RHJ

Uranium Royalty Corp. (NASDAQ:UROY) is trying to bring the royalty and streaming model, which has been successful in other commodities, into the uranium space. Being a first mover into a particular business segment could prove to be an advantage, but on the other hand, the first years are usually challenging. As such, UROY is yet to start receiving meaningful revenues from its existing agreements, and there’s uncertainty about when that will happen with some projects. The ones that are in production, don’t appear to have the potential to bring significant cash, either. While the 1.5Mlbs of U3O8 on the balance sheet gives a direct link to uranium prices, their market value is only a fraction of the EV. Overall, I think that given the current stage of the business development, UROY is not the best way to get uranium exposure.

Company overview

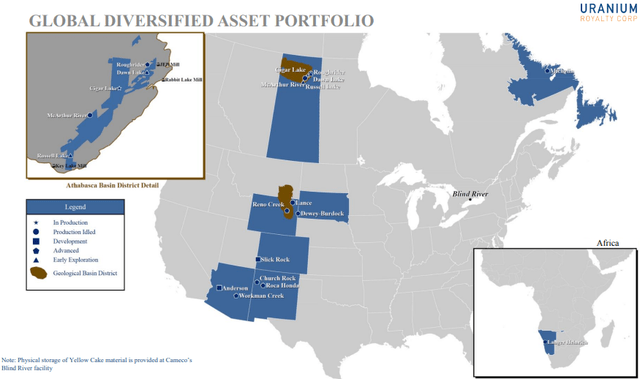

Registered in Canada, Uranium Royalty Corp. brands itself as the only pure-play uranium royalty. Its portfolio is primarily focused on North America, betting on a domestically powered nuclear renaissance on the continent. There’s one agreement outside NA – a deal with Paladin Energy (OTCQX:PALAF) for its Langer Heinrich project in Namibia.

UROY also holds 1,548,068 lbs of uranium on its books, which at current market prices has a market value of US$78M. The company also has short-term investments, which are mostly comprised of 7M shares of Yellow Cake (OTCQX:YLLXF), which are worth around US$35M at current market prices.

Capital structure

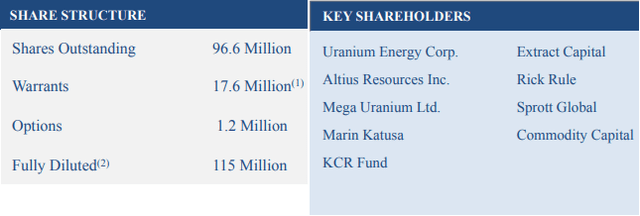

As of 31 July, the capital structure consists of 96.6M shares, 17.6M warrants with 17.5M of them listed with an exercise price of US$2.00 and an expiration date of 6 December 2024. The 1.2M options have a weighted average exercise price of US$3.50, which is currently out of the money.

Regarding potential dilution in the future, UROY has recently renewed its ATM equity program and issued shares up to an amount of US$40M, which at current prices would be 13-14M new shares.

Portfolio overview

Since UROY markets itself as a royalty company, it makes sense to give a closer look at their agreements. Currently, the company’s portfolio consists of 15 deals for 14 different projects.

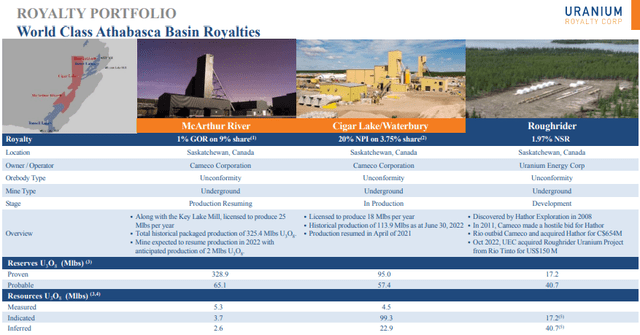

However, most projects are still in development and given the expected cost pressure over the initially estimated construction CAPEX as well as tough permitting process in NA, the timing of the cash flows from these projects is uncertain. Two of the projects – McArthur River and Cigar Lake are currently in production.

The royalty agreement at McArthur River is structured as 1% GORR (gross overriding royalties) on 9.063% share of total production, which implies that UROY won’t be affected by fluctuations in operating costs. The project, operated by Cameco (CCJ), has been on a care and maintenance for some time, due to low uranium prices, but now is being transitioned back to operation and is expected to produce 2Mlbs of uranium concentrate in 2022 and to reach a rate of 15Mlbs in 2024 onwards. In that regard, a few days ago, UROY announced that it will receive its share of production for 2022 in physical form, instead of cash. Assuming that the projected extraction rate is reached, UROY’s interest under the agreement will be 15M*9.063%*1%*US$50 or slightly below 13.6klbs annually, which at current uranium prices of US$50/lbs is about US$680k. Of course, many investors, myself included, expect higher U3O8 prices, so the cash, attributable to UROY from this agreement, could go towards US$1M in case of US$75/lbs.

UROY’s flagship agreements (UROY)

The royalty agreement at the Cigar Lake/Waterbury project is structured as 10-20% NPI (net profit interest) at 3.75% share of total production. This type of deal implies that UROY will not be protected from a rise in production costs and makes calculations for cash flows even more difficult. The project is licensed for a production rate of 18Mlbs of uranium concentrate per annum, but Cameco intends to extract around 13.5Mlbs. Also, when total production since inception from the project (currently at 114Mlbs) reaches 200Mlbs, the NPI of UROY will drop from 20% to 10%. At projected production rates, this could happen in a 6-7 year time frame. But for calculation purposes, I’ll stick with 20%. Unfortunately, I wasn’t able to find the current NPI of the project, so I’ll assume it’s around US$15, which may be optimistic. The annual cash proceeds from the agreement should be around 13.5M*3.75%*20%*US$15 or around US$1.5M, which could drop by half after 6-7 years. Note that there’s one more caveat to this agreement – although already in production, it will start making payments to UROY only after the development costs of the project are exhausted.

UROY also has royalty agreements for two past producing projects – Langer Heinrich and Lance. The operator of the former – Paladin Energy intends to resume production in 2024 and has raised the necessary fund to do so. For that project, UROY has a PR (production royalty) at a fixed rate at AU$0.12/kg. The measured, inferred and indicated resources of the project are around 128Mlbs, which translates into 58Mkg, which should bring around AU$7M for the life of mine, which is below US$5M at the current FX rate. The other project – Lance will likely be put back into production soon, but since UROY’s interest there comprises of two separate agreements, which are not related to the entire project, I’ll refrain from calculating any proceeds and just take it at face value.

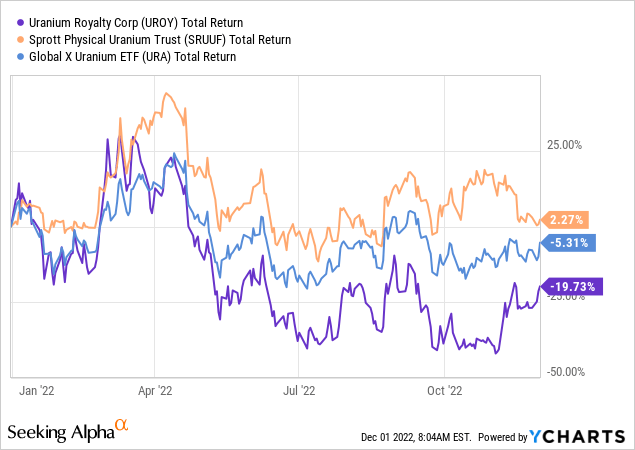

Share price and valuation

Looking at YTD performance, UROY is down 19.7% and has been outperformed by both the Sprott Physical Uranium Trust (OTCPK:SRUUF) and the Global X Uranium ETF (URA). The current EV of UROY, taking into account cash and equivalents, as well as the uranium inventory and the investment in Yellow Cake is around US$175M, which should be derived from the royalty agreements.

Even though it may be optimistic, I’ll assign 25x expected cash flow value of the two producing agreements – which puts the one for McArthur River at US$17M and the one for Cigar Lake at US$37.5M. For the value of Langer Heinrich, I’ll use the above calculated US$5M, while the remaining projects will be taken at book value, although some of them may never end up in production. As of 31 July, the rest of the royalty portfolio is carried at CAD$24.9M, which is roughly US$19M. So the combined estimated value of the portfolio comes at US$78.5M. Even if I double this estimation, it’s below the US175M implied by the current EV.

Risks

Cash flow uncertainty risk

The royalty business model is low-risk by design. However, that would be true if the majority of agreements are cash flow producing. This is not the case with UROY. There’s an uncertainty whether and when some of the agreements will start generating revenue, especially considering the lengthy permitting processes in NA.

Uranium price risk

Obviously, UROY is exposed to the price of uranium, so a downward move will impact the company negatively, as it will lower the value of the inventory holdings and also could jeopardize the path to production of some of the projects in the portfolio. However, I don’t think that the chances for a meaningful decline in uranium prices are high. On the contrary, I expect an upward move in U3O8 prices, as the reality that nuclear energy is both clean and reliable will begin setting in amidst an ongoing energy crisis. In that case, UROY may appreciate, but given my estimates of the value of the royalties portfolio, it has some room to grow before surpassing the EV. Also, uranium equities and even the Sprott Physical Uranium Trust may do better in such cases, given that UROY is far away from receiving cash flows from most of its holdings.

Conclusion

It seems like the current valuation of UROY has gotten a little ahead of itself, while uncertainty around the cash flows timing remains. However, as I’m generally bullish on uranium, I won’t consider the stock a sell and will rather stay away from it. Instead, I think investors could look elsewhere for uranium exposure either through an instrument tracking the commodity itself or equities of producers/developers/explorers.

Be the first to comment