JimVallee

Investing in precious metals always comes hand in hand with a number of misconceptions that ultimately result in disappointment. That is also the reason why many retail investors are now shunning gold as an investment.

Investing in gold should not come as a result of certain expectations, i.e., interest rates would go down, geopolitical risks will accelerate, inflation will skyrocket, etc. Instead, the precious metal is primarily used as a hedge to certain asset classes and ultimately as an insurance against risks related to the global monetary regime.

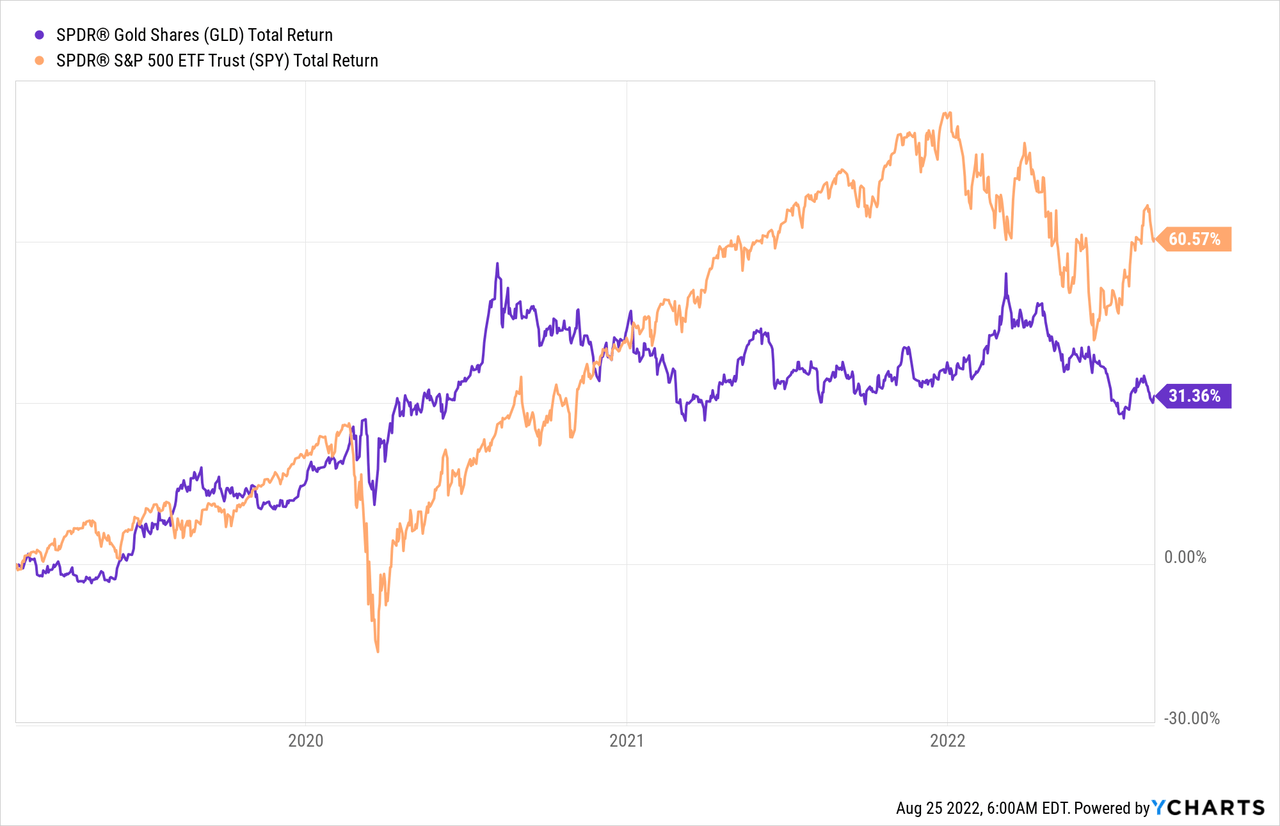

Since February 2019, when I first covered my reasons for owning gold, the SPDR Gold Trust ETF (NYSEARCA:GLD) returned roughly 31%. Although this was lower than the broader equity market, the GLD significantly reduced overall variance of a well-diversified equity portfolio (more on that here).

Hence, if one was holding the GLD through this period in order to maximize returns, he/she would have been disappointed. On the contrary, however, if the objective is risk reduction while also not sacrificing returns, then GLD has been an excellent addition to an all-equity portfolio.

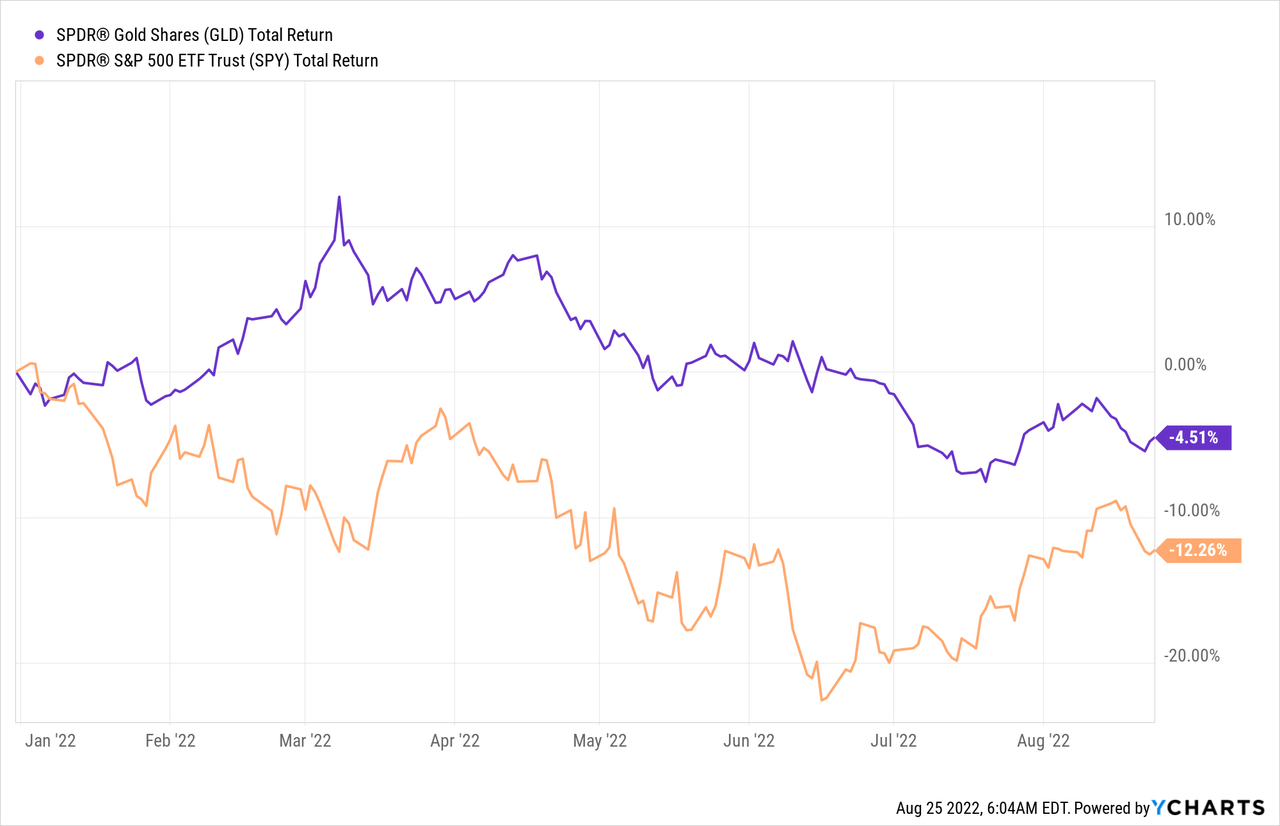

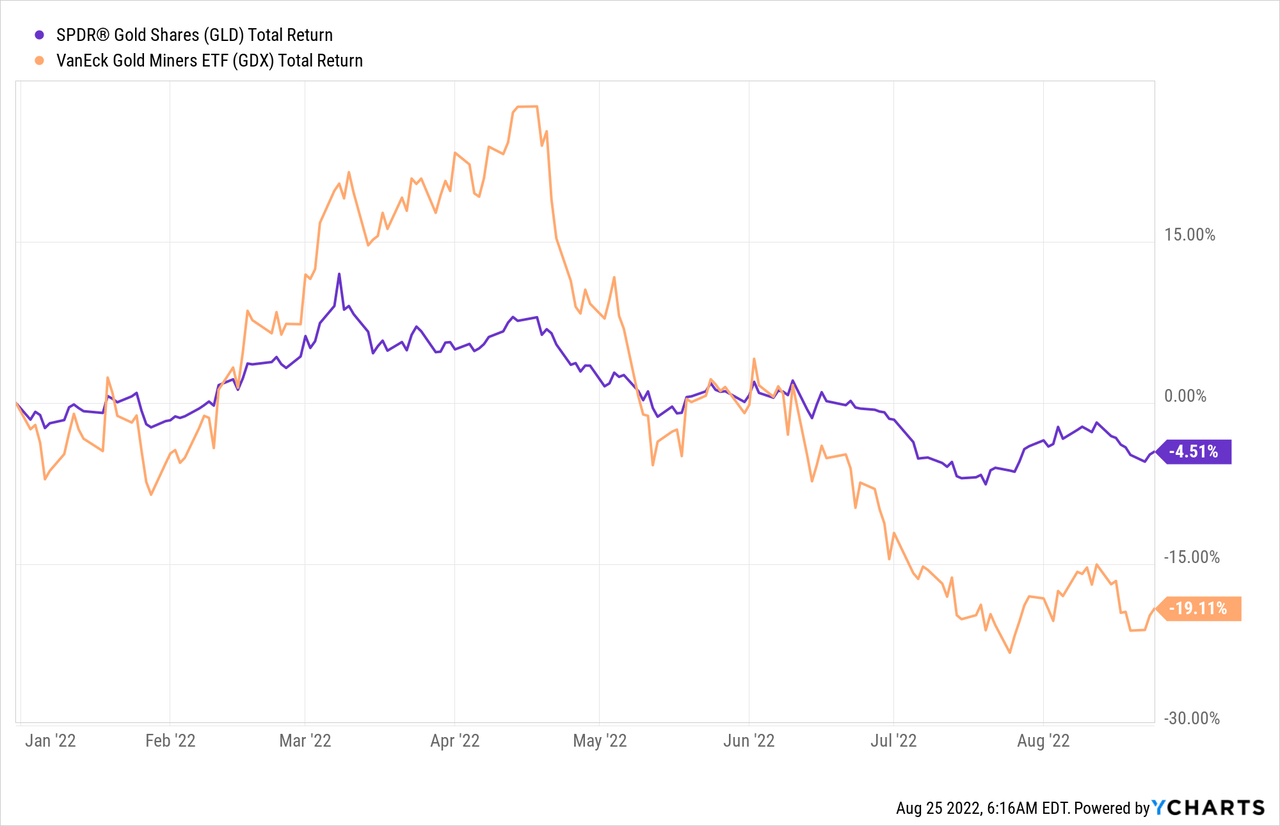

Even as the market was falling steeply for most of this year, the GLD held strong and has declined by less than 5% year to date.

It is important to recognize that we are talking about exposure to the price of gold through the GLD and not about gold mining stocks, which are far more speculative and do not possess the risk-reduction qualities to the extent that gold has.

Don’t Fall Victim To Narratives

Another pitfall that investors are often falling to is the narrative that real interest rates should increase, and with that, the price of gold should collapse due to the supposedly inverse relationship between the two.

To begin with, the inverse relationship between the price of gold and real interest rates is far from stable over the long term and could even turn positive at times. To learn more on this topic, you can read my thought piece called – ‘Gold And Real Rates – The Narrative Bias‘.

Even more importantly, however, the strongest movements in the price of gold were not driven by real interest rates, as opposed to growing risks and uncertainties around the prevailing monetary system (more on that here and here).

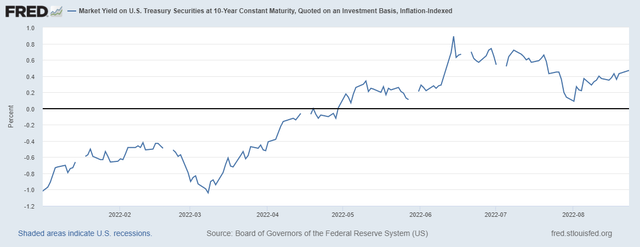

Having said all that, we should not be surprised that even though rates on the U.S. Treasury Inflation-Protected Securities have skyrocketed in recent months, the price of gold has remained relatively stable.

Even if we calculate the real interest rates by subtracting the current rate of inflation from the prevailing bond yields on the long-end of the curve, we still cannot explain the recent movements in the price of the yellow metal.

The reason being that we are currently undergoing an unprecedented period for the existing monetary system. The level of fiscal and monetary intervention into the market is also reaching unsustainable levels and with that speculations about a major paradigm shift are growing.

In addition to the countless unconventional policies adopted recently, pricing of most asset classes is also a clear sign that the current monetary regime is ripe for a change. For example, the equity market seems to have disconnected with fundamentals as it skyrocketed following the pandemic lockdowns in the spring of 2020 while economic fundamentals worsened. With that, bond yields fell to near zero and the Shiller P/E ratio reached its second-highest level ever recorded.

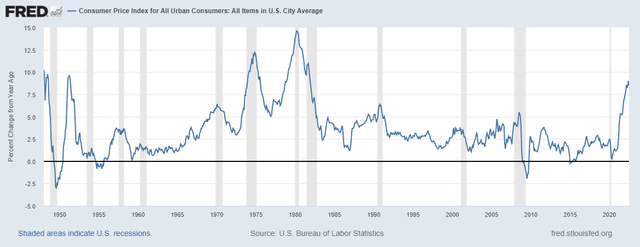

However, as we now face significant deglobalization trends, inflationary pressures are likely to remain elevated and with that risks for the monetary regime are growing. As we see in the graph below, the current change of the CPI is flirting with the previous highs during the 1970s and early 1980s.

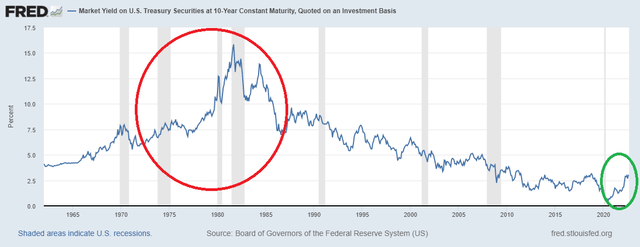

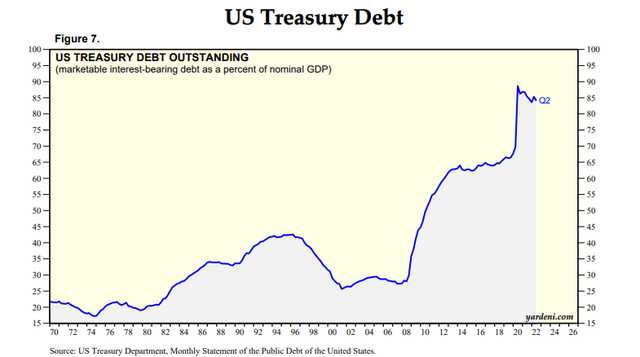

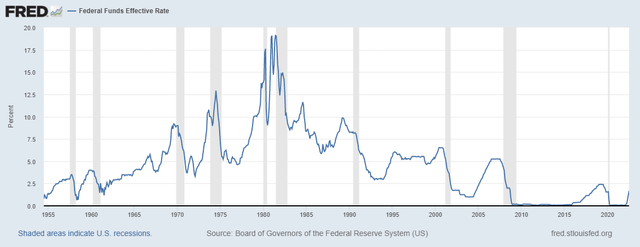

As we see below, during the 1970s-1980s period bond yields skyrocketed, but due to the current level of U.S. Treasury Debt to GDP, this was not allowed this time around.

What came as a result is an overpriced bond market that is almost entirely dependent on the decisions made at the Federal Reserve. But this development wasn’t limited to the fixed income market.

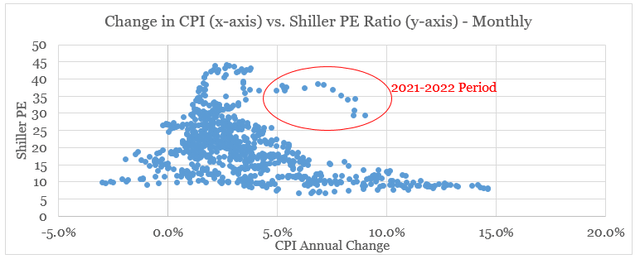

In the graph below, on the x-axis, we have plotted the annual changes to the Consumer Price Index on a monthly basis since 1948. On the y-axis, we have the Shiller P/E ratio for the respective month.

Prepared by the author, using data from FRED and multpl.com

What we notice is that neither very high nor negative changes to the CPI are supportive for the equity market as businesses suffer both through high inflationary and deflationary periods. What is striking here, however, is that current equity valuations are extremely elevated when accounting for the high inflation.

If history is any guide, in order for equity valuations to remain stable, inflation should rapidly come down in the coming months. This could prove to be the case in the short-run, but inflation will most likely remain elevated as deglobalization intensifies.

On the other hand, earnings could decline (thus reducing the Shiller P/E), if the current recession becomes deeper than currently expected. The problem with this scenario is that in such an event monetary authorities would be forced to once again intervene but their efforts will be limited by the low level of the Fed fund’s rate and the bloated balance sheet.

Ultimately this will require another new and unconventional policy response which will only add more pressure to the restart of the existing monetary regime.

Conclusion

If maximizing short-term returns is your goal, then for most of the time gold will lead to disappointing results. The precious metal, however, has been an excellent addition to an all-equity portfolio from an overall risk-reduction point of view. As retail investors tend to succumb to speculative narratives, such as the risk of rising real interest rates, gold is also a good store of value as the monetary system faces ever higher risks of a tumultuous restart.

Be the first to comment