Sundry Photography/iStock Editorial via Getty Images

This Article was researched and written by January Mbuvi.

Investment Thesis

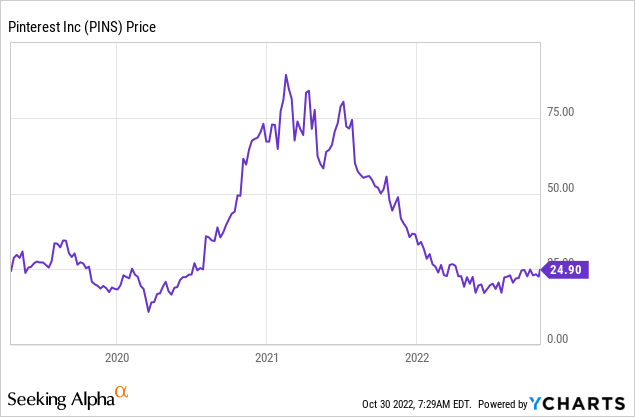

Pinterest, Inc. (NYSE:PINS) is a visual search engine that people worldwide use to find ideas for making a life they love. Initially founded in 2008 as Cold Brew Lab Inc, the company changed its name to Pinterest, Inc. in April 2012. Since going public in April 2019, PINS has had a mixed performance, which, in my opinion, is consistent with a company’s natural growth trajectory.

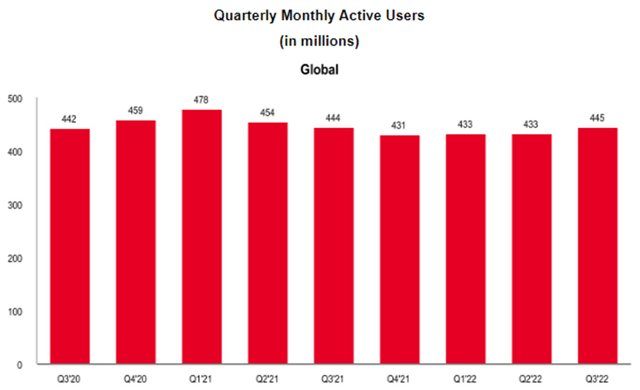

From its IPO to early 2020, it had slow growth forming the startup phase of the growth cycle. From mid-2020 to late 2021, the company experienced rapid growth, hitting its highest price per share. The stage was characterized by a drastically growing number of monthly active users [MAUs], as will be presented later in this article. This period forms the growth phase of the growth curve.

In 2022, the company first experienced a drastic downward trend in share prices, but in April, the share prices stabilized. The price decline was primarily due to the declining number of MAUs, which in my view, form impulsive customers during the growth phase. At the moment, the company’s MAUs appear stable; this is because of its loyal MAUs, leading me to conclude that the company is now mature.

At this stage, Pinterest now has a loyal customer base. Depending on the company’s intervention strategies, it can be very profitable and grow its customer base by improving customers’ experience in the platform.

I am bullish on the stock because I find it has very promising strategic plans to thrive in its maturity phase. The top and bottom lines of PINS have shown remarkable resilience across the company’s many epoch-hopping iterations.

A Mature PINS and Competitive?

As earlier alluded, I believe that PINS is in the maturity stage of its growth cycle. To support this argument, I will cite the company’s almost plateaued share price in 2022, which came after a drastic upward trajectory which I term the growth phase. The phenomena can be explained by the changing numbers of the company’s MAUs, which further lends credence to my argument.

Q1 ’21 recorded the highest number of MAUs, marking the summit of the growth phase. From my point of view, the steady drop in numbers from 478 to 444 in Q3 ’21 shows the transition from growth to maturity. From Q4 ’21 to Q3 ’22, the numbers look pretty stable, representing loyal customers, and the business is now mature. The share price movement can be understood in light of the above patterns in MAUs.

Having established that the company is well into its mature phase, it is essential to evaluate Pinterest’s measures to ensure its continued success, particularly its efforts to maintain or increase its competitive position, profitability, and clientele. Here’s why I think the company can accomplish all of these goals:

1. Improving Customer experience

Improving customer experience provides numerous business advantages, ranging from client base expansion to reduced service and marketing costs. These benefits are possible because it leads to more customer satisfaction and offers what customers want, that is, having a customer-centered business aiming at precisely addressing the diverse customer needs.

PINS features well-planned customer service initiatives. In this article, I’ll discuss a few. Firstly is the personalization on its core surfaces. On personalization, they’re producing more relevant consumer experiences by merging their unique first-party signal with machine learning to offer related content. This move will not only make things easier for customers, but it will also help advertisers get more out of their ads.

Another aspect is the company’s unique human curation. It enables the customers to draw more utility from their single search. For instance, while machine learning helps them recommend a pair of women’s fall boots, human curation at scale lets them advise the best skirt and sweater options to complete the look. They can do this because those boots have been saved as part of outfits on other Pinterest boards. This style of curating is unique to Pinterest and unlike other sites.

Another intervention is partnering with businesses to create high-quality shopping experiences by establishing seamless handoffs. They’re piloting a hosted checkout product with Shopify that lets users check out directly with merchants on Pinterest.

The last of the few interventions I chose to discuss is the plan to reach a new audience, especially Generation Z, by making products and experiences that appeal to them. These are some of the many interventions the company is making to improve customer experience.

The ones that I discussed and the ones that weren’t, like the partnerships with Warner Music Group, Warner Chappell Music, Merlyn, and BMG to add more music to Pinterest, will help improve the customer experience.

By taking a fresh look at these interventions, we can see that PINS is adaptable and meeting the ever-changing demands of its clientele. Undoubtedly, this gives them a leg up on the competition.

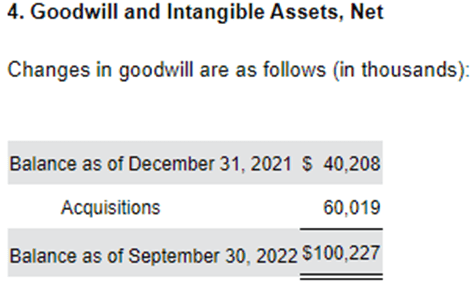

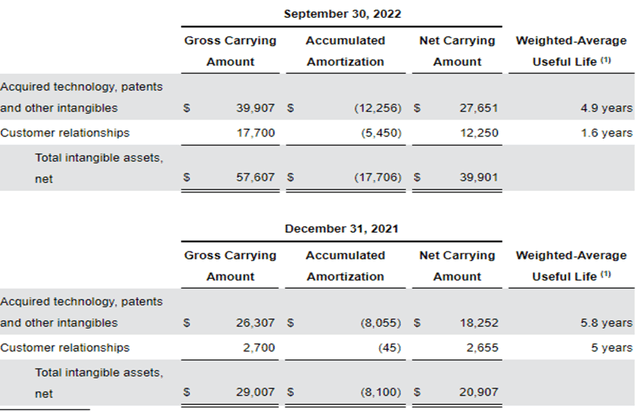

2. Acquisition

On June 10, 2022, PINS bought all of the shares of The Yes Platform, Inc., a shopping platform for fashion that AI powers. The acquisition resulted in a horizontal integration, which should be a growth catalyst for PINS. The goodwill shows some of the synergies PINS will benefit from the acquisition.

The company should boost its assets from this acquisition, which will be critical for its growth. It will also offer a wide range of service offerings and grow PINS’ customer base.

Finally, I find all the interventions to be long-term, which suggests that the company is optimized for both short- and long-term success. Furthermore, the company focuses on the customer, so there’s a good chance they’ll significantly increase their current customer base. That would be either by capitalizing on emerging audiences or converting impulse buyers into loyal ones by enhancing their experience within the platform, which would positively impact the company’s top and bottom lines.

Very Resilient Top and Bottom Lines

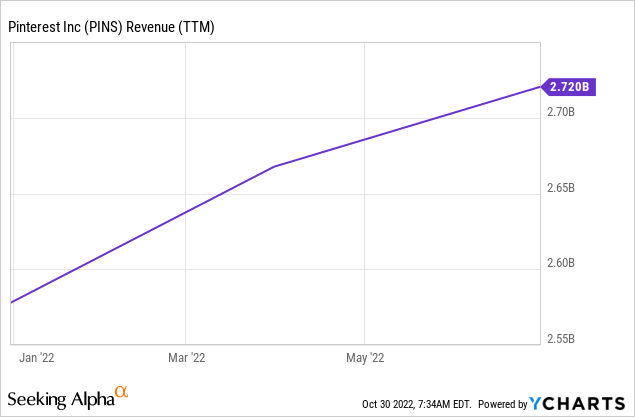

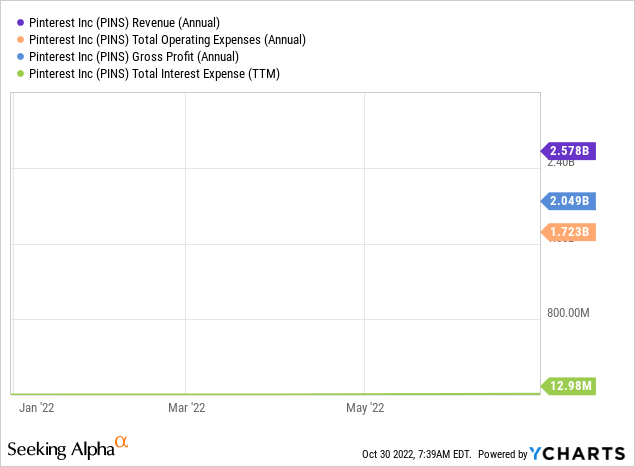

PINS’ revenue and profitability have held up despite the substantial decline in MAUs. The company has a 3-year CAGR revenue growth rate of 39.73% and a YoY growth rate of 13.75%, growing its revenues from 1.69B in 2020 to 2.58B in 2021 FY and trailing at 2.72B.

The company attributes the good results to its ads innovation.

Pinterest CFO Todd Morgenfeld said, “This ability to grow revenue faster than users have been driven by ads innovation.”

Ads being the primary driver of revenue growth, the company plans to deepen engagement with its clients to generate more per-user revenues. To improve their engagement, the company seeks to enhance its customer experience on the platform using the abovementioned interventions. They’re improving Pinterest ads through insight-led marketing, greater automation, and improved tools, measurement, and formats.

With the company making the ads system more improved and efficient, I am confident that the 2022 and 2023 revenue estimates of 2.81B and 3.21B, respectively, are very feasible.

In terms of profitability, the company has a gross profit margin of 77.10% and a net income margin of 2.21%, which are not only due to the growing revenues but also the relatively low operating expenses. Further, the company has an EBIT margin of 4.35%. It has a low-interest expense following the low debt value of $183.24m, which is 0.1X its market cap of $16.89B, this further boosts its profitability margins.

PINS has also been excellent at generating cash. Currently, the company has a total of $622.68M as cash from operations TTM and $599.58M as levered free cashflow TTM. I expect these figures to grow, especially with the acquisition of The Yes Platform, Inc and the management, during the Q3 2022 call promising to improve efficiency and reduce the operating costs.

PINS, in my opinion, is a great business since it can capitalize on the size of its client base to bring in significant income and healthy margins. Please take this into account while deciding how to invest.

Risks

The reader may come away from this essay thinking that PINS is a risk-free investment opportunity. Still, the reality is that no investment strategy is without its share of potential pitfalls. Below are some of the risks associated with investing in PINS.

- Third-Party Reliance: The company relies on online app stores and search engines, including their methods, policies, and results, to route traffic and recruit new Pinners. This reliance diminishes the company’s autonomy and risks breaking if any of these sources fail.

- Giant competitors: large companies like Amazon present Pinterest with formidable competition. The company will need to take the initiative to keep up with the competition.

The above concerns represent this promising firm’s most significant threat to investors. Prospective investors, I implore you to watch these dangers as you make your financial moves.

Conclusion

PINS appears to be a mature business, having undergone its growth phase since its IPO in 2019. It is embarking on promising interventions to help them thrive and be competitive in their maturity phase. Despite reporting a significant drop in MAUs, the company has demonstrated its resilience through constant revenue growth and high-profit margins.

The company is streamlining and improving its ads system, which is its primary revenue source, making me very optimistic about its future financial years. I recommend a strong buy to potential investors seeking a profitable, resilient, and growing company. To the current investors, it’s time to up their stake in the company.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment