Olemedia

Piedmont Lithium (NASDAQ:PLL) reports a considerable amount of probable reserves and interesting lithium projects in Ghana, Quebec, and the U.S. In my view, with sufficient investment in exploration and measurement of reserves, I believe that there is an upside potential in the stock valuation. With that, the company still needs a lot of permits, and much more financing will be necessary. In my view, it is a stock to be followed by non conservative stock pickers.

Piedmont Lithium

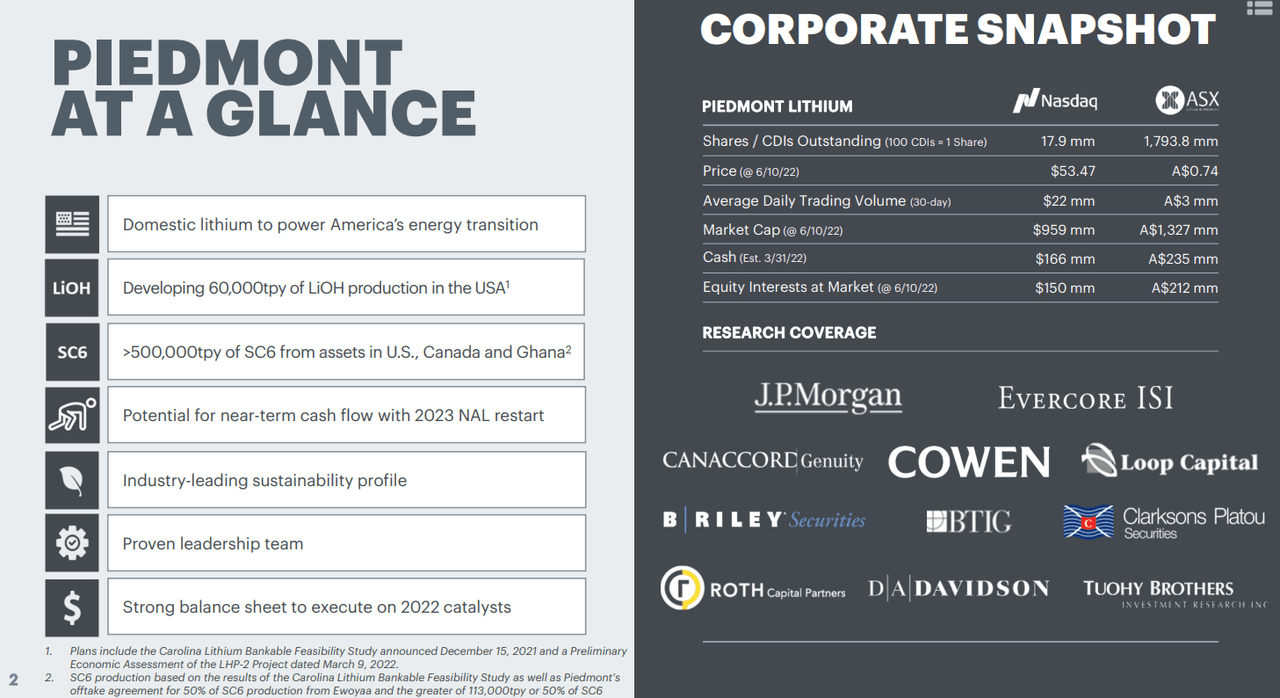

Piedmont Lithium runs multi-asset lithium businesses to sustain the revolution commenced by the electric vehicle. Considering the number of financial institutions covering the stock, I believe that most investors will take the company’s expectations and production figures very seriously.

June 2022 Presentation

I believe that the company’s flagship project in Carolina did most likely interest the investment community because of its easy access to road and rail infrastructure. Besides, the project is located close to a historical lithium district. These are, in my view, powerful reasons to conduct research about mining projects. With that, in my view, most investors will most likely disagree on the valuation assessment. My financial models indicated that Piedmont Lithium is an interesting investment for optimistic individuals.

Sum Of The Parts Under My Base Case Results In A Valuation Of $134 Per Share

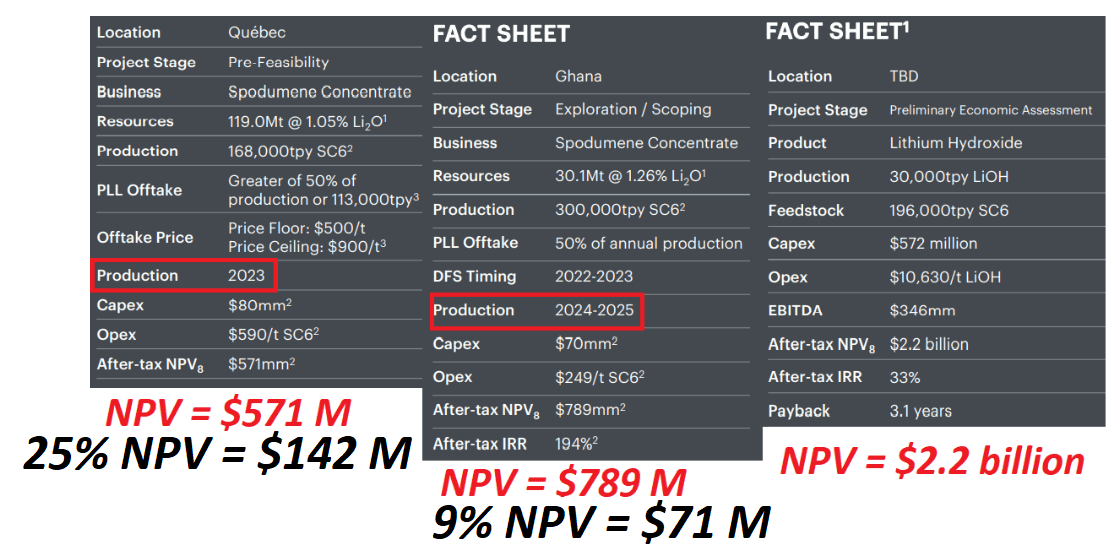

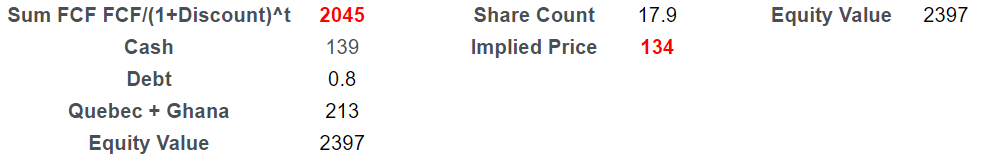

Piedmont Lithium reports interests in Quebec, Ghana, and the United States. According to a presentation distributed in June, the company’s project in Quebec has a net present value close to $517 million. However, considering that Piedmont holds a 25% interest in the project, in my view, Piedmont’s interest may be worth close to $142 million.

Management also acquired an exploration stage project in Ghana with a valuation of close to $789 million. Applying the interest in the project of 9%, the interest should be worth approximately $71 million. I used these numbers for the total valuation of the company under my base case scenario.

June 2022 Presentation

June 2022 Presentation

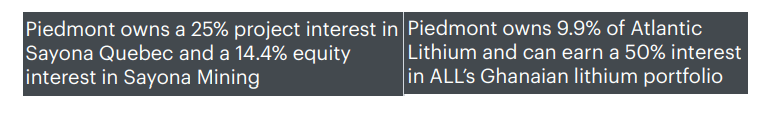

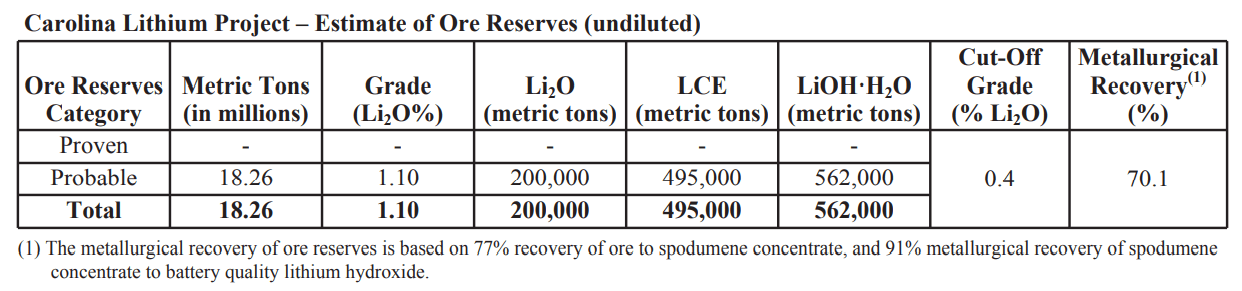

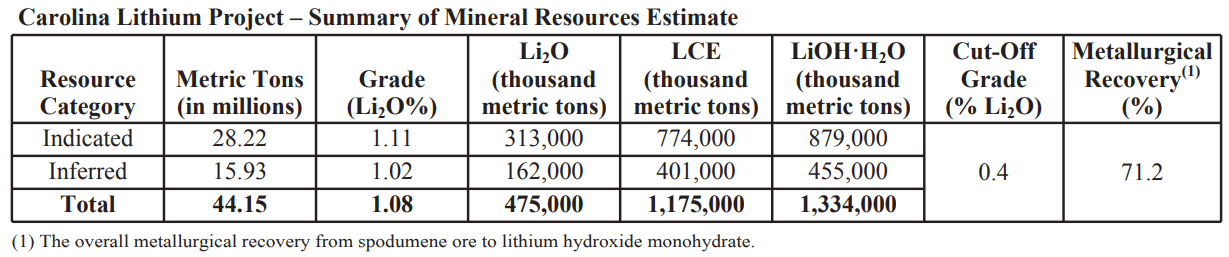

The lithium project in the United States is Piedmont’s largest investment, so I took longer to assess it. The company believes to have an estimated probable reserves of 18.26 million tons with a grade of 1.1%. Management still needs to do a lot of work to measure the reserves. As of today, the company only reports indicated and inferred resources. Many investors may not invest in the company because of the necessary work to be done to assess the reserves.

10-k

10-k

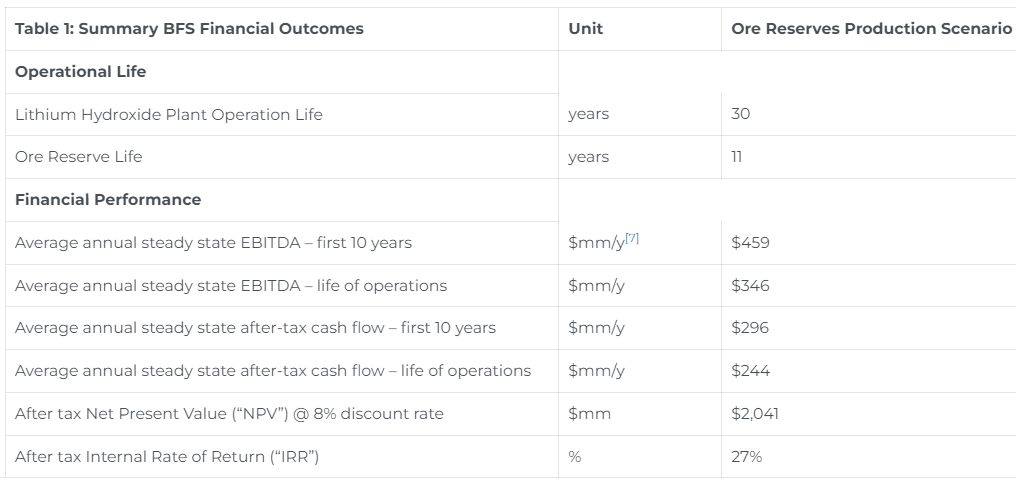

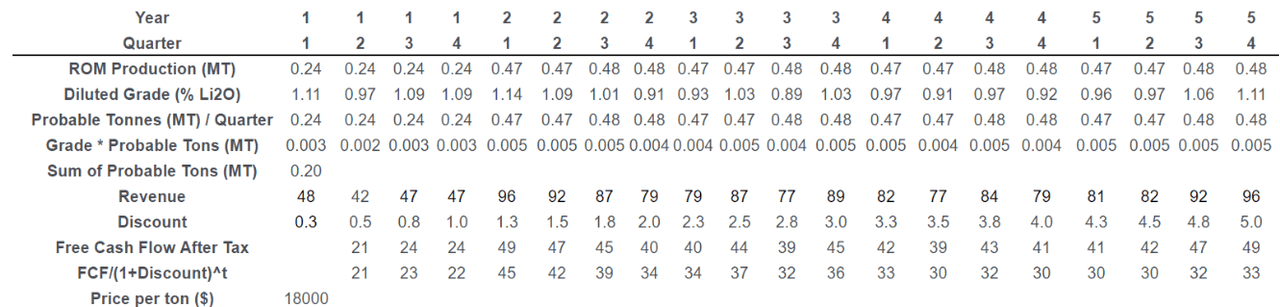

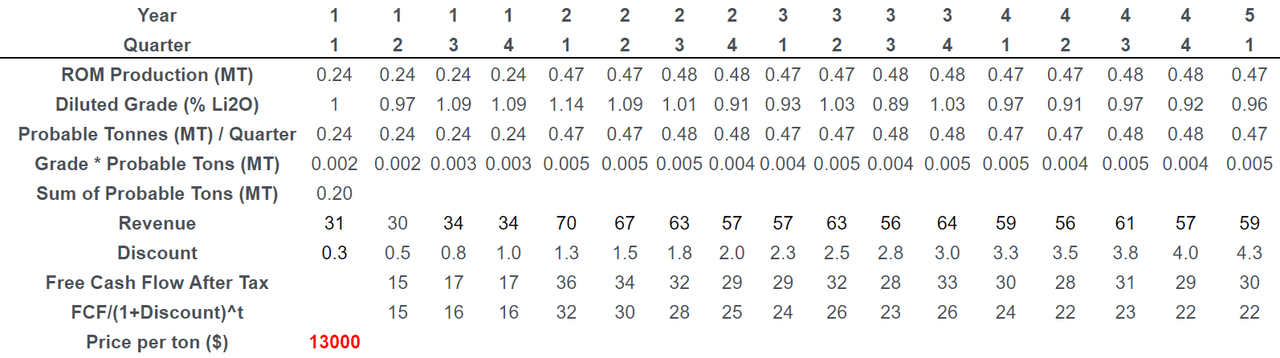

For the valuation of the project, I used a price of $18k per ton of lithium and operations for about 30 years. I included ore reserve life of 11 years and 30 years of plant operation life. My numbers are close to the figures reported by Piedmont in the technical report. Let’s note that the company announced a net present value, for the whole project, of $2.04 billion.

The BFS assumes a fixed price of $18,000/t for battery quality lithium hydroxide and $900/t for spodumene concentrate (SC6). Source: Technical Report

Technical Report

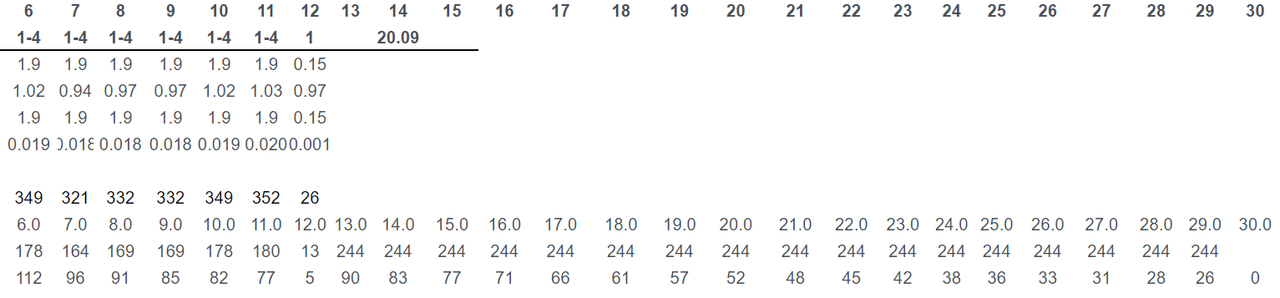

For the first 11 years, I assumed between 0.24 million lithium tons and 0.48 million lithium tons produced per quarter. Revenue would grow from $48 million per quarter to 96 million per quarter in the fifth year. From year 11 to year 30, the company would produce after tax cash flow of $244 million, which is close to the assumption made by Piedmont Lithium.

Now, by summing everything with a discount of 8% and adding cash of $139 million and $213 million from Ghana and Quebec, I obtained an implied valuation of $2.39 billion and a share price of $134 per share. Let’s note that I am assuming that the company will deliver positive cash flow from year 1 to year 30.

Author’s Work

Author’s Work

Author’s Work

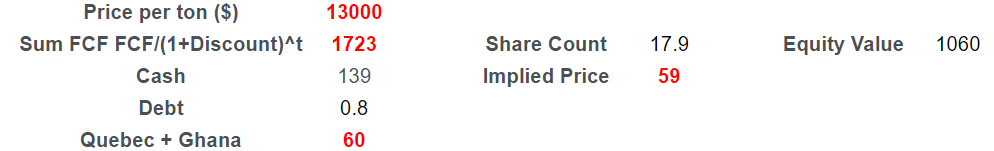

Under Bearish Conditions, I Obtained A Valuation Of $59 Per Share

Very conservative individuals may not use the net present value to assess the valuation of the projects in Ghana and Quebec. In the last annual report, Piedmont Lithium reported investments worth $44 million in Quebec. Besides, Piedmont Lithium paid $16 million for its investments in Ghana, and expects to pay a total of $87 million. A very conservative investor would value these two stakes at $60 million.

On August 31, 2021, we paid approximately $16.0 million to acquire an equity interest of approximately 10% in Atlantic Lithium. Additionally, we entered into a long-term supply agreement for spodumene concentrate, whereby we have the ability to acquire a 50% equity interest in Atlantic Lithium Ghana, through future staged payments totaling approximately $87.0 million in two phases over a period of three to four years. Source: 10-k

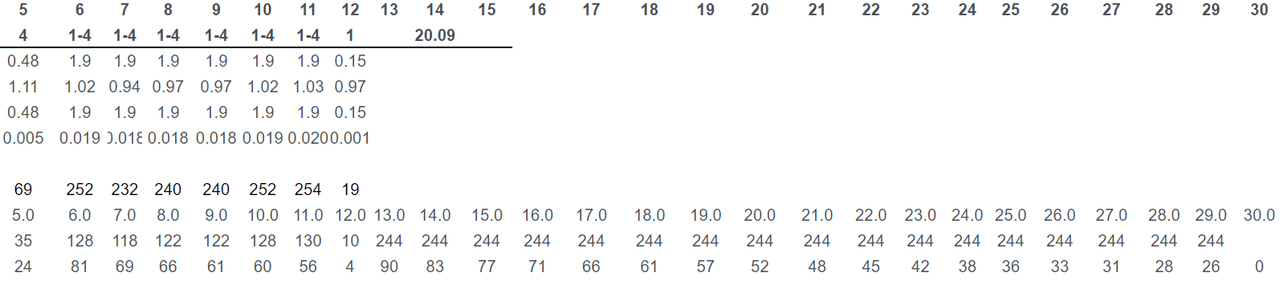

Most of the reserves reported by Piedmont Lithium are probable reserves, which means that there is between 50% and 90% probability of recovery. Hence, under this case scenario, I assumed that the company would recover 50% of its probable reserves.

Probable reserves are those with the likelihood of recovery for between possible and proved reserves, or over 50-percent but under 90-percent. Source: Probable Reserves Definition

I also assumed $13k per ton, 1% grade of lithium, a discount of 8%, and a valuation of $60 million for the interests in Ghana and Quebec. My results include an equity value of $1 billion and a fair valuation of $59 per share.

Author’s Work

Author’s Work

Author’s Work

Balance Sheet: Piedmont Lithium Needs More Cash

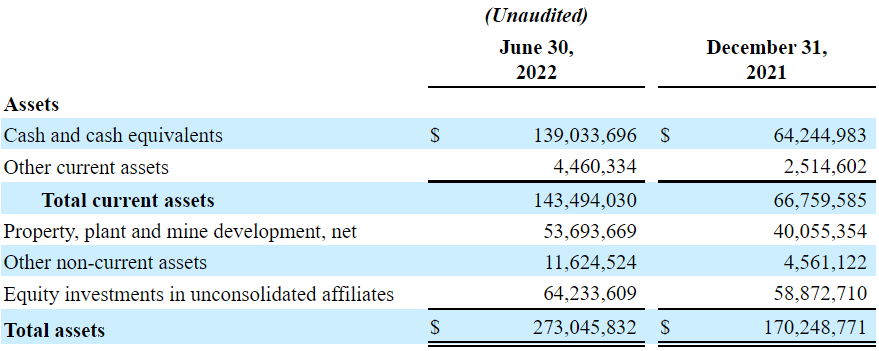

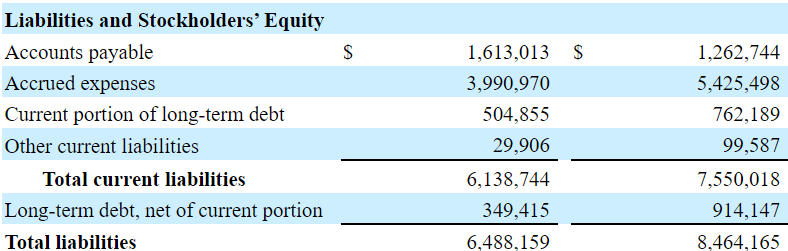

As of June 30, 2022, the company reported $139 million in cash, $273 million in total assets, and $6 million in total liabilities. As mentioned, mine development is still not worth much because the company has to invest more money in exploration and development.

10-Q

With that, it is very beneficial that the company does not report a lot of long-term debt. In my view, financial institutions will likely provide financing in the near future. Keep in mind that Piedmont already found a vehicle manufacturer, and reached a sales agreement with it.

On September 28, 2020, we entered into a sales agreement with a vehicle manufacturer to provide spodumene concentrate to the Buyer. Source: 10-k

10-Q

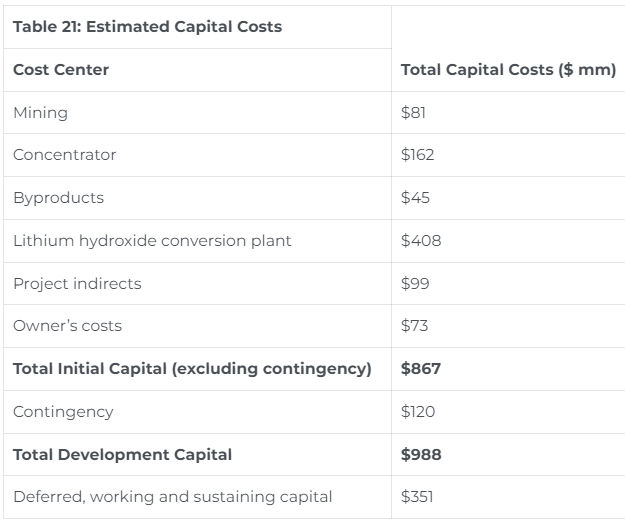

With that about the total amount of liquidity in hand, let’s note that Piedmont Lithium needs a substantial amount of liquidity in order to produce lithium in the United States. According to the technical report, Piedmont Lithium needs more than $900 million for the conversion plant, the mine, the concentrator, and the rest of the project.

Technical Report

New Contracts With Clients, More Financing, Permits, and More Measured Reserves Will Likely Push The Valuation Up

I believe that the company’s stock price will likely reach more reasonable levels once management signs more agreements with buyers of lithium. According to the annual report, Piedmont continues to make substantial efforts under a defined marketing and sales strategy:

We continue to develop a marketing and sales strategy that includes production from our Carolina Lithium Project as well as our other lithium projects. Based on historical and current production in the Carolina Tin-Spodumene Belt and other demand by producers in North Carolina, we anticipate producing battery-grade lithium hydroxide, spodumene concentrate, and certain other byproducts including quartz, feldspar, and mica, all of which may be used by the global electric vehicle, energy storage and construction materials markets. Source: 10-k

Once Piedmont reports a sufficient number of clients, both financial institutions and banks will most likely offer cheap financing. With fresh money, management could finance further exploration to define the resources as well as to calculate the amount of measured reserves.

Finally, I believe that Piedmont’s stock price will trend higher as the company receives additional permits for further exploration and development. In the last annual report, the company disclosed a significant number of permits necessary to run further operations.

We may require additional permits for our Carolina Lithium Project including, but not limited to, an NCG01 General Stormwater Permit for stormwater discharges from construction activities issued by DEMLR, an Individual Stormwater Permit for mine dewatering issued by DEMLR, a road abandonment approved by the North Carolina Department of Transportation and Gaston County under North Carolina General Statute 136-63, an Encroachment Permit for an at-grade rail crossing issued by NCDOT, various driveway permits issued by NCDOT, a Gaston County Watershed Permit approved by Gaston County Planning, various building permits approved by Gaston County Planning, explosives permits approved by the Bureau of Alcohol, Tobacco, and Firearms, and Hazardous Chemical Permits issued by Gaston County Fire Officials. Source: 10-k

Risk Factors Would Include Failed Geological Model, Lower Production than Expected, Or New Environmental Laws

Piedmont is still at the development stage, so in my view, the most serious risk is a failed geological model, or failed production estimates. Under the worst case scenario, the amount of proven reserves would be lower than expected. Analysts would most likely decrease their production expectations, and free cash flow expectations would decline too. Finally, the stock price could fall.

Piedmont Lithium’s business model would also suffer significantly if new environmental laws change the way mining is conducted in the United States. As a result, the company may modify its feasibility plan, and the project may not be profitable. The worst outcome would create significant value destruction for shareholders.

Conclusion

Piedmont Lithium could see its stock price creep up to $134 per share with sufficient investment in exploration and measurement of its reserves. If Piedmont increases its proven reserves, obtains sufficient permits, and signs new agreements, stock demand will likely push the stock price higher. With that, I obviously see risks from new environmental regulations and failed production estimates, so most ultra conservative investors will pass on this name.

Be the first to comment