October, a positive sign for the theme park giant. With its pricing power, robust cash flows, and the return of Bob Iger, Disney stock may offer investors a happily ever after.

The End

Companies are being preemptive through cost-cutting measures as the fear of economic slowdown persists. Many growth stocks have performed poorly this year, with fear moving the markets. But as sentiment begins to change, greed is gearing some investors toward equities again.

Many communication stocks that experienced a boom from the pandemic are experiencing record declines. Although Disney has experienced a fall in price, its overall growth, profitability, and momentum remain solid, which is why our quant rating has a buy rating for the stock. With the return of legacy CEO Bob Iger, investor excitement has already reared its head, with shares of the stock +6.3% upon announcement. “The Board has concluded that as Disney embarks on an increasingly complex period of industry transformation, Bob Iger is uniquely situated to lead the Company through this pivotal period,” said Chairman Susan Arnold. As such, consider Disney stock for a portfolio, or we have many other Growth Stocks with excellent valuations to consider. They possess solid fundamentals that capitalize on their respective industries’ growth drivers. Our investment research tools help to ensure you’re furnished with the best resources to make informed investment decisions.

Be the first to comment