StockPhotoAstur

Thesis

Leading independent oil refinery company Phillips 66 (NYSE:PSX) has seen its stock recover remarkably from its September lows. Crack spreads have improved markedly from their August pessimistic lows, while gasoline futures held their August levels.

Despite the strength in PSX over the past month, we assess that the industry’s earnings estimates looked too optimistic as we head into a global recession. Therefore, we believe that the market has not re-rated PSX, as Phillips 66 and its peers could be subjected to significant estimates cuts moving ahead, as the industry is certainly not immune to a recession.

Hence, we explain why we don’t encourage investors to add now. While Phillips 66’s revised revenue and earnings growth estimates have likely reflected normalization, given FY22’s massive recovery, we urge investors to continue biding their time. Moreover, our assessment of its price action suggests that PSX would likely continue to face significant selling pressure at its June highs. As such, the reward-to-risk profile seems unattractive at the current levels.

Also, the recent sharp rally from its September lows appeared to have reflected the optimism from the recovery in crack spreads and gasoline futures. Hence, we believe it’s appropriate for investors sitting on massive gains from its COVID lows to cut exposure and wait for panic selling to occur first before returning to add more positions.

Phillips 66: Expect Slower Growth Through FY23

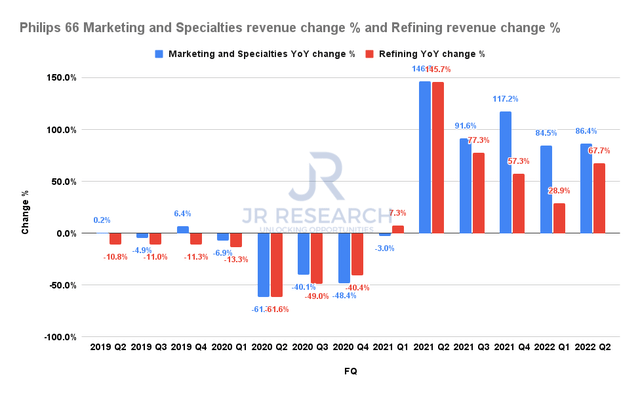

Phillips 66 M&S revenue change and Refining revenue change % (Company filings)

Phillips 66 has continued to post solid revenue growth momentum through FQ2, with its leading revenue segments experiencing broad-based growth. As a reminder, Marketing and Specialties delivered revenue growth of 86.4% in Q2, up from Q1’s 84.5%. Refining posted revenue growth of 67.7%, stemming the downward normalization through Q1.

Hence, investors should keenly watch Phillips 66’s upcoming FQ3 earnings release on November 1 to assess its momentum.

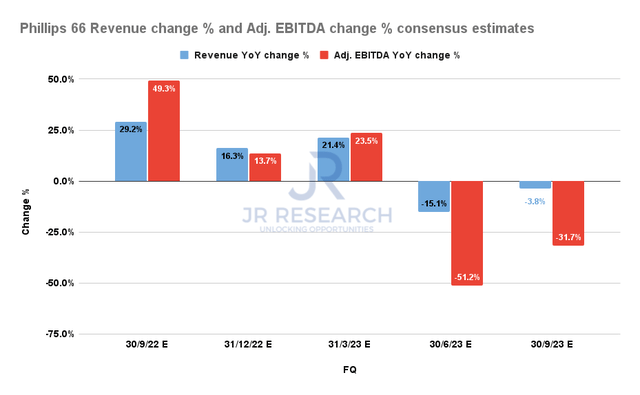

Phillips 66 Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

However, investors may need to be prepared for a much slower quarter for Q3, as even the bullish consensus estimates suggest revenue growth of just 29%. Its adjusted EBITDA growth is also projected to fall to 49.3% for FQ3.

Importantly, Phillips 66’s growth cadence is expected to slow through FY23, potentially even declining in Q2’23. Hence, we believe the market had not re-rated PSX despite its seemingly low valuations in anticipation of a less remarkable FY23 performance. In other words, the market has likely priced in peak growth for PSX and its industry for FY22.

Therefore, the critical question is whether the consensus estimates have reflected the execution risks of a recession through 2023.

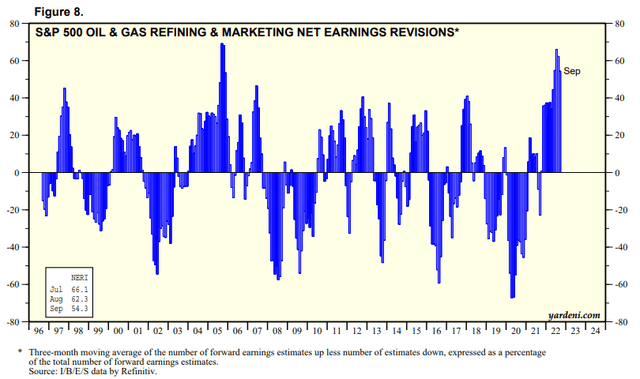

S&P 500 Oil & Gas Refining & Marketing industry net earnings revisions % (Yardeni Research, Refinitiv)

As seen above, the industry analysts steadily raised their estimates through September. However, past experiences of recessions should inform PSX investors that Phillips 66 and its peers are not immune. Furthermore, the specter of a worse-than-expected recession should not be ruled out, which could lead to significant estimates cuts, given the Street’s over-optimism.

The revised estimates suggest that analysts project the industry earnings to fall by 38.4% in 2023. PSX analysts have also penciled in a 35% YoY decline in Phillips 66 adjusted EPS for FY23. Therefore, analysts have not marked down PSX’s earnings estimates ahead of its peers, suggesting that it would not be immune to further cuts, forcing value compression.

Is PSX Stock A Buy, Sell, Or Hold?

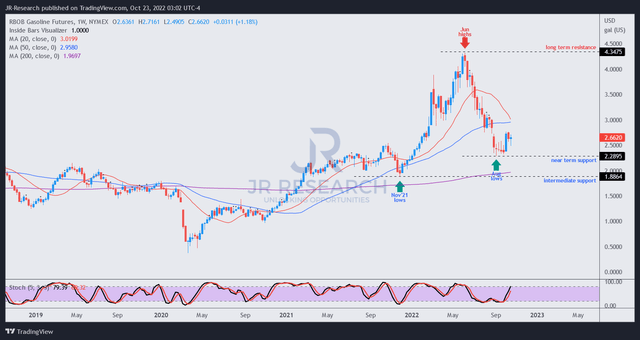

RBOB gasoline futures price chart (weekly) (TradingView)

We noted that RBOB gasoline futures (RB1) have attempted to bottom following a steep fall to their August lows. Therefore, we assess that RB1 should be consolidating along its near-term support but is unlikely to regain its June highs.

We gleaned that RB1 has already lost its medium-term bullish bias and looks unlikely to retake its critical 50-week moving average (blue line). We deduce that the sellers have taken the initiative decisively, leveraging its Augusts lows to draw in buyers.

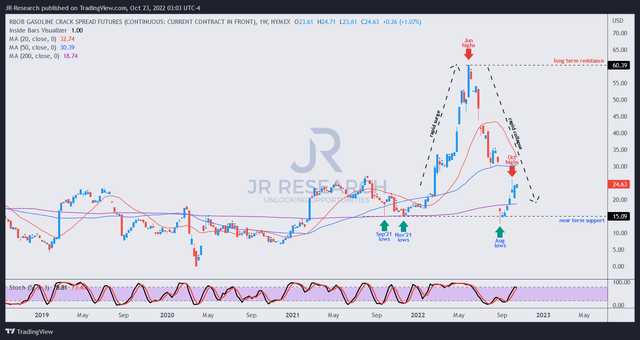

RBOB gasoline crack spread price chart (weekly) (TradingView)

Also, its crack spread (ARE1) has bottomed in line with its underlying gasoline futures. Notwithstanding, we also gleaned that ARE1 is unlikely to regain its June highs as we head closer to a recession. Therefore, Phillips 66’s profitability margins could peak in FY22, and investors need to be ready for a marked normalization through FY23.

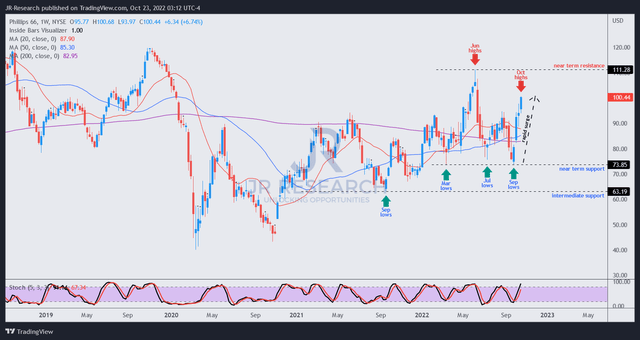

PSX price chart (weekly) (TradingView)

Despite that, PSX recovered remarkably from its September lows, gaining nearly 36% through its October highs. However, we gleaned that the rapid surge is not sustainable. Instead, it appears that the market could have drawn in buyers rapidly, as these overly-optimistic PSX bulls could be betting on regaining its June highs.

However, as we explained earlier, the underlying markets do not support such a move. Furthermore, the potential for a worse-than-expected recession could put further pressure on estimates cuts, which could put more selling pressure on PSX’s forward momentum at these levels.

Hence, we assess that the reward-to-risk profile is not attractive at these levels, even though PSX last traded at an NTM normalized P/E of 6.86x, below its industry peers’ average of 8.83x.

We urge investors sitting on massive gains to consider cutting exposure and wait for a steeper fall before re-entering their positions.

As such, we rate PSX a Sell.

Be the first to comment