Spencer Platt/Getty Images News

Introduction

I’ve written several bearish SA articles about Camber Energy (NYSE:CEI) and I think this is a good time to take another look at this company considering it recently resumed releasing financial results after changing the accounting for its Series C preferred shares.

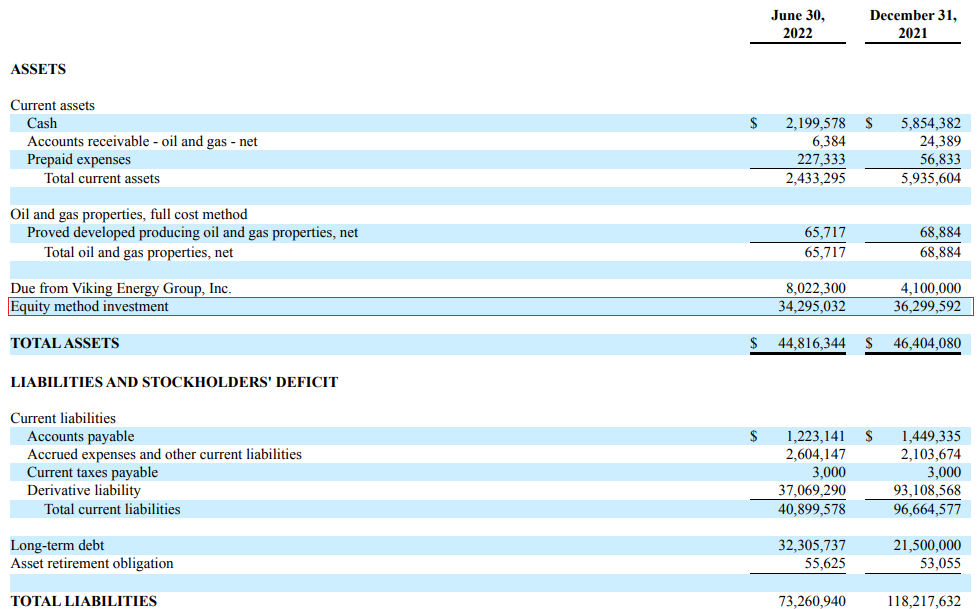

In my view, the situation looks bad as cash is low and debt stood at over $32 million as of June. In addition, Camber Energy’s 695 Series C preferred shares are likely to result in significant stock dilution in the future. Let’s review.

Overview of the recent developments

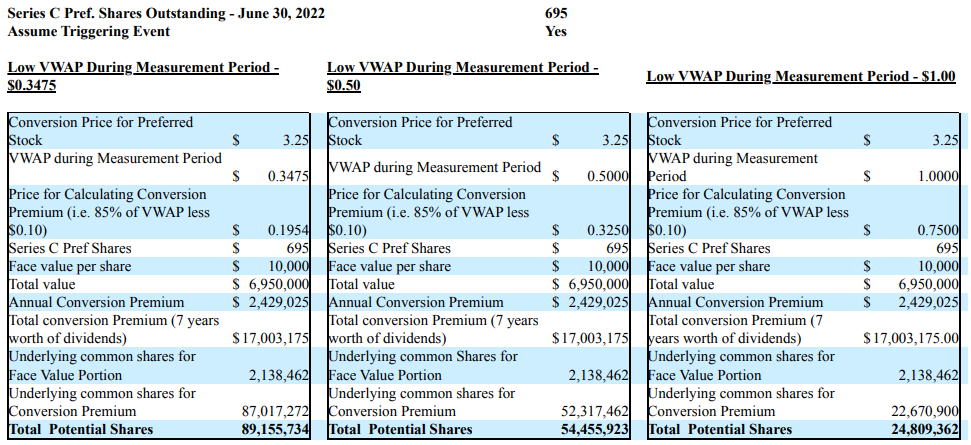

Camber Energy is a small oil and gas company which owns a 61% stake in Viking Energy (OTCQB:VKIN). The two companies have been trying to merge since February 2021 and the main problem was that Camber treated its Series C preferred shares as permanent equity in its financial reports, which the SEC didn’t agree with. These preferred shares are convertible into common shares at a fixed rate of $3.25 but when this happens, the owners get dividends (at an annual rate of 34.95%) as if the shares had been held to maturity. This is referred to as the conversion premium and can be paid in shares or cash. If the premium is paid in cash, the amount is fixed and not subject to adjustment. However, if the premium is paid in shares, the conversion ratio is based on a VWAP for the lowest stock price over the 30 days before the conversion date and 30 days after the conversion date. In addition, if the VWAP for the 30 days after the conversion date is lower than the VWAP for the 30 days before the conversion date, Camber Energy has to issue additional common shares. As you can see, there is a derivative liability present, and the way Camber Energy measures its fair value now in its accounts is combining the cash value required to settle the conversion premium with the lesser of the conversion price or the lowest closing price of its shares after the conversion date for the additional shares that are issued. If this sounds complicated to you, here are three tables prepared by Camber Energy that give an estimate of how many common shares it would need to issue at different share price levels if all Series C preferred shares are converted at the same time.

Camber Energy

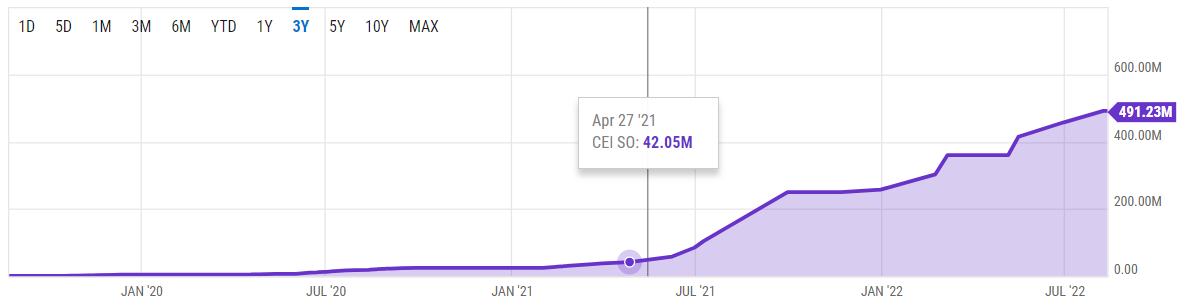

Basically, the lower the share price is, the more stock dilution there is from the conversion of these Series C shares. And considering the company has just $2.2 million in cash as of June, it seems likely that we’ll see the share count soar in the future. Looking at historical data, we can see that the number of common shares outstanding has increased more than tenfold in less than a year and a half.

YCharts

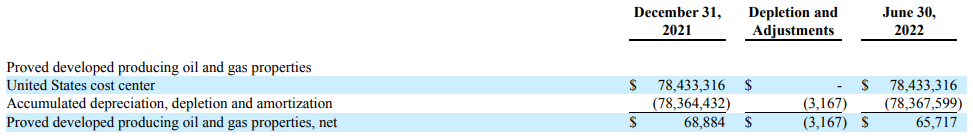

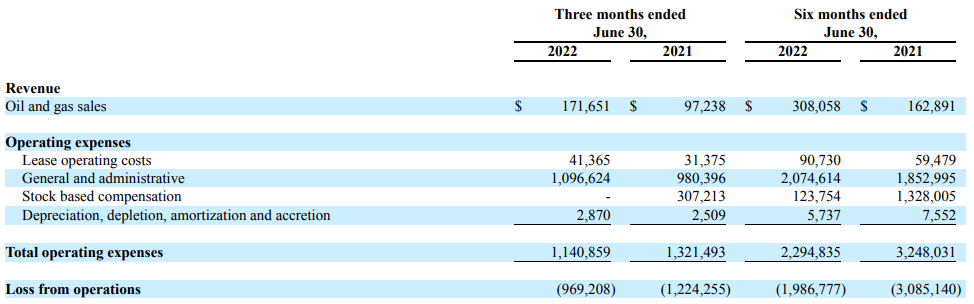

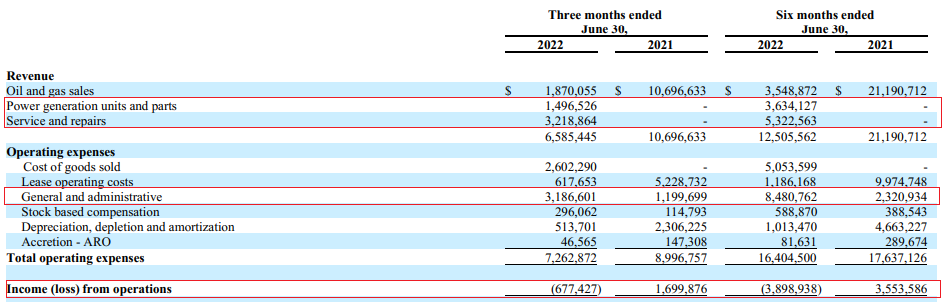

Turning our attention to the financials of Camber Energy, we can see that this is technically still an oil and gas producer. The company uses the full cost accounting method but there is no data about reserves. The oil and gas properties are almost completely depreciated, and revenues came in at just $0.3 million in H1 2022.

Camber Energy

Camber Energy

So, how come revenues are coming only from oil and gas sales considering Camber Energy holds a 61% stake in Viking? Well, it’s because Camber Energy accounts for this investment using the equity method of accounting.

Camber Energy

The reason for this is that Viking had 28,092 Series C preferred shares as of June, and each one of them comes with 37,500 votes. All those shares are held by James Doris, who is the CEO of both Camber Energy and Viking Energy. As of the time of writing the 61% stake in Viking Energy has a market value of just $24.5 million, which is bad news for Camber Energy as the company has $32.3 million in long-term debts which are secured by lien on substantially all of its assets.

So, what’s happening with the merger? Well, Camber Energy hasn’t backed out of it yet but for the deal to go through, there would have to be changes to the exchange ratios. Overall, I don’t think the merger wouldn’t change the fundamentals of Camber Energy by much as Viking Energy seems to be struggling financially following its decision to transition away from the oil and gas business. In H1 2022, the company booked a loss from operations of $3.8 million as G&A expenses ballooned to $8.5 million.

Viking Energy

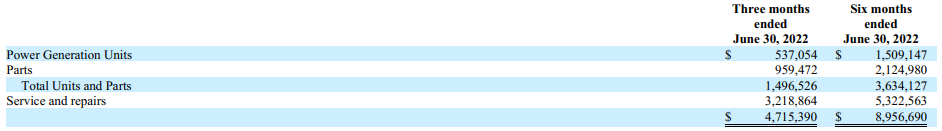

As a reminder, Viking Energy’s main subsidiary is Canadian industrial engines and power generation products manufacturer Simson-Maxwell. Between August 6 and September 30, this company booked revenues of $3.5 million, and its net profit was $78,961. It looks like its revenues are growing at a good pace, but the high G&A expenses are eating into the profits of the group.

Viking Energy

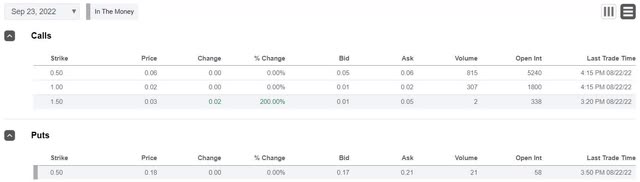

In my view, Viking Energy shouldn’t be worth much in its current state and Camber Energy looks overvalued based on fundamentals. Even if the merger is completed, I don’t expect stock dilution due to Series C preferred shares to stop anytime soon and I’m bearish. I think that it could be a viable idea to open a small short position in Camber Energy and data from Fintel shows that the short borrow fee rate stands at 7.62% as of the time of writing. In my view, it would be worth hedging the risk through call options with a strike price of $0.50.

Seeking Alpha

Turning our attention to the risks for the bear case, I think that the major one is that sometimes the share prices of microcap companies can increase for spurious and unknown reasons, and we’ve seen this happen with Camber Energy’s stock in the past. It could be best for risk-averse investors to avoid this stock.

Investor takeaway

Camber Energy’s share count continued to increase rapidly over the past months, and it seems this trend is likely to continue in the near future. The company has over $30 million in debt and its main asset is its stake in Viking Energy, which is currently worth less than that. I think that the merger between the two companies is likely to take place soon as the accounting issues have been resolved. However, Viking Energy has high G&A expenses for a company of its caliber, and I think its business is close to worthless in its current state.

In my view, the share price of Camber Energy is likely to continue to decline in the near future, but I can’t give you a forecast for how low it can go. I’m bearish and I think it could be a good idea to open a small short position.

Be the first to comment