simonkr

Delek US Holdings, Inc. (NYSE:DK) is a downstream energy company that operates in a few segments of the industry. The company is likely most well-known for its refining operations, but it also has interests in asphalt, renewable fuels, and logistics, and owns and operates a network of gasoline stations. This admittedly is a bit different than the upstream and midstream energy companies that I usually discuss in this column but many of the fundamentals are similar. We can clearly see this by looking at Delek’s stock price, which has climbed an impressive 36.44% over the past year, clearly beating the market as a whole. Despite this strong appreciation, the stock still appears to be considerably undervalued so there is still time for investors to jump into it. This is reinforced by the company’s reasonably strong growth pipeline and the overall fundamentals for the industry. Overall, this is a company that could certainly be worth considering for any investor.

About Delek US Holdings

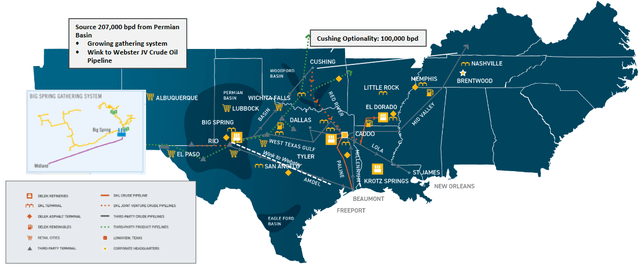

As stated in the introduction, Delek US Holdings is a downstream energy company that has operations all across the downstream space. The company is mostly known as a refiner but it also manufactures asphalt. It also has interests in logistics, gasoline stations, and the emerging renewable fuels sector:

One thing that we notice is that Delek’s operations are primarily located in Texas and the surrounding states. This is not exactly unusual since Texas has been at the forefront of the American energy industry for a considerable period of time. This is mostly because of the Permian Basin, which is by far the most hydrocarbon-rich region of the United States. According to the U.S. Energy Information, the basin contains 5 billion barrels of crude oil and 19 trillion cubic feet of natural gas that is economically recoverable, despite the fact that the basin has been exploited by energy producers since the 1920s. As this is the location where the greatest oil production takes place, it makes sense to have refineries nearby in order to reduce transportation costs.

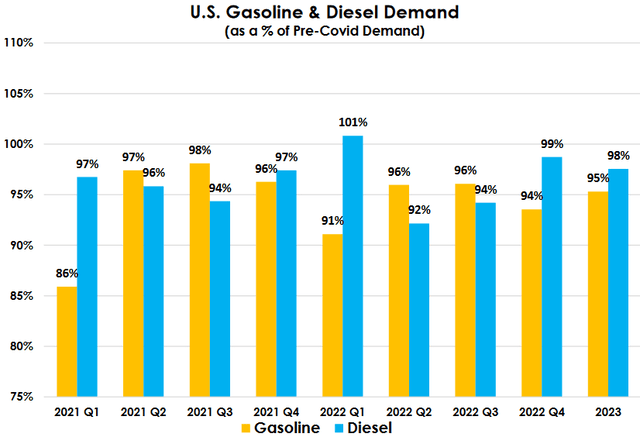

It is also very nice to see that Delek is reasonably well-diversified. This is especially important in this industry given the general hostility that politicians have been expressing towards it over the past few years. As everyone reading this is no doubt well aware, the Federal government has been actively attempting to reduce the consumption of oil and refined products in the United States. Unfortunately, 75% of Delek’s second-quarter 2022 revenue came from its refinery operations. The more that the company can develop the other segments of the business, the lower this percentage will ultimately end up being and the more protected it will be against hostile governments. Fortunately, so far there has been little decline in refined product demand. In fact, the nationwide demand is close to what it was prior to the 2020 COVID-19 lockdowns:

Thus, so far there appears to be no significant slowdown in the company’s primary business, and in fact, its refinery operations saw considerable growth in the second quarter. The refining unit had a contribution margin of $618.3 million in the second quarter of 2022 compared to $14.1 million in the year-ago quarter. This was mostly due to a larger crack spread, which increased by 181.7% year-over-year. This is important because the crack spread is how refineries make money. The crack spread is defined as the difference between crude oil prices and refined product prices. Thus, contrary to popular belief, refineries are not necessarily more profitable when oil and gasoline prices rise, as they did during the second quarter. It is the difference between the two prices that is critical, which actually allows a refinery operator like Delek to serve as a partial hedge in a portfolio that is dominated by upstream companies.

As stated earlier in the article, Delek is pushing to enter the emerging renewables industry. The company’s move is not into the energy sources that many investors will likely think of when they picture a renewable company. The firm is not constructing wind farms or deploying solar panels. Rather, it is manufacturing biodiesel fuel. This is a form of diesel fuel that is made by combining lipids such as animal fat or soybean oil with alcohol. The nice thing about biodiesel is that it can generally use the same infrastructure as regular diesel fuel so customers do not need to construct new pipelines or replace existing truck engines in order to use this form of fuel. As it is made from biological products that would otherwise be disposed of, it is generally considered to be more environmentally sound than standard petroleum-based diesel fuel. Delek currently owns three biodiesel-production facilities that are capable of making approximately 40 million gallons of biodiesel fuel annually. When we consider today’s incredibly high price for diesel fuel and the fact that the United States currently only has enough diesel fuel to last for 25 days, it should be easy to see the opportunity here as the country attempts to reduce its reliance on traditional fossil fuels.

Delek is moving to take advantage of this opportunity. The company recently sold the Bakersfield Refinery to a company known as GCE Holdings Acquisitions, LLC. This company intends to turn the refinery into the largest biodiesel production facility in the western United States. This facility, when completed, will be capable of producing approximately 220 million gallons of biodiesel and is expected to begin operation during the second quarter of 2023. The reason that this will benefit Delek is that Delek holds an option to allow it to receive 33% of the facility’s cash flow into perpetuity at an upfront cost of only $13.3 million. The company has not stated whether or not it will exercise this option but it appears to be implying that it will based on statements that have been made in various presentations and earnings calls. This, therefore, presents a growth opportunity for the company next year.

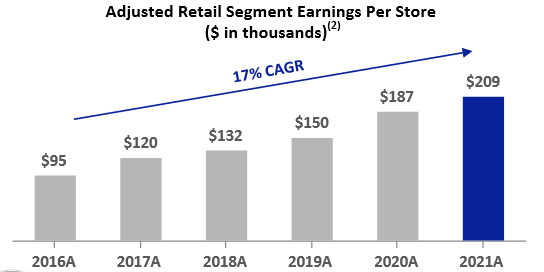

As mentioned earlier, Delek is also an owner and operator of gasoline stations and convenience stores throughout Texas and New Mexico. This offers additional diversification for the company, primarily because it is able to sell products that are completely outside of the energy sector. This is in fact quite lucrative because the profit margin on these products is substantially higher than the profit margin on gasoline. In the second quarter of 2022, Delek’s retailing operation only had an average profit margin of $0.33 per gallon of gasoline, down from $0.39 per gallon of gasoline in the year-ago quarter. This is less than a 10% margin considering the prevailing price of gasoline during the quarter. However, it had an average 34.0% margin on merchandise sold in its convenience stores during the same quarter. In addition, this aspect of the company’s business is consistently profitable. In fact, it has increased its earnings per store at a 17% compound annual growth rate since 2016:

Delek US Holdings

One of the most surprising things that we see here is that Delek even managed to grow its earnings per store in 2020 despite the steep drop in gasoline demand and prices. This is something that we should be able to appreciate as investors since it shows that the company’s diversified downstream operations help to provide a hedge against a decline in crude oil prices. This is something that may become very important over the next few quarters because of macroeconomic conditions in the United States. The country posted negative gross domestic product growth during the first two quarters of 2022, which is the classical definition of a recession. As I pointed out in a recent article, it is very likely that there will be another negative gross domestic product print in the third quarter. Thus, the country clearly appears to be in a recession, and oil price declines usually accompany recessions. We therefore might see a short-term decline in crude oil prices in the near future. Gasoline stations, however, tend to see higher profits when crude oil prices decline as we can see above in 2020. The company’s retail segment could thus help add a measure of support to Delek’s cash flow in such an event and offset any decline in the other areas of its business. It is far from a full hedge though since the retail operation only accounted for 2.69% of the company’s second-quarter 2022 profits. The retail segment accounted for 33.85% of the company’s second-quarter 2021 profits though, so we can clearly see how this particular segment benefits from lower energy prices.

Financial Considerations

It is always important to analyze the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid. As most companies lack the cash to completely pay off their debt as it matures, this is usually accomplished by issuing new debt and using the money to repay the existing debt. This can cause a company’s interest costs to increase following the rollover depending on the conditions in the market. In addition, a company needs to make regular payments on its debt if it is to remain solvent. Thus, any event that causes its cash flows to decline could push the company into financial distress if it has too much debt. This is an especially big concern in the energy industry due to the overall volatility of commodity prices and as such is a risk that no investors should ignore.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. In addition, the ratio tells us how well the company’s equity can cover its debt in the event of a bankruptcy or liquidation event, which is arguably more important. As of June 30, 2022, Delek had a net debt of $2.0149 billion compared to $1.3374 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.51, which is considerably better than the 2.03 ratio that Delek US Holdings had the last time that I looked at the company. However, it is still not nearly as good as the sub-1.0 ratios that many of the best companies in the sector possess.

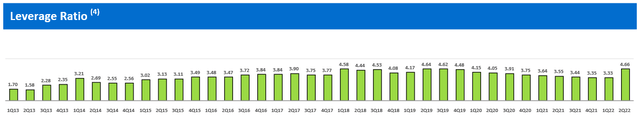

Ultimately though, a company’s ability to carry its debt is more important than the raw amount of debt on its balance sheet. The usual way that we judge this is by looking at the company’s leverage ratio, which is also known as the debt-to-EBITDA ratio. This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. As of June 30, 2022, Delek US Holdings had a leverage ratio of 4.66 based on its trailing twelve-month EBITDA. This is a substantial increase over what the company had at the same time last year:

We can see that the company had been steadily reducing its leverage ratio since the second quarter of 2019 but that trend reversed during the most recent quarter. This was primarily driven by an event at Delek Logistics Partners (DKL) and not Delek itself. During the second quarter, the partnership bought 3Bear Delaware Holding for $624.7 million. While this is likely to have a fairly significant positive impact on the partnership’s financial performance, it did significantly increase the company’s debt. As Delek US Holdings owns 78.9% of the partnership, the debt that the partnership took on to complete this acquisition is consolidated into the parent company even though, strictly speaking, Delek US Holdings is not necessarily responsible for this debt. Delek US Holdings only has $64.7 million of debt outside of the partnership, so its financial structure looks much stronger than we would think just by looking at these numbers.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. One method that we can use to value a diversified downstream company like Delek US Holdings is by looking at the price-to-earnings growth ratio. This is a modified version of the traditional price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued at the current price and vice versa.

According to Zacks Investment Research, Delek US Holdings will grow its earnings per share at a 10.11% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 0.44 at the current price. Thus, the stock appears to be considerably undervalued relative to its earnings per share growth, which is actually the case for just about anything in the traditional energy industry. We can also use this ratio to determine a fair value for the stock, which works out to $66.20 per share. If the stock were to actually go to this value, it would give shareholders a 127.26% return if they bought at the current price. This is certainly a respectable return on any investment.

Conclusion

In conclusion, there appears to be a lot to like about Delek as the company has been considerably strengthening its business over the last year. The diverse operations, in particular, could help position the company to weather any potential near-term economic turmoil in the United States. The fact that the company is moving into renewable sources of power may also provide it with a long-term growth engine. The only weakness here is the company’s fairly high debt load but most of that is due to the company’s drop-down midstream partnership and not due to Delek US Holdings itself. This is a tolerable risk though when we consider the incredible undervaluation of the stock. Overall, the company certainly appears worthy of the purchase at today’s price.

Be the first to comment