utah778

Earnings of Pinnacle Financial Partners, Inc. (NASDAQ:NASDAQ:PNFP) will likely continue to grow till the end of 2023 on the back of strong loan growth. Further, margin expansion and higher income from BHG will lift earnings. Meanwhile, provisioning will likely remain near the historical average. Overall, I’m expecting Pinnacle Financial to report earnings of $7.35 per share for 2022, up 9% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimate mostly because I’ve revised upwards the loan growth estimate. For 2023, I’m expecting the company to report earnings of $7.54 per share, up 3% year-over-year. The year-end target price is quite close to the current market price. Therefore, I’m downgrading Pinnacle Financial Partners to a hold rating.

Team Expansion to Bear Fruit

Loan growth during the first half of the year beat the historical average as well as my expectations. The portfolio grew by 12.6% from the end of 2021 till the end of June 2022 (25% annualized). The management expects loan growth to return to a more normal level in the second half of the year after the second quarter’s extraordinary performance, as mentioned in the latest conference call. The management is expecting high teens to low 20% loan growth for 2022, as mentioned in the earnings presentation. This target seems easily achievable given the first half’s performance.

One reason why loan growth would decelerate to a normal level is the high borrowing costs, which will likely dampen credit demand. Further, high inflation, which touched 8.3% year-over-year in August, will add to the financial woes of customers and discourage discretionary spending, which will in turn limit consumer loan growth.

On the other hand, Pinnacle Financial Partners’ market share will likely continue to grow on the back of management’s efforts. The company is currently “aggressively” recruiting revenue producers, as mentioned in the presentation. The management has budgeted higher expenses for these new hires. Including salary pressures related to the existing workforce and other incremental expenses, the management is expecting its non-interest expenses to grow in the mid-teen-percentage range.

Considering these factors, I’m expecting the loan portfolio to grow by 12% annualized in the second half of 2022, leading to full-year loan growth of 19%. In my last report on Pinnacle Financial, I estimated loan growth of 12.7% for this year. I’ve increased my loan growth estimate partly because of the second quarter’s outstanding performance. Further, I’ve revised upwards my growth estimate for the second half of the year because I realize now that I had underestimated the management’s capabilities previously. For 2023, I’m expecting the loan book to grow by 10%.

Meanwhile, deposit growth will likely match loan growth. However, other balance sheet items will likely trail loan growth. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 17,624 | 19,693 | 22,139 | 23,151 | 27,648 | 30,518 | ||||

| Growth of Net Loans | 13.2% | 11.7% | 12.4% | 4.6% | 19.4% | 10.4% | ||||

| Other Earning Assets | 3,847 | 4,338 | 8,268 | 11,047 | 9,500 | 10,486 | ||||

| Deposits | 18,847 | 20,181 | 27,706 | 31,305 | 34,245 | 37,801 | ||||

| Borrowings and Sub-Debt | 2,033 | 2,938 | 1,887 | 1,464 | 1,931 | 1,970 | ||||

| Common equity | 3,966 | 4,356 | 4,687 | 5,093 | 5,356 | 5,856 | ||||

| Book Value Per Share ($) | 51.2 | 56.7 | 62.0 | 67.1 | 70.5 | 77.1 | ||||

| Tangible BVPS ($) | 27.3 | 32.4 | 37.3 | 42.7 | 45.7 | 52.3 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

High Deposit Beta to Limit the Margin’s Rate-Sensitivity

According to details given in the 10-Q filing, around 51% of the loan portfolio is linked to variable rates. Further, around 7% of the loan portfolio comprises fixed-rate loans that will mature within a year. As a result, the average earning-asset yield is quite rate-sensitive.

Pinnacle Financial has improved its deposit mix over the last year and a half so that the average deposit cost is slightly stickier than before. The company has successfully increased non-interest-bearing deposits to 33.9% of total deposits at the end of June 2022, up from 26.7% at the end of December 2020. Further, it has reduced variable-rate deposits to 58.6% at the end of June 2022 from 60.6% at the end of December 2020. Nevertheless, the deposit beta (rate sensitivity) is still quite high because variable-rate deposits continue to comprise the majority of the deposit book.

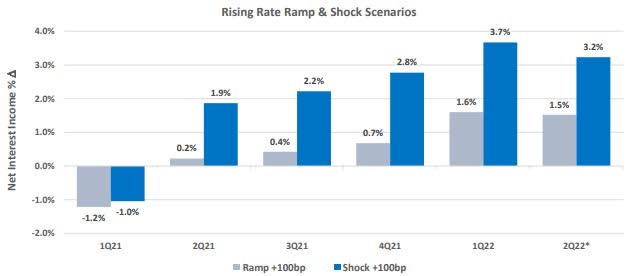

Overall, the balance sheet is only slightly asset sensitive. The results of the management’s interest rate sensitivity analysis given in the presentation showed that a 100-basis points hike in interest rates could boost the net interest income but only 1.5% over twelve months.

2Q 2022 Earnings Presentation

Considering these factors, I’m expecting the margin to grow by 15 basis points in the second half of 2022 before remaining unchanged throughout 2023.

Normalized Provisioning Likely

The loan portfolio’s credit quality has improved immensely over the last year. Non-performing loans and loans 90 days past due altogether were down to just 0.07% of total loans at the end of June 2022 from 0.24% at the end of June 2021. In comparison, allowances made up 1.03% of total loans at the end of June 2022. In my opinion, allowance coverage appears comfortable even after considering the high-inflation environment and the resultant financial stress for borrowers.

The anticipated loan additions discussed above will likely be the only driver of provision expenses. Overall, I’m expecting provisioning to be near the historical average through the end of 2023. I’m expecting the net provision expense to make up 0.16% of total loans (annualized) every quarter till the end of 2023, which is the same as the average from 2017 to 2019.

Expecting Earnings to Grow by 9%

The anticipated loan additions and margin expansion discussed above will likely be the chief drivers of earnings growth this year. Further, the management is optimistic about the Bankers Healthcare Group (“BHG”) where it expects a 15% growth, as mentioned in the presentation. Under BHG, Pinnacle Financial lends to medical and other professionals as well as patients. BHG impacts the fee income because of its gain-on-sale model.

Overall, I’m expecting Pinnacle Financial to report earnings of $7.35 per share for 2022, up 9% year-over-year. For 2023, I’m expecting earnings to grow by 3% to $7.54 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 736 | 766 | 822 | 932 | 1,077 | 1,181 | ||||

| Provision for loan losses | 34 | 27 | 192 | 16 | 40 | 48 | ||||

| Non-interest income | 201 | 264 | 318 | 396 | 457 | 484 | ||||

| Non-interest expense | 453 | 505 | 577 | 660 | 789 | 896 | ||||

| Net income – Common Sh. | 359 | 401 | 305 | 512 | 558 | 573 | ||||

| EPS – Diluted ($) | 4.64 | 5.22 | 4.03 | 6.75 | 7.35 | 7.54 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Pinnacle Financial, I estimated earnings of $6.87 per share for 2022. I’ve increased my earnings estimate mostly because of the upward revision in my loan growth estimate. I’ve also slightly tweaked all the other income statement line items following the second quarter’s results.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Downgrading to a Hold Rating

Given the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share to $0.24 per share in the fourth quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 13% for 2023, which is in line with the last five-year average of 14%. Based on my dividend estimate, Pinnacle Financial is offering a forward dividend yield of 1.2%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Pinnacle Financial. The stock has traded at an average P/TB ratio of 1.84 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 27.3 | 32.4 | 37.3 | 42.7 | ||

| Average Market Price ($) | 61.7 | 56.9 | 46.2 | 89.7 | ||

| Historical P/TB | 2.26x | 1.76x | 1.24x | 2.10x | 1.84x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $45.7 gives a target price of $84.1 for the end of 2022. This price target implies a 3.9% upside from the September 13 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.64x | 1.74x | 1.84x | 1.94x | 2.04x |

| TBVPS – Dec 2022 ($) | 45.7 | 45.7 | 45.7 | 45.7 | 45.7 |

| Target Price ($) | 75.0 | 79.6 | 84.1 | 88.7 | 93.3 |

| Market Price ($) | 81.0 | 81.0 | 81.0 | 81.0 | 81.0 |

| Upside/(Downside) | (7.4)% | (1.8)% | 3.9% | 9.5% | 15.2% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 4.64 | 5.22 | 4.03 | 6.75 | ||

| Average Market Price ($) | 61.7 | 56.9 | 46.2 | 89.7 | ||

| Historical P/E | 13.3x | 10.9x | 11.5x | 13.3x | 12.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $7.35 gives a target price of $90.0 for the end of 2022. This price target implies an 11.1% upside from the September 13 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.2x | 11.2x | 12.2x | 13.2x | 14.2x |

| EPS 2022 ($) | 7.35 | 7.35 | 7.35 | 7.35 | 7.35 |

| Target Price ($) | 75.3 | 82.6 | 90.0 | 97.3 | 104.7 |

| Market Price ($) | 81.0 | 81.0 | 81.0 | 81.0 | 81.0 |

| Upside/(Downside) | (7.1)% | 2.0% | 11.1% | 20.2% | 29.2% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $87.0, which implies a 7.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 8.7%.

In my last report, I upgraded Pinnacle Financial to a buy rating. Since then, the stock price has rallied, leaving a smaller price upside. Therefore, I’m now downgrading Pinnacle Financial Partners to a hold rating.

Be the first to comment