jetcityimage

General Electric (NYSE:GE) is facing an uncertain future, which is reflected in the company’s valuation.

The industrial corporation is confronting a variety of challenges, including rising raw-materials costs, supply-chain issues, a highly cyclical Aerospace division, and increasingly unstable free cash flow guidance.

With General Electric’s results date approaching next week (October 25th, 2022), investors may wish to avoid the industrial giant until it outlines a clear route for its free cash flow in 2022 and 2023.

3Q-22 Earnings Probably Affected By Higher Costs And Supply-Chain Issues

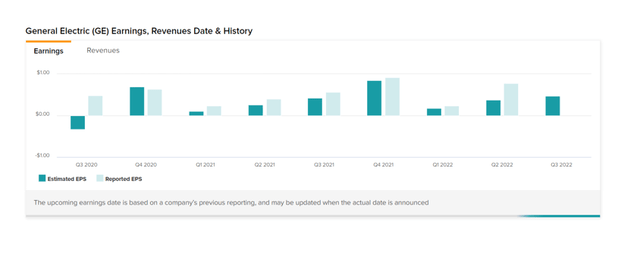

The market expects General Electric to earn $0.47 per share and generate $18.81 billion in revenue in the third quarter.

With increasing uncertainty in its industries, I believe General Electric will have to publish dismal earnings.

Rising raw-material costs and ongoing supply-chain concerns are likely to have taken a toll on General Electric’s operations in the third quarter, perhaps leading to a disappointing earnings report next week.

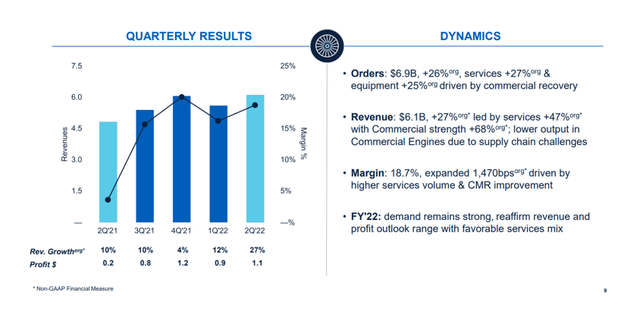

The Aerospace segment is currently performing the best for General Electric, benefiting from strong equipment and services order growth. The segment’s revenues increased by 27% to $6.1 billion in 2Q-22, but it may face significant challenges in the near future as the U.S. economy appears to be in decline.

The issue with Aerospace is that it is a highly cyclical industry, and recent order increase for General Electric’s equipment and services was most likely driven by pent-up demand following the pandemic. In short, as the economic outlook worsens, Aerospace is particularly vulnerable to a severe earnings slump.

Revenue Growth (General Electric)

Free Cash Flow Is Probably More At Risk Than At Any Time In The Last Year

Given recent economic uncertainty, I believe the industrial behemoth will struggle to meet its free cash flow guidance next week.

General Electric previously projected for $5.5-6.5 billion in free cash flow this year, but stated in the most recent earnings release that $1.0 billion of this free cash flow will be pushed into the following year due to ‘timing of working capital dynamics’.

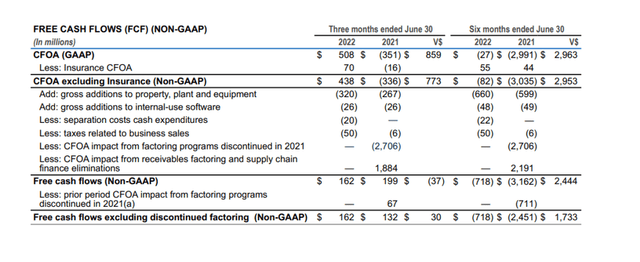

I find it difficult to imagine that General Electric will meet its reduced free cash flow target given that free cash flow was only $162 million in the second quarter and minus $718 million in the six months ending June.

Free Cash Flows (General Electric)

To fulfill its free cash flow estimate for 2022, General Electric will have to absolutely kill it in 3Q-22 and 4Q-22, the odds of which have fallen significantly in my opinion, given that the U.S. economy is obviously slowing and inflation continues to wreak havoc on businesses and consumers alike.

Furthermore, when economic development prospects deteriorate and uncertainty takes over corporate decision-making, corporations have a significant proclivity to postpone capital investments and equipment upgrades.

As a result, investors must anticipate that General Electric’s third-quarter earnings will fall short of estimates and that the industrial behemoth will further defer free cash flow into the coming year.

General Electric’s stock is priced at 15-17x free cash flow, based on $4.5 billion to $5.5 billion in free cash flow this year, which may be deemed a stretched multiple given the industrial conglomerate’s profitability concerns, particularly in the Power and Renewable Energy divisions.

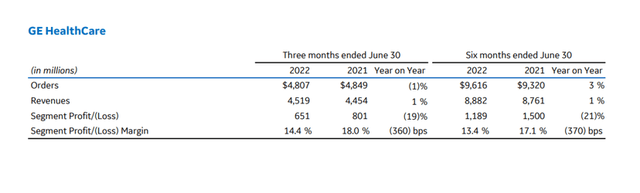

General Electric’s Healthcare business provides some security to investors, owing to the fact that consumers want GE’s healthcare goods even during recessions, which can assist stabilize revenue growth and free cash flow.

Healthcare Division (General Electric)

Why General Electric Could See A Higher Valuation

If General Electric does not decrease its free cash flow forecast for 2022 and instead reports robust order and sales growth in the Aerospace division, I could be incorrect about General Electric and investors could pile back into the company.

The industrial company has also announced that it will spin off its healthcare division next year, which might serve as a growth accelerator.

Having said that, I continue to believe that the risks exceed the possible returns here, since General Electric will remain reliant on the cyclical Aerospace business in the near future, and the free cash flow estimate appears increasingly unattainable, given cost and supply-chain challenges.

My Conclusion

Buy General Electric stock only when the industrial company has clarified its free cash flow condition.

I believe the industrial company is quite likely to lower its free cash flow forecast at the end of the month, which will weigh substantially on investor confidence. Moreover, purchasing a highly exposed, cyclical conglomerate at the start of a recession may not be a wise financial move.

The dangers of a recession are especially significant in General Electric’s aviation division, which has been driving the company’s growth in recent quarters. Keep your distance.

Be the first to comment