LukaTDB/E+ via Getty Images

The Fed released the results of its annual bank stress tests earlier this week, meant to evaluate each firm’s resiliency under a potentially deep recession. The good news is that all 34 banks participating tested above their minimum capital requirement. Even under the most severe stress scenario, the system aggregate common equity capital ratio, representing a cushion against loan losses, is projected to fall from a current 12.5% to 9.7% but still be more than double the minimum requirement. Simply put, banks are well-capitalized largely having learned some hard lessons from the last financial crisis.

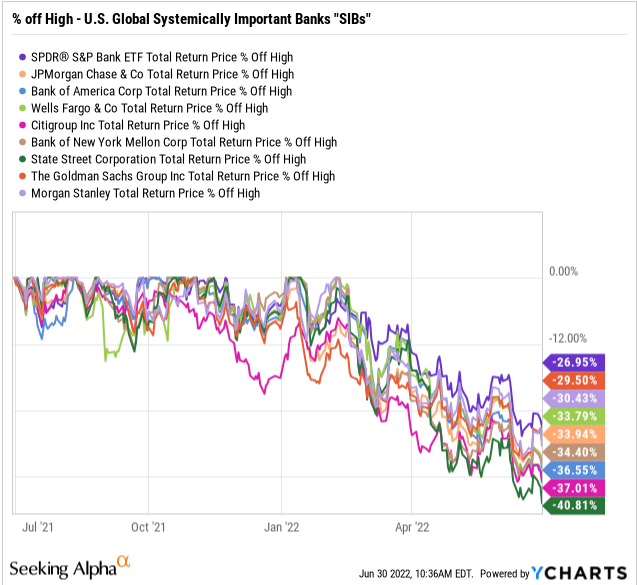

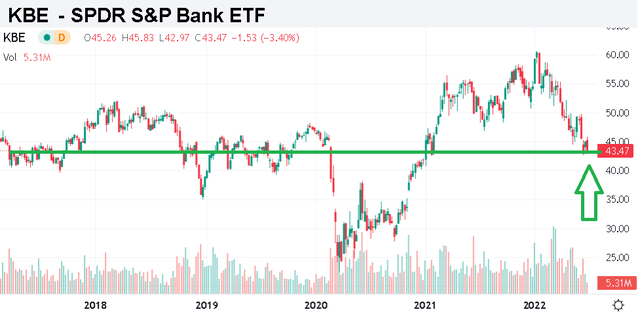

That being said, the Fed’s proverbial regulatory stamp of approval hardly provides solace to investors as bank stocks have been terrible. The SPDR S&P Bank ETF (NYSEARCA:KBE) is down nearly 30% from its high with many of the mega-cap leaders performing even worse. From a record 2021 with the group benefiting from the pandemic economic boom, the story now is the convergence of several macro headwinds. Record inflation and a growth slowdown, all while the Fed is reversing its easy-money policies explain much of the weakness.

Looking ahead at the upcoming Q2 earnings season, we’ll get an updated assessment from the largest banks of current conditions. While the more challenging economic environment is a common theme for the sector, the silver lining is that the selloff in bank stocks has helped to reset expectations. We like the KBE ETF as a good option to capture diversified exposure to U.S. banks as valuations for the group are down to attractive levels. The potential for better-than-expected economic indicators and a shifting market narrative can represent a bullish case for the sector.

source: YCharts

2022 Bank Dividend Increases

Following the stress test results, several banks moved forward with announced dividend increases. We’ll be focusing on the eight largest U.S. banks categorized by the Fed as being “systemically important”. Goldman Sachs Group (GS) led the banks by hiking its quarterly dividend rate 25% to $2.00 per share, which now yields 2.6% on a forward basis. Wells Fargo & Co (WFC) came out with a planned 20% increase. Morgan Stanley (MS) and State Street Corp (STT) also increased their payouts by double digits.

JPMorgan Chase & Co (JPM) and Citigroup Inc (C) were the exceptions, leaving their dividends unchanged. Even though both banks passed the latest stress test, the Fed is requiring them to keep a higher capital buffer. In other words, the higher future capital requirement is limiting the availability of excess liquidity for an increased payout and JPM and C kept their payouts flat, but keep in mind that the two stocks already offer above-average dividend yields at 3.5% and 4.3%, respectively. JPM has doubled its quarterly dividend rate over the past five years while Citigroup screens favorably across several valuation metrics. On the other hand, Wells Fargo’s dividend is climbing, but the quarterly rate is still below its pre-pandemic level that was cut in 2020. The point here is to say that there are many moving parts, and the dividend is just one aspect of the banks’ investment outlook.

| Bank Dividend Announcements Following 2022 Stress Test | |||

| Increase | Quarterly Rate | FWD Yield | |

| Goldman Sachs Group | 25.0% | $ 2.00 | 2.6% |

| Wells Fargo & Co | 20.0% | $ 0.30 | 3.0% |

| Morgan Stanley | 11.0% | $ 0.775 | 4.0% |

| State Street Corp | 10.0% | $ 0.63 | 3.9% |

| Bank of New York Mellon Corp (BK) | 8.8% | $ 0.37 | 3.5% |

| Bank of America Corp (BAC) | 4.8% | $ 0.22 | 2.6% |

| JPMorgan Chase & Co | – | $ 1.00 | 3.5% |

| Citigroup Inc | – | $ 0.51 | 4.3% |

Banks Q2 Earnings Preview

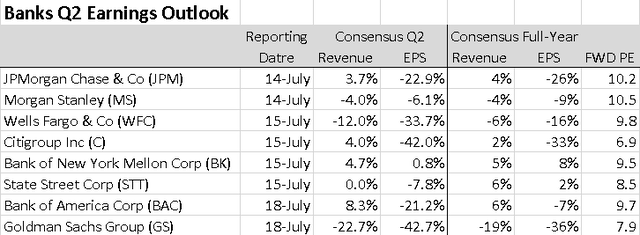

The Q2 earnings season for the big banks kicks off on July 14th with JPM and MS reporting followed by C, WFC, STT, and Bank of New York Mellon Corp (BK) as notable names the next day. The setup here is a sense that economic conditions worsened over the quarter leading to soft growth and lower earnings. From the current Q2 consensus, the market is expecting a sharp decline in EPS for the group extending for the rest of the year, particularly against strong 2021 comparables.

source data: Seeking Alpha

We mentioned record inflation with the CPI reaching 8.6% in May. The Fed’s response with a series of rate hikes and the expectation for continued monetary tightening has added significant financial market volatility. Everything from mortgage lending, business banking, wealth management, and capital markets trading is seeing some impact. The trends flow directly into each bank’s quarterly earnings.

Wells Fargo, for example, has a relatively larger exposure to home mortgages in a slowing housing market. In investment banking, Goldman Sachs and Morgan Stanley are coming off a bumper year in 2021 defined by a record performance in financial assets as well as strong IPO and M&A activity. The reversal now represents a weaker operating environment expected to linger.

State Street Corp, concentrated more on the asset management side, is likely to see some pressure on its fee income with AUM correlated to equity market levels. Operating expenses including employee salaries amid the tight labor market will be important for margins on the cost side. Bank of New York Mellon stands out as the only stock in this group expected to report both revenue and earnings growth in Q2 from the period last year based on its less volatile core asset servicing business. Finally, JPMorgan and Bank of America have more diversified banking businesses and are seen as bellwethers for overall industry activity.

An important theme this quarter will likely be the shifts in loan loss provisions. This is a measure banks update on a quarterly basis to account for internal estimates for non-performing loans and potential defaults. It’s been sort of a roller coaster since the start of the pandemic when banks set aside billions as a provision for credit losses as an expense on the income statement. The banks reversing or “releasing” those reserves into improving financial conditions during 2021 boosted earnings last year.

The setup for this Q2 is likely going to be a return of higher provisions on a net basis pressuring earnings depending on how each bank sees credit conditions evolving. Much of these trends are already incorporated into the earnings estimates, but our take is that this reporting season will be tricky given the number of variables to arrive at that bottom line. We see room for the banks to outperform on the earnings side based on efficiency efforts and the group’s ability to manage costs.

Banks Stocks 2022 Forecast

There is an aspect of higher interest rates being positive for bank margins. While performance indicators like the net interest margin can get a boost this year, banks as a cyclical sector are being weighed down by the poor macro outlook. Recent indicators like consumer sentiment declining to levels last seen at the pandemic lows set the stage for a sluggish economy also affecting business spending. For banks, it comes down to the lending activity and credit conditions which have been tightened by the Fed precisely as a measure to bring down inflation.

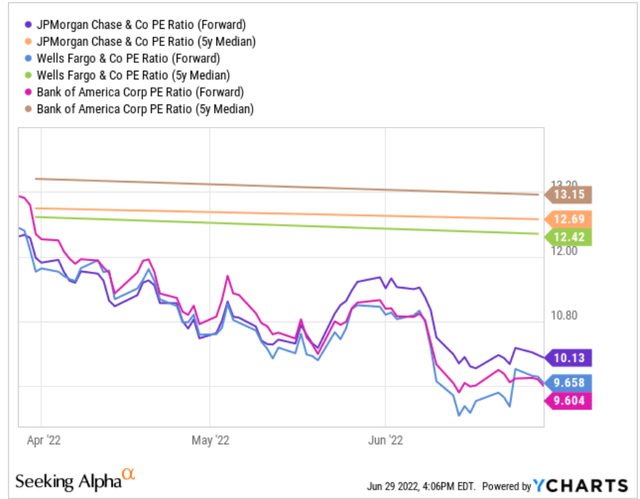

Still, we see room to take a glass-half-full type of approach. First, valuations are well off their highs and even at what we would call attractive levels for most of the banks. Even with the depressed earnings estimates this year, bank stocks are trading well below historical averages for their valuation multiple across the P/E and price to book. From the chart below, JPM trading at a 10.1x forward P/E multiple is about 20% below its 5-year average P/E closer to 12.7x. Other bank stocks have even larger spreads.

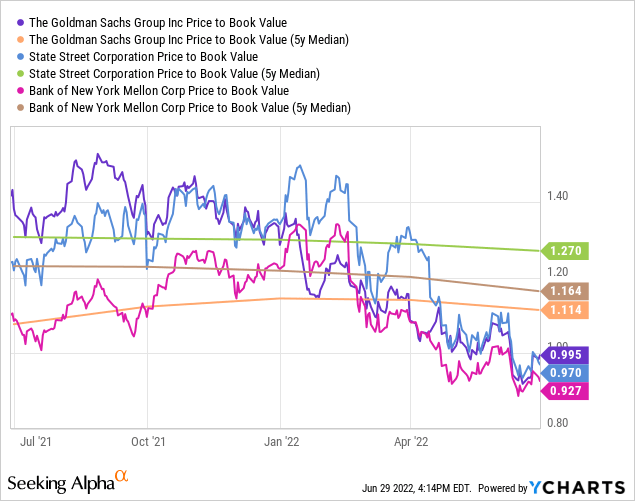

source: YCharts

Stocks like GS, STT, and BK are just a few examples of banks currently trading below book value with P/B ratio under 1x. The implication here is that the market is deeply pessimistic and expects conditions to deteriorate further. That said, this doom and gloom outlook implied by the trading action could still prove to be wrong.

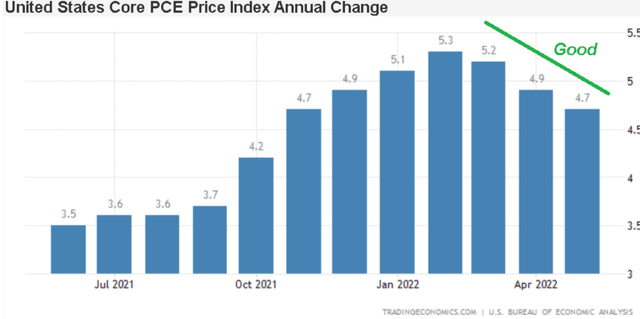

The first step in re-establishing market confidence as part of the bullish case for banks will be a confirmation that inflation has peaked and can trend lower. Favorably, the latest core PCE for May, often seen as the Fed’s preferred indicator, ticked lower in May by rising less than expected.

source: Tradingeconomics .com

Getting into the more high-profile June and July CPI readout, there is a possibility that the combination of commodity and fuel prices well off their highs along with signs of retailers moving to discount merchandise can begin to show consumer prices cooling off even further. Into Q4 and 2023, the Fed may have some flexibility to ease up on its aggressive rate-hiking trajectory.

If true, this would support a view that the economic conditions can stabilize with a resilient labor market brushing aside concerns of a deeper recession is a positive risk asset in general. Banks are well-positioned to benefit from an improving narrative in the context of a “soft landing” scenario compared to the currently low expectations.

Bullish the KBE ETF

There are plenty of bank stocks that we like and it’s hard to pick just one. The SPDR S&P Bank ETF is a good option for diversified exposure to capture all the high-level themes. The fund features an equal weighting methodology with 100 holdings which means that smaller regional banks gain importance in their contribution to the fund’s performance as the major players. The idea here is that KBE can capture the high-level themes to carry the entire industry higher in a turnaround.

Notably, while KBE does not include the “investment banks” like GS or MS, there is a thought that more traditional banks with exposure to consumer credit, which is seen as a near-term drag, may very well provide the most upside in an eventual turnaround.

Without having to pick winners and losers, the current level in KBE under $45.00 per share, and below pre-pandemic levels, looks like a good entry point for a long-term holding. During the current market volatility, one strategy we recommend is to average into a position over time to secure a low-cost basis. The fund incorporating some of the recent dividend hikes has a forward yield approaching 3% as a solid income vehicle.

Seeking Alpha

Final Thoughts

Banks have been beaten down this year, but look interesting as a group following the selloff. Despite the near-term headwinds, the Fed’s annual stress tests showed the industry is prepared to navigate any potential storms through strong balance sheets. The combination of attractive valuations, above-average dividend yields, and room for market conditions to improve over the second half of the year get us bullish on the sector.

To be clear, there are still plenty of risks. A further deteriorating macro outlook from the current baseline can open the door for another leg lower in bank stocks. The Russia-Ukraine conflict poses unique risks as it relates to the global financial system and inflationary trends through supply chain disruptions.

Be the first to comment