JHVEPhoto/iStock Editorial via Getty Images

Canadian e-Commerce company Shopify (NYSE:SHOP) completed a 10-for-1 stock split on Wednesday. While there can be no assurance that shares of Shopify will perform well after the stock split, the lower share price may make the e-Commerce company more affordable to some investors. While the stock split doesn’t change Shopify’s valuation metrics, the firm’s e-Commerce growth does seem to be significantly underpriced!

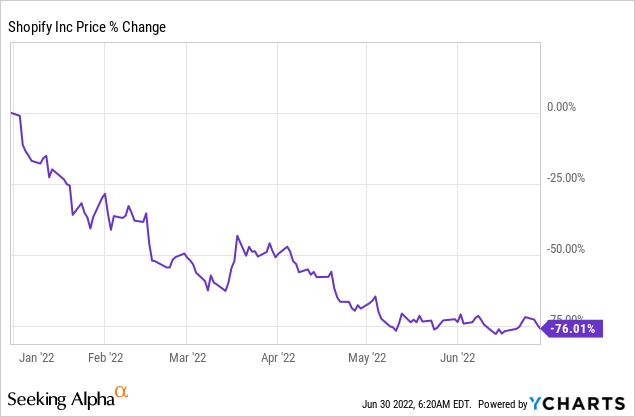

Shopify has been a big loser in 2022

Shares of Shopify have lost an incredible 76% of their value in the first six months of the year due to a fundamental re-evaluation of the firm’s growth prospects in a post-COVID world. While Shopify has been a big winner during the pandemic, the end of pandemic has been very painful for investors.

Reason for the stock split

Shopify is not the only company splitting its stock. Many companies this year announced stock splits to make their shares more appealing to investors: Alphabet (GOOG) (GOOGL) announced a 20-for-1 stock split earlier this year and e-Commerce giant Amazon (AMZN) also did a 20-for-1 stock split. Tesla (TSLA), in June, filed for a 3-for-1 stock split.

By doing splits of high-priced stocks, companies can chiefly lower their stock prices. In a stock split, companies issue more shares to shareholders while maintaining the same level of market capitalization, meaning valuation ratios don’t change. The rationale for a split is to make stocks superficially cheaper, thereby potentially expanding the group of potential buyers.

A long term play on the e-Commerce market

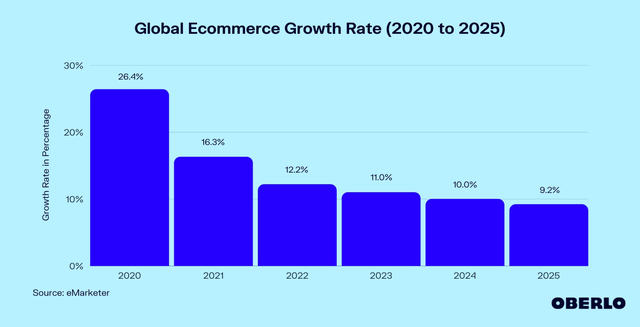

Shopify is chiefly a long term bet on sustained growth in the rapidly expanding e-Commerce market. Projections made by Oberlo call for continual growth in the e-Commerce sector over the next four years, although growth rates are expected to moderate post-pandemic.

While Shopify’s merchant-centric platform benefited from the COVID-19 pandemic in all major key metrics (revenue, gross merchandise and subscription plan growth), conditions in the e-Commerce industry are normalizing after the pandemic and Shopify expects a moderation of top line and merchant acquisition growth going forward. The long term prospects in the e-Commerce industry still look great, however, chiefly because the e-Commerce share of retail sales is expected to increase consistently in the future.

Shopify has warned of a normalization of growth in the e-Commerce business when it submitted its first-quarter earnings card and avoided giving specific revenue guidance for FY 2022. Uncertainty about exactly what revenue growth rates investors can expect in the near term has greatly weighed on Shopify’s stock performance this year.

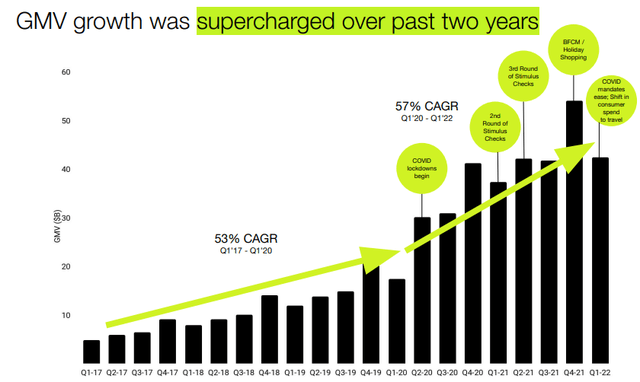

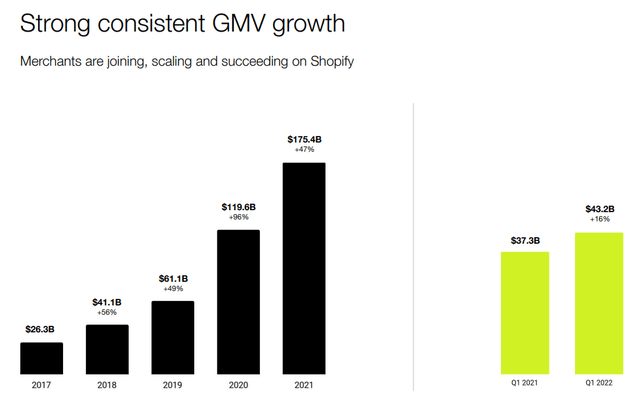

Although Shopify’s growth may be slowing, the e-Commerce company is still going to grow strongly going forward. The key to Shopify’s growth is to on-board more merchants to Shopify. The more merchants join Shopify’s e-Commerce platform, the stronger the tailwinds for Shopify’s gross merchandise value/GMV growth are going to be. In FY 2021, Shopify’s GMV soared 47% year over year to $175.4B. While some moderation in Shopify’s GMV growth can and perhaps should be expected in FY 2022, the Shopify platform will likely continue to sign on a ton of new merchants that are willing to try out Shopify’s subscription plans and merchant solutions…. meaning Shopify’s GMV will grow, albeit at a slower rate.

Gross profit dollar growth

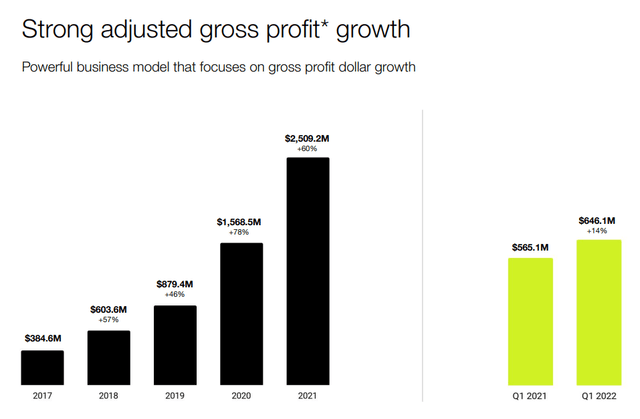

Shopify achieves profitability on a gross profit basis, meaning the e-Commerce company consistently manages to turn a profit from its platform business. Shopify generated $646.1M in adjusted gross profits in Q1’22, showing 14% year over year growth. Shopify’s gross profits soared 60% in FY 2021 and although FY 2022 will be a more challenging year, I am looking forward to seeing gross profits in the range of $2.6-$2.7B.

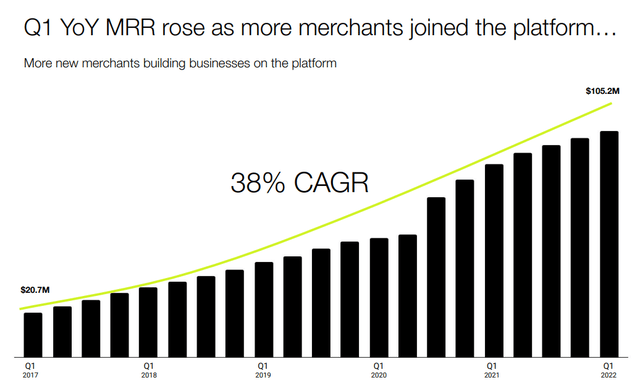

From FY 2019 to FY 2021 Shopify signed on one million new merchants to its platform which has been key for growth in Shopify’s monthly recurring revenues/MRR. Merchants that sign on to Shopify’s online platform choose monthly subscription plans to sell online which has resulted in Shopify’s recurring revenue base more than quintuple in the last five years. The current level of revenues is $105.2M and Shopify is set for sustained MRR growth in its subscription business.

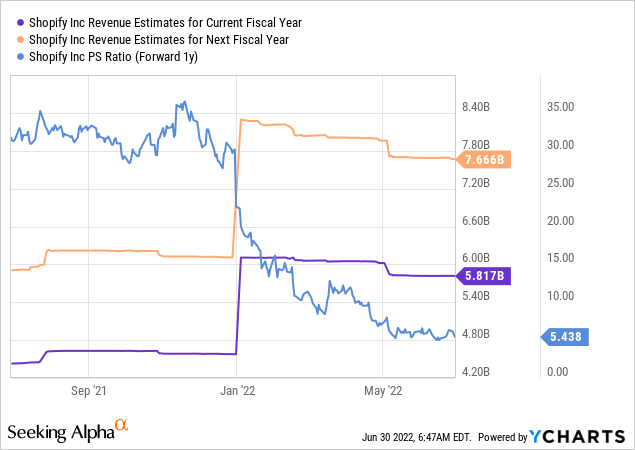

Valuation

Shopify has seen a huge re-evaluation of its growth prospects in 2022, and much of it is undeserved. Shopify is expected to achieve revenues of $5.82B in FY 2022 and $7.67B in FY 2023, implying revenue growth rates of 26.1% in FY 2022 and 31.8% in FY 2023. Because of the steep drop in Shopify’s valuation, shares of the e-Commerce company sell for a price-to-revenue ratio (FY 2023) of 5.4 X. I believe the P-S ratio is too low considering that Shopify is expected to generate at least 26% annual top line growth in each of the next four years.

Risks with Shopify

Shopify’s growth prospects chiefly depend on the constitution of the e-Commerce market. The e-Commerce market is projected to grow strongly going forward, but the short term picture may be a bit more challenging. Shopify did warn of a normalization of growth in the e-Commerce industry in the first-quarter and this uncertainty is weighing on Shopify’s valuation. I see slowing top line growth and possibly weakening penetration in the merchant business as risks for Shopify and the stock.

Final thoughts

The stock split is done and investors should return their focus on Shopify’s long term growth opportunity in the e-Commerce market. The stock split itself didn’t change anything fundamentally about Shopify and its valuation. Shopify’s large e-Commerce platform will continue to grow and merchant growth is key to growing Shopify’s monthly recurring revenues, as well as gross merchandise value. As long as Shopify can add new merchants to its platform, the firm’s MRR is going to grow. Longer term, Shopify’s growth of its merchant base is key to an upwards revaluation of the firm’s shares!

Be the first to comment