bjdlzx

We’re at a wonderful steak dinner in a nice restaurant. You can hear the wine glasses clinking, the silverware clattering. Laughter fills the room, along with hushed voices and soft whispers said with smiles. It’s a beautiful night, gentle breeze coming off of the ocean, and I’m enjoying a nice little gathering catching-up with friends. Coincidentally they’re also fellow investors, and they’re sharing stories and thoughts about the world, the economy and families. It’s another snapshot in those moments in life that remind you why we’re in this game in the first place.

Then he says it.

He says it in response to stock valuations, specifically in commodity companies. I forget exactly what we were talking, but the words still ring clearly in my mind… “why would you ever pay more than 6x for a commodity producer in a cyclical industry.“

He said it.

Matter of fact, plain and simple, not incredulously, but by someone who’s been in the field, invested in the space, and is wide eyed about the risks.

“You wouldn’t would you, because why would you?“

No it’s not a dinner conversation most “normal” people have (as my wife likes to remind me), but it is one investors tend to have because as we’ve said, the game never stops.

OXY’s Q2 2022

So I’m recalling this conversation after having looked over OXY’s second quarter earnings. Many have asked through this quarter whether we can update our thoughts on the company, and we’ve resisted because there’s simply not much to add since our last missive. The company continues to execute, and we continue to wait as it completes its list of to dos.

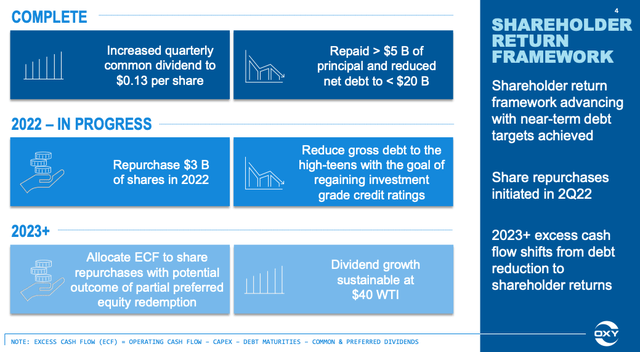

What’s there to say when they’ve explained to you that debt will continue to be paid down. Check. Will initiate a share buyback. Check. Pay down further debt later in Q4. Check. Think about tackling the preferred shares issued to Buffett in 2023 once shareholder returns exceed $4/share. Check.

It all makes sense. Even the current shift in strategy from debt repayment to buybacks for the quarter. Buying back shares now won’t derail the company from its ultimate goal of achieving investment grade shortly (likely before YE by 2 out of the 3 ratings agencies). Take the opportunity to buyback cheap shares ($3B / $~60/share = 50M shares) helps mitigate the dilutive issuance of shares that may be coming from Buffett’s exercise of warrants (or the exercise of $22/share 2027 warrants). So yes… sense it makes, Yoda would say, and sense it made when they announced the roadmap so many months ago. So execution is fine, operationally the company’s fine, and things are proceeding on track.

Oil prices for this quarter has sold off slightly since last, but still average above $100/barrel QTD, somewhere between what they were in Q1 and Q2. In our quarterly letter, we reiterated out view that oil prices will continue to climb higher. If oil prices do hold at today’s levels, we’d anticipate slightly better results in free cash flow than Q1, but slightly less than Q2. Remember also that the odd quarters, Q1 and Q3 also require certain cash payments (e.g., semi-annual interest payments) that impacts cash flows.

Nothing Really Matters… Nothing Really Matters to Me

Some analysts quibbled with the quarter, lower production here, higher costs there, but to us that’s missing the Forrest from the trees, especially when the Forrest just grew by $4.2B trees. So yes, earnings were more than fine. What matters to us is still something that’s somewhat more difficult to quantify, and really what we’d like an answer to.

What mattered to us was thinking through… will Berkshire Hathaway (BRK.A) (BRK.B)/ Warren Buffett buy all of OXY?

Walking Through Whys

As we write this note, Buffett already owns close to 181M shares, well 181,684,791 shares to be exact. Not to mention his 83,858,848.81 in warrants to purchase the common stock at $59.62.

In total, that’s nearly 268,543,640 in shares, or nearly 25% of the company. As we wrote previously, he’ll likely exchange half of his $10B in preferred shares for common stock, which would be more tax efficient.

After which, he’ll have spent about $15B for 25% of the company (181M shares * ~$59/average = $10B + $5B of preferred to warrant exercise/common swap). What about the remaining 75%?

Well he could be a passive holder some argue. What? Why? Again, it’s a commodity producer, in a cyclically volatile industry. The moat’s about as deep as a puddle. The shares swing wildly depending on oil prices, and despite a string of fantastic quarters, the market still ascribes a depressed multiple for E&Ps. So as an investment vehicles, there are likely better options. Even integrated could arguably offer a better long-term investments in stability, shielding some of the sector’s volatility with their midstream assets. Moreover, if you own a 25% stake, it also becomes much less liquid. Exiting that position is possible, but it sure wouldn’t be quick. So we don’t think he’s necessarily out for capital appreciation here.

Still, perhaps he’ll keep it at 25% and hold it for the long-term, electing the equity method and record a portion of OXY’s earnings into Berkshire’s earnings. Hmmm, we’re still suspect about that because why would they? Sure, they’ve done so for Kraft Heinz, where they own 26.6% and Pilot Travel Centers LLC, Electric Transmission Texas and Iroquois Gas Transmissions, but most of these are outliers as the Kraft ownership was more of a “ride-along” deal with 3G Capital, and Pilot is a company that they’ll soon own a majority of in 2023.

So if it’s not a stock in a company with a competitive advantage (i.e., moat) and it’s not earnings he’s . . . what is it?

It’s insurance.

It’s a hedge.

It’s a hedge against inflation for the next decade in the event energy prices rise considerably.

It’s a hedge against the ‘70s repeating.

Most importantly, it bullet proofs his conglomerate, a sprawling distribution, logistics and manufacturing empire that’s able to compound extraordinary wealth because of low input costs (i.e., money/cost of capital and energy).

It’s a direct hedge against the rising energy costs for the conglomerate, one that has substantial operations in a few pillars, insurance, utilities, railroad and industrial/building/consumer products.

Sustaining the Conglomerate

For a conglomerate to sustain itself, there are three lifebloods, quality management, access to low cost of capital (i.e., cheap money) and energy. Let’s leave management aside for now, and simply discuss money and energy.

Berkshire has long-conquered the former with its insurance “float,” low debt levels and enormous free cash flow generation. The company’s balance sheet is a fortress, so much so that Berkshire became the “go-to” lender of last resort for many banks during the Great Financial Crisis. As a funding vehicle, there are very few companies that can provide its operating subsidiaries, each running independently, with such a low cost of capital. So on that front, mission accomplished. What about energy though?

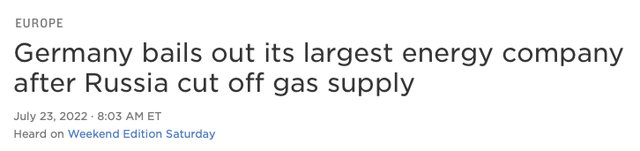

Much of Berkshire today is a sprawling logistics and manufacturing empire. Think about it another way, OXY is essentially Germany, though arguably with a more rational leader. As strong as it is financially, all of those industries, can quickly grind to a halt if an exogenous global event occurs to cut off its access to energy.

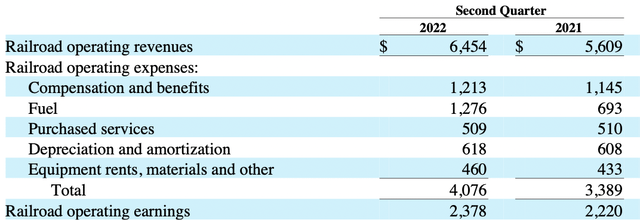

So hence the investment in OXY. As transportation fuels, natural gas, and other oil input costs rise on the backs of increasing crude prices, the input costs for Buffett’s conglomerate can rise dramatically. Just take a look at one of Berkshire’s pillars, BNSF, the railroad. As oil prices rose from mid-$60s in Q2 2021, to ~$100/barrel a year later, so too did BNSF’s fuel costs.

Berkshire Hathaway Q2 2022 Form 10Q

Next to wages it’s become the largest expense for that segment of Buffett’s conglomerate.

The above is also only railroad. We haven’t even touched upon the cost of natural gas for Berkshire Hathaway Energy (“BHE”), or the raw material costs for its industrial products or manufacturing groups (think, Lubrizol, Precision Castparts, IMC Metalworking, etc.). All of these industrial/manufacturing entities are facing higher input prices for raw materials (e.g., oil feedstocks), freight costs, and energy costs.

Furthermore, it’s not just affordability, but also availability. Sometimes even if you have the money, you may not have the opportunity to purchase a good in high demand. Though contractually, each of Berkshire’s entities no doubt have supply agreements, acquiring an E&P producer would better solidify and insulate the group’s overall supply chain from unforeseen events.

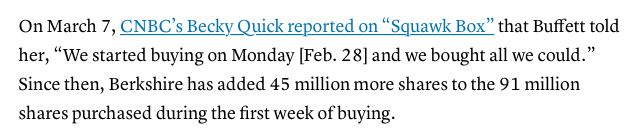

Frankly, we don’t think it’s a coincidence that Buffett began accumulating OXY shares soon after the Russian/Ukraine invasion. Many presumably assume that it was after he read OXY’s Q1 2022 quarterly report and deduced that the company was on the right path. As reported on CNBC:

CNBC

We’re not so certain. To buy a commodity producer in such size, you’d have to have a view on where oil prices are going, and we believe the Ukraine invasion and the subsequent leap in oil prices caught his attention (or his management team’s eye) for this key input. No, to buy a commodity producer, you’d have to have a view on where oil prices were going, and we believe the Ukraine invasion and the subsequent leap in oil prices made Buffett and his management team reconsider this key input.

As for quality of management, OXY is helmed by a manager Buffett has previously expressed respect for, so from that perspective, OXY’s CEO Vicki Hollub checks-the-box.

In fact, like many of Buffett’s companies, we’d surmise that the company could perform even better under the conglomerate’s ownership, as it frees the management team from the external/internal pressures of being a public company.

So we’ll venture a guess here.

We believe Berkshire will acquire the remaining shares of OXY. There’s little reason to buy such a large stake in a cyclical / commodity business unless there’s a compelling strategic fit and we think there is one. It’s completing the supply chain from raw materials to finished products at an affordable price, while acquiring a free optionality on CCUS and potential future ESG endeavors for the conglomerate. The latter point isn’t something to underestimate. In an increasingly ESG-focused world, a company’s ability/social license to freely operate and use fossil fuels will be paramount. OXY’s new ventures into carbon capture could “green-ify” (if there’s such a word) the products/services provided by the conglomerate. Tack onto the fact that OXY is still currently undervalued (i.e., it’s priced as if oil is at $70 instead of $95), the reasons for taking full control amplify.

So how much? Let’s take a stab at this. We think he’s content to continue buying OXY at $60/share, half a percent here, half a percent there. As aforementioned, he’s spent about $10B for his 17% stake, and if he exercises his warrants (again swapping $5B of his preferred stock (a replay of his Bank of America investment)), he’ll have spent ~$15B for 25% of OXY at around ~$60.

What about the remaining 75%? Well if this is anything like BNSF, which he acquired after owning ~22.6%, his last BNSF shares purchased in the public market was January 2009, and subsequently made an offer 10 months later, the OXY drama could also play out within a year, particularly if oil prices continue to climb after its recent rout. Notably, the BNSF/Berkshire negotiations took only a few days, so between the onset of talks to an ultimate deal announcement, total time was less than 2 weeks. Things can move quickly when you have Buffett’s wherewithal.

A 30% premium to OXY’s $70/share closing price would translate to an $90/share acquisition price for the remaining 75% that he currently does not own, tacking on another ~$68B spent. Buffett would effectively be “all-in” for OXY at more or less $80B (ex-debt). Again, we anticipate at $100/barrel oil, OXY will generate ~$15B in free cash flow (“FCF”), a 5-6x FCF multiple to $80B spent. Oh no, he’d never spend that much people say, he hates paying a premium and a 5-6x multiple on a commodity producer is just too much, and yet he paid an 17x on BNSF’s cash flow when he valued the company at $34B when FCF was more or less $2B back in 2009. That’s a toll-taker though, warranting a premium, and hence the mid-teens multiple. Sure, but get a commodity producer cheap enough, price can take care of many ills.

More importantly though, buying OXY isn’t about maximizing capital gains here. It’s really about hedging the downside for a conglomerate. It’s really about protecting a legacy and a lifetime spent building an economic flywheel.

It’s about protecting a lifetime of work

So why would you ever pay more than 6x for a commodity producer in a cyclical industry?

He probably wouldn’t, but that doesn’t mean he wouldn’t buy some insurance… and OXY may just be it.

Be the first to comment