JHVEPhoto/iStock Editorial via Getty Images

Overview

Intel (NASDAQ:INTC) is the world’s largest semiconductor manufacturer by revenue, supplying microprocessors for multiple computer manufacturers such as Lenovo, HP, and Dell.

The stock has seen its share of struggles recently down 50.99% YTD. The next closest Dow component in terms of poor performance is Nike (NKE), down 47.10% YTD. The poor performance on Intel hasn’t been limited to this year. The stock is down 50% over the past two years and 54% over the past three years. Intel’s five-year performance is down as well by 35%.

The poor performance of semiconductor stocks is not limited to Intel as one of its largest competitors, Advanced Micro Devices (AMD) is down over 60% YTD.

Financial Performance

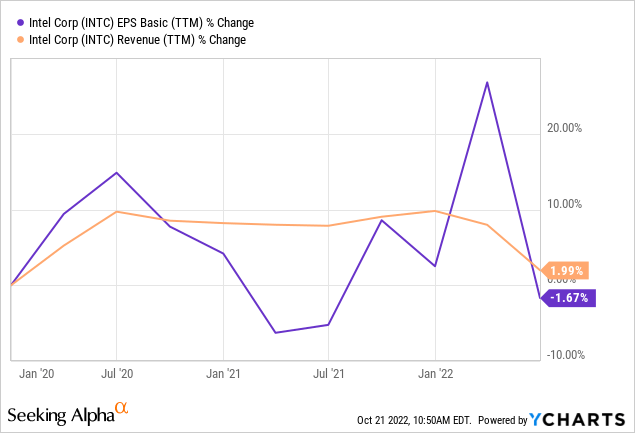

Intel is set to announce earnings/revenue performance next week. The company’s last quarterly announcement was not a positive one. The company missed its EPS estimates by $0.64 and missed revenue by $2.60B. Looking at the chart below you can see that Intel has not been able to increase its earnings/revenue in a substantial way over the past three years.

Based on recent news, such as the announcement of planned layoffs coming next month and slowing PC demand, I don’t expect next week’s earnings announcement to change this trend. While I don’t expect Intel will see quite as steep of a fall as was seen after its Q2 earnings release (a drop of nearly 9%), I do expect another drop in the stock price (4%-5%) once earnings are released.

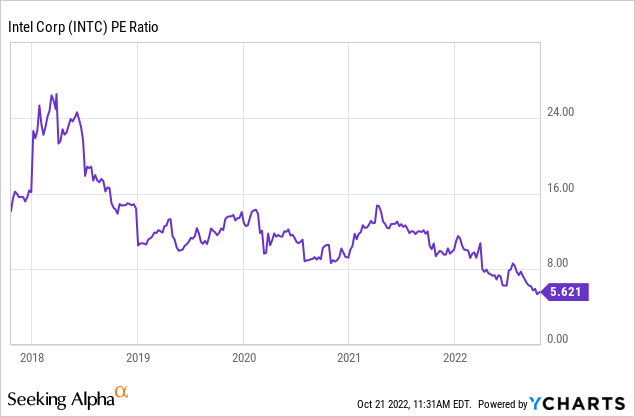

The poor performance of Intel’s stock has led to a falling P/E ratio over the past several years as you can see in the chart below.

While this isn’t the kind of trend you like to see from a stock looking to rebound it does make it an option for value investors looking for a good buy based on whether or not you believe a turnaround is possible.

And while Intel’s revenue and earnings have been declining/flat recently, it’s not all bad news for Intel. While the Intel Foundry Services and Client Computing Group business units have seen disappointing results, Intel’s Mobileye is a bright spot with Q2 revenue up 41%.

Mobileye won’t be a part of Intel’s business units once Intel’s IPO for the subsidiary takes place. Intel is looking to raise as much as $820 million from the IPO which will be used for working capital. While there are different ways to look at this IPO, I think it’s a smart move for Intel as it continues transitioning its core business strategy. I believe the IPO will help improve Intel’s struggling cash flow, which will allow it to continue building and outfitting new fabs as it manufactures for other companies.

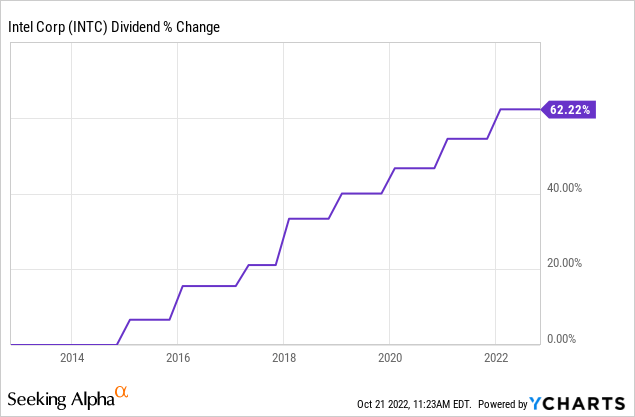

Another area in which I believe the IPO will help Intel is ensuring that the company continues its strong record of dividend growth.

Looking at the chart above, you can see that even while struggling with its stock performance the company has maintained its commitment to raising its dividend on a regular basis over the past decade. The current dividend yield of 5.60% makes it an attractive option for investors looking for a reliable yield with future growth.

Conclusion

Intel’s stock has performed poorly, there’s no question about that. While the Dow Jones Industrial Average Index (DJI) is down over 16% YTD, Intel’s decline has more than tripled that loss down nearly 51%. Whether the stock’s lower PE ratio and high dividend yield make it attractive to value/income investors depends on exactly what the investor is looking for.

I don’t see a turnaround in Intel’s stock price coming anytime soon. The company will report its Q3 earnings next week and I don’t expect there to be anything in that report that will help offset the current challenges Intel faces (slowing demand, extending supply chain challenges, customer inventory reductions, etc.). I’m actually bearish on the stock market in general in the near term and for a company with the struggles of Intel, I believe the declines in stock price will continue into 2023. For this reason, I would suggest short-term investors avoid this stock. I would suggest current owners of Intel to hold the stock, collect the dividend, and wait for the turnaround that may be a few years away.

However, for long-term investors that are willing to hold onto the stock for five years or longer, perhaps in a retirement account, I do think Intel is worth considering based on whether or not you want to try and time the market. While I don’t expect near-term price appreciation for Intel, that could change with an overall bull market, which I don’t try to predict. Either way, I do expect long-term investors (5 years or longer) to see price appreciation from Intel in the long run as the company executes its strategic partnerships with MediaTek (OTCPK:MDTKF), Meta (META), AWS (AMZN), NVIDIA (NVDA), and others. In addition to these partnerships, I do believe that the passage of the CHIPS Act will also add to Intel’s long-term returns as it aids in Intel’s new factories set to open in 2025.

Be the first to comment