Morsa Images/DigitalVision via Getty Images

Investment Thesis

ClearPoint Neuro (NASDAQ:CLPT) designed the first navigation system that enables real-time MRI guidance and minimally invasive procedures for neurological diseases. The company has found a strong foothold in the U.S. and Europe, by partnering with over 60 well-established hospitals, and there are over 60 biopharma partners that range primarily from pre-clinical to phase 1 clinical trial. Just recently, the company had its first drug approval with PTC Therapeutics (PTCT).

Over the past few years, the management had done a great job in growing the number of hospital partners using the ClearPoint navigation system, biopharma partners who are engaging with ClearPoint clinical services and using its disposables in clinical trials, and developing a robust product pipeline to expand into the larger operating room (“OR”) market and reduce the time taken to perform surgeries and thus increases the number of surgeries that can be completed in a day. These early successes and investments today will lay the ground for even stronger growth in the future.

However, Covid has had a huge impact as case volumes were canceled, which impacted the functional Neuro Navigation revenue and hardware sales as they were unable to install navigation systems on partners’ sites. The current macro environment also calls for the need to attain profitability, thus, the need to re-prioritize its investments. Furthermore, while many investors are bullish about the over 50 biopharma partners, it is important to recognize that these clinical trials generally take a long time to materialize, and commercialization is not guaranteed.

Unlike most investments, ClearPoint is for the long-term hold rather than the speculative or short-term play. The company continues to be priced at a premium today, although it can be a great investment in the long run.

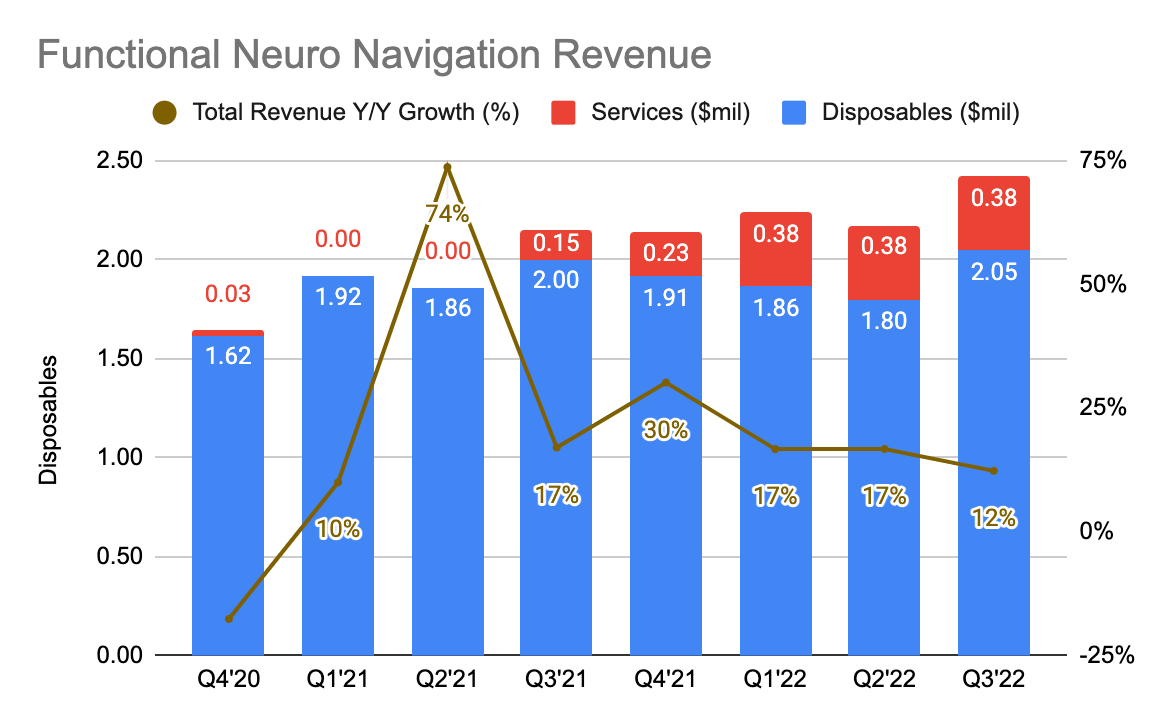

Functional Neuro Navigation

CLPT 10-Q

Like previous quarters, case volume continues to be affected by Covid as hospitals are prioritizing Covid patients over elective surgeries, putting pressure on its revenue growth. According to the management, this is expected to be reflected in the next 2 quarters.

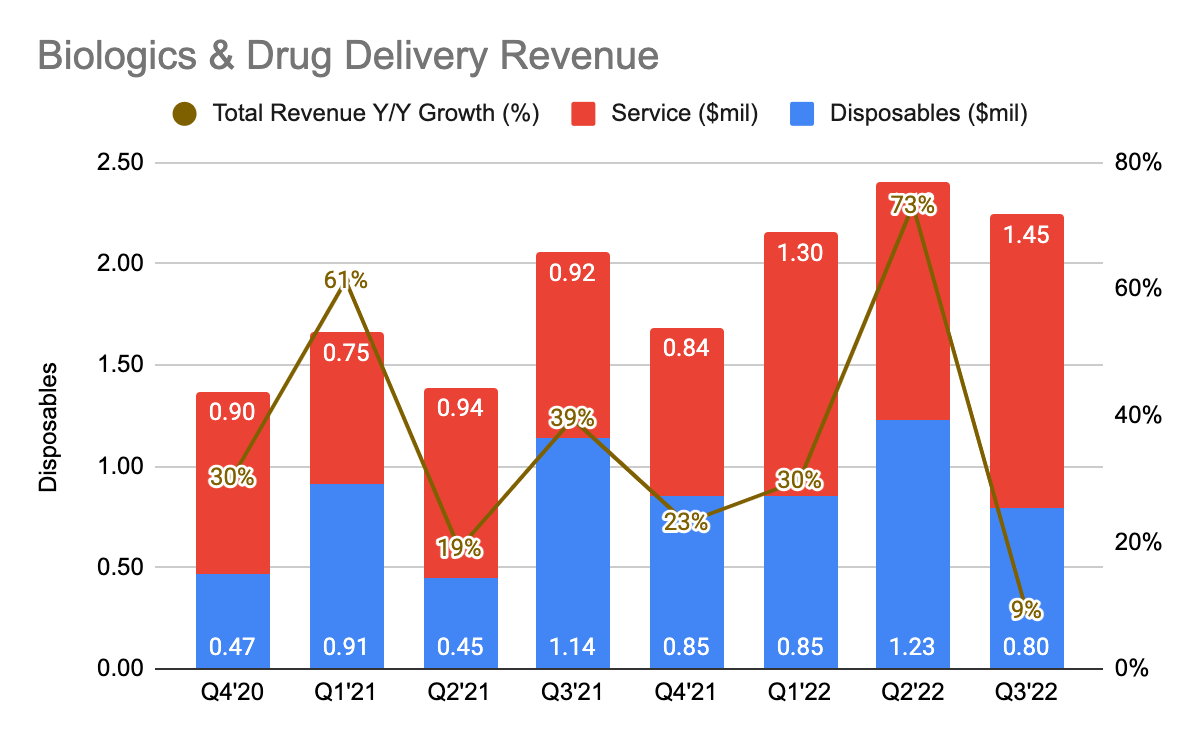

Biologics & Drug Delivery

CLPT 10-Q

This quarter’s result may come as a surprise to many as B&DD revenue only grew 9% Y/Y, a deceleration from the previous quarter, and one of the lowest positive growth rates reported in the company’s history. However, I doubt this is a concern as B&DD revenue is lumpy in general and does not exhibit recurring-like or predictable revenue. Later, I will also go on to explain why growth is likely to push back to 4Q22.

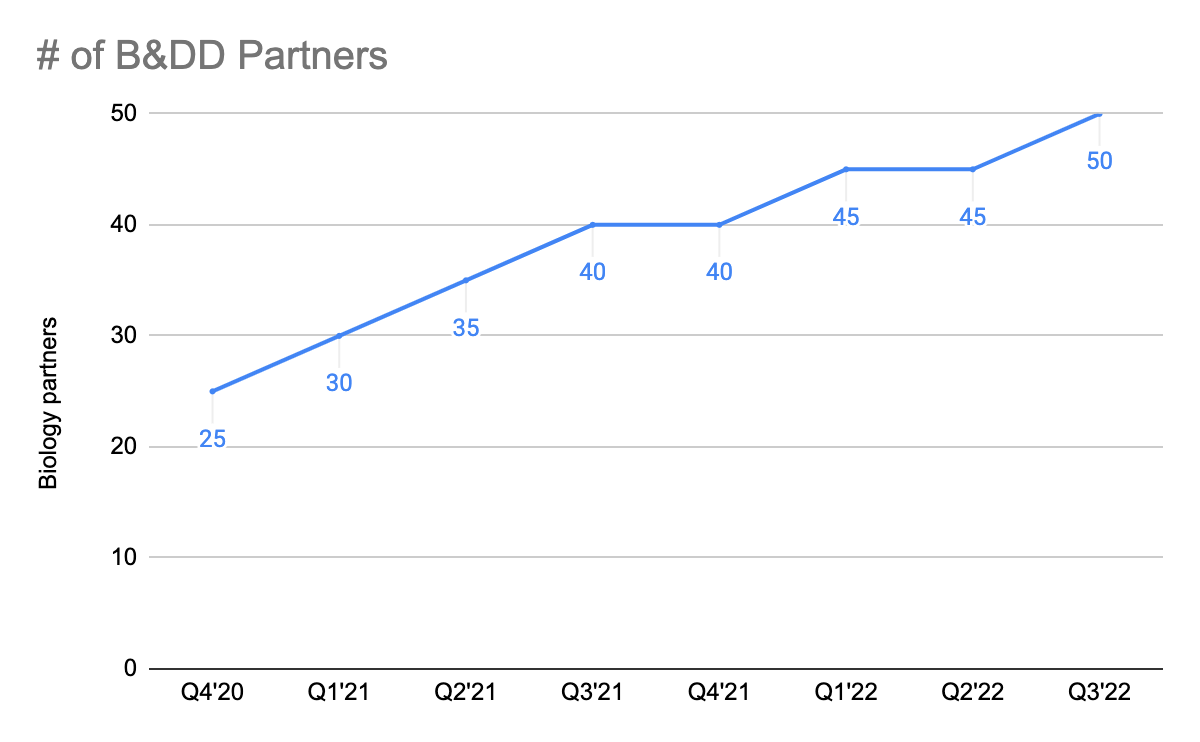

CLPT 10-Q

One of the highlights is the 50 biopharma partners reported in the quarter. Much of the investment thesis surrounding the company is the number of potential commercialization that could materialize out of these partners, thus, investors ideally like to see the numbers growing over time.

During the 3Q22 earnings call, CEO Joe Burnett stated that the potential revenue it can generate for clinical trials up to phase 3 is $10 million, and they can go on to attain profitability before the commercialization stage:

“If one of our partners or even one of the programs within a partner, would purchase the entire suite of products and services that our team can now provide, the total value of those products and services from initiation of the program through the completion of a Phase 3 clinical trial could potentially add up to $10 million per program before the drug or biologic is even approved…This is one of the reasons that we believe that we can ramp revenue and achieve profitability without requiring the contribution of large commercially available drug therapies during that time horizon”

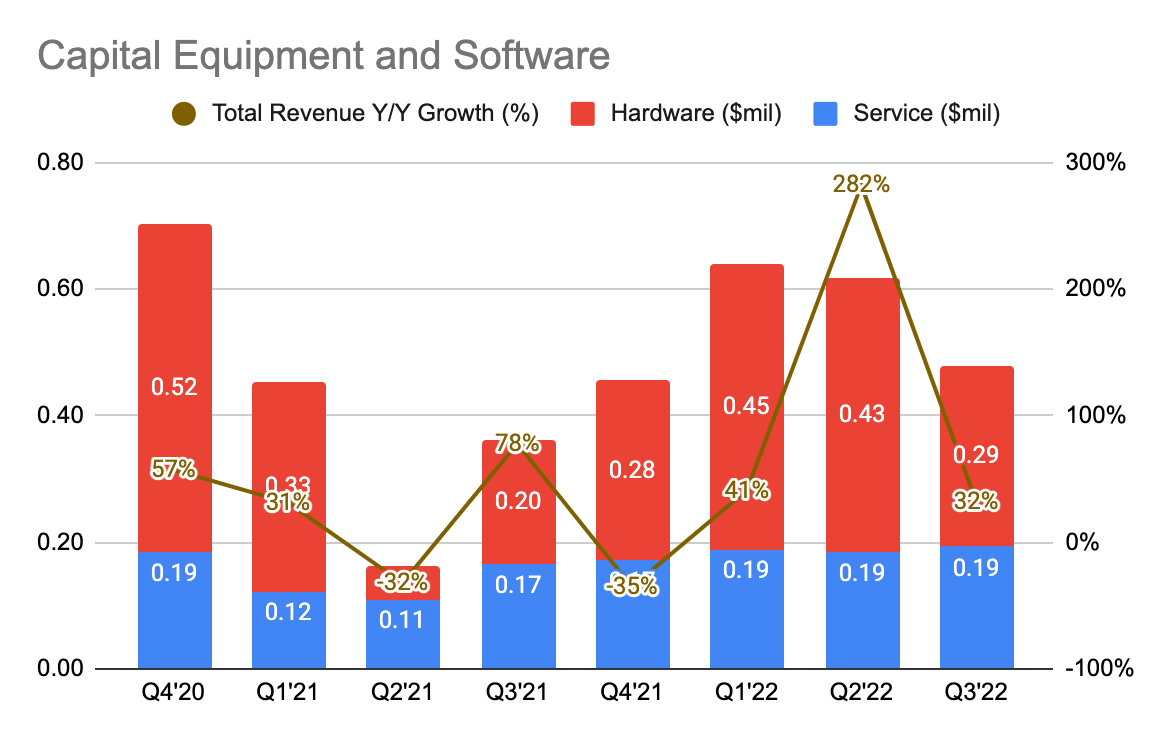

Capital Equipment and Software (Hardware Sales)

CLPT 10-Q

Capital Equipment and software revenue, which previously has been impacted by Covid has resumed as its total revenue grew 32% Y/Y, bringing its total year-to-date system placements to 10. One of the key commentaries in the earnings call was the 40 hospitals in the funnel:

“We have more than 40 additional hospitals in our active funnel, which again is the strongest installation and capital funnel that we have had in our history.”

This goes to show that ClearPoint is gaining significant traction, although, the onboarding period is largely dependent on when they could install the systems on partners’ sites.

Growth Likely to Push Back to Next Quarter

The management guided FY22 revenue to be $22 million, and after netting out the first 9 months’ revenue, 4Q22 revenue is expected to be $6.62 million. This equates to 55% Y/Y growth from a year ago, suggesting that growth in 3Q22 is pushed back into the fourth quarter. The reason for the assumption is that B&DD revenue tends to be lumpy in general, and a portion of the surgeries canceled previously will resume in 4Q22. Therefore, I do not think this was a bad quarter for the company although many would argue so given the mere 13% Y/Y revenue growth.

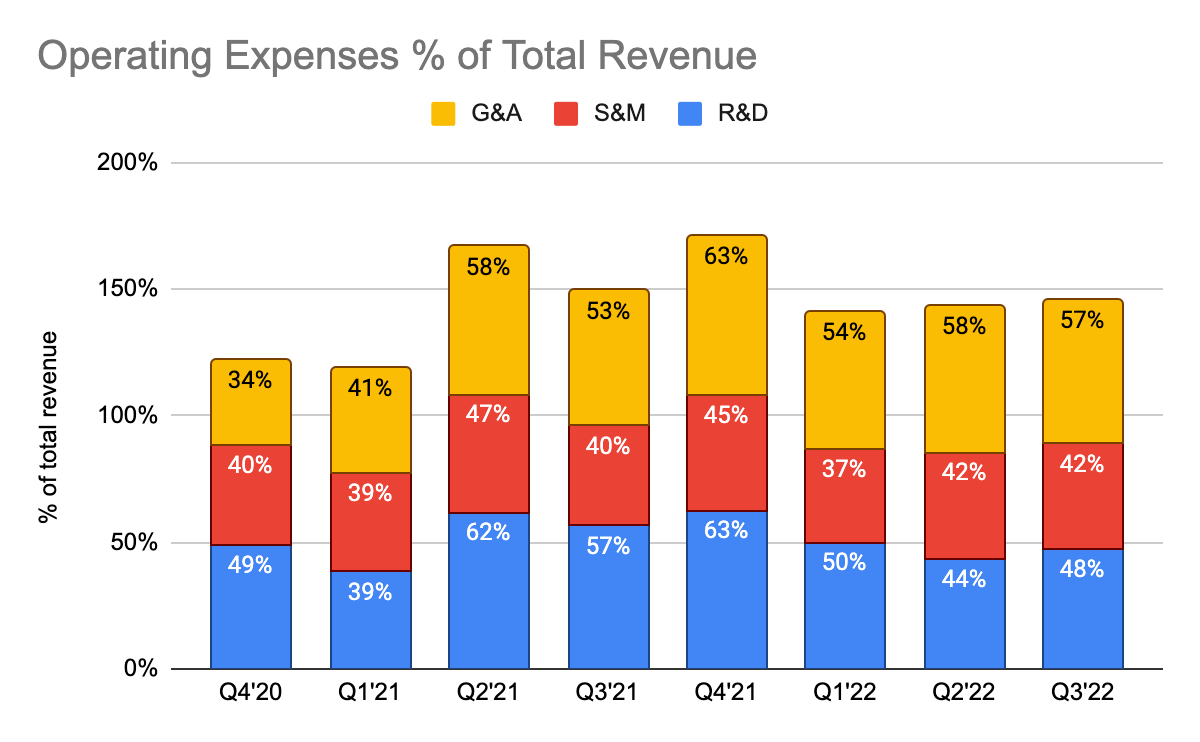

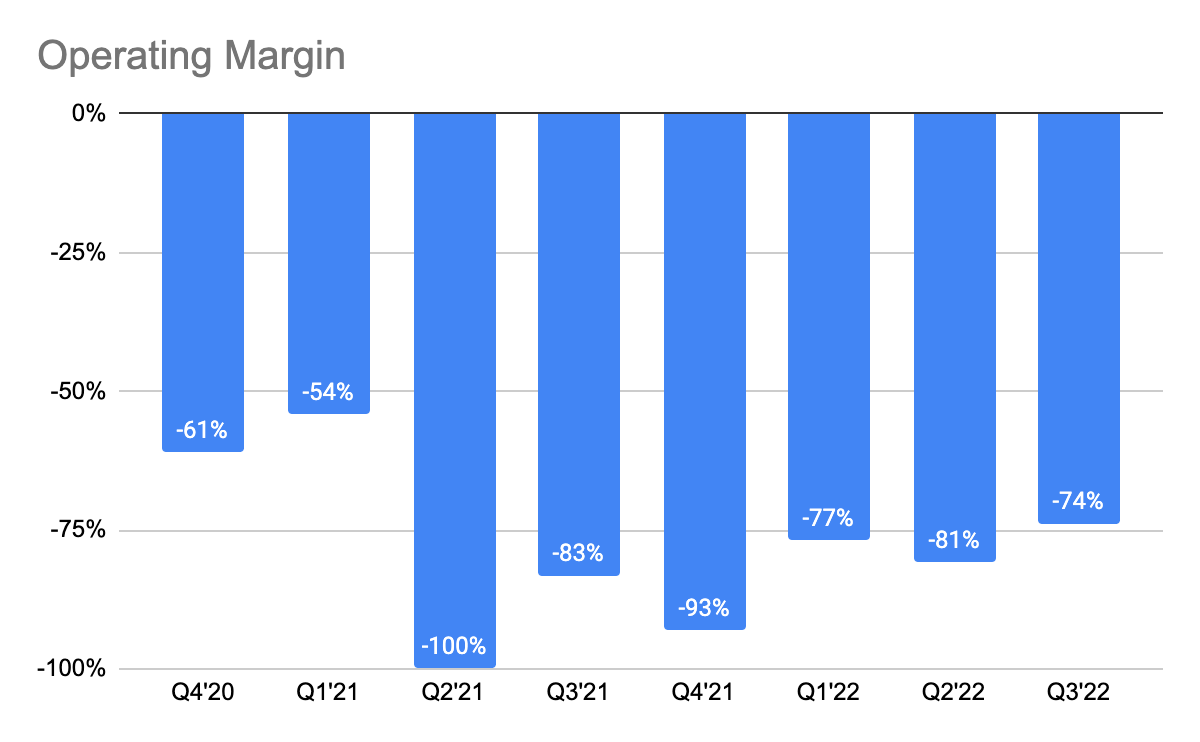

High Operating Losses

CLPT 10-Q CLPT 10-Q

With its lower revenue and continually high reinvestment rates, its overall operating expenses continue to make up a large portion of its total revenue. This led to a negative operating margin of 74%, which seems uncomfortably high in the current macro as the need to prioritize profitability is increasingly important. However, given that there is $40 million of cash sitting on the balance sheet, and the anticipated lower operational cash burn in the next couple of quarters, there is roughly 2 to 3 years of cash runway.

Same Stance on Valuation

As per my previous article, I continue to hold on to the stance that the current valuation is priced at a premium. That being said, dependent on your horizon, this can be a great long-term play as there could be multiple clinical trials that could materialize in the future (which could take very long) which could justify the valuation today.

Conclusion

All in all, I do not think the lower revenue growth in 3Q22 is a concern as the growth is likely to be pushed back into 4Q22. We could argue that if not for Covid, revenue growth for FNN and hardware sales could have re-accelerated. The number of biopharma partners and hospital partners continues to grow as well. My stance on valuation remains unchanged, that it is certainly priced at a premium today, although, with a long-term horizon, I think it can be a great long-term play.

Be the first to comment