piranka

Nvidia (NASDAQ:NVDA) investors may have hoped that the stock had become a “tech blue-chip” coming out of the pandemic, uncoupling itself from the typical volatility seen at other tech names. While that may have been true earlier this year, the company’s stumbles in its gaming division have led the stock price to crash anyways. NVDA retains a clear-cut secular growth story though it is clear that its story is not immune to the same macro-headwinds facing much of the economy. If one is of the opinion that the world is heading towards a greater level of digitization and that must be powered by NVDA chips, then this volatility may present an attractive buying opportunity for long-term investors.

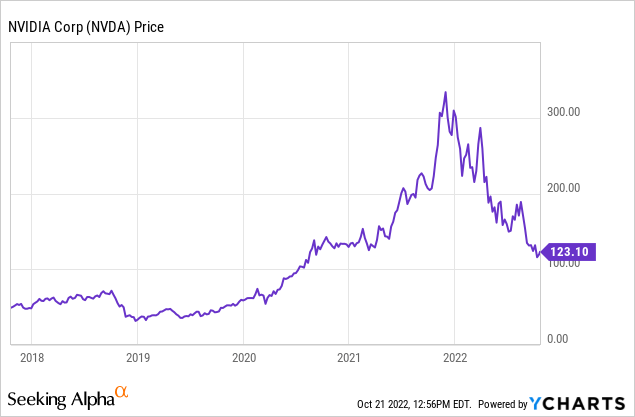

NVDA Stock Price

NVDA peaked at around $346 per share in late 2021 and for much of 2022 showed strong relative strength even amidst a reckoning in the tech sector. That has all changed in a matter of months.

I last covered NVDA in July where I rated the stock a buy though it has since fallen 20%. I viewed the stock as being buyable then (albeit still at a rich multiple) – the underperformance in the stock price has helped improve the value proposition further.

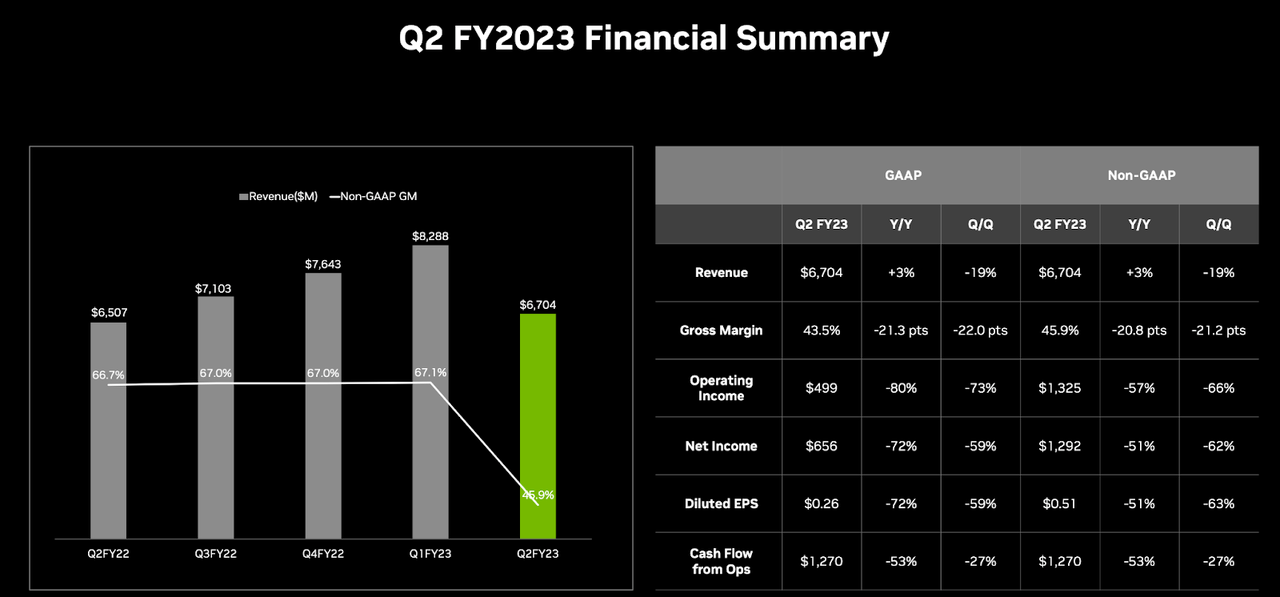

NVDA Stock Key Metrics

NVDA’s latest quarter showed anemic 3% year over year revenue growth with earnings per share declining 72%. NVDA had invested heavily in headcount growth ahead of the slowdown in the business. NVDA had jumped after first quarter results where management guided for the second quarter to see $8.1 billion in revenue – the second quarter result of $6.7 billion fell far short of that outlook.

FY23 Q2 Presentation

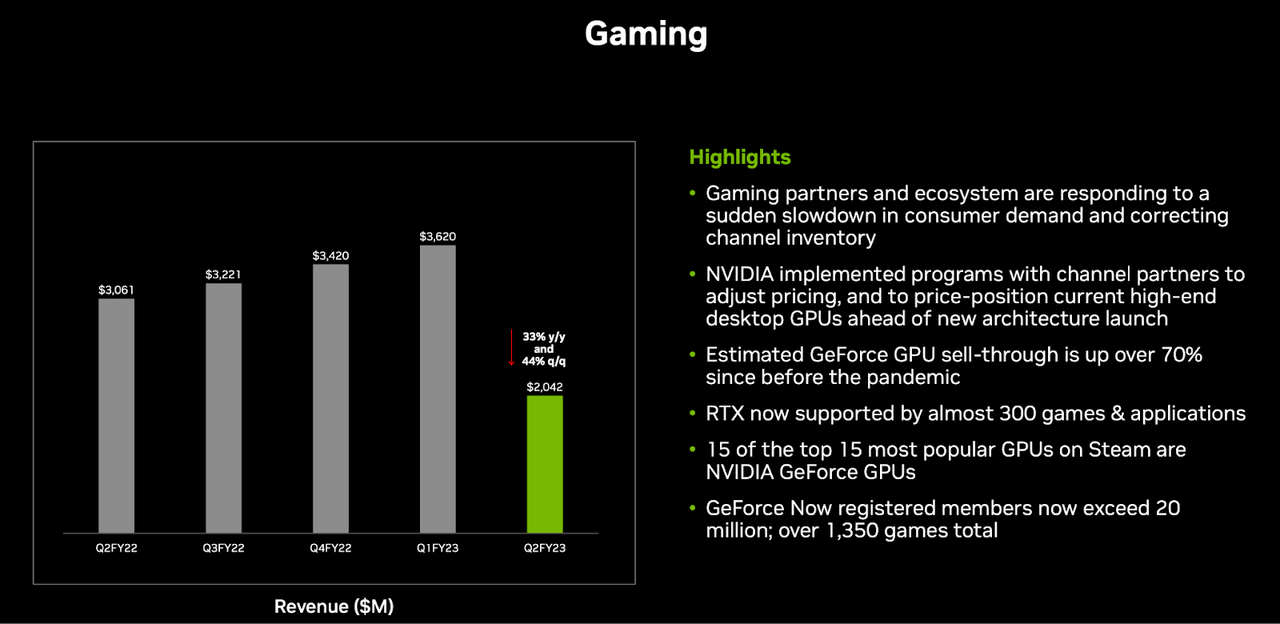

The main culprit was the gaming division, which saw an unexpectedly dramatic slowdown with revenues declining 33% year over year to $2.0 billion.

FY23 Q2 Presentation

On the conference call, management blamed softness in Europe related to the Ukraine war and COVID lockdowns in China. The company responded by taking steps to reduce inventory and increase prices.

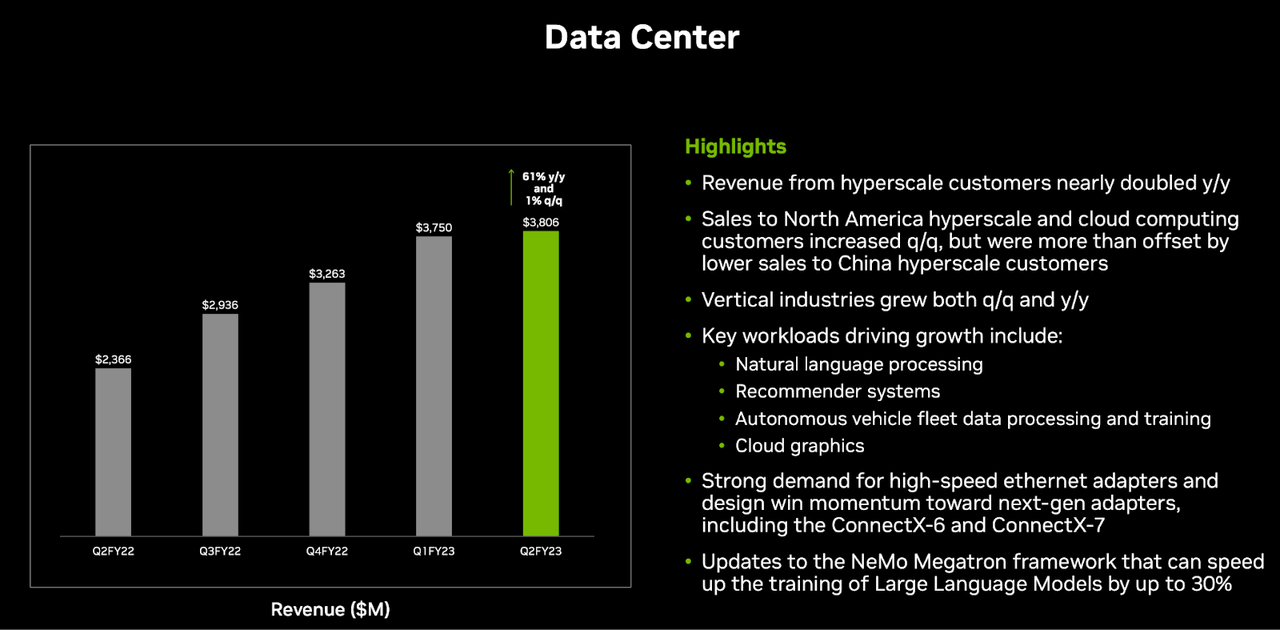

The data center business remained a bright spot, growing 61% year over year to $3.8 billion. The company had already seen data center revenues eclipse gaming revenues in the first quarter, but the difference is now even more pronounced. Data Center revenues now make up more than 50% of overall revenues, and I expect that percentage to only increase from here.

FY23 Q2 Presentation

Management noted that the data center strength is particularly impressive considering that Chinese hyperscalers and internet companies had slowed down infrastructure investment this year – they expect the Chinese business to eventually recover. NVDA saw North American hyperscalers double revenues year over year, helping to offset the Chinese slowdown. Think about that: 60% growth in spite of a temporary slowdown in one of its largest markets – that’s an incredible result.

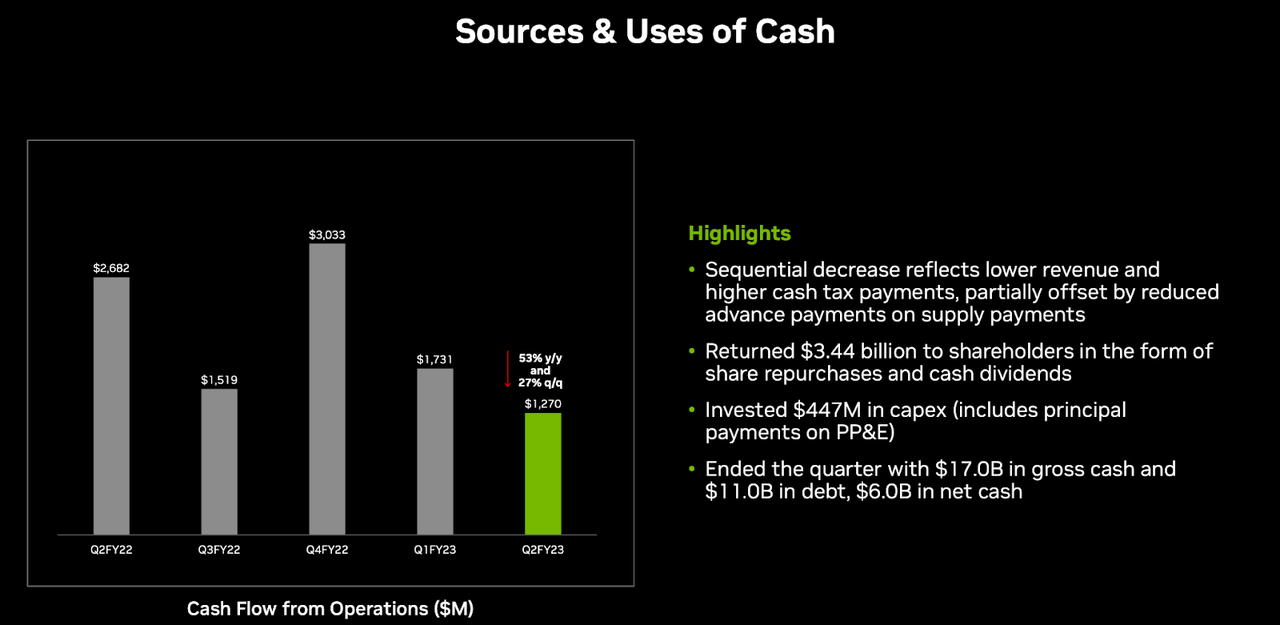

NVDA generated $1.2 billion in cash from operations in the quarter but maintained its capital allocation policy with $3.44 billion returned to shareholders through share repurchases and dividends. The company ended the quarter with $6 billion in net cash.

FY23 Q2 Presentation

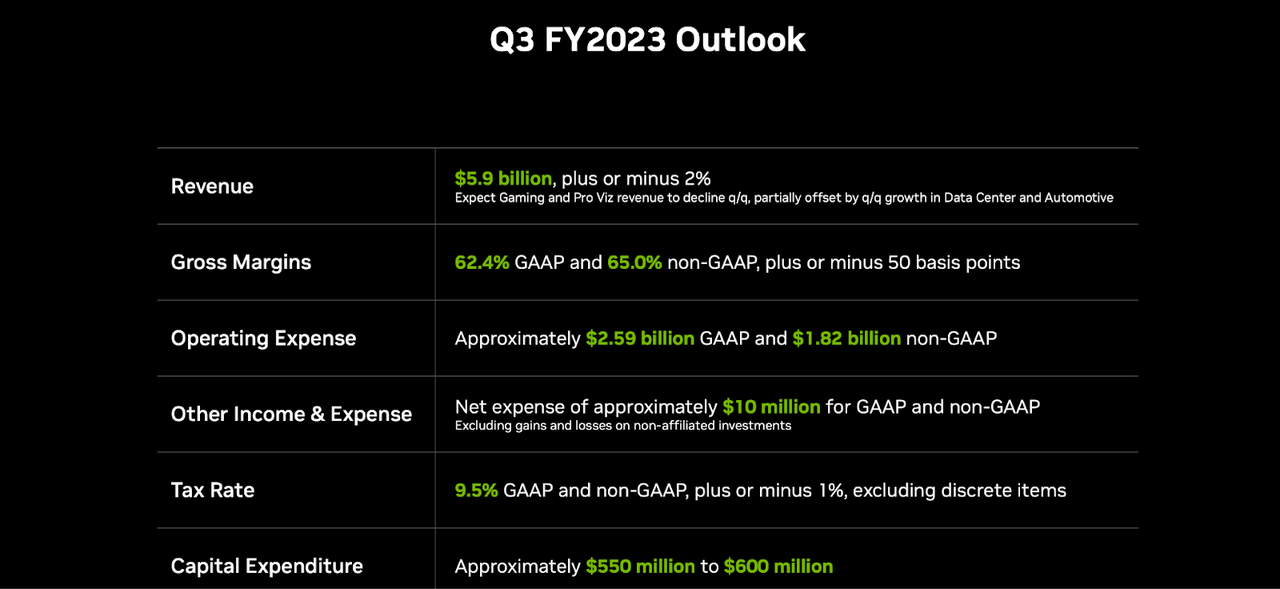

Looking ahead, NVDA expects revenue to decline sequentially to $5.9 billion, representing 16.9% year over year declines. The expense outlook implies around $1.82 billion in net income, or a 38.6% decline year over year.

FY23 Q2 Presentation

Is NVDA Stock A Buy, Sell, or Hold?

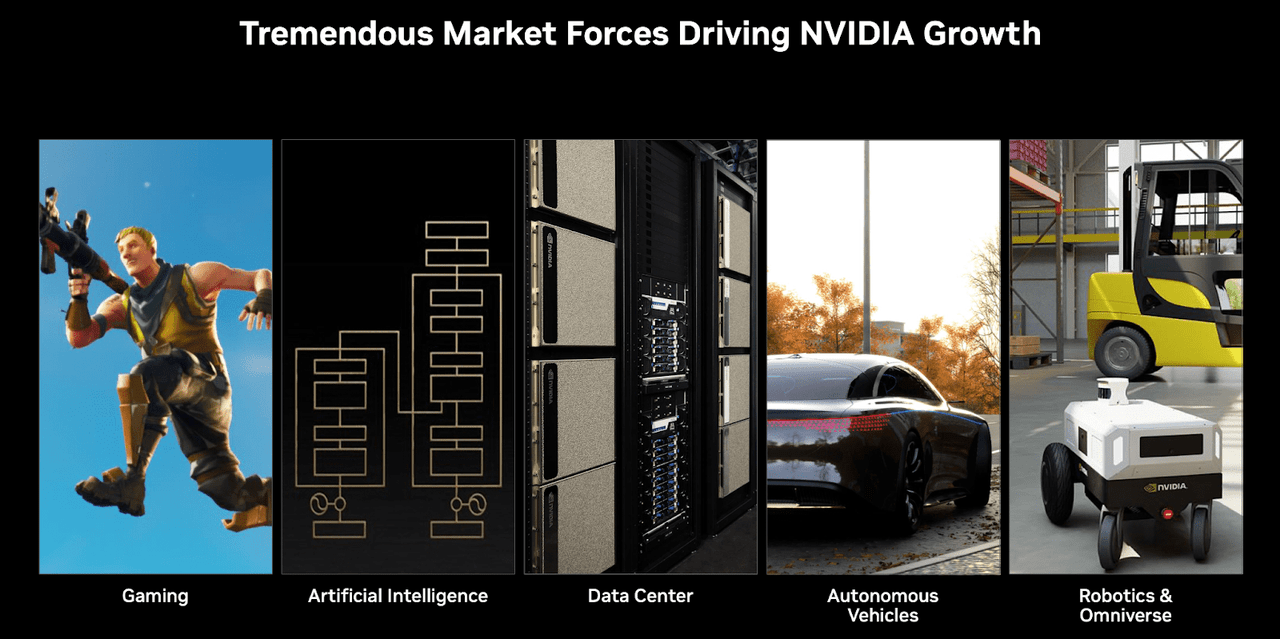

It is tempting to conclude that this slowdown is no coincidence – just as other tech companies are experiencing steep deceleration in growth rates coming out of the pandemic, perhaps this was just a matter of time. Perhaps NVDA had previously been benefitting from the crypto markets and the latest crypto crash reflects the fallout. But readers should focus on the long-term thesis – this is much more than crypto. NVDA remains positioned to power the next phase of the digitization era, ranging from gaming to artificial intelligence to data center and more.

FY23 Q2 Presentation

The world is moving towards a more digital world and “smarter digital” applications like autonomous vehicles. That is a trend that does not look likely to end.

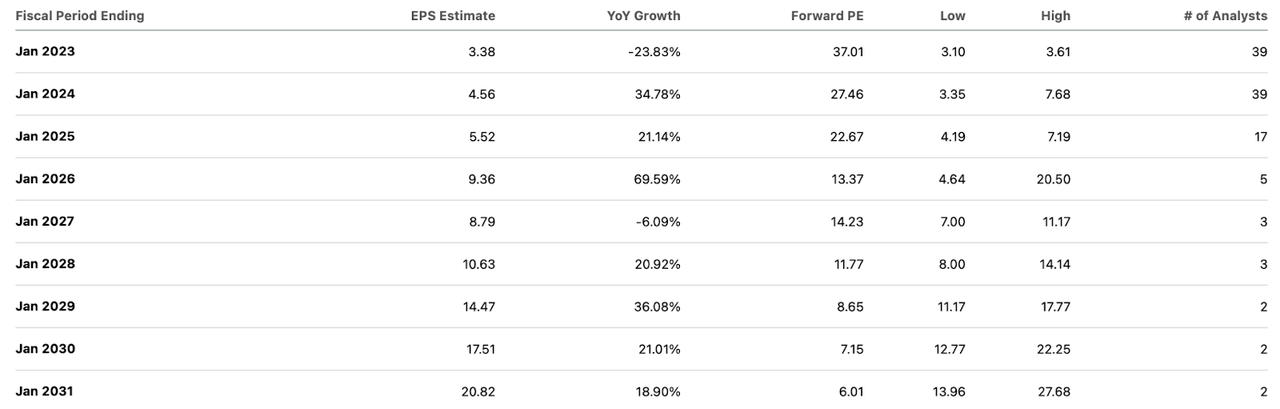

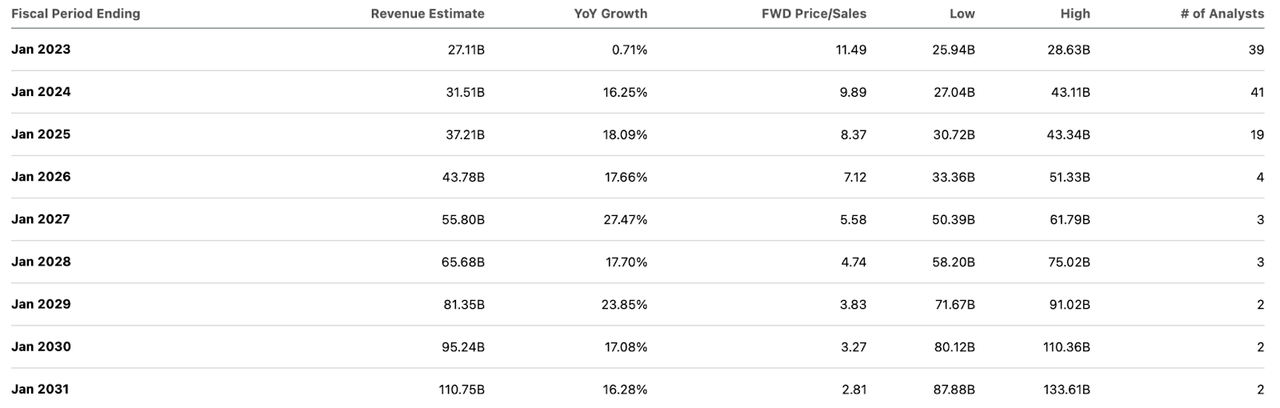

Consensus estimates call for strong growth over the coming decade.

Seeking Alpha

Those earnings estimates look reasonable as compared with the robust double-digit revenue growth estimates.

Seeking Alpha

For reference, NVDA is projected to see net margin expand from 36% last year to 46.8% in 2030.

One could definitely make the argument that at 37x earnings, NVDA is not obviously cheap as other tech stocks in the sector. Close competitor AMD for example stands out at 16x earnings. Yet this is the kind of stock that I’d expect to command a premium multiple due to the secular growth drivers. At a 2x price to earnings growth ratio (‘PEG ratio’), NVDA might trade at 40x earnings in 2024, reflecting a stock price of $217 per share or 74% potential upside over the next 2 years. On the downside, we mustn’t ignore that NVDA previously traded at 12x-20x earnings prior to 2016, when it was viewed to be more cyclical than secular. It is possible that the aforementioned secular growth drivers are more illusory (in particular, autonomous vehicles might be still many years away), leading to multiple contraction. The stock might not seem to have so much downside based on consensus estimates as it is already trading at the top end of that range based on 2024 estimates, but consensus estimates might prove too optimistic in such a scenario. Another risk is that of pricing pressure. It is possible that AMD and other competitors are able to catch up and compete on price. From the outside looking in, such a risk is very difficult to predict. The company has already guided for steep contraction in earnings, showing that operating leverage can work in both directions. The company has solid cash flow and net cash on its balance sheet to weather the storm, but the stock may see volatility nonetheless. As I discussed with subscribers of Best of Breed Growth Stocks, a diversified basket of beaten down tech stocks may be the perfect strategy in the current environment. NVDA fits the bill as part of the higher quality allocation in that basket.

Be the first to comment