Chris Gordon /E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the PIMCO Municipal Income Fund III (NYSE:PMX) as an investment option at its current market price. This is a fund I keep on my radar screen because I see value in PIMCO’s CEF offerings across the board on many occasions. I am an avid investor in the muni space, and I have held muni CEFs from PIMCO in the past.

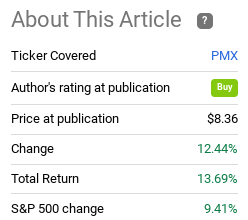

Back in October I took a look at each PIMCO national muni CEF and saw quite a bit of value in PMX in particular. This turned out to be a timely call, with the fund pumping out a gain in excess of 13% since that article was written:

Fund Performance (Seeking Alpha)

While I welcome this strong return, it also gives me pause. When I see any fixed-income bond fund, muni or otherwise, register such a large gain in a short time period I have to reflect on whether or not that can continue. To be fair, leveraged CEFs are going to have above-average swings – but that is precisely the point of revisiting it. There is a good chance PMX could see a bit of a breather here and I feel inclined to downshift my rating to “neutral” going forward. There are a couple of reasons for this beyond just the actual price return, and I will touch on each of them in the paragraphs that follow.

Relative Value Gone With The Wind

To start the review I will touch on the most obvious point of distinction between then and now. When I suggested buying PMX in early October, I saw value in both the broader muni sector and PMX. The fund had a modest premium that was made even more attractive by the fact its sister funds from PIMCO – PIMCO Municipal Income Fund (PMF) and PIMCO Municipal Income Fund II (PML) had much larger premiums. Fast forward to today, and that relative advantage has completely flipped on its head:

| Fund | Premium to NAV in October | Current Premium to NAV |

| PMX | 6% | 17% |

| PMF | 14% | 13% |

| PML | 14% | 5% |

Source: PIMCO

The thought here is straightforward. A few months ago PMX looked like a value. Today that reality rests with PML from PIMCO, as well as numerous other muni CEFs across the investment universe that have discounts to NAV (in some cases quite steep discounts!).

While a premium/discount is not the only consideration when evaluating a leveraged CEF, it is an important point. PMX has seen the vast majority of its recent gain come from premium expansion. While good for current shareholders, it limits the value for new positions by a substantial margin. This factor is the single most important factor I have for downgrading my rating to “hold” for now.

Be Selective Because Munis Are Not The Only Income Play Out There

I will now shift to the fixed-income sector as a whole. As my followers know, I have been a muni bull for the past six months or so. My call on this was poorly timed at first, but since I reiterated this call the sector has actually done very well. PMX is one such example, but across the muni CEF universe funds have pushed higher as investors finally recognized the inherent value. The good news is I see continued upside in the space because it was simply too beaten down.

This may sound contradictory then to suggest PMX is no longer a “buy”. It is not meant to be. As I mentioned I believe munis have further to run, but I am not going to buy-in at any price to capture that potential. Beyond the fact that PMX is expensive itself, I want to point out that munis are not the only game in town.

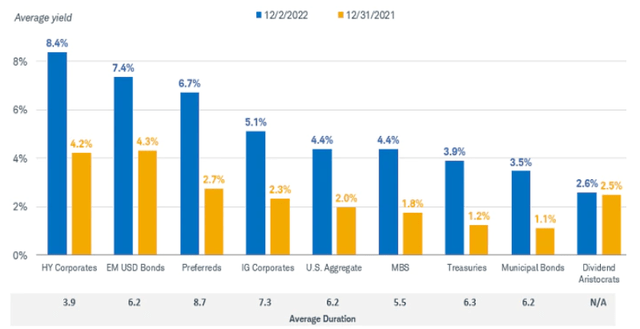

As a working professional in the top tax bracket, I favor munis personally because of the tax-exempt status. But that idea may not be right for everyone – such as for retirees or younger professionals whose income is lower. The bright side of this equation is that while munis look attractive, so do other sectors in the fixed-income space. Yields have spiked across the board, with some sectors offering higher income streams that munis can offer, especially for investors in lower tax brackets:

Current Yields and Durations (Various Sectors) (Charles Schwab)

What I am illustrating here is there is no reason to rush into any particular play at this moment. There is value and yield in a number of different fixed-income areas. This includes munis, of course, but other sectors offer yields that are just as competitive with less interest rate risk. This is key to understanding why I am shying away from muni funds at a hefty premium price – it simply isn’t necessary to overpay for income in this environment.

Back To PMX: Income Metrics Aren’t Great

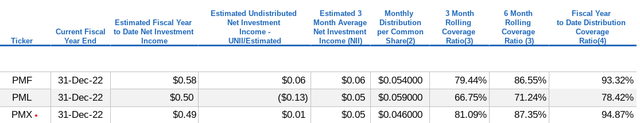

Shifting the discussion to focus on PMX and the other two PIMCO national muni CEF options, I will dive into the most recent income metrics. At time of writing, these figures don’t look especially comforting for any of the funds. I don’t want to come off as alarmist, because in truth the figures are not really that poor. But only PMF has an income cushion that is attractive, and all three are falling well short of 100% in their coverage distribution ratios:

The positive attribute to mention is that PMX’s yield (and PML’s and PMF’s for that matter) will both remain attractive even with a modest distribution cut. The absolute value plus the tax savings will keep investors interested in these options in 2023 regardless, in my opinion. But the flip side of this is that PMX is simply not looking too impressive with these metrics. When I couple this reality with a 17% premium to NAV to buy it, it should be easy to understand why my outlook has shifted for now.

Muni Sector To Benefit From Lower Supply

At this juncture I have gone over a few of my concerns for PMX. But I must emphasize that I am not “bearish” on this fund. Do I think it has gotten a bit overvalued? Yes, I do. But that doesn’t mean I expect a wave of selling either. Recent investors are sitting with a tidy profit so selling and triggering a taxable gain this late in the year may not be advantageous. In addition, as mentioned above, those interested primarily in the income stream may see legitimate reasons for holding on. The conclusion I draw is there is not an immediate risk to the fund or rationale for blindly selling. So keep that in mind.

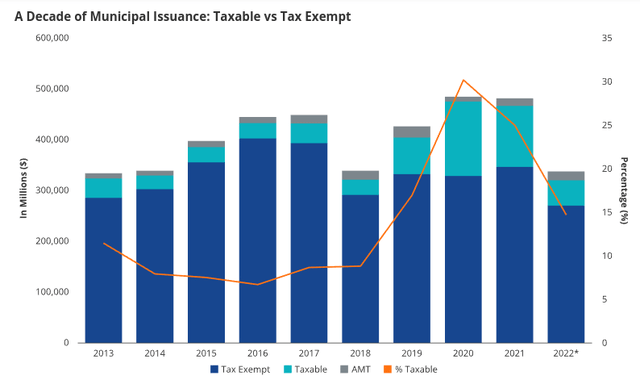

A fundamental part of this backdrop has to do with the underlying attractiveness of the muni sector. Tax collections / receipts have been robust and state and local governments continue to benefit from federal aid. Further, as interest rates have risen, municipalities have been less inclined to issue a lot of new debt. This has led to a marked drop in new issuance in both the tax-exempt and taxable muni sectors:

Municipal Bond Issuance (By Year) (VanEck)

The general thought from me is that demand is likely to outpace supply in the next few months. Investors are rotating back into bonds – including muni bonds – but supply has been restrained. This is a favorable backdrop for higher prices, or at least for stable prices.

Interest Rate Risk Hasn’t Gone Away

My last topic will touch on a chief risk facing leveraged bond funds going forward. While PMX has had a nice run in the past two months, let us not forget that the story for 2022 has been very negative until now:

PMX YTD Return (Seeking Alpha)

This is a pretty scary chart so we should examine the reasons behind it. Rising interest rates is certainly one, which explains why fixed-income has done poorly overall in 2022.

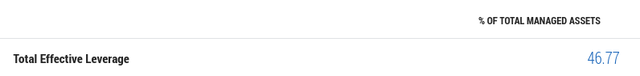

But that is only part of the story. Readers need to remember that PMX is a leveraged play on the muni space. This means when the trade moves against it, the downside will be amplified. And the leverage is no small matter, clocking in at almost 47% total fund assets:

Now, I am not anticipating another 25% drop in this fund! If I was, my rating would certainly be more bearish. But what I am illustrating is readers need to evaluate this risk with more than just a cursory nod. If the interest rate environment turns out to be similar next year compared to what we saw this year – watch out.

This is important now because we have seen bonds, including munis, rise in the last few months on hopes of a Fed pivot in 2023. Fed Chairman Powell has suggested a .50 basis point hike later this month, which is a less hawkish signal since increases have been .75 basis points this year. If we end up seeing a more dovish Fed to wrap up 2022 and that continues in 2023, then funds like PMX have plenty of room to move higher.

The problem is that this sentiment is starting to get baked into current prices. This helps explain PMX’s double-digit return. So now the risk is that expectations of a less aggressive Fed tightening cycle may be too optimistic. If the Fed disappoints the market in the next few quarters, the gains PMX has enjoyed will likely evaporate.

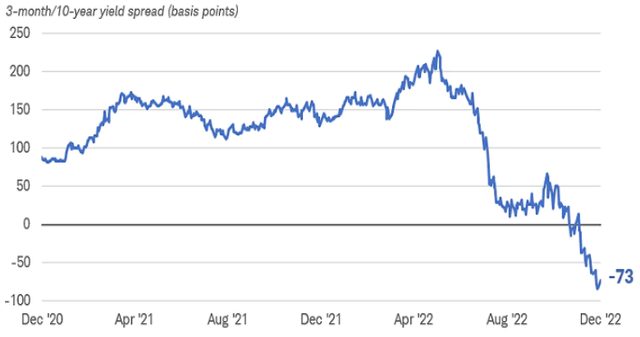

Furthermore, the yield curve remains inverted which puts pressure on leveraged plays inherently. I have discussed this in many reviews throughout 2022 so I will keep in brief here. The summary is that an inverted yield curve puts pressure on fund expenses while simultaneously limiting investment opportunities in longer-dated issues. This again ties back to PMX’s very poor calendar year performance. While this concept appears backward-looking, let us remember that yield curve is actually more inverted now than it has been throughout 2022:

Yield Curve Inversion (Bloomberg)

The takeaway is this is not a risk to ignore. It may very well be mitigated if the Fed does shift its tone and reduce its pace of rate increases next year. But that is not a foregone conclusion and readers need to evaluate this risk before deciding to buy any bond fund at the moment – especially those at premium prices.

Bottom-line

PMX has been a big winner since my last review. I saw value and the market clearly agreed. That is the good news. The bad news is the value is mostly gone for now. So if investors did not already buy in, I would urge caution due to the fund’s large premium to NAV, modest income metrics, and ongoing leverage and interest rate risk. While I continue to like the muni sector heading into 2023, I am suggesting investors be very discerning with the funds they buy and their entry points. Therefore, I believe a downgrade to “hold” for this fund is justified, and I would suggest readers approach any new positions very selectively at this time.

Be the first to comment