M. Suhail

Thesis

Given a highly challenging macro-economic environment, I argue there is a case to be made for investing in quality companies – whereby I define quality as a business’ ability to capture steady revenue growth, above-industry median profit margins, and long-term value accumulation.

In my opinion, Home Depot (NYSE:HD) offers investors exposure to the above-described quality dimensions. Moreover, valued at a one-year forward EV/EBIT of about x13.5, the opportunity is not unreasonably expensive. In fact, according to my valuation model, HD stock should be fairly priced at around $321.92/share. I initiate with a ‘Buy’ recommendation.

About Home Depot

Home Depot, Inc. is the world’s largest retailer for ‘home improvement’ shopping. As of December 31 2021, the company operated 2,317 US-based stores that sell a broad portfolio of building materials, home improvement articles, lawn and garden products, and décor products – and customers have also the option to rent, instead of buy, certain tool and equipment rental services. Moreover, Home Depot also sells services relating to facilities maintenance, repair, and operations products, as well as various installation services.

Steady Value Accumulation

Making reference to Home Depot’s financials, it is easy to see why I like to define Home Depot as a quality business. The company has an excellent track-record of steady revenue growth and value accumulation.

From 2013 to 2022 (TTM reference), Home Depot expanded its topline at a 10-year CAGR of about 7.5%, more than double the respective nominal GDP growth. Even more notably, over the same period Home Depot’s operating income increased at a 10.5% CAGR – highlighting well managed efficiency gains. During the past decade, there has not been one year when Home Depot reported declining revenues, or declining profitability.

For the trailing twelve months, Home Depot generated revenues of $155.2 billion and operating income of $24.0 billion. As compared to the respective period in 2021, revenues increased 2.6% and operating income increased 3%. Although the headline growth is not eye-catching, the growth is notable in context of a clearly challenging macro-economic environment.

Strong Profitability

Another strong argument that highlights Home Depot’s quality is the business’ ability to capture strong profitability margins – which are generally considered as a clear indication of efficient management and strong competitive moat.

Home Depot’s EBIT margin and net income margin are almost 100% above the industry median, while the company’s capital efficiency ratio – return on assets – is 373% above the industry (TTM reference).

Seeking Alpha

Look Beyond The Fear

Investors are arguably pricing in a recession-driven earnings contraction for Home Depot. For reference, Home Depot stock is down about 33% year to date, versus a loss of 22% for the S&P 500 (SPY).

Seeking Alpha

But speculations about a slowing business environment for Home Depot might be excessive. In Q2 2022, HD’s CEO Ted Decker commented: (emphasis added)

In the second quarter, we delivered the highest quarterly sales and earnings in our company’s history …

… Our performance reflects continued strength in demand for home improvement projects. Our team has done a fantastic job serving our customers, while continuing to navigate a challenging and dynamic environment …

While other companies including FedEx, Walmart and Ford issued a profit warning, Home Depot affirmed financial guidance for 2022.

- Total sales growth and comparable sales growth of approximately 3.0 percent

- Operating margin of approximately 15.4 percent

- Net interest expense of approximately $1.6 billion

- Tax rate of approximately 24.6 percent

- Diluted earnings-per-share-percent-growth to be mid-single digits

Attractive Valuation

Home Depot is valued attractively but approximately in line with the industry median – priced at a one year forward EV/EBIT of about x13.5. But investors should consider that multiples might not fully capture a company’s growth outlook and ‘risk’ (cost of equity). Thus, to derive a more precise estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

Residual Earnings Model

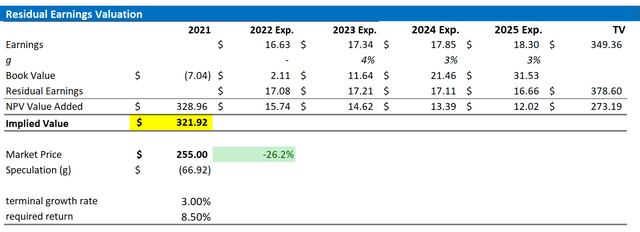

With regard to my Home Depot stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on Home Depot’s cost of equity at 8.5%.

- For the terminal growth rate after 2025, I apply 3%, which (about one percentage point higher than estimated nominal global GDP growth).

Given these assumptions, I calculate a base-case target price for Home Depot of about $321.92/share.

Analyst Consensus EPS; Author’s Calculations

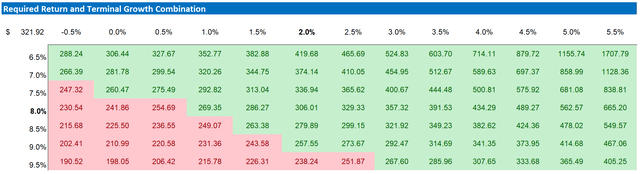

Notably, my base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of HD’s cost of equity and terminal growth rate, I have constructed a sensitivity table. Note, the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus EPS; Author’s Calculations

Risks

With exposure to about $155 billion of discretionary spending, Home Depot is clearly levered to health of the global/US economy. Accordingly, investors could argue that a recession-driven demand destruction would impact Home Depot’s business profitability – even though the current outlook is still strong. In addition, investors should also note that much of HD’s share price volatility is driven by investor sentiment towards risk assets (stocks) in general. Thus, investors should expect price volatility even though HD’s business outlook remains unchanged.

Conclusion

HD stock is down some 33% YTD. But Home Depot’s business might actually be less vulnerable to an economic slowdown than what the market is currently pricing. In any case, reflecting on HD’s value proposition, I argue the company’s long term business potential remains strong and I calculate a base-case target price for Home Depot of about $321.92/share.

Be the first to comment