jaturonoofer

By Valuentum Analysts.

These are very dark days for equity real estate investment trusts (“REITs”) (e.g., Vanguard Real Estate ETF (VNQ)) and mortgage REITs (e.g., iShares Mortgage Real Estate Capped ETF (REM)), with the VNQ and REM down ~25% and ~30% on a price-only basis, respectively, so far in 2022. This is against a backdrop of Valuentum’s simulated Dividend Growth Newsletter portfolio and simulated High Yield Dividend Newsletter portfolio that are doing far better.

The lesson in 2022, as it has been every year: don’t chase yield for yield’s sake. And most of all, please understand: a dividend is generally considered to be capital appreciation that otherwise would have been achieved had the dividend not been paid. It’s not a value-creating dynamic. A business owner — you, as the owner of the stock — already own the cash on the balance sheet that would be paid as a dividend. A dividend is merely a way to distribute capital to the owner.

Business models, traditional free cash flow generation, and valuations simply matter, too, and not the P/E ratio, which is problematic for a number of reasons (that’s a topic for another article), but rather the application of the discounted cash flow model. At Valuentum, we believe that stocks have intrinsic value on the basis of the net cash position on their balance sheets and future expected free cash flows. These are the two primary cash-based sources of intrinsic value. Valuations can and do change over time, too, as expectations change.

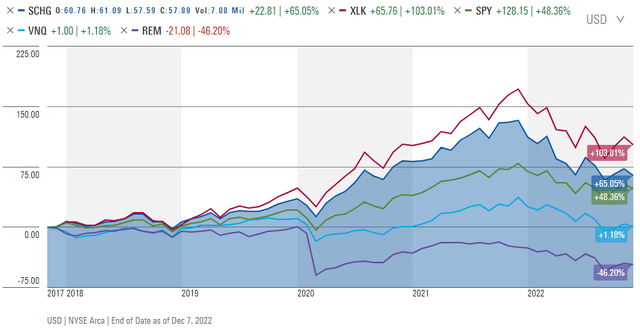

But just how bad has it been for REITs, not only in 2022, but over the past 5 years? Really, really bad. Here’s some perspective on how terrible it has been for REIT equities the past five years relative to the S&P 500 SPDR (SPY), technology equities, and the area of large-cap growth. Many talk about the pain experienced in technology and mega-caps this year, which might be considered reasonable considering how well the sector has performed the past five years, but REITs have simply been underperformers for a long time — for a large part of the bull market (and during this raging bear market, too!).

REITs have been absolutely obliterated on a relative basis the past five years. (Image Source: Morningstar)

Unfortunately, investors with a myopic focus on the dividend or dividend yield tend to miss the big picture of investing, and while the areas of high yield dividends and dividend growth have been outperformers relative to the S&P 500 this year as our simulated newsletter portfolios have shown, business fundamentals simply matter. The area of large-cap growth, for example, as measured by the Schwab U.S. Large-Cap Growth ETF (SCHG), has advanced more than 65% during the past five years, while technology, as measured by the Technology Select SPDR ETF (XLK), has more than doubled over the same time period, both of these areas outperforming the S&P 500 Index (SP500).

However, equity REITs, as measured by the Vanguard Real Estate ETF, have been roughly flat on a price-only basis the past five years, while mortgage REITs, as measured by the iShares Mortgage Real Estate Capped ETF, have simply collapsed during the same time. Mortgage REITs may never return to their glory days given the eroding dynamics that dividend payments have on capital appreciation! The SPDR S&P Dividend ETF (SDY) and SPDR Portfolio S&P 500 High Dividend ETF (SPYD) have also underperformed the S&P 500, on a price-only basis, the past five years (these ETFs’ returns are not pictured for easier viewing in the graph above).

The love affair with REITs by retail investors doesn’t make a lot of sense to us, particularly in what could be a rising interest rate environment for some time, where REIT assets have yet to come to reflect true liquid intrinsic values. Most REIT assets are illiquid and don’t trade daily like that of stocks (there are even non-traded REITs), and while publicly-traded REIT equities show that asset values have tumbled, by proxy, there are more troubling things at work for long-term REIT investors, from both a fundamental and financial basis that many REIT investors may be overlooking, even during these very difficult times.

Fundamental and Financial Factors are Working Against REITs

There are a few fundamental long-term considerations working against REITs. For starters, the labor force is less than enthused about returning back to the office after COVID-19, and remote jobs are becoming more and more common. This means the need for office space may, over the long run, not be as much as previously thought. Secondly, consumers are growing more and more comfortable ordering online, making many smaller retailers or mall-based retailers and their rents obsolete. These two trends, in particular, are worrisome for REIT investors.

But there’s more to the REIT story, and something that we include in every one of our REIT dividend reports:

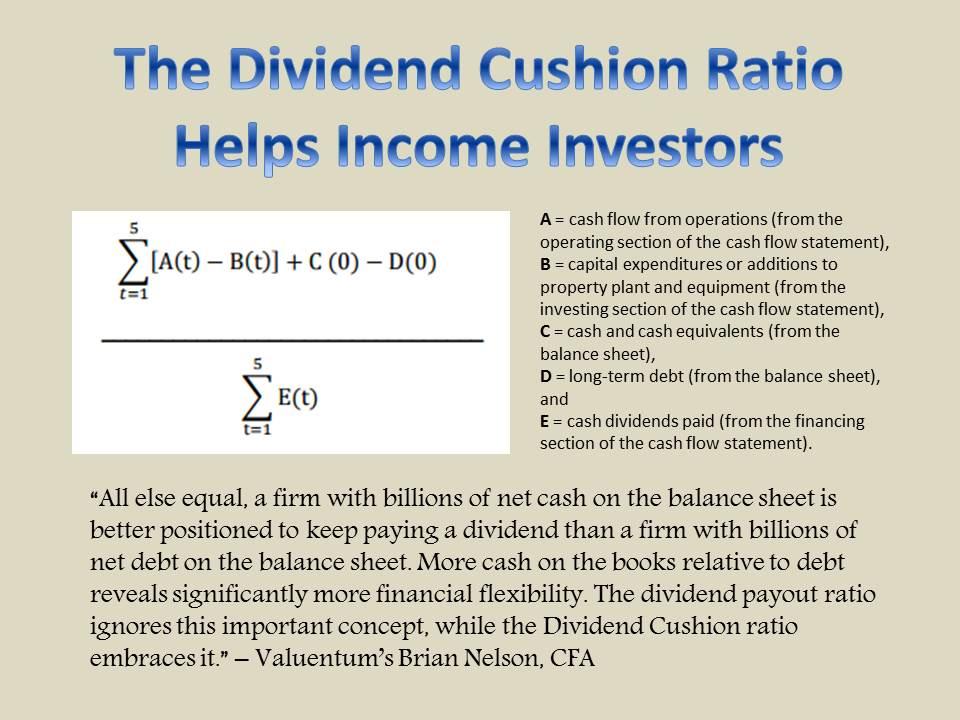

REITs pay out 90% of annual taxable income and therefore are unable to meaningfully reinvest internally generated funds, resulting in external capital-market dependence. The weak internal cash-flow retention of most REITs translates into poor raw, unadjusted Dividend Cushion ratios, which could become severe during the depths of the real estate cycle. Even though a REIT’s operating cash flow may be robust, the lack of cash accumulation on the balance sheet and the massive debt needed to purchase/develop new properties can become restrictive. The adjusted Dividend Cushion ratio accounts for expectations of continued access to the capital markets, which while “normal,” cannot be guaranteed in times of tight credit.

Sometimes, a REIT paying out most of its taxable income in the form of dividends is spun to investors as a “good thing,” but we’d much rather have a corporate idea that has a strong net cash position on the books, so that it can cover the payout in the event that cash flow from operations, and/or free cash flow in particular, comes up short relative to expectations. Office REIT SL Green Realty Corp. (SLG), for example, recently cut its payout nearly 13%, due in part to weakened net rent revenue on a year-to-date basis, but also due to balance sheet strain due to the REIT’s inability to build up stores of cash on the books. The Dividend Cushion ratio captures this dynamic, while FFO coverage ratios do not.

Image: The Dividend Cushion ratio is one of the most powerful financial tools an income or dividend growth investor can use in conjunction with qualitative dividend analysis. The ratio is one-of-a-kind in that it is both free-cash-flow based and forward looking. Since its creation in 2012, the Dividend Cushion ratio has forewarned readers of approximately 50 dividend cuts. We estimate its efficacy at ~90%. (Image Source: Valuentum)

Institutional Investors Are Fleeing The REIT Sector

According to a report from the National Association of Real Estate Investment Trusts, as retrieved through Seeking Alpha, U.S. REITs raised a mere $1.46 billion in capital during November, a number that was down a staggering ~84%. According to the report, there were only three offerings during the month, which compares to more than 20 in November of last year. So far during 2022, the appetite for REIT investments has been abysmal given the pace of capital-raising that took hold last year. Withdrawals from non-traded REITs have also been soaring, reaching more than $2 billion in the second quarter and $3 billion in the third quarter of 2022 (a huge increase from prior quarters which were far below $1 billion), according to data from Robert A Stanger & Co.

Many of our readers understand how cautious we are with respect to highlighting ideas that are capital-market dependent, meaning those ideas that do not generate sufficient free cash flow in excess of cash dividends paid, a situation that is often compounded by that company’s huge net debt position. We don’t include any REITs in our Best Ideas Newsletter portfolio, we include Realty Income Corporation (NYSE:O) in the Dividend Growth Newsletter portfolio, and we include a few in the High Yield Dividend Newsletter portfolio, but the group is not one for the faint of heart. Rising interest rates have only compounded what has been a bad situation for REITs so far this year. Even Blackstone (BX) had to limit withdrawals from non-publicly traded $70 billion Blackstone Real Estate Income Trust (BREIT) after redemptions soared from investors concerned about the health of commercial real estate.

Realty Income Continues to Hold Up Better Than Most

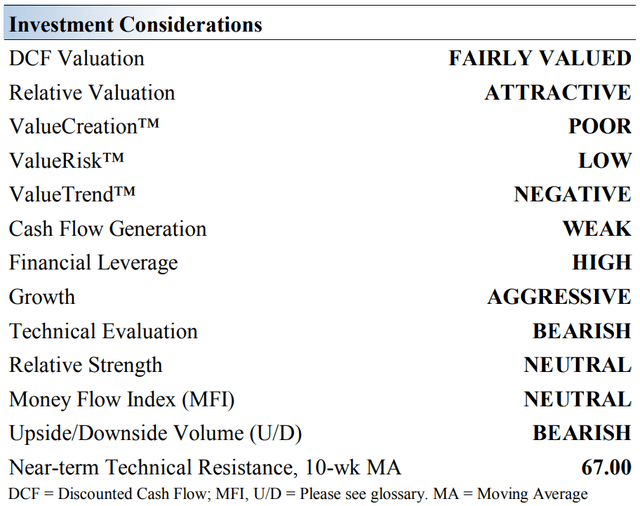

Realty Income’s Investment Considerations (Image Source: Valuentum)

For those new to REIT investing, Realty Income is a REIT that has 11,200+ properties across the US, Puerto Rico, and UK. It is an integrated real estate company with in-house finance/accounting, tenant research, portfolio management, and capital markets expertise. We like the REIT’s solid “A-rated” investment grade credit ratings from the big rating agencies (A3/A-).

Realty Income’s stated goals are simple: generate dependable monthly cash dividends from a consistent and predictable level of cash flow from operations. Convenience, grocery, dollar, and drug stores represent a key focus for the REIT.

Realty Income merged with VEREIT through an all-stock deal in November 2021. Meaningful synergies are expected from this merger. After that merger was completed, the enlarged entity spun off its office property holdings into a standalone publicly traded firm, Orion Office REIT Inc. (ONL). We adjusted our cash flow model for Realty Income accordingly.

Realty Income’s dividend track record is fantastic. The Dividend Aristocrat has paid out ~625 consecutive monthly dividends. Since going public in 1994, Realty Income has increased its monthly payout ~115 times. We caution that the REIT remains capital-market dependent, however. We’re never completely comfortable with stocks that are capital-market dependent.

Realty Income is steadily expanding its overseas footprint and has built up a robust investment and development pipeline in the UK and more recently, Spain. We appreciate its push overseas, as that supports its cash flow growth trajectory.

Realty Income’s Latest Quarterly Results

Realty Income has outperformed a broader REIT index this year. (Image Source: Morningstar)

Realty Income reported third-quarter results for the period ending September 30, 2022, and they were pretty good. Adjusted funds from operations (AFFO) advanced 7.7%, while normalized FFO advanced 9%, during a period when the company declared its 100th consecutive quarterly dividend increase, a payout that is now ~5% more than that of a year ago. Here’s what management had to say about the quarter:

During the quarter, we invested approximately $1.9 billion in real estate at a cash cap rate of 6.1%, bringing our total to $5.1 billion year to date. Additionally, we enhanced our financial flexibility by raising over $2.0 billion of equity during the quarter, $1.3 billion of which we intend to settle in the fourth quarter at $66.70 per share, while further de-risking the balance sheet with a $750 million 10-year bond offering in October…

…Finally, the operating fundamentals of our business remain healthy as we finished the quarter with occupancy of 98.9% while registering a rent recapture rate of 108.5% on properties re-leased. We are fortunate to manage a consistent business model that provides dependable results, and believe we are well-positioned to continue generating long-term value for shareholders.

Looking ahead, Realty Income raised its normalized FFO per share for 2022 to the range of $3.99-$4.07 (was $3.92-$4.05) and its AFFO per share to the range of $3.87-$3.94 (was $3.84-$3.97). Same store rent growth was reiterated at a 2% pace of expansion for the year, and occupancy rates are still targeted to be over 98%. The “Monthly Dividend Company,” as Realty Income is dubbed, remains one of the best-executing Dividend Aristocrats on the market today.

We continue to be impressed with Realty Income’s ability to keep raising its dividend payout, even though we have reservations about reading too much about what the dividend is and what it isn’t, and while REIT economics have deteriorated in 2022, the company is doing much better than peers. We’re not fans of the capital-market dependence risk of REITs, in general, and Realty Income holds a rather elevated net debt to annualized pro forma adjusted EBITAre ratio of 5.2x, but we’re sticking with the company as an idea in the simulated Dividend Growth Newsletter portfolio at this time.

Concluding Thoughts

Equity and mortgage REITs have been under considerable pressure during 2022. Institutional investors seem to be fleeing the sector, but retail investor interest still seems unusually high. We think this might be a tell-tale sign that retail investors could end up getting burned, if they haven’t been already by the terrible performance across the sector so far in 2022. Withdrawals on non-publicly traded REITs are soaring, and SL Green’s dividend cut may be the first of many in the sector to come. We only include a select few REITs across our simulated newsletter portfolios.

That said, Realty Income may continue to be a relatively better performer. The company is known as “The Monthly Dividend Company” and has paid out ~625 consecutive monthly dividends during its 50+ year operating history and has increased its payout ~115 times since going public in 1994. The REIT has solid “A-rated” investment grade credit ratings (A3/A-), though it remains capital-market dependent. In November 2021, Realty Income merged with VEREIT and subsequently spun off its office properties via a new standalone firm, Orion Office REIT. Material synergies are expected to be realized from its merger with VEREIT.

We forecast that Realty Income will continue growing its dividend going forward, but the company is not immune to the REIT sector’s troubles, which we think are important to speak plainly about in this note. Rising interest rates, troubling traditional free cash flow (CFO less capex) generation, reduced office and retail space compared to prior expectations are just a few major concerns. To put it bluntly, REITs have been relatively terrible investments the past five years compared to some of the best- and worst-performing areas in 2022. A myopic focus on the dividend payment or dividend yield is not healthy and could lead to not only long-term underperformance but to eroding income, as in the most recent case of SL Green, or eroding capital appreciation, as in many of the mortgage REITs that may never return to their glory days.

Be the first to comment