Faiz Dila

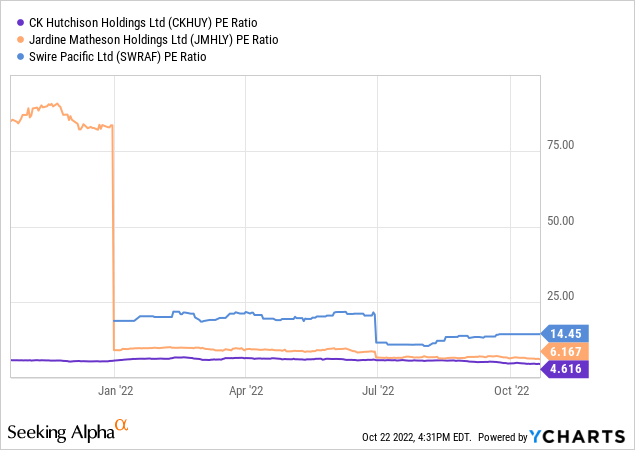

Recent news of a potential combination between CK Hutchison’s (OTCPK:CKHUY) Three UK and Vodafone (VOD) will be well-received by investors. While the proposed terms would mean CKH owning a minority 49% and Vodafone owning 51% of the post-merger entity, a deal would go a long way toward realizing the company’s goal to drive consolidation across its key telco markets (in-line with developments in Italy and most recently, Indonesia). With CKH actively looking to unlock value via value accretive reorganization efforts as well, I see a clear case for a narrower conglomerate discount going forward. Supported by an improved ROE/ROIC profile post rationalization of its property assets, and with a pending UK telco merger set to improve CKH’s underlying economics further, expect more shareholder return capacity to catalyze a re-rating toward peers such as Jardine Matheson (OTCPK:JMHLY) and Swire Pacific (OTCPK:SWRAY).

Puts and Takes from the Proposed Three UK/Vodafone Deal

CKH’s recent disclosure of a proposed merger of its Three UK unit and Vodafone UK was a positive surprise. Per the preliminary deal terms, the post-combination ownership split will be CKH/Vodafone at 49%/51%, with no cash consideration involved. Instead, the ownership thresholds will be decided based on the debt contribution by the respective companies. Given UK regulator Ofcom sees both operators as “sub-scale” with unfavorable economics (i.e., returns below their cost of capital), the deal should face limited regulatory hurdles as well. Management’s stated rationale, citing scale benefits to accelerate its 5G rollout and expand rural/small-medium business connectivity, also checks the right boxes. Still, no legally binding agreement has been made at this point, so the deal terms remain subject to change.

Compelling Cost Synergy Benefits

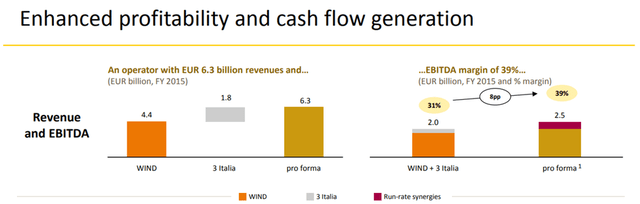

The low-hanging fruit here is on the cost side – by sharing capex and overhead (e.g., staff expenses), the combined entity should reap higher margins almost immediately post-merger. Using the 3 Italia/Wind Tre transaction as a reference, the merger could see significant high-single digit to double-digit % opex/capex savings over time. Applying this to Three UK/Vodafone’s standalone >20% EBITDA margins as a starting point would imply a massively accretive >30% EBITDA margin profile in a base case scenario. The accretion at the net income level is less clear, however, given the additional debt to be injected by both entities. That said, even with the elevated debt funding costs today, the scale of the cost synergy benefits should support a solid high-single digit % earnings accretion scenario, in my view.

Regulatory Overhang Weighs on Revenue Synergy Outcome

On the other hand, completing telco merger deals typically comes with strings attached, particularly on the revenue side. The Wind Tre merger, for instance, came at the cost of facilitating Iliad’s entry into the Italian telco market. In essence, any revenue gains (e.g., incremental wholesale fees from network sharing) were more than offset by Iliad’s share gains as it built out its network. Per its disclosures, Wind Tre suffered a steady revenue decline from 2018-2021, alongside a compression in its EBITDA margins amid the heightened competitive pressures. The Three UK/Vodafone deal differs in that there isn’t a disruptive new operator looking to enter, though, so I expect a more favorable revenue impact here, helped by the ongoing industry consolidation. Offsetting this will likely be any potential capacity reservation requirements for mobile virtual network operators (MVNOs). All in all, pending visibility here, I would hold off on penciling in any potential post-combination gains for CKH, particularly on the revenue front.

Positive Capital Return Implications

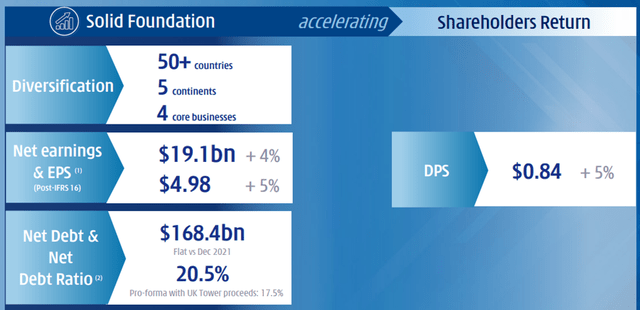

Of note, the non-cash nature of the proposed combination bodes well for CKH’s shareholder return prospects. Given any additional merger-related debt will also be recognized off-balance sheet, CKH should see a limited impact on its net leverage ratio (currently at ~21% relative to total capital excluding UK tower sale proceeds). This leaves the company with ample financial capacity to ramp up buybacks going forward. At ~5x P/E as well, further repurchases (up to the major shareholder equity interest cap as stipulated in the Hong Kong ‘Creeper Rule’) should be net accretive, in my view.

A Potentially Value-Enhancing Telco Merger on the Cards

It remains early days, but most signs point to a net positive outcome from CKH’s latest telco consolidation effort in the UK. More broadly, the group’s intent on the capital allocation front is a key positive, with the Three UK/Vodafone talks coming on the heels of an accretive Hutchison 3/Indosat combination in Indonesia. Plus, the low capital intensity of the proposed deal (non-cash, off-balance sheet debt) leaves CKH with ample capital return capacity going forward. With the stock underperforming in recent months and trading at a steep relative valuation discount to key peers Jardine Matheson and Swire Pacific despite a solid mid to high single digit % dividend yield, I think CKH is worth a look here.

Be the first to comment